[ad_1]

jetcityimage/iStock Editorial via Getty Images

Lowes (New York Stock Exchange: Low) is one of our favorite stocks in recent years. Lowe’s not only grew revenue and net income, but also improved margins, bought back shares, and increased value. its shareholders in the form of dividend payments.

Lowe’s latest quarterly report looks promising for some financial numbers, but we believe there may be headwinds in the short term.

First, let’s look at the Q1 numbers for LOW.

Financial and operational outlook for the first quarter

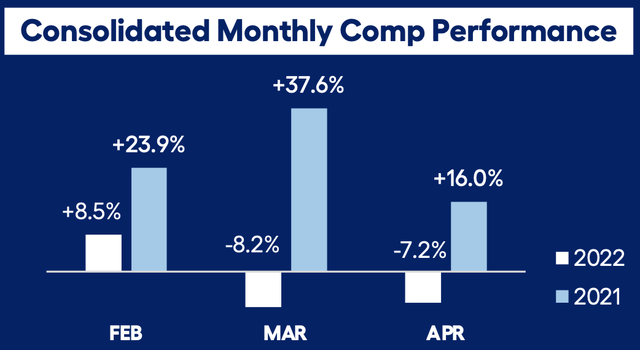

Lowe’s reports total revenue for the first quarter of 2022 of $23.7 billion, up from $24.4 billion in the same period last year. Traditional sales declined 4%, primarily due to lower sales in the US home improvement business segment. The company explains that the unusually cold temperatures he experienced in March and April of this year caused sales to decline, primarily affecting his DIY customer base.

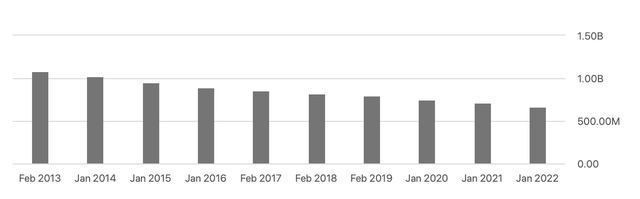

Consolidated monthly settlement (Macrotrends.net) Earnings (Lowes)

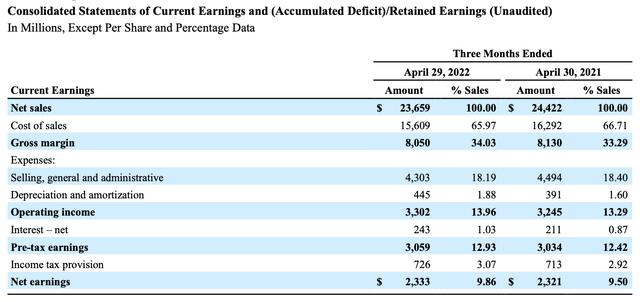

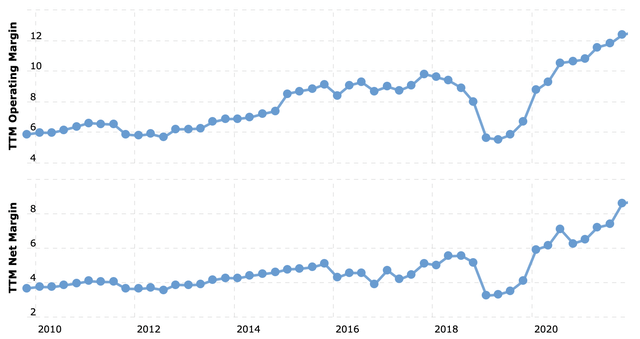

Earnings declines were offset by improved operating margins enabled by the company’s “Total Home” strategy and “Enduring Productivity Improvement” initiatives. The company reported EPS of $3.51, up more than 9% compared to the same period last year.

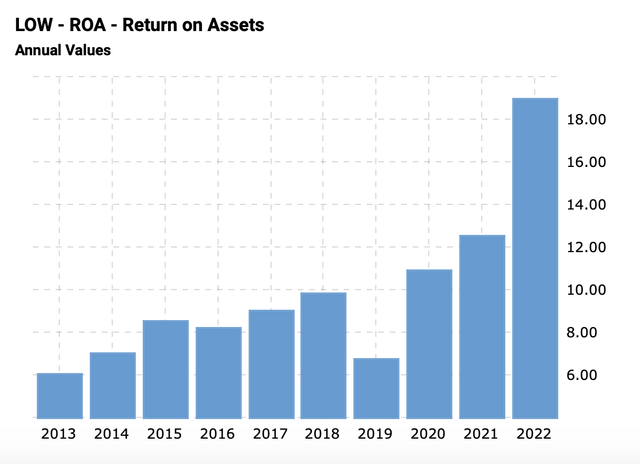

And proof that LOW’s business model is working is that the company has consistently improved its return on assets (ROA) over the past decade.

ROAs (Macrotrends.net)

In our opinion, LOW’s financial results and unchanged outlook for 2022 look promising. However, we believe there may be short-term macroeconomic headwinds, mainly due to rising input costs and labor shortages. So far, Lowe’s has proven that it can successfully expand margins even in this inflationary environment. Looking ahead, the home center market remains strong, and the operating profit margin is expected to grow even further in 2022.

evaluation

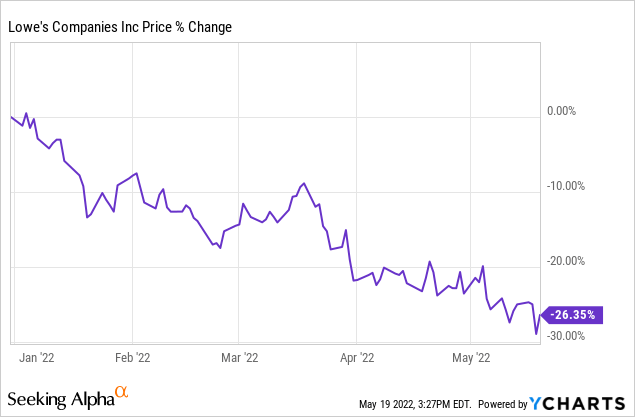

Lowe’s stock, like many other stocks, took a big hit in 2022, down more than 26% year-to-date.

