[ad_1]

Edwin Tan

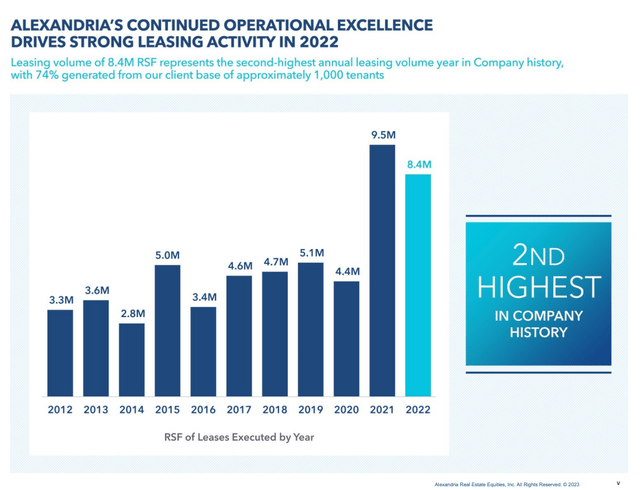

Alexandria Real Estate (NYSE: ARE) just reported fourth-quarter and full-year 2022 results, once again showing why it’s a different kind of office REIT. Even high-quality peers such as Boston Properties (BXP)) and Kilroy Real Estate (KRCMore) has shown strong headwinds from the work-from-home trend, but Alexandria continues to impress with excellent leasing, rent growth and occupancy rates. It also shows that it holds value. In 2022, it will complete approximately $2.2 billion in real estate disposals and partial interest sales, generating approximately $1.2 billion in profits. These sales were completed at very low cap rates, averaging around 4.5%. Throughout 2022, the company has seen strong rental activity, proving that there is great demand for the types of properties they offer.

Alexandria Investor Presentation

we I’m afraid Alexandria would have had to cut rents to maintain occupancy, but it’s actually increasing rents at an alarming pace. Up to 31% rent increase on lease renewal. That’s a bit lower than in recent years, but it’s still the fourth-highest number in the company’s history. On a cash basis, rents rose by up to 22.1% on lease renewals, making him the second highest in the company’s history. In addition to strong lease spreads, the company has a very favorable lease structure, with approximately 96% of its leases including approximately 3% annual rent accretion and approximately 93% being triple net leases. The company clearly has a lot of pricing power and demand for its properties remains strong.

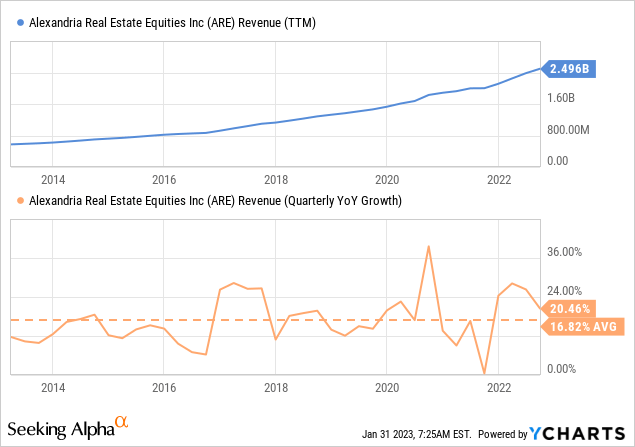

growth

Alexandria has delivered impressive revenue growth through a combination of new development and strong rental growth. As you can see in the chart below, revenue has been growing very consistently, with a compound quarterly growth rate of ~16% year over year.

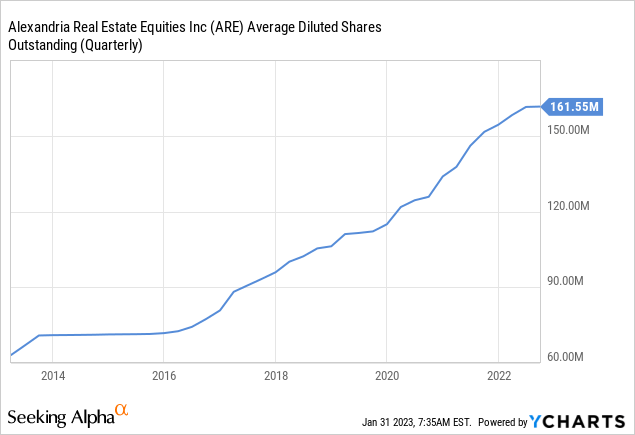

Sure, there’s a lot of dilution along the way, and the company often sells shares to raise money to fund growth projects. Luckily, the company is trading at a relatively high valuation, meaning it got a decent price for the shares it issued.

Importantly, the amount of money under management per share has been on the rise, nearly doubling over the past decade. Still, we would like the company to rely more on capital recycling and debt financing, as equity capital tends to be more expensive. The positive side of this reliance on equity financing is that the balance sheet is in very good shape.

