[ad_1]

Bill Ackman heads the renowned hedge fund Pershing Square Capital Management LP. The billionaire investor is currently in the spotlight for his comments on the Russo-Ukrainian war. His idea of a “negotiated solution” did not sit well with the public, who accused him of being a “pacifier.”

Pershing Square has approximately $7.46 billion in assets under management. Like several hedge funds that have underperformed due to volatile market behavior, Pershing Square has generated a negative return of 19.64% over the past 12 months. Nonetheless, since filing his latest 13F holdings on August 15, the fund has earned a positive 6.24% return. The fund boasts that he has earned $2.7 billion this year alone from hedging against rate hikes. Let’s take a look at some of Ackman’s favorite brands.

Howard Hughes Corporation (NYSE:HHC)

Texas-based Howard Hughes (HHC) is a real estate development and management company focused on multiple Master Planned Communities (MPCs). HHC’s high-growth real estate assets bode well for the company compared to its mostly fixed-rate debt structure.

The hedge fund manager believes HHC is poised for long-term returns from “rising land prices and rising rental income.”

HHC is Pershing Square’s fifth largest holding, representing 14.23% of the portfolio. This fund owns his 13,620,164 shares of his HHC with a current value of his $950.69 million. Notably, on October 14, Pershing Square issued a tender offer to purchase up to 6.34 million additional Howard Hughes shares. The price range for the cash tender offer is $60 to $52.25, and his expiration date is November 10th.

Is HHC a good stock to buy?

With three unanimous buy ratings, Howard Hughes stock has a strong buy consensus rating. At TipRanks, Howard Hughes’ average price target of $87 means he could rise 45.8% from his current level. Meanwhile, the stock is down 41.6% so far this year.

Lowe’s Companies (NYSE:LOW)

American home improvement retailer Lowe’s (low) dominates Pershing Square’s portfolio (19.86%). The fund owns his 10,207,306 shares of Lowe’s stock with a current value of $1.78 billion.

Despite rising interest rates and the accompanying downturn in the housing market, Ackman believes Lowe’s “Pro” category products will continue to be in demand to complete critical projects undertaken during the pandemic. In particular, Ackman believes in the long-term earnings prospects of LOW, which trades at relatively low valuations compared to its peers.

Is Lowes Buy, Sell, or Hold?

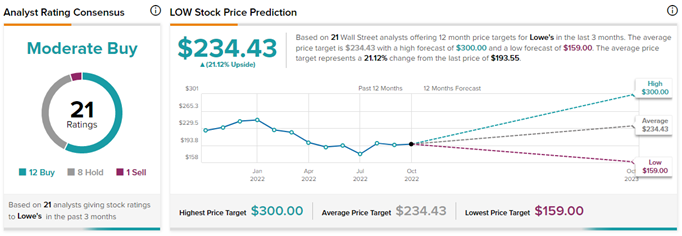

At TipRanks, the consensus rating for Lowe’s stock is Medium Buy. This is based on his 12 buys, 8 holds, and his 1 sell valuation. Lowe’s Companies’ average price forecast is $234.43, indicating a potential upside of 21.1% from current levels. On the other hand, the stock has lost the 22.8% potential upside from its current level.

thoughts of the end

Bill Ackman is known for producing profitable returns for investors through his business acumen. Investors may choose to follow Ackman’s investment choices in order to make informed decisions. In particular, TipRanks has accumulated multiple top-his expert recommendations that you can consider when making investment choices to maximize your returns.

Disclosure

[ad_2]

Source link