[ad_1]

Marco Bello

“I can calculate the motion of heavenly bodies but not the madness of crowds.” – Sir Isaac Newton, mathematician, physicist, alchemist, theologian, and speculator.

“What goes up must come down” – Sir Isaac Newton, mathematician, physicist, alchemist, theologian, and speculator.

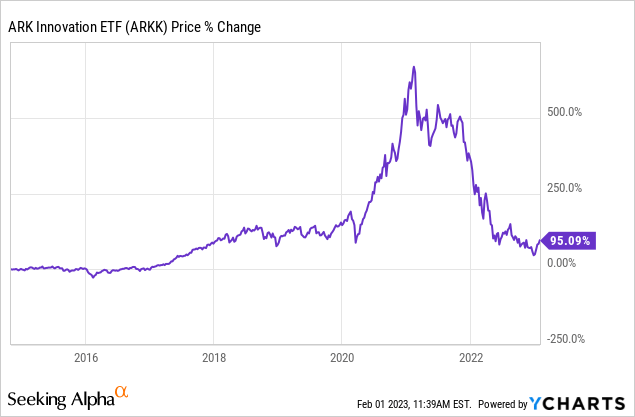

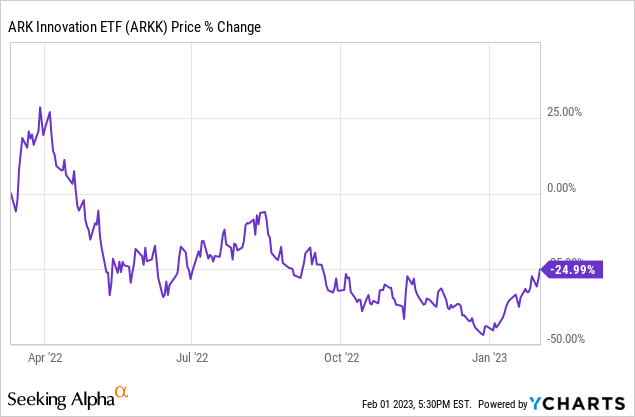

In this article, published on March 11, 2022, I asked this question: “Why Has ARKK Dropped Over 30% This Year And Where Is It Headed?” My answer was essentially that it contained mainly ridiculously priced pseudo-growth stocks, more than 60% of which had negative free cash flow. I expected ARKK to continue to decline, and it has.

It’s time to revisit ARK Innovation ETF (NYSEARCA:ARKK) and ask the WHY question again but in a larger context. It isn’t just ARKK and the few dozen stocks it holds. It’s us. What drives us to herd behavior, which is pretty much assured of disaster?

Analysts have argued that extremely low interest rates and easy money from the Fed were the major contributors to what in retrospect was a bubble. That seems right as far as it goes. The Fed did not, however, hold a pistol to the heads of millions of investors and force them to buy stocks and bonds. The proximate cause of Bubbles and the subsequent Crashes derives from basic human nature. We want to buy when we are optimistic and stock prices are going up. The longer they have been going up, the more persuasive the argument that it’s a permanent bull market and has a long way to go. The end comes after a steep final run-up, when the last buyers are fully invested and a few market participants decide to get out all at once.

In the beginning, powerful bull markets are more or less rational. The economy is growing. New products and business models are flourishing. A few hyper-growth companies are increasing revenues so fast that efforts to assign valuations seem pointless. Investors throw money at any stock with a story and often do better than old fuddy-duddies who analyze more closely.

In the 1980s, I first discovered the approach of Richard Driehaus, who believed in investing in relatively new small companies with rapid growth and a large potential market. He didn’t feel earnings and free cash flow were necessary. He did believe that sales revenue should be growing rapidly. He also believed in diversification and had a formula to justify his approach. Out of ten such investments, one or two would go out of business, several would do nothing much, a couple would do reasonably well, and one or two would be ten or twenty baggers. The 10-20 baggers would provide a big overall rate of compounding.