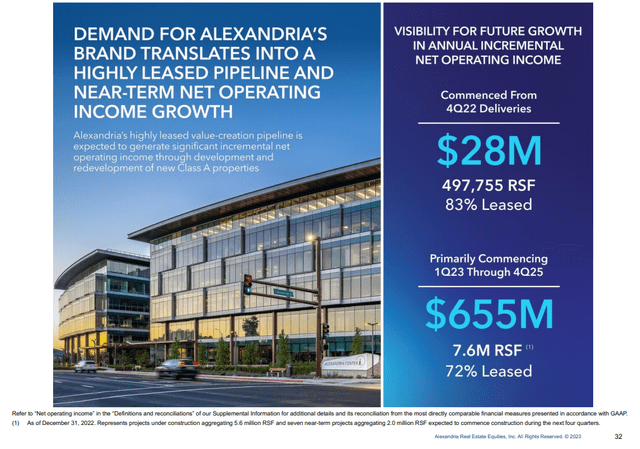

The company has good prospects for future net operating income growth, thanks to several projects slated to go online. The company has several projects that started in the fourth quarter of 2022 and other significant projects to be delivered by the fourth quarter of 2025.

Alexandria Investor Presentation

Balance sheet

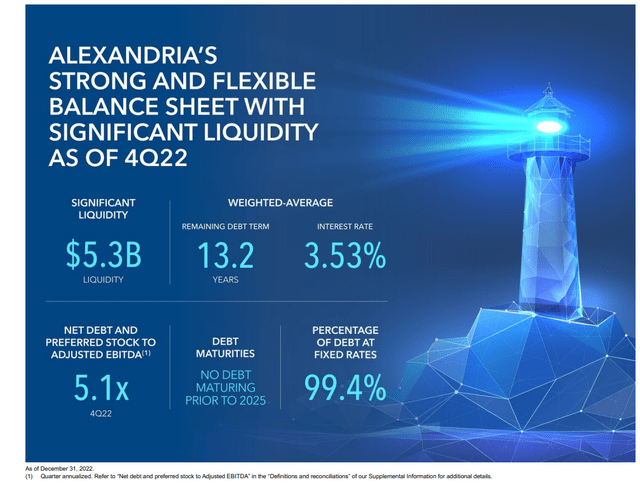

Alexandria has one of the strongest balance sheets in the industry and a strong investment grade credit rating. BBB+ from S&P Global and Baa1 from Moody’s. The majority of the debt is fixed rate, with a relatively low weighted average interest cost of just 3.53%. Net debt and preferred stock to adjusted EBITDA is just 5.1x.

Alexandria Investor Presentation

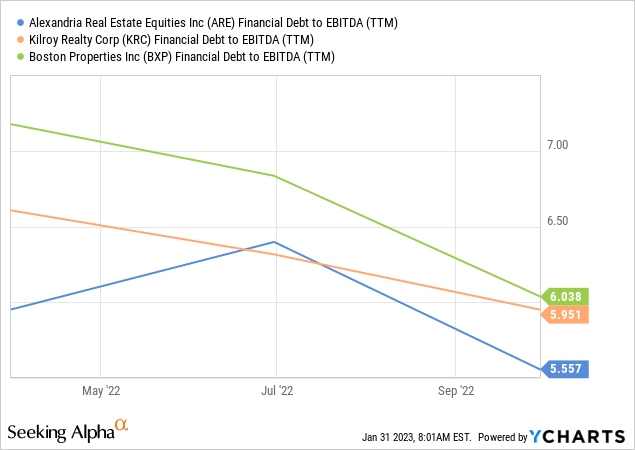

We actually think the company could leverage a little more to reduce its reliance on equity issuance. For example, Boston Properties and Kilroy Realty are believed to have solid balance sheets, while Alexandria is up to 10% less leveraged.

investment

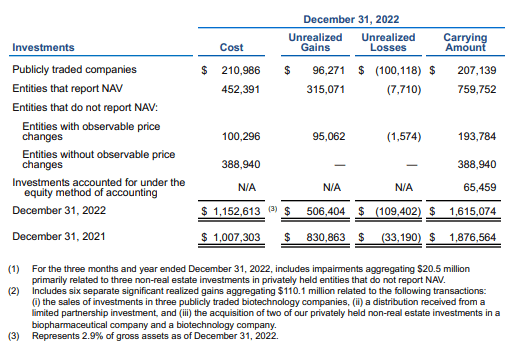

In addition to top-notch life science properties, Alexandria has several biotech investments. With a book value of around $1.6 billion at the end of 2022, it’s not a negligible amount considering the company’s market cap is around $25 billion, but it’s not a game changer either. In some cases, Alexandria invests in its own tenants. About 29% of the investments are tenant companies and about 82% are private companies.

