[ad_1]

According to the latest Henley Global Citizens report, which tracks migration trends in personal wealth and investments around the world, India’s stringent tax laws and reporting requirements, as well as the desire for stronger passports, remain the biggest drivers of migration. It is a factor.

According to the report, young tech entrepreneurs continue to aspire to access global business and investment opportunities and are increasingly crossing borders as their appetite for risk increases.

Separately, the report found that the number of US dollar millionaires and billionaires in India will grow over the next decade compared to just 20% in the US and 10% in France, Germany, Italy and the UK. revealed an 80% increase.

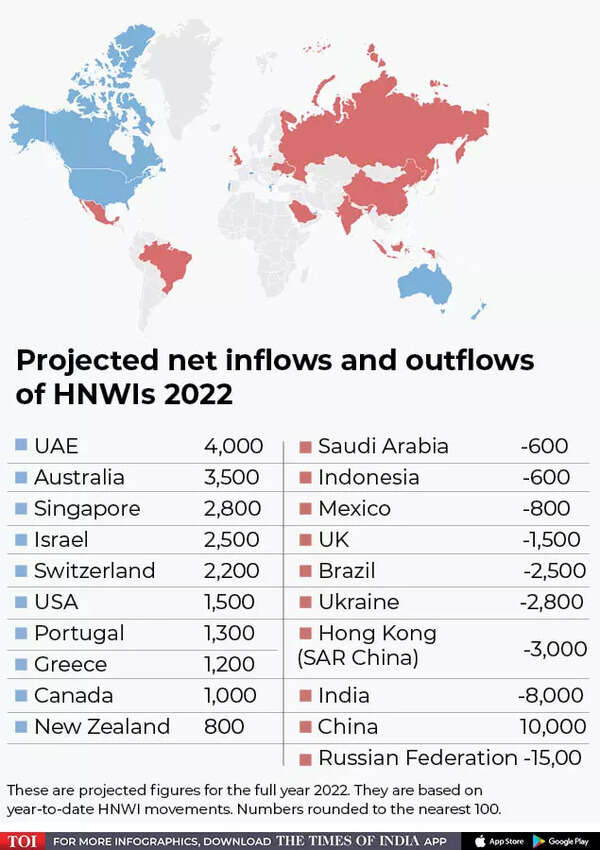

However, the latest projected net inflows and outflows of U.S. dollar billionaires for 2022 (i.e. the difference between the number of wealthy migrants moving into a country and the number migrating out of it) suggests that India’s net loss this year will be about It shows 8,000. .

“These outflows are not a particular concern because India creates far more new millionaires each year than it loses to migration.Wealthy individuals are also trending back Wealthy people are expected to move out as standards improve, and they have returned in increasing numbers.

“India’s general wealth projections are very strong. We expect the HNWI (high net worth individuals) population to grow by 80% by 2031. will become one of the fastest growing wealth markets in the world in 2020, with strong growth especially in the local financial services, healthcare and technology sectors,” said New World Wealth’s Research Director Andrew Amoils said.

Singapore and UAE largest wealth magnet

According to forecasts from the Henley Private Wealth Migration Dashboard, the UAE is expected to attract the largest net inflow of the world’s HNWIs (at least 4,000) in 2022.

Singapore is third behind Australia (3,500), with a net inflow of 2,800 expected this year.

Fourth on the list is Israel at 2,500, Switzerland at 2,200 and the United States at 1,500.

“We are also starting to see considerable interest from families across Asia looking to make Singapore or the United Arab Emirates an established base. It is likely to remain a popular destination,” said Nirbhay Handa, Head of Business Development Group at Henley & Partners.

But why are India’s rich leaving the country?

While the traditional base of industrialists has not changed, joining their ranks is a new generation of technology eager to diversify a portion of their wealth in jurisdictions that offer many incentives and high tax efficiencies. I am an entrepreneur.

“The attraction of higher standards of living, including better educational and medical facilities for families, will also continue to be a key driver, perhaps even more so with the impact of Covid.

“Increasingly strict tax residency rules (introduced in 2020 and 2021) will not reduce the personal tax rate for the wealthy, coupled with the desire for visa-free travel, will create alternatives. It is also a consistent primary motivation for residency and citizenship.” In Khaitan and Co.’s direct tax, individual client and investment fund practice

where are they migrating?

For Indians, EU countries and old favorites Dubai and Singapore have emerged as top contenders.

While Singapore is a preferred destination for tech entrepreneurs and family office establishments due to its strong legal system and the availability of world-class financial advisors, the Dubai Golden Visa is more difficult to obtain due to the ease of procurement and the multiple opportunities it offers. .

Others looked to Europe, especially Mediterranean countries such as Portugal, Malta, and Greece. This is because these countries are gateways to the EU, offer a favorable standard of living and typically have low physical residency requirements. Family or business interests in India.

what is the challenge?

“Challenges for Indians include strict exchange controls for making remittances, inheritance tax on overseas assets, and India’s residency rules for stateless persons. Increasingly, they are turning to legal and financial advisors for nuanced advice on navigating these obstacles through the use of holding companies.Individuals should do their due diligence before moving capital to avoid any unpleasant surprises. We encourage you to start planning,” said Ajinky.

[ad_2]

Source link