[ad_1]

Bymuratdeniz

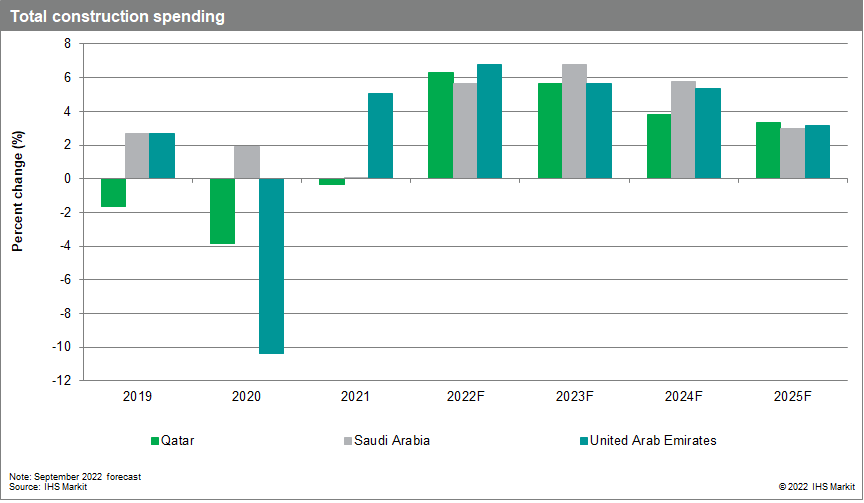

Construction and real estate in Saudi Arabia, the United Arab Emirates and Qatar – sectors vital to diversifying these economies away from hydrocarbons – are recovering from the challenges posed by the COVID-19 lockdowns.

Earnings Higher hydrocarbon prices are expected to sustain the performance of the construction sector for the remainder of 2022 and 2023. Going into 2023, all three countries are likely to continue to enjoy strong construction growth, but Saudi Arabia has overtaken her two, recording growth of 6.8%, while Qatar and the UAE both have her share of growth. It is expected to record growth of 5.6%.

Relatively high consumer prices and tightening global financial conditions are unlikely to decelerate trends significantly.The main constraints to the performance of these sectors appear on the supply side of the construction materials and labor markets. There is a possibility. Demand for both is expected to soar, especially in Saudi Arabia, where several mega-projects are likely to face delays as the supply of construction materials becomes increasingly scarce.

Slower growth in the rest of the world will make the projected relatively high growth in construction markets in Saudi Arabia and the rest of the Gulf Cooperation Council (GCC) more attractive to foreign workers in the sector I guess. Due to the limited production capacity of construction materials, the scarcity of construction materials will increase, which may increase the price of construction materials.

Saudi Arabia

Construction sector results in Q1 2022 were disappointing in Saudi Arabia (and possibly the UAE). The sector is he in 2020 and he is in 2021 because he was caught in a recession during his COVID-19 lockdown. Foreign workers, who make up the bulk of the sector’s workforce, returned to their home countries when the pandemic hit and are returning, albeit slowly.

Segment performance improved in the second quarter of 2022 as seasonally adjusted gross value added of construction in Saudi Arabia was estimated to have surged by 8.0% in the quarter. This result, combined with very strong growth in fixed investment, with capital expenditures on planned megaprojects released on top of the sector’s recovery, is expected to boost the construction sector’s output in 2022 and his 2023. It convinced me to raise my outlook.

Most of Saudi Arabia’s megaprojects will become major tourist attractions, causing further multiplier effects on construction sector spending in the form of accommodation, equipment and other infrastructure. Tourism, construction and real estate among other sectors will therefore be boosted by large-scale projects in line with the Kingdom’s revenue diversification goals.

Challenges to the Kingdom’s construction prospects are the availability of construction workers, especially skilled manpower, and rising construction material prices. Both factors could be mitigated by further inflows of construction workers, mainly from countries in South Asia and East Africa, and the current decline in construction material prices after the peak in commodity prices following Russia’s invasion of Ukraine. High. Demand is so high that the kingdom may run out of both materials and workers in the near future.

Qatar

Qatar’s high growth in total construction volume is partly driven by ongoing preparations for the 2022 FIFA World Cup. Qatar’s economy is estimated to have spent more than 60 times what South Africa spent on her at the 2010 World Cup.

Qatar plans to suspend several construction sector projects during the World Cup, delaying activities scheduled for November and December while the event takes place. We do not believe this moratorium will result in a long-term slowdown in construction sector activity in the United Arab Emirates.

Questions remain about the use of stadiums and hotel rooms after the World Cup. This risk may be partially offset by prospects for further tourism and hospitality over the next few years, especially if the World Cup is successfully hosted, but the pace of construction and infrastructure spending will likely increase before the World Cup. could slow significantly compared to the 2022 period.

A key strength of Qatar’s economy over the decade after the World Cup events is the expected significant increase in gas production capacity from the expansion of Northfield, which could increase gas production capacity by more than 60% by 2027. We evaluate that it will continue to exist. Rapidly growing European economies, especially those seeking to replace Russian gas supplies, are looking to new gas production in the Gulf states, thus facilitating expansion of economic activity.

Construction Insights from S&P Market Intelligence, Global Construction, The Economist, Neo Joseph Sibya

original post

Editor’s note: The summary bullet points for this article were chosen by the editors of Seeking Alpha.

[ad_2]

Source link