[ad_1]

Disclaimer: The Industry Talk section features insights from crypto industry players and is not a part of the editorial content of Cryptonews.com.

Peer-to-peer (P2P) exchanges enable traders to swap cryptocurrencies without needing to go through a third party.

Instead, traders can buy cryptocurrencies directly from the seller using their preferred payment method. The transaction is usually protected by an escrow service, which ensures that neither the buyer nor seller is scammed.

In this comparison guide, we review the best P2P crypto exchange platforms in the market.

The Top 8 P2P Crypto Exchanges Ranked

In terms of supported markets, pricing, user-friendliness, and other important metrics – the best P2P crypto exchange platforms can be found on the list below:

- OKX – Overall Best P2P Crypto Exchange

- Binance – Peer-to-Peer Ecosystem With 300+Payment Methods

- Uniswap – Leading Decentralized Exchange for Ethereum-Based Tokens

- PancakeSwap – Most Popular DEX for Trading BSc Tokens

- Huobi – Top Peer-to-Peer Exchange to Trade USDT, BTC, and ETH

- Bybit – Derivatives Exchange Offering P2P Trades via Fiat Money

- LocalBitcoins – Enjoy 30 Days of 0% Trading Fees After Registering

- DeFi Swap – Up-and-Coming DEX About to Launch

Visit OKX Now

The Best Peer-to-Peer Bitcoin Exchanges Reviewed

Choosing the best P2P crypto exchange will depend on a variety of factors. For instance, while some exchanges in this space specialize in Ethereum-based tokens, others support the BSc standard.

It is also important to assess factors surrounding security, reputation, fees, and mobile friendliness when selecting a provider.

Below, we provide reviews of the eight best P2P crypto exchanges in the market.

1. OKX – Overall Best P2P Crypto Exchange

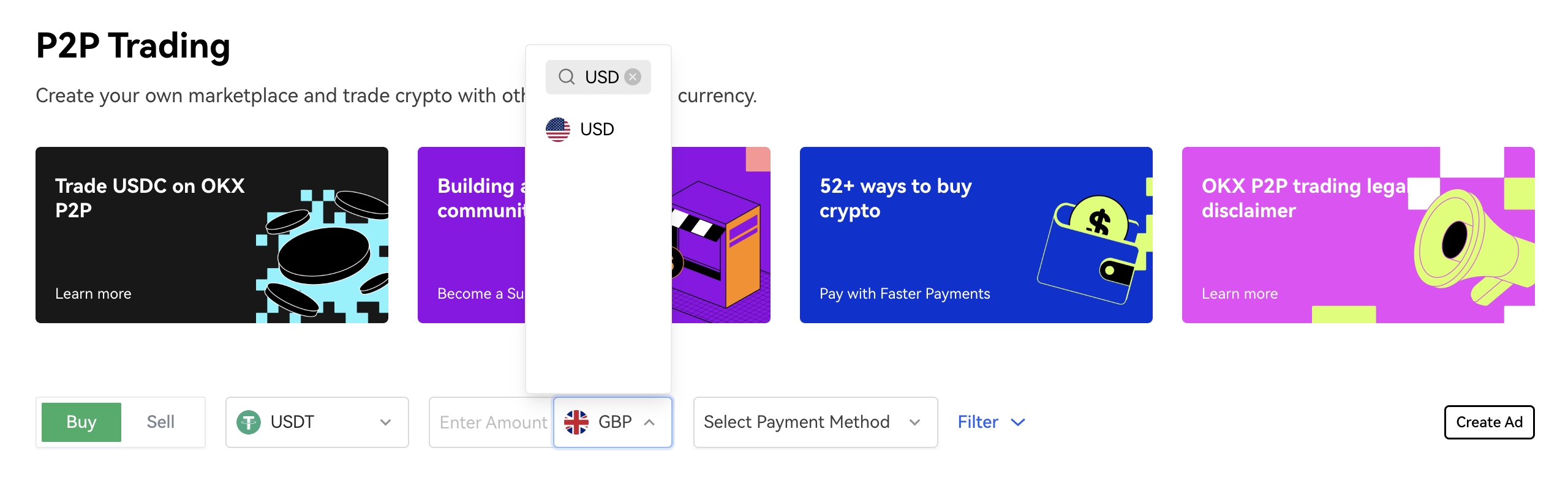

OKX is the overall best P2P crypto exchange to consider today. Although OKX is primarily known for its centralized spot trading exchange – which supports fiat currency deposits, it has since opened its own P2P alternative. This will appeal to traders that wish to swap tokens without going through a centralized order book.

