[ad_1]

The goal of Credible Operations, Inc. (NMLS number 1681276, hereinafter “Credible”) is to give you the tools and confidence you need to improve your finances. We advertise products from partner lenders who insure our services, but all opinions are our own.

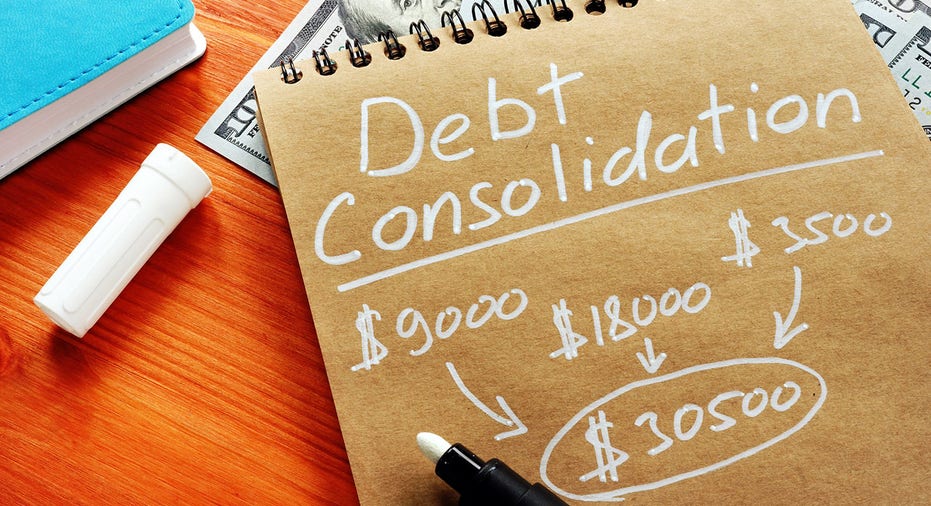

Debt consolidation allows you to combine multiple high-interest debts into one manageable payment. Find out if it hurts your credit. (iStock)

If you want to reduce or simplify your monthly debt payments, debt consolidation may be for you. It will help you organize your finances and make it easier to pay off your debts. Debt consolidation allows him to consolidate all his debts into one payment, so he doesn’t have to worry about multiple payments, interest rates, and due dates.

Like any financial strategy, debt consolidation is not for everyone. Here’s what you need to know about debt consolidation and how it affects your credit.

If you’re looking for a personal loan to consolidate your debt, Credible can help. Compare personal loan interest rates From various lenders in minutes.

How does debt consolidation work?

Debt consolidation combines multiple debts into one manageable payment, ideally at a low interest rate. It simplifies the debt repayment process and helps you save on interest.a debt consolidation loan A type of personal loan.

If you’re overwhelmed with multiple debts, including outstanding credit card balances, medical bills, and tax debt, debt consolidation can be a great solution. You can pay off your debt with less confusion because you don’t have to keep track of various payments and interest rates.

debt consolidation options

Debt consolidation methods include:

- Personal loan – You can do it make a personal loan Use that money to pay off what you owe, at a lower interest rate than all or most of your other debt. Many financial institutions such as banks, credit unions, and online lenders offer debt consolidation loans.

- Borrow from friends and family — If you have a loved one with extra cash, consider asking for a loan at a low interest rate. You can use the funds to pay off your debts and pay back your family and friends in monthly payments. Make sure your repayment plan is in writing so everyone is on the same page.

- balance transfer credit card — When you open a balance transfer card, your current credit card debt is transferred to it. In most cases, balance transfer cards come with a promotional 0% APR. You can avoid paying interest by paying the full amount during the campaign period. Otherwise, you will have to repay the remaining balance at the card’s normal interest rate. Typically, you need good to good credit to qualify for the 0% introductory APR.

- Home Equity Loan or HELOC — a Home Equity Loan or Home Equity Line of Credit (HELOC) You can borrow money using your home as collateral. You can get the cash you need to pay off high-interest debt at low interest rates. But if you can’t pay it back, the lender can foreclose on your home.

- Cash Out Automatic Refinancing — If you have equity in your car, a cash-out car refinance allows you to replace your current car loan with a new, larger loan. You can use the difference to pay off your debt. To qualify for a cash-out car refinance, the value of the vehicle must be greater than the balance of the car loan.

- Severance pay – If you have a retirement account like a 401(k), you can withdraw money from it to settle your debts. You pay yourself interest and loan payments usually come out of your paycheck. Note that once you withdraw funds from your retirement account, you lose the power of compounding interest on that amount. You may also be taxed on the amount you withdraw from your retirement account if you fail to repay the loan.

How debt consolidation affects your credit

Debt consolidation can have both positive and negative effects on credit.

- Difficult questions can lower your credit score. When applying for a bank transfer card or personal loans to consolidate debts, Lenders conduct rigorous checks on your credit. This can temporarily lower your credit score.

- Your average credit age will drop. As your credit account ages and shows a track record of timely payments, your credit score can increase. Opening a new account can lower the average age of your account and lower your credit score.

- The credit mix will become more diverse. Credit mix refers to the types of accounts you have, such as credit cards, loans, and mortgages. Lenders like to keep a variety of accounts, so opening new credit cards and personal loans can improve your credit score.

- Decrease in credit utilization. Credit utilization is the amount of revolving credits you are using divided by the amount of revolving credits available. A new debt consolidation account can increase your available credit, which may lower your ratio and improve your credit score.

- Timely payments can improve your payment history. Making timely payments on your new debt consolidation loan will gradually improve your credit score. The most important factor in determining your credit score is your payment history.

When you need debt consolidation

Debt consolidation isn’t for everyone, but it’s a great option if you’re struggling to keep up with your monthly payments. If you can get a lower interest rate than your current debt, you can save hundreds to thousands of dollars in interest over the life of the loan. However, even with a significantly longer repayment period, you may end up paying more interest overall. Consider these factors before consolidating your debt.

Debt consolidation may also be worth it if you know you can stick to your budget in the future. You will fall into the same cycle again.

Check Credible easily Compare personal loan interest rates without affecting your credit.

how to get started

If you decide to go ahead with debt consolidation, first check your credit score to see where you stand and what types of loans and credit cards you’re eligible for. Then make a list of all the debts you want to consolidate.

Next, think about which debt consolidation route you want to take. Weigh all your options to find the best rates. Please choose the appropriate method according to your situation and make the payment on time.

Alternatives to Debt Consolidation Loans

If a debt consolidation loan isn’t right for you, other options are available.

- budget — The easiest way to pay off debt is to create a budget and stick to it. You can choose from different types of budgets to suit your needs.

- DIY Debt Repayment Strategies — You can pay off your debt yourself using the debt snowball or debt avalanche method. The Snowball Debt Law focuses on paying off the smallest debt first, while the Debt Avalanche Strategy seeks to maximize interest savings by paying off the debt at the highest interest rate first. It is intended to

- debt consolidation — Debt consolidation is the process of negotiating with your creditors to settle for less than you owe. You can negotiate on your own or hire a professional debt consolidation company. However, be aware that debt consolidation can negatively affect your credit.

- Debt Management Plan — Debt management plans offered by credit counseling agencies are designed to help people with a lot of unsecured debt. Credit counselors negotiate interest rates, monthly payments, or fees with creditors. Once they do, you make one payment to a credit counseling agency who will use the money to pay your creditors. , may adversely affect credit.

If you decide to take out a personal loan for debt consolidation, visit Credible. Compare personal loan interest rates.

[ad_2]

Source link