[ad_1]

Despite the fact that Nu Skin Enterprises (NYSE:NUS) stock rose 5.6% last week, insiders who have sold US$1.3 million worth of shares in the past 12 months may be in a better position. Holding the stock would have meant that the current investment was worth less than it was at the time of sale. Therefore, it may have been the best decision for him to sell at US$45.23, an average price higher than the current price.

Insider trading is not the most important thing when it comes to long-term investing, but in theory you should pay attention to whether insiders are buying or selling stocks.

See the latest analysis from Nu Skin Enterprises

Insider trading at Nu Skin Enterprises in the last 12 months

Chairman of the Board, Stephen Rand, had the largest insider sale in the last 12 months. His one transaction was $46.07 per share and he was $1 million worth of shares. Insider sales are generally not favored, but are more of a concern when the sale is made at a low price. It is somewhat consoling that this sale came at a price well above his current stock price of $36.71. Therefore, we may have no idea how insiders feel about the current stock price.

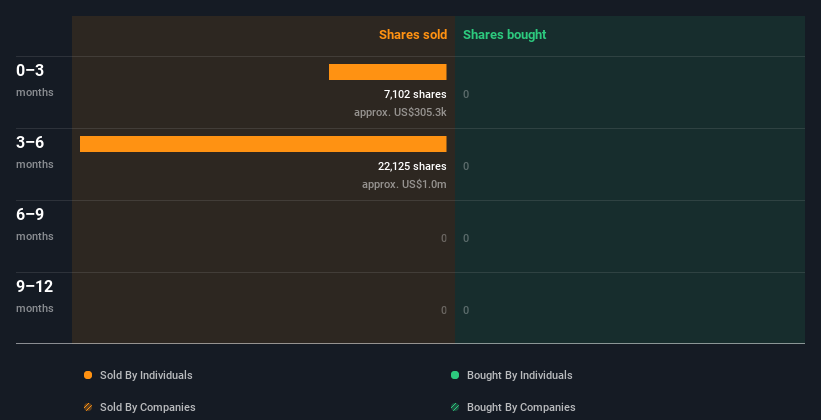

No Nu Skin Enterprises insider bought a single share last year. The chart below shows insider trading (by company and individual) over the past year. If you want to know exactly who sold, how much and when, click the chart below.

if you were like me you would No i want to miss this freedom A list of growth companies that insiders are buying.

A Nu Skin Enterprises insider recently sold his stake

Nu Skin Enterprises has seen a significant amount of insider selling in the last three months. Specifically, the insider said he sold US$320,000 worth of shares during that time, though no purchases were recorded at all. This could suggest that some insiders don’t think the stock is cheap.

Does Nu Skin Enterprises boast high insider ownership?

Another way to test the alignment of company leaders with other shareholders is to look at the number of shares they own. High insider ownership often leads company management to pay more attention to the interests of shareholders. The insider owns his 1.6% stake in Nu Skin Enterprises, which is worth approximately US$30 million. This level of insider ownership is good, but not particularly outstanding. It certainly suggests a reasonable degree of adjustment.

What does this data tell you about Nu Skin Enterprise Insider?

The insider has not bought any stock in Nu Skin Enterprises in the last three months, but there has been some selling. Also, last year there were no purchases that gave me peace of mind. Insiders own shares, but given the history of sales, we’re still pretty cautious. While we’d love to know what’s going on with insider ownership and trading, we should also consider the risks facing the stock before making an investment decision.For example, Nu Skin Enterprises two warning signs I think you should know.

If you want to check out another company – one with potentially great financials – don’t miss freedom An interesting list of companies with high return on equity and low debt.

For the purposes of this article, an insider is an individual who reports a transaction to the relevant regulatory body. Currently, we consider open market transactions and private disposals, but not derivative transactions.

Valuation is complicated, but we’re here to help make it simple.

find out if Nu Skin Enterprise You may be overestimated or underestimated by checking out our comprehensive analysis including: Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View Free Analysis

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

[ad_2]

Source link