The Driehaus approach looks easy because it doesn’t call for detailed analysis of things like earnings and cash flow. Who can argue with the Driehaus approach? Driehaus had consistently great results and made gobs of money.

There are a couple of catches to this approach. One is survivor bias. Not everybody has the gifts of Richard Driehaus. How many wannabe Driehauses are strewn on the side of the road and forgotten. It turned out not to be so easy to make reasonably accurate estimates of future market size, competitors, and long-term revenue growth. You can learn more by googling Richard Driehaus.

ARK Innovation ETF seems to have adopted the Driehaus premise. Buy a collection of companies with rapid growth and/or new products or business models – “disruptors” of stodgy old ways of doing business. A few will fail. Some will go nowhere. Some will be moderately successful. A few winners, however, will make up for the losers and then some. Finding those companies was the principle behind ARKK. It produced a portfolio of what we came to call “Cathie Wood stocks,” after ARK CEO Cathie Wood.

ARK Innovation ETF’s Charts And A Table Tell An Unhappy Story

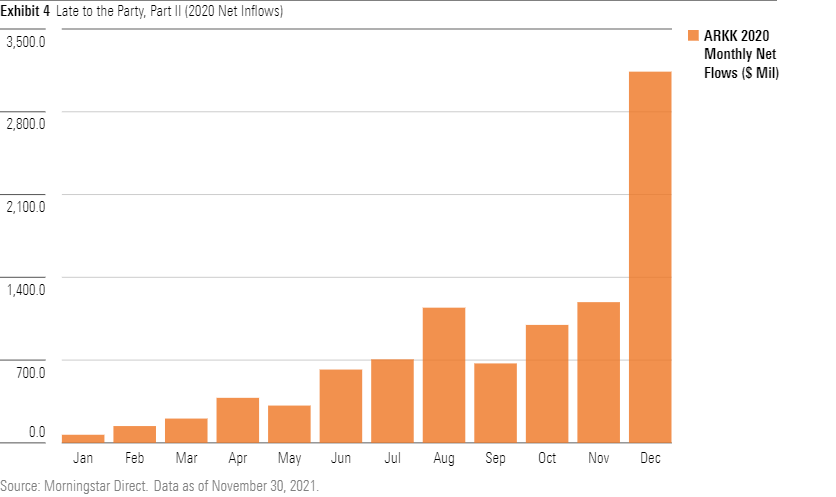

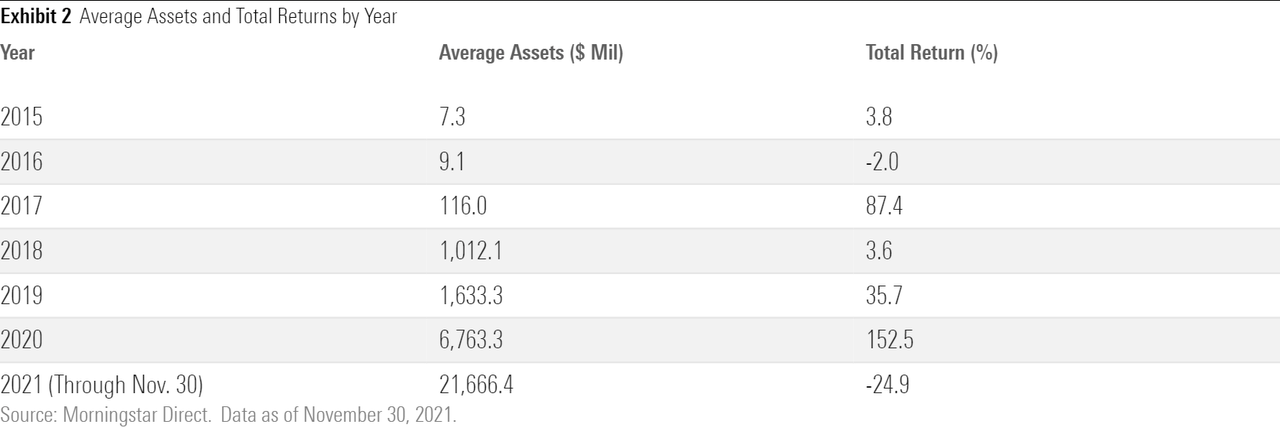

The Driehaus/ARKK approach worked well enough for long enough to pull in large amounts of cash. Most investors in the ARK Innovation ETF arrived just in time to see 60% of their capital vaporized when rapid growth stocks turned down. Comparatively few investors made money in ARKK. The great majority lost money in a big way. This very good article by Morningstar’s Amy Arnott entitled “ARKK: An Object Lesson in How Not To Invest” documented the disaster.

The first price chart below by Y Charts contains the entire history of Ark Innovation ETF beginning on November, 5. 2014. It also shows the terrible symmetry of most Bubble/Crashes. ARKK did very little over its first two years, a mere 2% return, but heated up in 2017 with an 87% return mainly due to a single stock, Grayscale Bitcoin Trust (OTC:GBTC), which was up 1600%. Still, by the middle of 2018, the assets under management were a modest $1.1 billion. The bull market in rapid growth stocks had not yet reached the point where investors were interested in Cathie Wood stocks.

In the second chart below, an orange bar chart provided by Morningstar shows assets had barely become visible before 2017, rose in 2018, and declined in 2019 after 2018 Total Returns were actually negative. The table which follows, Average Assets and Total Returns, puts hard numbers on the fact that very few investors owned ARKK early enough to profit from the sharp rise, but many owned it during the devastating decline which followed.

