[ad_1]

future technology retail warehouse Gorodenkov

prologue

I have learned from experience that megatrends tend to lead to more inefficient opportunities in the market, so I like to play megatrends in a way that has secondary effects that are not obvious. is an example of megatrend.I Net Lease Corporate Real Estate ETF (NYSEARCA:NETL) as one option for playing this trend.

Constraints in warehouse supply have resulted in favorable pricing and low vacancy rates for NETL’s industrial tenants, which have grown rapidly and are the largest tenant exposure. Meanwhile, the rent environment remains weak in retail, which comprises NETL’s second largest tenant segment, with a more balanced market. I’ll take a hold while waiting for both of these engines to fire along with a technical trigger.

Structure of Netlease ETF

sector mix

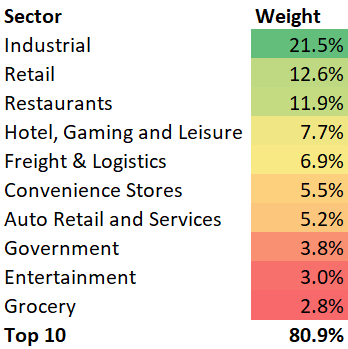

NETL Sector Mix (NETL website, author analysis)

industrial, retail, The restaurants sector accounts for 46.1% of total exposure. Industrial tenants lease space for storage warehouses in logistics operations. In retail, leasing includes stores and outlets for customers, as well as in the entertainment sector.

Industrial has the largest weight at 21.5%, making it important to analyze its fundamental drivers. Given that there are only 22 holdings across the ETFs, we believe the 60.7% weightings of the top five sectors are well diversified.

state mix

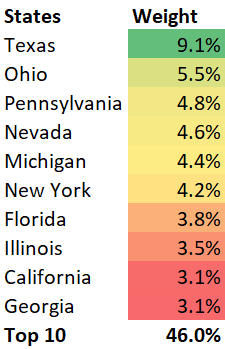

NETL States Mix (NETL website, author analysis)

It’s no surprise that Texas tops the list with an oversized weight of 9.1%. Texas ranks her second in manufacturing states in the United States, with approximately 1.2 million manufacturing jobs and her 20,000 manufacturing companies. That said, given that California ranks her number one on the list of manufacturing states, I’m a little surprised by the low state mix.

Top 10 holdings

NETL Top 10 Holdings (NETL website, author analysis)

Top 10 holdings include Realty Income (O), WP Carey (WPC), National Retail Property (NNN), Stag Industrial (STAG), VICI Property (VICI), Getty Realty (GTY) and Ugly Realty. (ADC), which contains essential properties. (EPRT), Gladstone Commercial (GOOD), Spirit Realty Capital (SRC).

I’ve never seen a mixed split like this before. Curiously, NETL weights the top 5 holdings and the top 6-10 holdings almost evenly. Among the top 10 holdings, retailers accounted for 47% of the total, suggesting that more REITs outside the top 10 could retain industrial weight.

established theory

My take on NETL consists of three parts:

- Rising e-commerce sales are a tailwind for megatrends

- Space shortage drives demand for industrial space

- Retail Rent Rise Hasn’t Started Yet

Rising e-commerce sales are a tailwind for megatrends

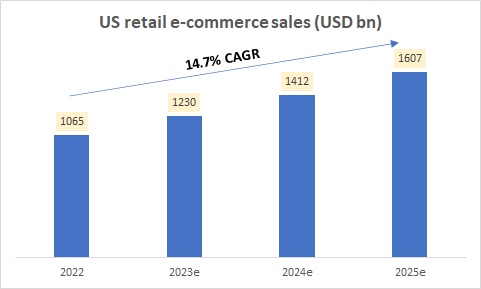

US retail ecommerce sales (eMarketer, author analysis)

US retail e-commerce sales are expected to grow rapidly at a CAGR of 14.7% over the next three years. Importantly, most of this growth is due to sales volume. Mass production of these means demand for capacity in supply chains such as retail stores and industrial warehouses. Favorable long-term tailwinds for NETL given its combined 34.1% exposure to industrial and retail tenants.

Space shortage drives demand for industrial space

Industrial space supply constraints have led to a record low vacancy rate of less than 4% (versus the usual double-digit figures in the pre-pandemic era before the e-commerce boom), a year-on-year Very high rent growth of 17.6%. Chris Bjorson, International Director of Industrial Brokerage at JLL, said:

In my 27 years of working in industrial real estate, I have never seen work this intense. This is a truly unprecedented time for the US industrial market.

With 21.5% exposure to industrial tenants, this is beneficial for NETL. This segment is expected to maintain healthy rent growth and low vacancy rates going forward. Note that NETL’s uptime is already very high at 99.2%.

