[ad_1]

The easiest way to profit from a rising market is to buy an index fund. But you can do better or worse than that by buying individual stocks. for example, Alexandria Real Estate Equities (NYSE:ARE) shares are down 37% last year. This contrasts with the 24% market decline. But the long-term returns haven’t been too bad, with the stock down 17% over the past three years. Most recently, the stock has fallen another 12% in his month. However, this may be related to poor market conditions. Shares are down 6.1% at the same time.

So let’s see if the company’s long-term performance aligns with the underlying business progress.

Check out the latest analysis from Alexandria Real Estate Equities.

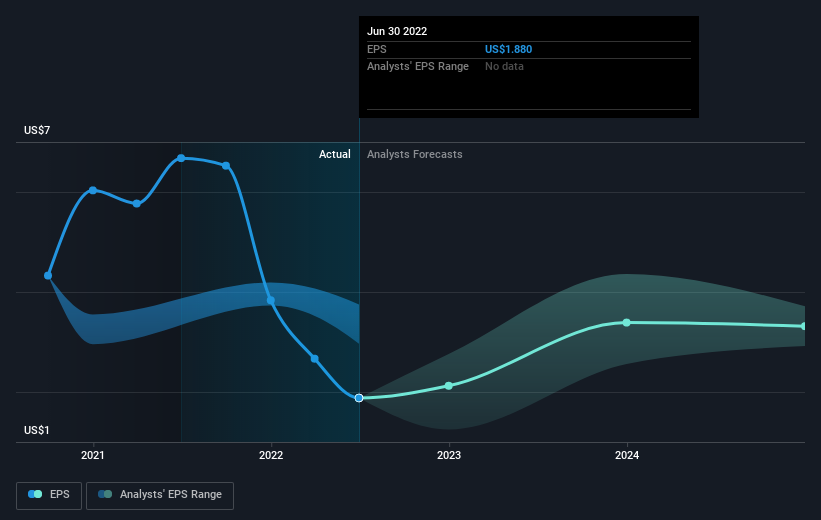

Markets are powerful pricing mechanisms, but stock prices reflect investor sentiment, not just underlying performance. One flawed but plausible way to assess how a company’s sentiment has changed is to compare its earnings per share (EPS) to its stock price.

Unfortunately, Alexandria Real Estate Equities reported a 72% decline in EPS last year. A 37% decline in the stock price is not as severe as the decline in earnings per share. The EPS slump may not have been as severe as feared. With a P/E ratio of 72.63, it’s safe to say that the market is seeing a recovery in EPS in the card.

The image below shows how the EPS changed over time (click the image to see the exact values).

Get a closer look at Alexandria Real Estate Equities key metrics by reviewing interactive graphs of Alexandria Real Estate Equities earnings, earnings and cash flow.

another point of view

Unfortunately, Alexandria Real Estate Equities shareholders have fallen by 35% over the year (including dividends). Unfortunately, this is a worse result than his 24% drop across the market. But it could simply be that the stock has been impacted by broader market jitters. Given the good opportunity, it might be worth keeping an eye on the fundamentals. Long-term investors shouldn’t be too upset, as they’ve been making 4% returns each year for five years. The recent plunge could be an opportunity, so it might be worth checking the fundamental data for signs of a long-term growth trend. It’s always interesting to track stock performance over the long term. However, many other factors should be considered to better understand Alexandria Real Estate Equities. Still, keep in mind what Alexandria Real Estate Equities shows. 4 warning signs in investment analysis one of which is a concern…

However, please note the following: Alexandria Real Estate Stocks May Not Be the Best Stock to Buy. Now take a look at this freedom A list of interesting companies with historical revenue growth (and further growth projections).

Please note that the market returns quoted in this article reflect market-weighted average returns for stocks currently traded on US exchanges.

Valuation is complicated, but we’re here to help make it simple.

find out if Alexandria Real Estate Stocks You may be overestimated or underestimated by checking out our comprehensive analysis including: Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View Free Analysis

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price sensitive company announcements or qualitative materials. Is not …

[ad_2]

Source link