The second bar chart below zooms in to show 2020 in month-by-month detail and is followed by a table which provides hard numbers detailing the increase in Assets Under Management as the price of Ark Innovation rose.

Morningstar Morningstar

All the major Bubbles have developed in a prosperous society near the top of an extended period of growth, accompanied by a long bull market which was initially brought about by real economic success. Crashes are thus a phenomenon of prosperity and arrive when everything has gone right for a while. They are often no more than a blip on long-term charts. Think of the Bubble/Crash of 1929 and the NASDAQ in 2000. The current Growth Stock Bubble/Crash is modest by comparison and will likely be a very small blip on long-term charts. It stands out for the fact so many asset classes participated because they were all dependent on extremely easy money. It earned the name “the Everything Bubble.” ARK Innovation was the epicenter in the final stages. Bitcoin was an exemplary asset.

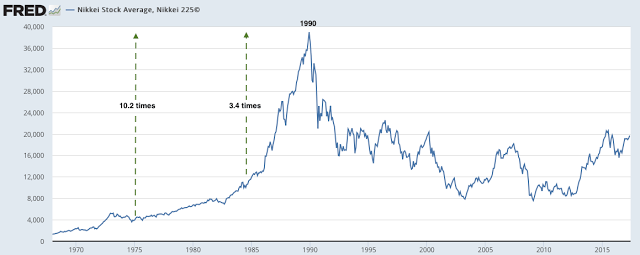

The most interesting Bubble/Crash in the last 100 years was the Japanese Bubble/Crash of stocks and property which began in the last days of 1989. The blow-up in solid stocks and real property was the most severe of any event involving actual valuable assets. Very practical people simply lost their minds for a period of time and behaved in ways they had never behaved before.

There’s remarkable resemblance in the charts of almost all markets which go through Bubbles followed by a Crash. Japan is a good model. In the beginning, it was a perfectly rational bull market which emerged from dirt-cheap prices when the market reopened after World War II. By cheap, I mean that growing blue chips sold at 2-time earnings, about a tenth the valuation at that time of similar companies in the U.S. The legendary investor John Templeton built his career and his fortune on scooping up Japanese companies at that time. There was plenty of room for the NIKKEI to double every few years. The trouble was that it kept on doubling until the whole market was selling around 80 times earnings. Ordinary criteria of value just disappeared. Here’s the chart of the Japanese market starting in 1965:

Federal Reserve Bank of St. Louis

Nikkei average 1965-2017.