Retail Rent Rise Hasn’t Started Yet

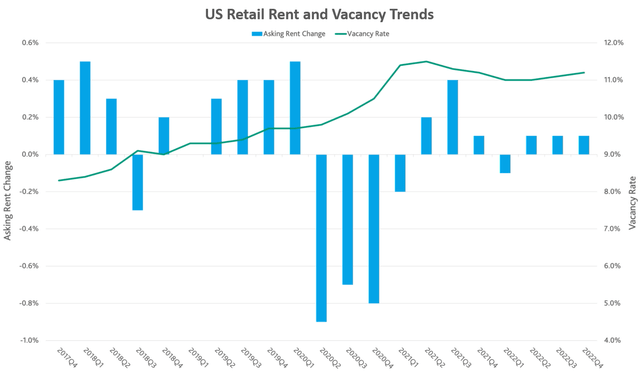

In Q4 2022, industry data from Moody’s Commercial Real Estate Analytics showed US retailer asking rents grew just 0.1% and vacancy rates were in the double digits.

U.S. retail asking rents and vacancy rates (Moody’s CRE analysis, author’s analysis)

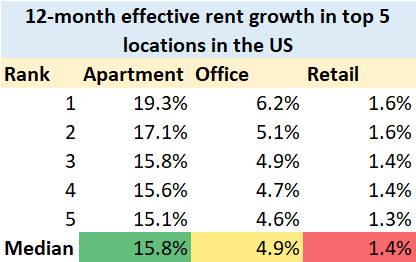

The table below clearly shows the slowdown in rent growth in retail.

US Effective Rent Growth Trends Across Segments (Moody’s CRE Analytics, Author’s Analysis)

The slow growth is due to the relative balance of supply and demand in the retail segment. This indicates that NETL’s engine has not yet spun and started. In that case, coupled with a favorable economic environment in the industrial sector, NETL will become increasingly attractive.

Evaluation so far

NETL’s valuation of fundamental factors is mixed, but leans toward a bullish bias due to its high exposure to industrial tenants. An engineer can guide prudent decision-making when:

technical analysis

If you are new to hunting alpha articles using technical analysis, I encourage you to read this post where I explain how and why I read charts using the principles of flow, location and traps. To do.

Please note that my charts are adjusted for dividends. In other words, it represents the total return for shareholders, not just the return on capital.

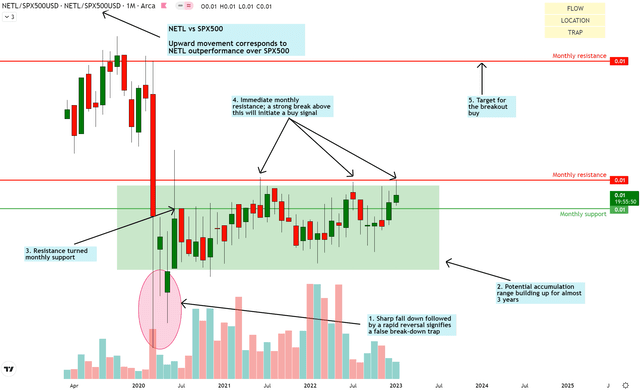

Read relative money flow

NETL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

The NETL vs S&P500 (SPY) (SPX) relative pair has many factors lined up. I am waiting for a significant breakout of the immediate monthly resistance to start buying.

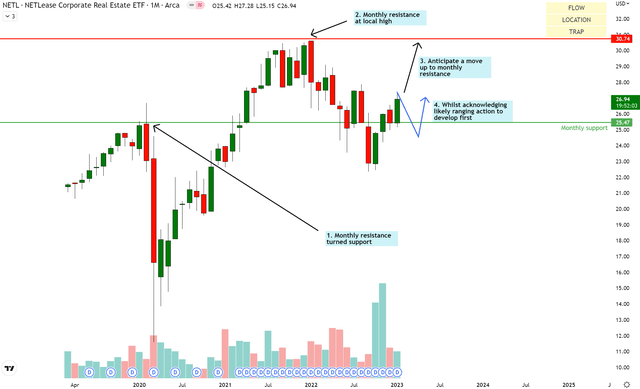

read absolute money flow

NETL vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

A clearer reading of absolute returns can be seen on the NETL absolute chart. However, we recognize that the price is likely to fluctuate around $25.47 for monthly support.

remove

I think NETL is a great, discreet way to respond to megatrends such as the growth of e-commerce. I expect the shortage of warehouse space to continue to lead to lower vacancies and higher rents for industrial tenants in NETL’s portfolio. I rate this as a ‘hold’ as the technicals have yet to show a clear buy trigger relative to the S&P500. I suspect that changing supply and demand dynamics in the U.S. retail rental market, leading to higher retail rents and lower vacancies, will be a key fundamental catalyst consistent with bullish technicals. increase.

Editor’s Note: This article describes one or more securities that are not traded on any major US exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link