Moreover, and perhaps most importantly, the OKX P2P Bitcoin exchange utilizes an aggregator pricing algorithm. In simple terms, this means that OKX can scour the market across multiple decentralized exchanges to find the best price possible for traders. For instance, let’s suppose that the trader wishes to swap Ethereum for Shiba Inu.

In this scenario, OKX would extract data from the likes of Uniswap, SushiSwap, and ShibaSwap to find the best price possible. OKX also hosts its own DEX, which often offers the best price possible – especially on ERC-20 tokens. We also like that OKX enables traders to set their network fees, from slow, average, and fast.

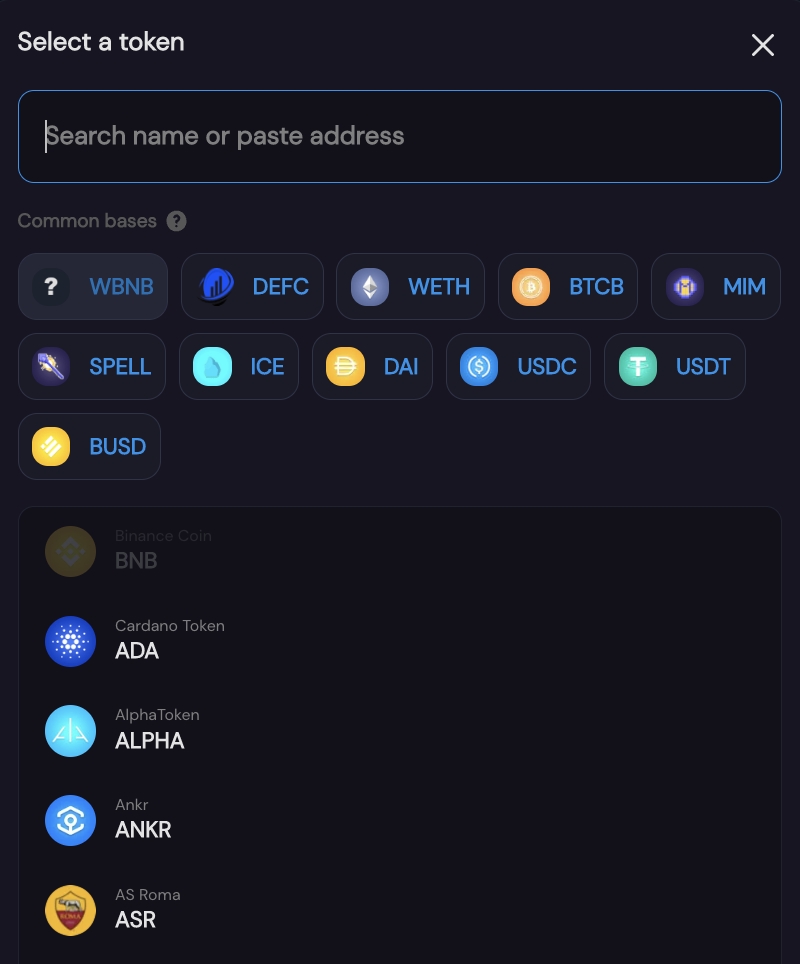

When swapping tokens, OKX also enables custom slippage rates. As is the case with most of the providers that make our list of the best P2P crypto exchanges, OKX enables clients to trade simply by connecting a wallet. The exchange supports MetaMask, Phantom, and WalletConnect. The latter offers access to the vast majority of leading wallets via a QR code.

OKX is also the best P2P crypto exchange when it comes to supported coins. Not only does it support the best altcoins on the Ethereum blockchain, but other 10 other networks. This includes the likes of BSc, Cronos, Solana, Fantom, Avalanche, and Polygon. This means that OKX traders can execute trades on a cross-chain basis.