After a third of a century, Japan’s NIKKEI index has not come close to its 1989 high. The end of the long post-World War II boom was accompanied by a downturn in population, which made aggregate growth hard to achieve, although on a per-capita basis, Japanese citizens continue to do just fine. The current bear market in U.S. stocks is a similar era-ending speculative event, although compared to past Bubble/Crashes it has been relatively mild. Japan’s Bubble/Crash was the most severe in part because it included real estate, but the 1929 Crash and Depression come pretty close, as the Dow Jones Industrial Average did not exceed its 1929 high until 1954. The NASDAQ 500 (NDAQ) Crash from 2000 to 2003 was about equal in percentage of loss, but many other parts of the market did well.

The 1929 Crash was before my time, and I know of it from family accounts and history books. Four major Crashes have occurred over the period when I was active as an investor. I made serious money with a leveraged short of Japan in 1989. I did well in 2000 by being in the right parts of the market and two emerging market closed-end funds, or CEFs. I did much less well in 2008-2009. The reason was pretty simple. As a value investor, I took too much on faith. I was insufficiently skeptical about value stocks – particularly financials – and didn’t try hard enough to poke at my assumptions and ask the right questions. What I learned from it was a very important fact: almost all of us have blind spots when it comes to things we believe strongly and take on faith.

Sir Isaac Newton And The South Sea Bubble

Isaac Newton arguably has the best track record of any scientist in history. His model of the universe remained the best explanation of the physical world for over 300 years and continues to serve well for everything above the quantum level. The mathematics he co-invented continues to be the starting point for much of physical science. He more or less invented physics, which was called “natural philosophy” in his day. The term itself gives away the hazy boundaries of science before Newton went to work. Most philosophy is now taught as a sub-category of history. Newton also solved major questions in optics and left well-defined questions awaiting modern experiments which led to quantum electrodynamics. One of Newton’s great strengths was acknowledging problems he could not address because of a lack of sufficient data. There’s another important principle which also applies to investors.

This same Isaac Newton, however, suffered a life-changing disaster in the financial area. The South Sea Company was organized to consolidate and provide funds for the English national debt, and when its debt was converted into shares, the result was a “Bubble” comparable to the Bubble markets of the past 100 years. Here’s how that original Bubble is described in Wikipedia:

The price of the stock went up over the course of a single year from about £100 to almost £1000 per share. Its success caused a country-wide frenzy-herd behavior[6]-as all types of people, from peasants to lords, developed a feverish interest in investing: in South Seas primarily, but in stocks generally. One famous apocryphal story is of a company that went public in 1720 as “a company for carrying out an undertaking of great advantage, but nobody to know what it is”.[35]

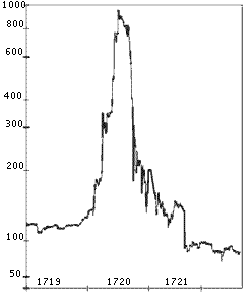

Newton was an early and successful buyer. He sold early at a profit. Unfortunately, he didn’t quit while he was ahead. The South Sea shares ignored Newton and continued to rise at an increasing rate. Here’s the chart:

Chart of South Sea Bubble (Wikipedia article on South Sea Bubble)

Newton was a practical man. Appointed Master of the Royal Mint, he worked it out that 20% of coins were counterfeit and vigorously pursued counterfeiters. He was no distracted Einstein but approached most problems in both science and the practical world with skepticism. Yet Newton was not immune to a certain human frailty. As South Sea shares continued to climb he began to experience fear of missing out, or FOMO. He joined the crowd and eventually lost most of his assets.

