[ad_1]

Zacks’ retail and wholesale divisions will largely struggle in 2022, facing high inflation. Still, with the holiday season fast approaching and travel still recovering from the shock of the pandemic, spending is expected to pick up nicely.

For those interested in the upcoming busy holiday season, here are the top three stocks in the sector – TravelCenters of America (TAs – Free report), Sportsman’s Warehouse Holdings Co., Ltd. (SPWH – free report), Booking Holdings, Inc. (BKNGMore – free reports) – all can be considerations.

Below is a chart showing the year-to-date performance of all three stocks, blended against the S&P 500 as a benchmark.

Image Source: Sachs Investment Research

Let’s dig deeper into each one.

Travel Center of America

TravelCenters Of America is a full-service national travel center chain in the United States. The company has a nationwide footprint serving hundreds of thousands of professional drivers and other highway travelers each month, including virtually all major trucking vehicles.

The company’s earnings outlook has brightened noticeably over the past few months, propelling the stock to the highly coveted #1 Zachs rank (a strong buy).

Image Source: Sachs Investment Research

TA has had strong earnings, beating both earnings and revenue estimates in each of the last three quarters. In its latest print, the company posted a 26.4% bottom line profit and 3% earnings for him.

Image Source: Sachs Investment Research

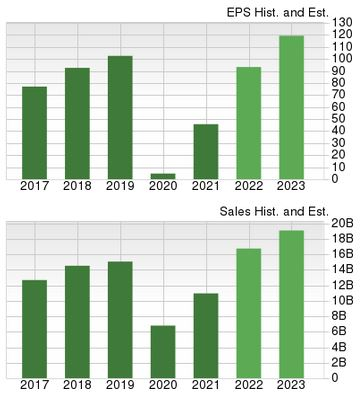

TA’s short-term growth profile is exciting. The company’s earnings and profits are projected to surge by more than 115% and 45%, respectively, this fiscal year (FY2022).

Still, it’s important to note that growth is projected to slow in fiscal year 23, with earnings taking a 45% hit and earnings down 11%.

Sportsman’s Warehouse Holdings Co., Ltd.

Sportsman’s Warehouse Holdings, Inc. is a retailer of outdoor sporting goods. Its stores sell camping gear, fishing gear, hunting gear, shooting gear, clothing, footwear, optics, electronics and accessories.

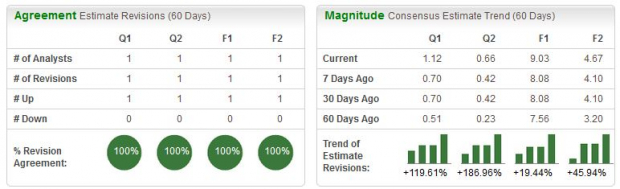

Analysts are bullish on recent earnings prospects, propelling SPWH to No. 1 in Zacks Rank (strong buy).

Image Source: Sachs Investment Research

Plus, stocks never look expensive. The company’s 7.8x future earnings multiple is well below his five-year median of 8.8x, a 66% discount compared to Zack’s retail and wholesale divisions.

SPWH boasts a style score of A worth.

Image Source: Sachs Investment Research

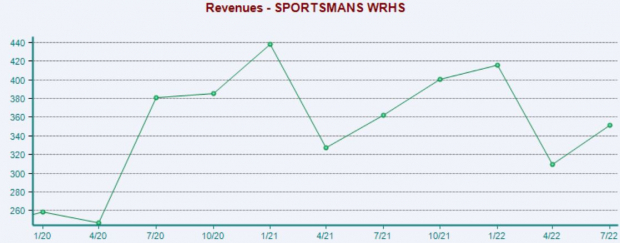

Like TA, Sportsman’s Warehouse has had strong earnings, beating earnings and revenue estimates in each of the last three quarters. In the latest print, the company posted his EPS of almost 40%, coupled with his 4.5% sales.

Image Source: Sachs Investment Research

Booking Holdings Co., Ltd.

Booking Holdings Inc. is one of the world’s largest online travel companies, offering hotel rooms, airline tickets, travel insurance, car rentals, vacation packages, cruises and destination “sightseeing”. The company boasts a Zacks rank of #2 (Buy).

BKNG is projected to grow at a solid pace. Profits are projected to exceed 100% this year (FY22) and double digits to over 30% in FY23.

Projected revenue growth comes on top of projected Y/Y revenue growth of 54% and 13% in FY22 and FY23, respectively.

Image Source: Sachs Investment Research

BKNG’s share price rose nearly double-digit 20% last month, significantly outperforming the S&P 500, indicating that buyers are gaining momentum.

Image Source: Sachs Investment Research

Conclusion

Consumers want to spend more as the holiday season approaches, which is expected to benefit retail and travel stocks.

Still, picking a strong stock is always important, and Zack Rank helps with that.

All three stocks above – TravelCenters of America (TAs – Free report), Sportsman’s Warehouse Holdings Co., Ltd. (SPWH – free report), Booking Holdings, Inc. (BKNGMore – Free Report) – All companies scored a favorable Zacks Rank 1 (strong buy) or Zacks Rank 2 (buy), indicating positive near-term earnings prospects.

[ad_2]

Source link