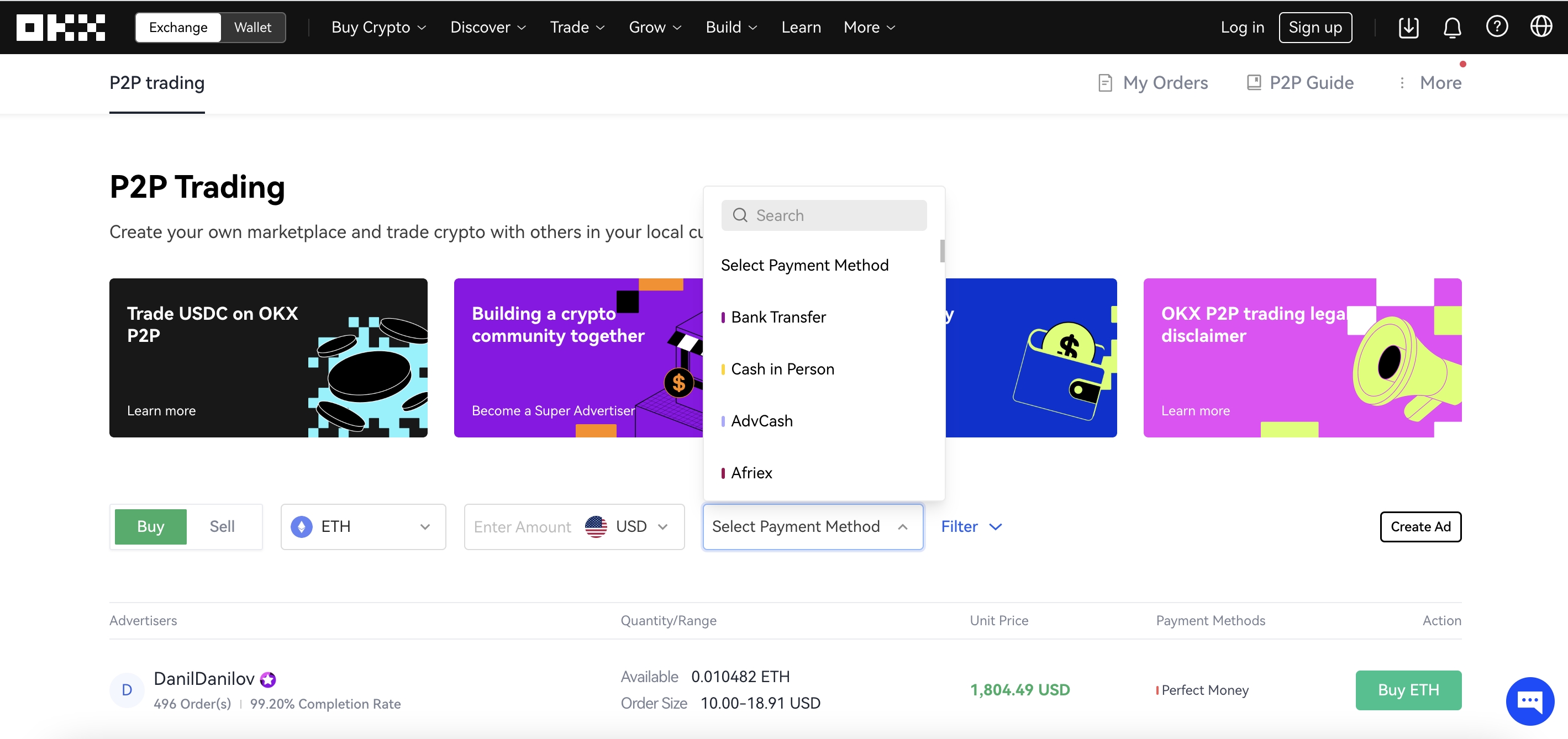

For instance, swapping USDT (Ethereum) for BNB (BSc). In addition to its DEX, OKX also offers a more conventional P2P trading platform. This enables traders to select their required tokens, country of residence, and preferred payment type. OKX will then display a range of options that support the trader’s requirements. Results are sorted by the best price on offer.

