[ad_1]

Verizon Communications (NYSE:VZ) Third Quarter 2022 Results

Key financial results

- Revenue: USD 34.2 billion (up 4.0% from Q3 2021).

- Net income: USD 4.9 billion (down 24% from Q3 2021).

- Margin: 14% (down from 20% in Q3 2021).

- The decrease in margin was due to an increase in expenses.

- EPS: USD 1.17 (down from USD 1.55 in Q3 2021).

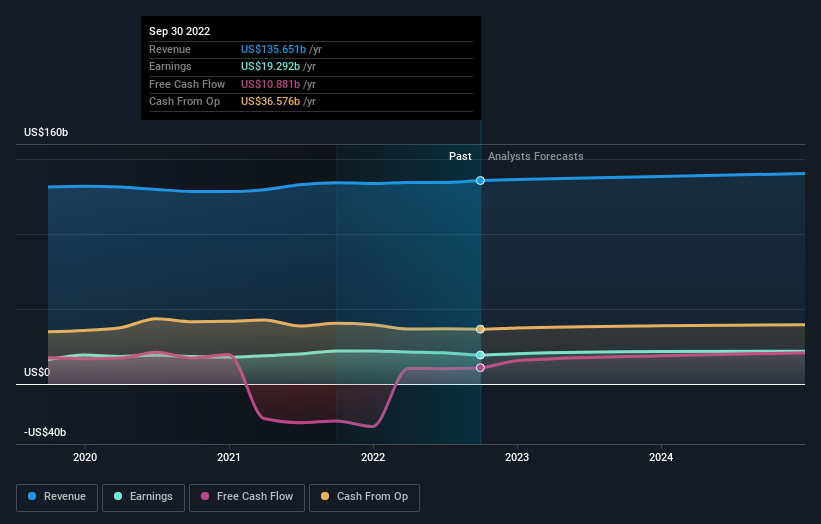

All numbers shown in the chart above are for the last 12 months (TTM) period.

Verizon Communications Earnings Exceeds Expectations, EPS Underperformed

Earnings exceeded analyst estimates by 1.3%. Earnings per share (EPS) fell 7.2% below analyst expectations.

Revenues are projected to grow at an average of 1.7% over the next three years, compared to the US telecom industry forecast of 1.1% annualized rate.

performance of American telecommunications industry.

The company’s stock is down 2.8% from a week ago.

risk analysis

Before proceeding to the next step, you should know: Two Verizon Communications Warning Signs what we discovered.

Valuation is complicated, but we’re here to help make it simple.

find out if Verizon Communications You may be overestimated or underestimated by checking out our comprehensive analysis including: Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View Free Analysis

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price sensitive company announcements or qualitative materials. Is not …

[ad_2]

Source link