[ad_1]

Longtime OMAAT readers will remember my obsession with Air Belgium a few years ago. Well, we have a pretty important update. It won’t surprise anyone who follows this airline. Air Belgium tends to run out of money by the end of the year and desperately needs new money.

What is Air Belgium?

Air Belgium is an airline that started operations in 2018. About four years after the airline was founded, it has already undergone several transformations.

- The airline started service with the Airbus A340, initially flying between Charleroi Airport (a Brussels suburb) and Hong Kong. The airline’s long-term plan was to add a route from Charleroi to mainland China.

- Within weeks, the airline suspended the route and realized it wasn’t a good business model.That was the last time I heard that Air Belgium operated passenger flights to China.

- At this point, the airline focused on becoming a wet lease operator, operating flights for other airlines that needed additional capacity. The timing was good as many 787s were grounded at the time due to engine problems.

- In October 2018, the company was on the brink of liquidation and an emergency general meeting was held to decide whether to dissolve.The company was finally able to get more money

- In July 2019, the airline announced it would resume scheduled flights, but would fly to the Caribbean rather than China.

- In June 2020, the airline announced that it would switch from Charleroi airport to Brussels airport and launch new routes, including flights to Africa.

- In July 2021, the airline announced it would acquire two Airbus A330-900neos and use them on passenger flights instead of Airbus A340s.

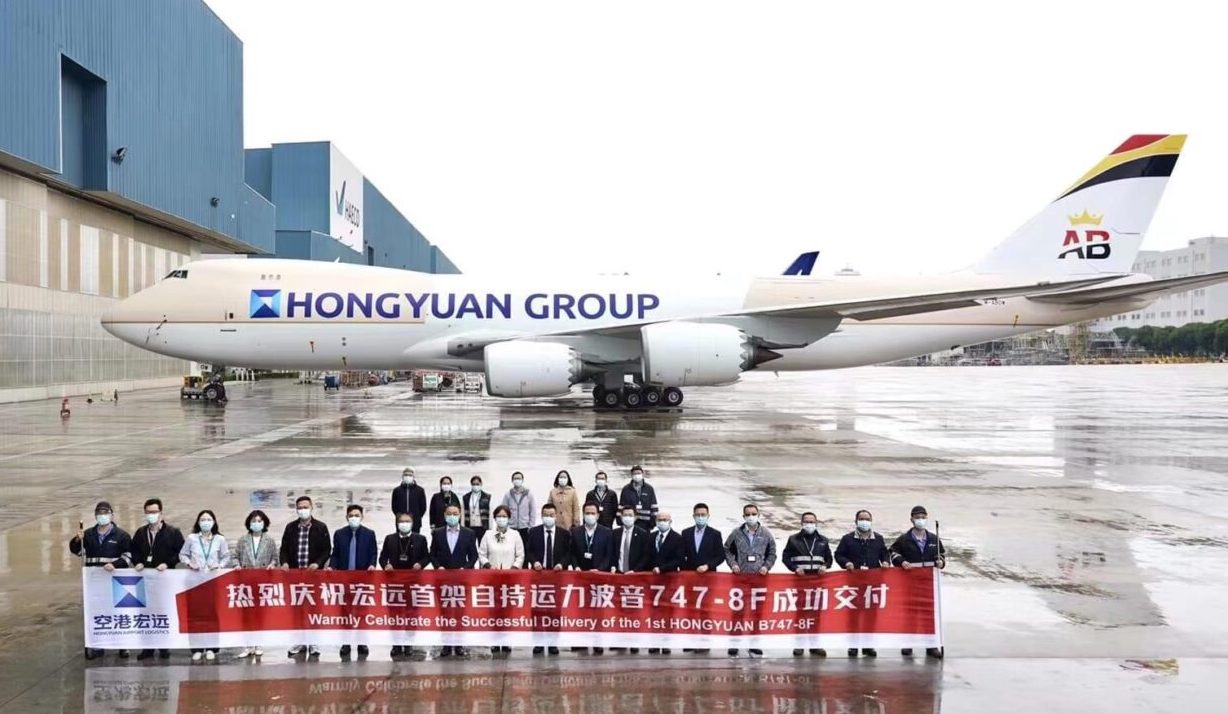

- In December 2021, the airline announced it would add a Boeing 747-8F to its fleet to expand its dedicated cargo operations.

I still have fond memories of my Air Belgium flight from Charleroi to Hong Kong. Only 25 passengers were on board. The picture below is rarely what the cabin looks like in the middle of a long haul flight.

So where is Air Belgium going at this point?

- The airline operates several cargo flights on behalf of Hongyuan Group and has two Boeing 747-8Fs used for it.

- The airline flies A330s to the Caribbean and Africa on a limited basis, but is constantly tinkering with routes and frequencies.

- Airlines may operate on a wet lease basis on behalf of other airlines

Is Air Belgium in danger of liquidation?

Les News 24 reports that Air Belgium needs at least €10 million by the end of the year to avoid bankruptcy. The company said he expects to lose 40 million euros in 2022 and has used up 16 million euros since a new funding round about eight months ago.

Describing the ownership structure of Air Belgium, Air Belgium is 49% owned by Hongyuan Group, 35% owned by the Walloon government and 10% owned by the Belgian government and other private investors.

What does Air Belgium’s management have to say about the story that the company is in financial trouble? I deny being at risk. He admits:

“Yes, finances are tight, very tight, but we will get it done!”

But he’s also confident that the company’s shareholders won’t give up.

“For five years, we have been told that the company is on the brink of bankruptcy every time it asks for funds.

At this point, Air Belgium is not only looking for sufficient funding to survive, but is also looking for significant investments so that it can pursue new business plans again. The company needs a lot of money for this expansion.

“Air Belgium aims at a larger and larger market. We are not a low-cost company.

The airline actually made a profit of €6 million in 2019. This is the only year in which airlines have made a profit. Ironically, it was also the year in which airlines leased aircraft more or less exclusively and did not actually try to sell their own flights. did.

Conclusion

Air Belgium is in financial trouble again and needs to raise more money before the end of the year. Air Belgium’s CEO appears arrogantly confident that the airline can make more money.

Air Belgium’s survival depends on the willingness of local governments and Chinese shareholders to put more money into Air Belgium. Frankly, I’m surprised Air Belgium is still open. Here’s the problem — I think airlines would do pretty well if they were just focused on cargo and were wet leasing operators. Because there is a big market for that.

However, the airline has had little success marketing its own flights and has not stayed in the market long enough to build demand and name recognition.Air Belgium operates its own passenger service. I think it’s time to give up trying.

What are your thoughts on Air Belgium’s survival odds?

[ad_2]

Source link