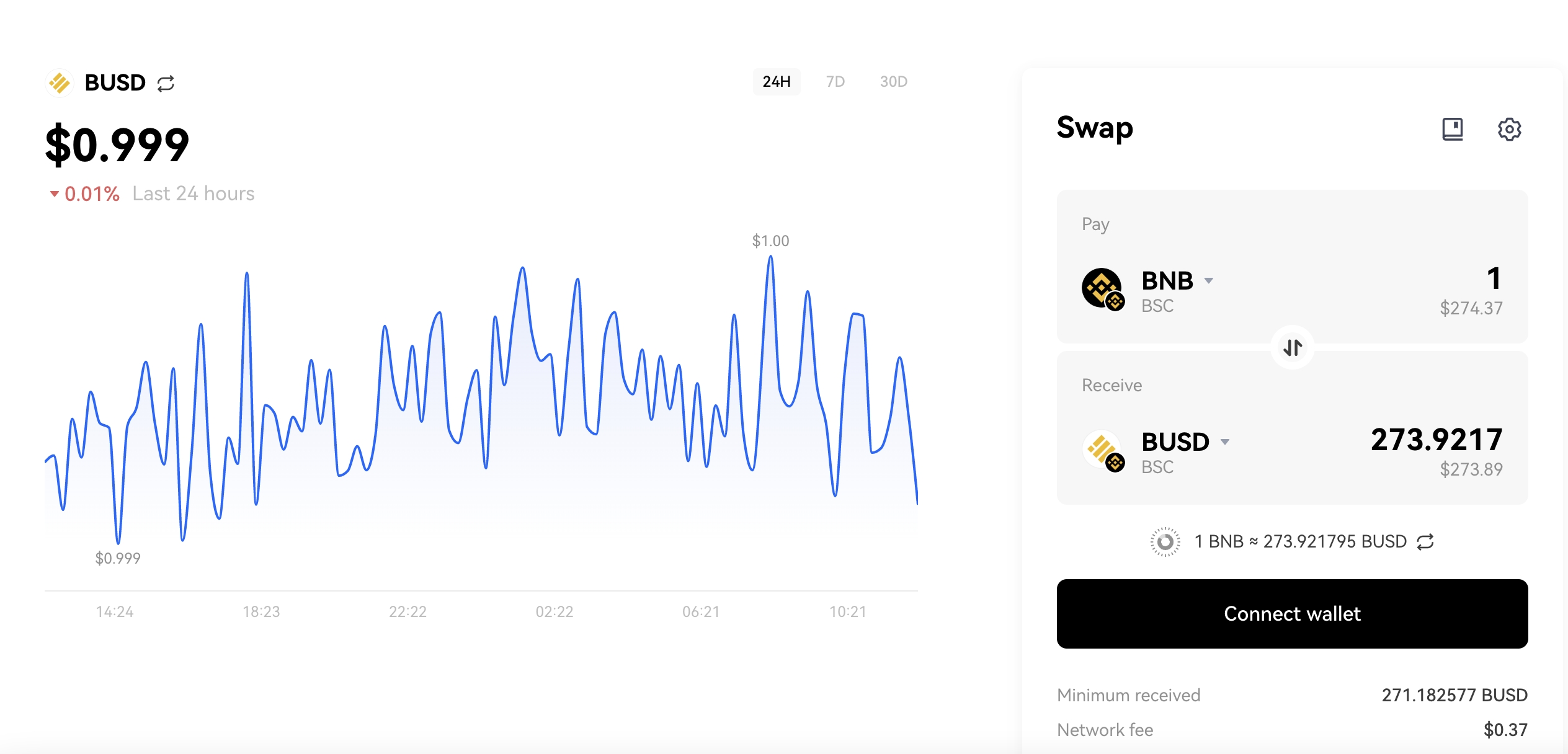

When it comes to fees, In terms of fees, the OKX DEX simply utilizes the network fee and passes this on to the trader. For instance, as of writing, swapping 1 BNB for BUSD would yield a network fee of just $0.37. Trading fees on the OKX P2P exchange, on the other hand, are set by the respective seller. This will be built into the exchange rate provided.

Another popular aspect of OKX is that it is often the go-to- exchange to buy new cryptocurrencies. For instance, OKX was the first exchange to enable investors to buy Tamadoge tokens – which is one of the best future cryptocurrency projects to watch. In fact, Tamadoge – which is building a P2E game and metaverse coin, generated gains of 10x in just 48 hours after listing on OKX.

| Supported Coins | Trading Fee |

| USDT, USDC, BTC, ETH, TUSD, and DAI on P2P exchange. 1,000+on the OKX DEX | Set by P2P sellers and built into the exchange rate. |

Visit OKX P2P

2. Binance – Peer-to-Peer Ecosystem With 300+Payment Methods

Binance is the largest centralized exchange globally. However, Binance is also a major player in the P2P trading space. Its P2P exchange hosts more than 300 payment methods across 70+fiat currencies. The former includes everything from local bank transfers and SEPA to Paypal and Western Union. As such, buying crypto via the Binance P2P exchange is seamless.

