[ad_1]

With the current economic climate, many wonder if we’ll see another housing market crash like we did in 2008.

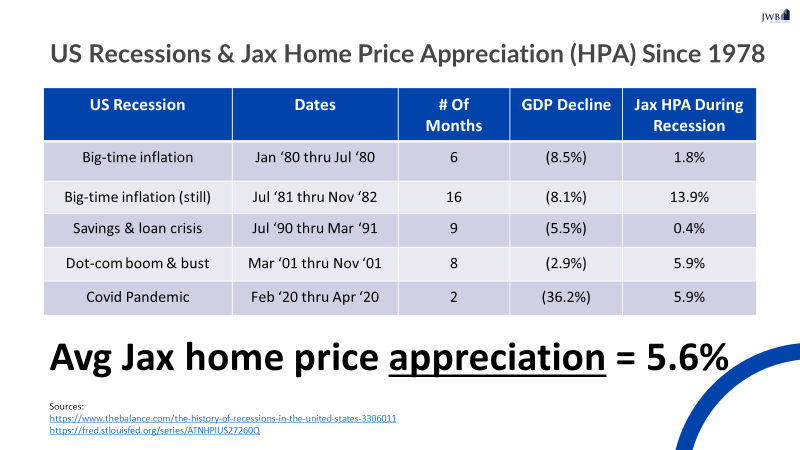

First, before getting into the indicators, it’s important to get a baseline of what really happens to house prices during a recession in the US. Tracking the last six recessions since 1978, we measured the decline in gross domestic product (GDP) during each recession and compared the increase in Jacksonville house prices during each period. In five of the last six recessions, Jacksonville home prices have actually gone up. The only recession in which house prices fell was in 2008, due to the housing market and lax lending practices. All other recessions were caused by factors other than real estate. Looking at this data, we can see that 2008 was the exception rather than the norm.

So if a recession doesn’t cause housing collapse, what could cause it?

Based on historical data, here are the things that can lead to housing collapse:

- Loose Lending Practices, Variable Rate Mortgages, “No Money Down” Loans

- Large, sudden increase in monthly payments

- High housing supply and low demand lead to high inventory month

- high unemployment

- Lack of equity in housing

- Population decline

- Lack of investor interest

- lack of affordability

Given the Great Recession of 2008 and the housing crash that followed, it’s easy to see that many of these factors came together in a perfect storm. But 2022 is a completely different story.

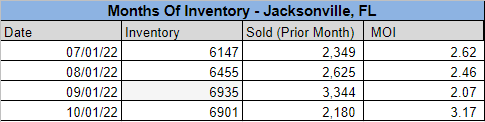

If there is to be a real estate crash in the near future, it will require an imbalance between supply and demand. This means that the market needs to have more homes in its inventory and there are too few buyers to supply the demand. Having a proven metric that shows the metric. This metric is called “Monthly Inventory” and is calculated by looking at the number of homes currently on the market and dividing it by the number of homes sold in the previous month. If inventory is his 6-7 months, history suggests that market house prices will rise as normal (Jacksonville’s average house price increase has been 4.6% per year since his 1982). , which indicates a higher-than-usual rise in house prices. Anything higher than 7 indicates a lower than normal increase in house prices (not necessarily a decrease in prices).

Here are Jacksonville’s inventory figures for the last few months of the year: That’s the biggest reason home prices rose 25% in the Jacksonville market last year.

An MOI of about 1 to 2 is unprecedented for Jacksonville real estate and has been experienced in the last two years. High MOI but significant price decline from 2008 to 2011. An MOI of less than 3 months is a strong indicator that a property market crash like 2008 will not occur.

If you’ve been thinking about investing in Jacksonville real estate, now is the time. Prices are expected to normalize and rental demand is expected to increase, resulting in a better risk-adjusted return on investment. JWB Real Estate Capital is the nation’s only vertically integrated real estate investment firm, helping busy professionals around the world invest in Jacksonville, Florida real estate. From sourcing turnkey rental properties to finding long-term residents to comprehensive property management, our team of experts provides full-service solutions for a truly stress-free investment experience. With our vertically integrated experience, JWB clients have earned 79% higher home price appreciation than the average Jacksonville investor since 2013.

Greg Cohen | Co-Founder, JWB Companies

I love talking about investing in rental properties! He hosts the weekly Not Your Average Investor Show, contributes to the JWB Real Estate Capital blog, and is often found in his Facebook group where he connects with the community and shares insights.

[ad_2]

Source link