[ad_1]

If you think the stock market is your ticket to being part of the Forbes 400 list of richest Americans, you are wrong. In fact, most ultra-high net worth individuals are on the list not because of their stock-picking or market-timing skills, but because of their entrepreneurial endeavours. After building their fortunes, they turned to the stock market with the relatively modest goal of preserving long-term purchasing power.

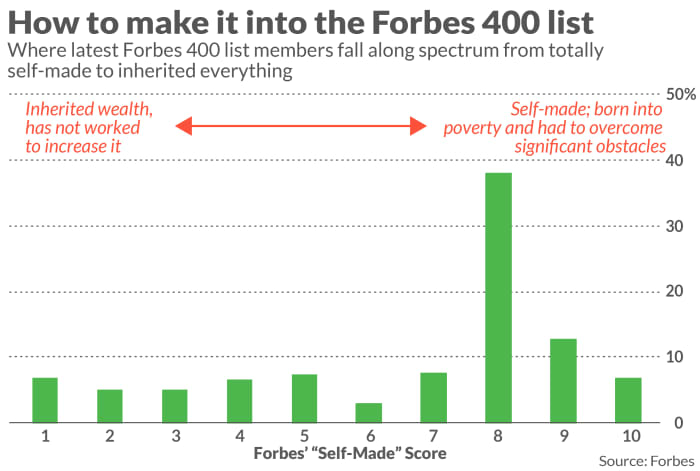

Of the 400 members on the 2022 list, 275 were classified as “self-made” by the magazine – or about 70%. Consider the chart below. This mirrors the 1 to 10 scale that Forbes used to rate his 400 members according to how well they were self-made, with 10 being completely self-made. The largest group — his 38% of list members — received an 8 rating. [but] Comes from middle class or middle class. An example is his Jeff Bezos on Amazon.com AMZN.

Mark Zuckerberg of Meta Platforms META,

This year’s majority of ultra-high net worth individuals is consistent with previous lists, but a valuable reality check on the myths entrenched among many investors, especially Generation Y and Generation Z investors. It is worth highlighting because it provides , and some proponents of the so-called FIRE early retirement movement, the stock market is an engine of wealth on the scale of the Forbes 400.

To illustrate how unrealistic this is, consider what it takes for an equity investor to qualify for this year’s Forbes 400 list. Assuming a 30-year investment horizon for a 100% S&P 500 SPX portfolio,

Without withdrawals along the way, you would need to start your portfolio with $82 million in 1992 to amass a $2.7 billion worth of portfolio today. That’s the minimum amount needed to be on the Forbes list this year. Please do your best.

Many investors may point to Warren Buffett, CEO and chairman of Berkshire Hathaway BRK.A.

BRK.B,

It was ranked #5 on this year’s Forbes 400 list. Wasn’t the stock market the source of his incredible wealth?

Yes, but his approach to acquiring entire companies, or even most of them, is not something you or I can imitate.

In any case, stock returns over the past 30 years have been among the best in U.S. history, so even my back-of-the-envelope calculations are overly optimistic. If we were to do this thought experiment using returns (courtesy of the database maintained by Edward McCurry at the University of Santa Clara), we would have had to start at $301 million 30 years ago to get to this. It must have been. This year’s Forbes 400 list.

Forbes 400 and the stock market

These are only hypothetical examples, but I would argue that the Forbes 400 members were on the list thanks to the wealth they created before they even set their sights on Wall Street. And once they committed to the market, their results were decent, but not exceptional.

Consider the performance of the members of the Forbes 400 list as a group over the last few years. The table below shows that the group as a whole has generated her 8.8% annualized return over the past six years. Wall Street activity.

| Increase from last year’s list of combined assets on the Forbes 400 list | S&P 500 equivalent earnings (including dividends) | |

|

Forbes 2022 list |

-11.1% |

-12.2% |

|

Forbes 2021 list |

40.6% |

43.30% |

|

Forbes 2020 list |

8.1% |

9.80% |

|

Forbes 2019 list |

2.2% |

3.70% |

|

Forbes 2018 list |

7.0% |

14.80% |

|

Forbes 2017 list |

12.5% |

14.40% |

| 6-year annual return | +8.8% | +11.1% |

Conclusion? If you want to be on the Forbes 400 list decades from now, create what the world needs. After you make your fortune, the stock market awaits.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee for audits.he can be reached at mark@hulbertratings.com

more: The stocks that performed best in January can be bought today due to these two reversals in the market.

plus: Will the stock market rise in 12 months? Here are the odds.

[ad_2]

Source link