[ad_1]

TexBr/iStock via Getty Images

Christopher Angiano

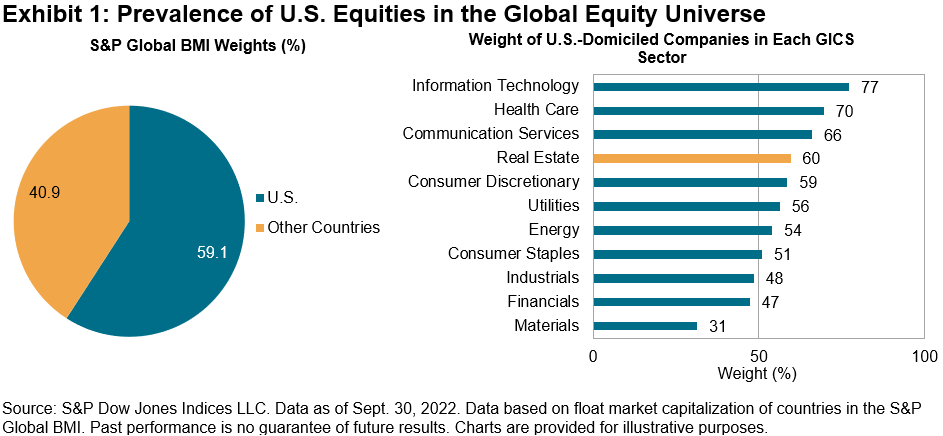

Dominance of US stocks

US equities account for 59.1% of the total global equity market by free float market capitalization (FMC) and at least 50% weighting in eight of the world’s 11 GICS sectors.given tendency and U.S. equities appear to play a very large role in explaining global performance and may help investors understand market dynamics.

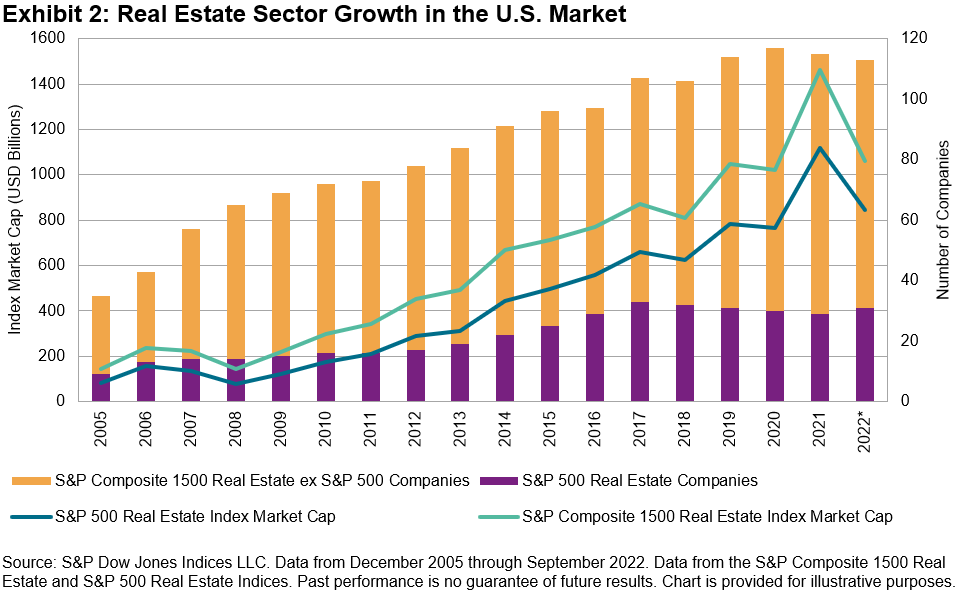

Evolution of the real estate sector

As of September 30, 2022, US-based companies accounted for 60% of the global real estate sector free float market capitalization, and real estate companies within the US market have increased in number and size over the past decade. I’m here. For example, Exhibit 2 shows that the S&P Composite 1500 includes 113 real estate companies.® Total FMC at the end of September 2022 is US$1.06 trillion, up from 35 companies with US$142 billion in FMC at the end of 2005.

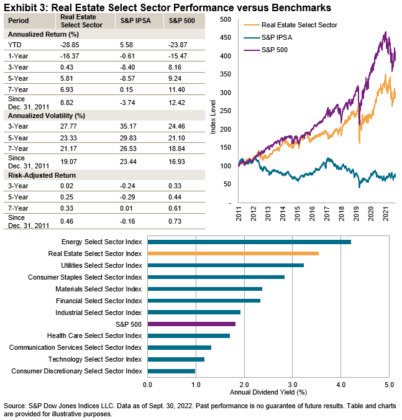

Long-term risk/return characteristics

The S&P IPSA, Chile’s large-cap benchmark, has shown strong returns year-to-date.Longer term, however, the US real estate select sector and the S&P 500® Outperforms at lower return volatility.

Historically, combined with the relatively low five-year average correlation between the property select sector and the S&P IPSA (0.33), Chilean market participants You may want to consider the potential decentralization by incorporating more broadly the

The real estate select sector has grown in recent years, offering higher dividend yields than the S&P 500 and many of its GICS sector segments. Therefore, the sector and the US stock market could be of interest to Chilean investors, especially in the current inflationary environment.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. all rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit the S&P Dow Jones Indices. See Terms of Use for full terms and disclosures.

original post

Editor’s note: The summary bullet points for this article were chosen by the editors of Seeking Alpha.

[ad_2]

Source link