Lowe’s looks better than it did six months ago.

But to determine if this is a good entry point, we need to take a closer look at some of the traditional price multiples compared to the sector median and Lowe’s 5-year average.

Lowe’s TTM price/earnings ratio is around 15, roughly halfway between the sector median of 11 and the five-year average of 20. In terms of EV/EBITDA and P/CF, the company is also in the midpoint of the sector, but undervalued compared to its five-year historical average.

In our opinion, the current price multiple is justified for four reasons:

1.) Dividends

Lowe’s has paid and increased dividends for the past 58 years. The current dividend yield is about 1.7%, and quarterly he’s $0.8 per share. With a current payout ratio of around 24%, which is below the sector median and five-year average, we believe this payout is sustainable.

2.) Share buyback

The company has engaged in continuous share buybacks over the past decade. They cut the number of shares outstanding he cut by as much as 40%. In the first quarter of 2022, the company repurchased 19 million of his shares for a total of $4.1 billion.

Share your outstanding balance (Seekingalpha.com)

3.) Increase margins

Over the past few years, Lowe’s has not only increased its revenue, but also expanded its margins. In our view, the improved operating margin and net margin point to positive progress in the company’s efficiency and profitability.

margin (Macrotrends.net)

4.) Projected Growth

Analysts estimate that average earnings per share for the next four quarters are expected to be $13.52, up more than 12% from EPS of $12.04 over the past four quarters.

We believe these forecasts are encouraging in light of potential macro headwinds such as a tight labor market and rising labor costs in the near term.

Overall, we think Lowe’s is justified at these price levels. Even with more volatility to come, this could be an attractive entry point for investors looking for modest growth, sustainable dividends, and buyback value.

risk

Before concluding the overview, it is necessary to highlight some of the key risks mentioned in Lowe’s annual report.

1.) Rapidly Evolving Retail Environment

In our opinion, many retailers in the first quarter, including Walmart (WMT) and Target (TGT), failed to keep up with changing demand and customer shopping habits. Lowe’s isn’t directly comparable to his WMT or TGT, but in turbulent times, inflation is high and all retailers need to pay close attention to changes in customer behavior. Failure to keep up with change can not only hurt your bottom line, but it can also lead to low inventory turns and obsolescence.

2.) Tight labor market

The current US labor market is highly competitive. Many businesses are struggling to recruit, train, and retain employees in the first quarter of 2022. If Lowe’s can’t hire and retain the right number of employees, it may find it difficult to offer unique, more personalized experiences to its customers. Rising labor costs can also have a negative impact on a company’s bottom line.

3.) US air-conditioned housing market

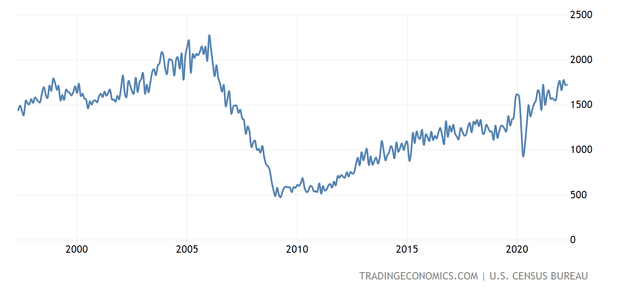

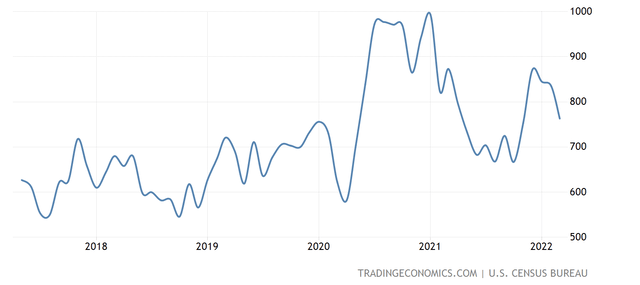

US housing starts still look relatively strong, although new housing starts fell slightly in both March and April.

Housing construction starts (tradingeconomics.com)

The three main headwinds for the housing industry are high mortgage rates, rising material prices and supply chain constraints. This general economic uncertainty could adversely affect Lowe’s financial performance in the near future.

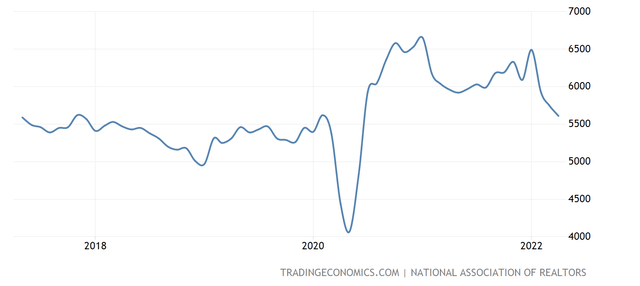

Moreover, both new home sales and existing home sales have fallen sharply in the past few months.

Sale of existing homes (tradingeconomics.com) new construction sales (tradingeconomics.com)

In our opinion, this trend is unlikely to reverse in the near term, with rising material prices, supply chain constraints, and high mortgage rates continuing.

our point

Solid first quarter financial performance, improved EPS and operating margin.

Attractive valuation after a significant year-to-date share price decline.

A cooling housing market could present temporary headwinds for Lowe’s.

[ad_2]

Source link