It’s easy to think that Newton’s return to buying South Seas shares was a single aberration in which he inexplicably abandoned the principles which had governed the rest of his life. This was not quite the case. When it came to scientific questions, Newton conformed to the basic principles of skepticism, close observation, experimentation, mathematics, and a basic rationality. In other areas of human experience, however, he sometimes simply followed the crowd.

Newton was not just a scientist. He was also an alchemist and theologian. We tend to sweep these facts under the rug, and his writing on these subjects was not uncovered until after his death. He doubted the majority view of God as a Trinity but had no doubts about the basic Christian story. We tend to skip over this side of Newton on the grounds that almost everybody else in England shared these beliefs. But that’s just the problem.

Skepticism and scientific method were not going to tell Newton anything about the Trinity. It exists or does not exist outside the realm of observation and advanced mathematics. Newton simply started with the authority of the herd. He accepted the broad view held by the mass of people. In alchemy, to which he devoted an astonishing amount of his time, he stood on the shoulders of midgets who had experienced an equal lack of success in turning lead into gold. How are we to understand this?

There were two Newtons – the one who made the tremendous leaps involving gravity and optics, and the one who more or less lost his mind and followed the crowd into the disaster of the South Sea Bubble.

Extraordinary Popular Delusions

In October of 1938, a strange meteor crashed into the countryside near Grover’s Mill, New Jersey. It proved to contain technologically advanced aliens. Along with the occupants of other meteors, these unfriendly visitors fanned out over important large parts of the East Coast and reports began to come in from other parts of the world. News bulletins broke into regular programming to report the progress of the invaders, now identified as Martians. Crowds formed and highways were clogged with people trying to get away from areas where Martians had been sighted. There were reports of heart attacks and attempted suicides.

It turned out to be a radio play put together by Orson Welles based on the book The War of the Worlds by his distant relative (different spelling) H.G. Wells. There were no actual Martian invaders. There couldn’t have been. We now know this as a 99.9% probability after brilliantly designed Mars Rovers like Oppy have observed, photographed, and scooped up gobs of Martian dirt. That’s the kind of physical observation that Newton the scientist would have liked. Mars isn’t very habitable unless you happen to be a machine. Even Matt Damon struggled a little.

Mars is far more distant from the sun than Earth. Most energy comes from the sun, and Mars is too far from the sun to gather sufficient energy to build an advanced civilization. Even a minor colony of Earthlings is a movie, not a likely future event. As much as I loved watching The Expanse, Mars won’t be Plan B for global warming, nor will any other part of Solar System. Think how the gathering of photons influences the temperatures in the northern and southern hemispheres of Earth as they tilt up to 57 degrees toward and away from the sun. From Mars, the sun looks like a dot. Very few photons reach Mars. It’s no place to go for a sun tan. Relax about Martians.

There are questions as to just how many 1938 Americans felt they were experiencing an invasion from Mars. Newspapers went for the largest numbers and funniest stories without working out how many people were actually listening to the radio. The rapidity with which the story spread does say something interesting about word-of-mouth communication now greatly enhanced by social media. On the other hand, how many people were going to admit on Monday morning that it scared the bejesus out of them? How many sell orders were executed on Monday morning? Would you have put in a buy order a few dollars under the market? Did one of the Rothschilds say gravely, Buy when Martians are in the streets?

When thinking of Bubbles and Crashes it’s important to keep in mind that not all participants are simply idiots. Check out Charles Mackay’s Extraordinary Popular Delusions And The Madness of Crowds, 1841, The latter phrase was added for the second edition in 1852. The reason is amusing. MacKay himself lost badly in the 1846-1849 Crash of the railroad boom. Don’t minimize that fact. The most famous debunker of popular delusions was pulled into one himself.

We owe it to Mackay that extraordinary popular delusions are mostly brought up today in terms of financial manias. Its first three chapters involve the three major financial Bubble/Crashes which came before MacKay’s time – The Mississippi Bubble of 1719-1720, the South Sea Bubble of 1720, and the Tulip Mania of 1636-37. Most readers lock on the Tulips episode because it is the most patently absurd.

