[ad_1]

verizon stock (VZ) No response to AT&T’s earnings report (T.) It did when the latter rose more than 10% at some point on Thursday.

Verizon’s stock was instead down on Friday, down about 5% after a disappointing quarter.

Earnings were down 7% year over year to $1.32, below expectations of $1.29. Earnings were up 4%, barely exceeding expectations. The company’s additional deferred payments were also below estimates.

On the plus side, the company reiterated its full-year earnings guidance, but not so much as AT&T beat out yesterday’s sales and bottom line earnings and raised its guidance.

As a result, Verizon’s stock is now at a 52-week low. That’s despite the dividend yield rising to about 7.5%.

Of course, it doesn’t help that AT&T reported good results. Even if he were paying a 6.5% dividend yield, he could be more attractive to telecom investors.

Trade Verizon Stock with Earnings

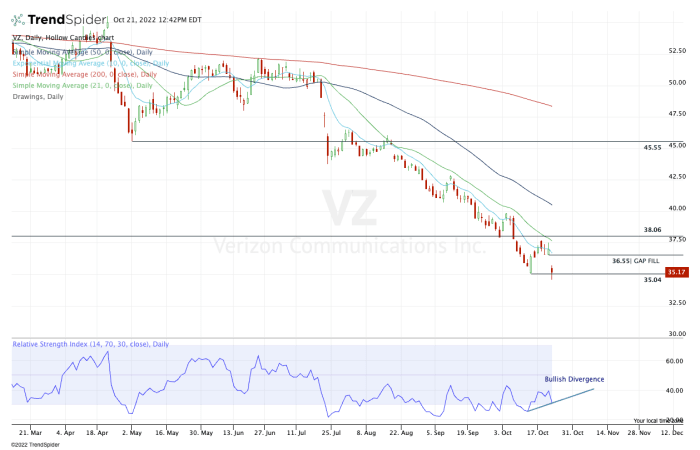

On the chart, Verizon hit a one-year low, but showed constructive price action. This is very rare.

Verizon stock fell below its 2022 low of $35.04, reaching $34.55 before recovering $35.04.

Look at it this way: Stocks have regained their previous lows after hitting new lows. This is known as a reversal and a bullish trader could go long his Verizon if it can close above $35.04.

They may use a stop loss just below the new lows.

Beyond that, $38 and 21 days are valid.

On the downside, yes, closing below $34.55 would be even more downside for Verizon stock.

We don’t know if Verizon will fall this far, but with a 78.6% retracement from 2019 highs to 2008 lows, a drop to the low $30s is likely.

Bottom line: pay attention to $35.04. It’s an important pivot in the short term.

[ad_2]

Source link