[ad_1]

By transferring your credit card balance to a card with a 0% balance transfer offer, you can save over $1,000 on the average credit card balance. Here’s how:

According to Reserve Bank of Australia data, the current average standard interest rate is 19.94% and credit card balances add up quickly when you carry them around.

If you were paying this amount on a credit card with an average balance of $2,876, you could save up to $1,187 over 36 months by switching to an introductory credit card with a 0% transfer rate based on offers currently available in Finder I can do it.

This also helps make repayments more manageable, as all dollars are used to repay the balance (instead of interest) during the interest-free period. So here are some balance transfer offers available in March 2022.

How was this month’s line-up chosen?

We chose the March lineup based on the length of the 0% pa balance transition period, annual fee, and other credit card great features offered on Finder in March 2022.

Great balance transfer deals have long-term offers with 0% annual interest, no balance transfer fees, and low or $0 annual fees. We picked the cards available from the Finder with the longest 0% duration and weighed their other features. There is no one best credit card for everyone. Please review important information. (Remember: You may not be eligible for balance transfer offers from your current credit card issuer or bank.)

best long term balance transfer offers

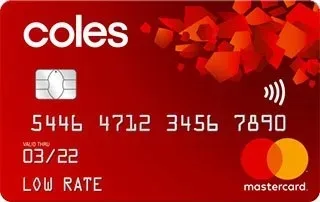

kohls low rate mastercard

- Balance transfer offer: 0% annual interest for 36 months, no balance transfer fees.

- Undo rate: 19.99% per annum

- Annual fee: $58.

- Purchase rate: 12.99% per annum

- Eligible Obligations: You can transfer up to 80% of your approved credit limit from credit cards or loans not issued by Citigroup.

Coles Low Rate Mastercard offers one of the longest 0% balance transfer offers on the market today, allowing you to pay off your existing balance for 36 months with no interest or balance transfer fees.

While some balance transfer offers only allow you to transfer debt from credit or store cards, Coles Low Rate Mastercard allows you to transfer personal loan balances as well.

Plus, with an annual fee of $58, it’s comparable to other low-rate credit cards.

To give you an idea of your potential savings, if your average credit card balance is $2,876 and your average standard interest rate is 19.94%, this balance transfer offer will save you approximately $1,187. This is based on the Finder’s Balance Transfer Calculator calculations, which also take into account annual fees during the 36-month introductory period.

Enter your balance and interest rate in the fields at the top of the balance transfer comparison table to see how much you can save.

The Coles Low Rate Mastercard offers an annual interest rate of 12.99% on your purchases and earns you 1 Flybuys point for every $2 spent at Coles supermarkets (in addition to what you’ve earned with Flybuys). Please note that interest free days do not apply to purchases for balance transfers. So new purchases will be charged interest immediately.

Also note that the direct debit interest rate will be 19.99% per annum after the introductory period. You can usually get more value by paying off what you owe short-term before making new purchases and using other features of the card.

To receive this balance transfer offer, you must apply by March 31, 2022 and include your balance transfer request as part of your application.

Note: I chose the Coles Low Rate Mastercard for March because it has a long 0% balance transition period, no balance transfer fees, a low annual fee, and the best savings based on Finder’s Balance Transfer Calculator. If you want to compare this to other long-term balance transfer offers, there are currently 3 other credit cards in our Finder database that offer 0% interest on balance transfers for 36 months. Citi Clear Credit Card, HSBC Platinum Credit Card, humm90 mastercard.

Best annual 0% balance transfer and $0 annual fee offer

Kogan Money Black Card – Special Offer

- Balance transfer offer: 0% annual interest for 30 months, no balance transfer fees.

- Undo rate: 21.74% year

- Annual fee: $0 (in progress).

- Purchase rate: 20.99% per annum

- Eligible Obligations: You can transfer up to 80% of your approved credit limit from Australian issued credit cards, store cards, personal loans and lines of credit.

Exclusive to Finder, this Kogan Money Black Card offer includes a 0% balance transfer fee for 30 months and no balance transfer fees or annual fees.

If you have several cards or personal loan balances to pay off, you can also use this offer to consolidate them. You can transfer balances from credit cards, store cards, personal loans, and lines of credit not issued by

As a simple example, if you send an average credit card balance of $2,876 from a card with an interest rate of 19.94%, you save $1,179 in interest. Also, if he uses this offer to consolidate a large debt of $5,000, it will save him $2,050 over a 36-month implementation period.

However, after the 0% balance transition period ends, the amount still outstanding will be charged an annual interest rate of 21.74%. So if you’re not sure how long you’ll need to pay off your balance, use our credit card repayment calculator to determine if this offer is right for you.

The Kogan Money Black credit card earns points for every dollar spent on eligible spend and can be used to earn money from shopping at Kogan.com. If you have balance transfer obligations, you will not get interest-free days at the time of purchase, so you may look forward to the rewards after clearing your balance.

This special offer runs until May 31, 2022, so you must apply through Finder before then and request a balance transfer within 90 days of approval.

Apply – Kogan Money Black

Best 0% balance transfer and 0% buy rate offer

Bankwest Breeze Classic Mastercard

- Balance transfer offer: 0% annual interest for 15 months, no balance transfer fees.

- Undo rate: 9.90% per annum

- Annual fee: $0 for the first year, $49 thereafter.

- Purchase rate: 0% pa for 15 months, then 9.90% pa

- Eligible Obligations: You can send a minimum of $500 from any credit card not issued by Bankwest. The maximum amount is 95% of your approved credit limit.

If you have a balance on your credit card and you have future spending, with the Bankwest Breeze Classic Mastercard you can save on both with 0% interest on balance transfers and purchases for the first 15 months. There is also no balance transfer fee for this offer. Also, the annual fee is $0 for the first year and $49 annually after that.

After the 15-month introductory period, an annual interest rate of 9.90% applies to both purchases and balance transfers. This rate is 10.04 percent lower than the average Australian standard credit card interest rate, making it a competitive low interest rate option.

The Bankwest Breeze Classic Mastercard also stands out from the other balance transfer offers we selected in March. If you’re still paying off your balance at the end of your introductory period, the interest rate is much higher (but you can save even more). If it takes more than 15 months to pay off what you owe, the 0% interest period will be longer.)

Another key feature you get with Bankwest Breeze is a digital credit card. You can set it up within 24 hours of being approved and add it to your Apple Pay, Google Pay, or Samsung Pay mobile wallet before your plastic card arrives in the mail.

Bankwest has not stated an end date for this offer, but it is only available for a limited time. To get 0% interest on balance transfers and purchases for 15 months, you must apply while the offer is still available.

Compare these balance transfer offers side by side

Here is a selection of credit cards with competitive balance transfer offers currently available on Finder. You can compare other balance transfer offers here. Looking for a new credit card but need to transfer your balance? Check out our wide range of credit card offers here.

Image: Finder, Getty Images, Included

[ad_2]

Source link