It’s the rest of MacKay’s book that I find the most intriguing. It documents the way otherwise rational human beings lose their grip on reality. There are chapters on prophecies, slow poisoning (which some cultures saw as okay as opposed to outright violence), haunted houses, the adventures of great criminals, relics, the Crusades, alchemy, and astrology. Notice that the chapter on alchemy assumes that it doesn’t work, a 180-degree flip from the herd opinion in Newton’s time just over one hundred years earlier. Prophecies about the end of the world were prominent around the years 1000 and 2000 of the Christian Era and continue into this day. Crowds gather on a hillside and wait to be transported. And wait. And wait. Then reset their prophecy clocks.

One of the smartest of my step-children believes devoutly in astrology. She has yet to provide a satisfactory explanation of how one’s fate is transmitted across millions of empty kilometers. What is the mechanism of transfer? I used to needle her about that question, but she now knows better than to be pulled into that discussion. To be fair, Newton himself had a similar problem with how gravity might actually work. Was there an invisible string of some sort that held the earth to the sun and the moon to the earth? The reality is that the earth and the moon are both confident that they are going in a straight line, which they are, of course, with adjustments for the curvature of space. When somebody in our house has a cold, my wife, an engineer and successful entrepreneur who was born in Tehran, burns incense over their head. They always get better after a few days.

Bitcoin And UFOs

Cathie Wood’s big winner in the early days of ARK Innovation was the aforementioned Grayscale Bitcoin Trust, which was up 1600% in 2017 and led ARKK to an 87% gain for the year. No wonder Cathie Wood had stuck to it through thick or thin. My Uncle John, a brilliant/lucky speculator and mathematician, always liked to hold one stock within his portfolio with no earnings or free cash flow. He made it a point to know nothing about the stock. He just glanced at the chart and calculated the right price for its puts, calls, and straddles. The good thing about having no earnings, he said, was that there was no P/E ratio to hold it down. It could go up any amount. That’s Bitcoin, which is more like a UFO than a stock.

At Los Alamos in the summer of 1950, the creator of the nuclear reactor, Enrico Fermi, was part of a discussion about aliens with three other physicists. In recent years, there had been many reports of UFOs, including the famous case in nearby Roswell. There had been a lot of speculation about aliens, and Edward Teller, father of the H-Bomb, was among those debating the subject. Fermi remained silent then suddenly looked up and asked, “Where are they?” What he meant was that if aliens were actually here, wouldn’t they be kicking up much more of a ruckus and having a more material impact on things?

Fermi’s remark is what puts the finger on the relationship of Bitcoin and UFO (UAPs if you prefer). They are both things people believe they see and try to figure out. Something is definitely out there. Surely they must have some purpose, but what is it? Bitcoin is useful for money laundering and a few other criminal activities, but that’s low-intensity stuff, like aliens who take pre-qualified weird people up to their mother ships and do bad things to them. We have reports of these things but they don’t really tell us much.

UFOs should be part of a major program to either conquer us, help us, eat us as hors oeuvres, or maybe just check in on us to be sure we are doing okay. Our minimum expectation would be a gift of some spiffy technology. I’m pretty sure they haven’t done that. One of my writing students decades ago told me that when she was a little girl, her father snuck her onto a top-secret base in the middle of the night to place her hand on the U-2 spy plane. An engineer, he proudly explained his role in putting together the most advanced piece of technology on the planet. He knew this beyond question. No alien artifacts figured in it.

Bitcoin is supposed to decentralize money and put the central banks out of business. Helping a few gangsters doesn’t get Bitcoin far along the path to conquering, replacing, or destroying central bank currencies. So far, all it has provided is that weird-looking addle-brained crook who hasn’t realized yet that he is going to do jail time. So why is Bitcoin even worth talking about? Because it’s the hollow investment idea which no one can explain which stands at the center of the current Bubble/Crash – especially at ARKK.