Alexandria Investor Presentation

guidance

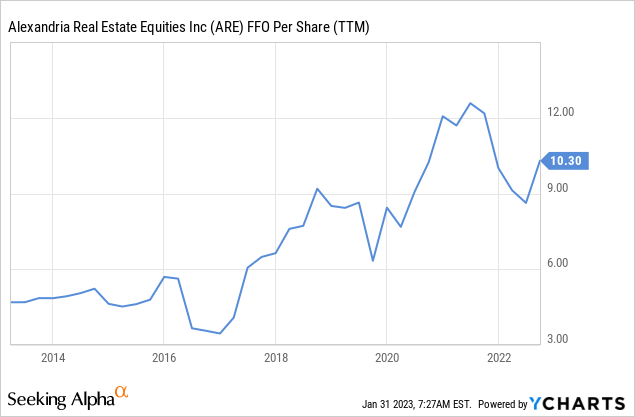

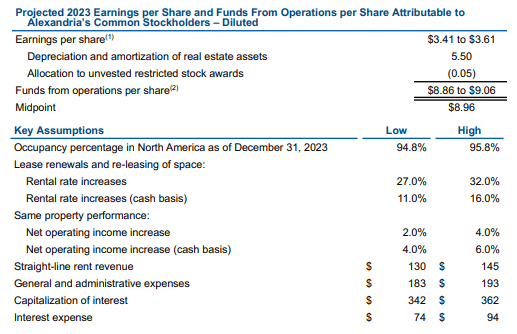

Alexandria is targeting $8.86 to $9.06 per share in 2023 and an occupancy rate of 94.8% to 95.8% by the end of 2023. In 2022 Alexandria achieved his FFO of $8.42 per share. This means that at the midpoint he expects FFO to grow by up to 6.4%. Occupancy is expected to improve slightly over the course of the year, but is already well above most of its office peers.

Alexandria Investor Presentation

evaluation

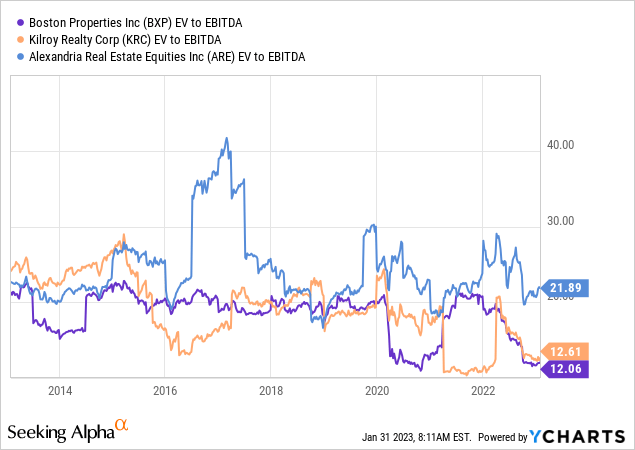

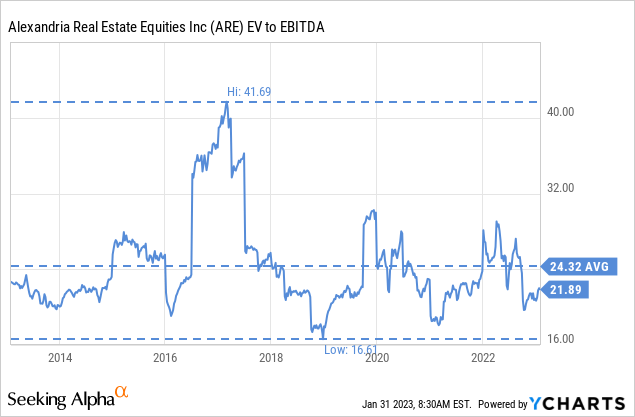

The market seems to be fairly aware that Alexandria outperforms its peers, as there is a large gap between Alexandria’s valuation and that of some of its higher quality peers. For example, the EV/EBITDA at which the company’s stock trades is much higher than that of Boston Properties or Kilroy Realty. However, these peers are much more affected by the trend of working from home.

Based on the 2023 guided FFO, the stock is trading at around 17.8x forward P/FFO. We believe this is a very reasonable multiple for a quality REIT that is still experiencing significant growth. On an EV/EBITDA basis, the company is trading at a slight discount to his 10-year average. While we don’t expect significant multiple expansion at this valuation, returns are still reasonable. Between ~3% dividend yield and 6-7% FFO growth, we believe the stock is priced at ~10% annual return.

risk

Alexandria continues to deliver excellent results, but we suspect the work-from-home trend that has had a significant impact on its peers could negatively impact the company at some point. By the way, the combination of excellent quality locations in some of the most desirable biotech clusters and a focus on life sciences customers has somewhat shielded the company from the headwinds experienced by other office REITs. That said, we believe investors should continue to be vigilant and monitor very close occupancy rates and rental spreads for bearish signs.

Conclusion

Alexandria delivered strong results in the fourth quarter and full year of 2022 despite some of its peers showing weakness due to the work-from-home trend and a weakening economy. That said, the stock isn’t particularly cheap, especially when compared to peers like Boston Properties and Kilroy Realty. We believe a higher rating is justified by our focus on life sciences attributes and our excellent operational results. We believe this is one of the cases where paying for quality is a good idea, and Alexandria has once again shown to be one of his REITs of the highest quality.

[ad_2]

Source link