The Children’s Crusade

Periods like the present occur when enough time has elapsed from the last such period, that most of the investors damaged in the previous market frenzy have disappeared from the scene. After several years of building enthusiasm, a new wave of innocents with no memory of the past enter the market. Making money in the market again looks easy. Vehicles like the ARK Innovation ETF make it look like a piece of cake. Many of the individual stocks held in ARKK looked like long-term winners right up to February 2021.

In the late stages of the bull market, I enjoyed a privileged vantage point. A group of young pros at the tennis club where I still teach a few lessons had become enthusiastic about the stock market. One of them had bought ARK Innovation on the final run to the top, and all of them owned a couple of Cathie Wood stocks. SoFi Technologies, Inc. (SOFI) and Roku, Inc. (ROKU) are two names that I recall. They got together on breaks and checked the market. I knew very little about the things they owned and joined them to ask a few questions. They were good Gen Z kids in their 20s. They had been happy to accept me as a tennis pro who apparently had some knowledge on tennis technique. They were patient with my questions.

- Me: What’s the P/E on that one?

- KID: What’s that?

- ME: Stock price divided by per share earnings.

- KID: I don’t know. Where do you get that?

- ME: How fast are sales increasing, how long can they keep it up, and what’s their stock price to sales ratio?

- KID: Whoooah!

It was like bumping into the Children’s Crusade as they boarded the ships which would transport them to ports where they would be sold into slavery. In late fall of 2020, I called them together, told them that I had quite a bit of experience in the markets, and thought they were headed for big trouble. They were polite. Within another month their stock positions were collapsing and they started asking serious questions.

They wanted to know what I was doing. I told them that I had a diversified portfolio with a lot of boring stocks like Berkshire Hathaway (BRK.A, BRK.B) and rarely bought or sold anything. I was doing nothing. As things went from bad to worse in their portfolios, I offered to give them a little investment seminar. The first thing I told them was that they were lucky to be taking a few lumps while their portfolios were small, and they had a great opportunity to learn from it.

This article about my personal portfolio was written partly for them. The title: “Why I Own What I Own: My Totally Dull, Utterly Boring, Get Rich Slowly And Stay Rich Portfolio.” It comes with a philosophy and a few principles. One of the kids who had a Seeking Alpha subscription, made copies. I talked about SA and explained to them that I looked over the articles every morning and focused on those which were written by authors I had learned to respect. The exception, I told them, was that I almost always read articles by writers who had the opposite view on a subject I regarded as important.

A few weeks ago, I asked one of them to guess my 2022 results and he was pretty close. He guessed I lost 3%. It was actually zero percent to four decimal places, not including I Bonds which I consider as an alternative investment. He realized that this was a pretty good result. It was in fact my best year in comparison to the S&P 500 (SP500), beating by almost 20%. I told the kids that I would likely underperform in 2023 but didn’t care, and I was pleased that they understood.

Can ARKK Make A Big Comeback?

Anything can happen. January was the best month ever for ARKK, and Cathie Wood is once again a popular guest on CNBC. Here’s the performance of ARKK since I wrote on it on March 11:

ARKK has rallied strongly off the bottom but is still down 25% since the March 22 article. Stocks which were leaders in the past bull market despite an absence of fundamentals rarely become leaders again in the next bull market. That’s the view of a fundamentals guy, of course. Remember that sticking to that view caused problems for me in 2008. If the Fed were forced to cut rates down to where they were in 2020 and infused freight cars of money to “save the system,” growth stocks might become long-term leaders once again. The probabilities argue against it, but you never know with certainty.

For me, ARK Innovation falls into a category I think of as, Don’t short/don’t buy, don’t own. I should add that I never short anything. The math works against you.

Now ask yourself: what things do you take on faith?

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link