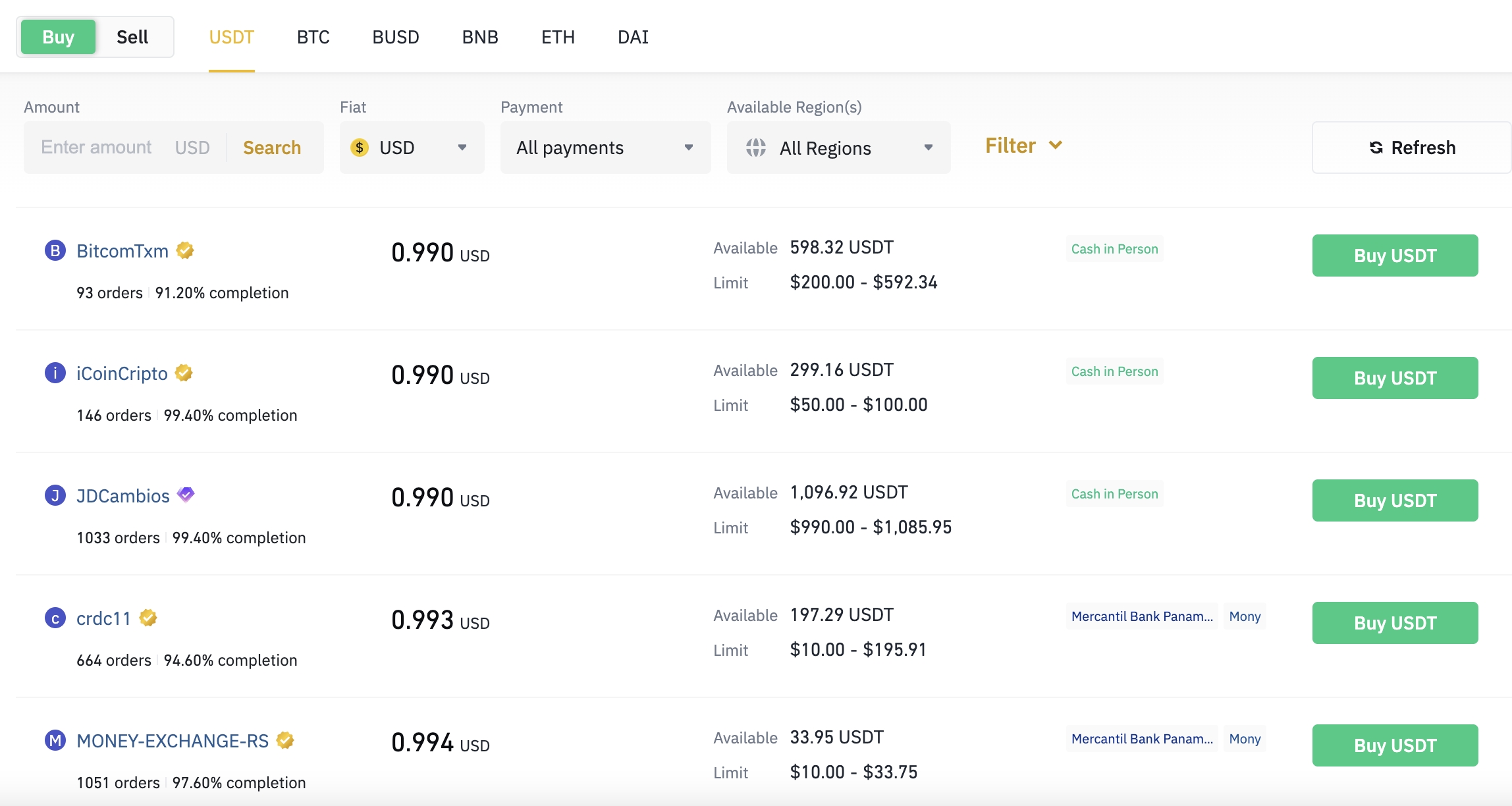

When using Binance for P2P exchanges, seven crypto assets are supported. This includes USDT, BTC, BUSC, BNB, ETH, ADA, and SHIB. The platform itself is very user-friendly and the filter system makes it a breeze to find a suitable seller. For instance, the user can select the coin they want to buy and their preferred payment method in their country of residence.

Binance will then display all suitable P2P sellers – listed from the most competitive price. Buyers accepting a P2P offer will not need to pay any transaction fees to Binance. Market makers, however, will pay between up to 0.35% depending on the trading pair and currency. We like that each trader on the Binance P2P will have their own profile.

This enables buyers to evaluate the legitimacy of the seller in a similar way to eBay. This is because buyers can leave reviews and ratings, which the seller cannot amend.

| Supported Coins | Trading Fee |

| USDT, BTC, BUSC, BNB, ETH, ADA, and SHIB | Set by P2P sellers and built into the exchange rate. Market makers will pay up to 0.35%. |

Visit Binance Now

3. Uniswap – Leading Decentralized Exchange for Ethereum-Based Tokens

Uniswap takes the P2P trading concept to the very next level. The reason for this is that the entire Uniswap ecosystem is decentralized. This means that no single person or entity has control over the platform and thus – trades are conducted on a truly peer-to-peer basis. In fact, there is no requirement for traders to open an account when using Uniswap.

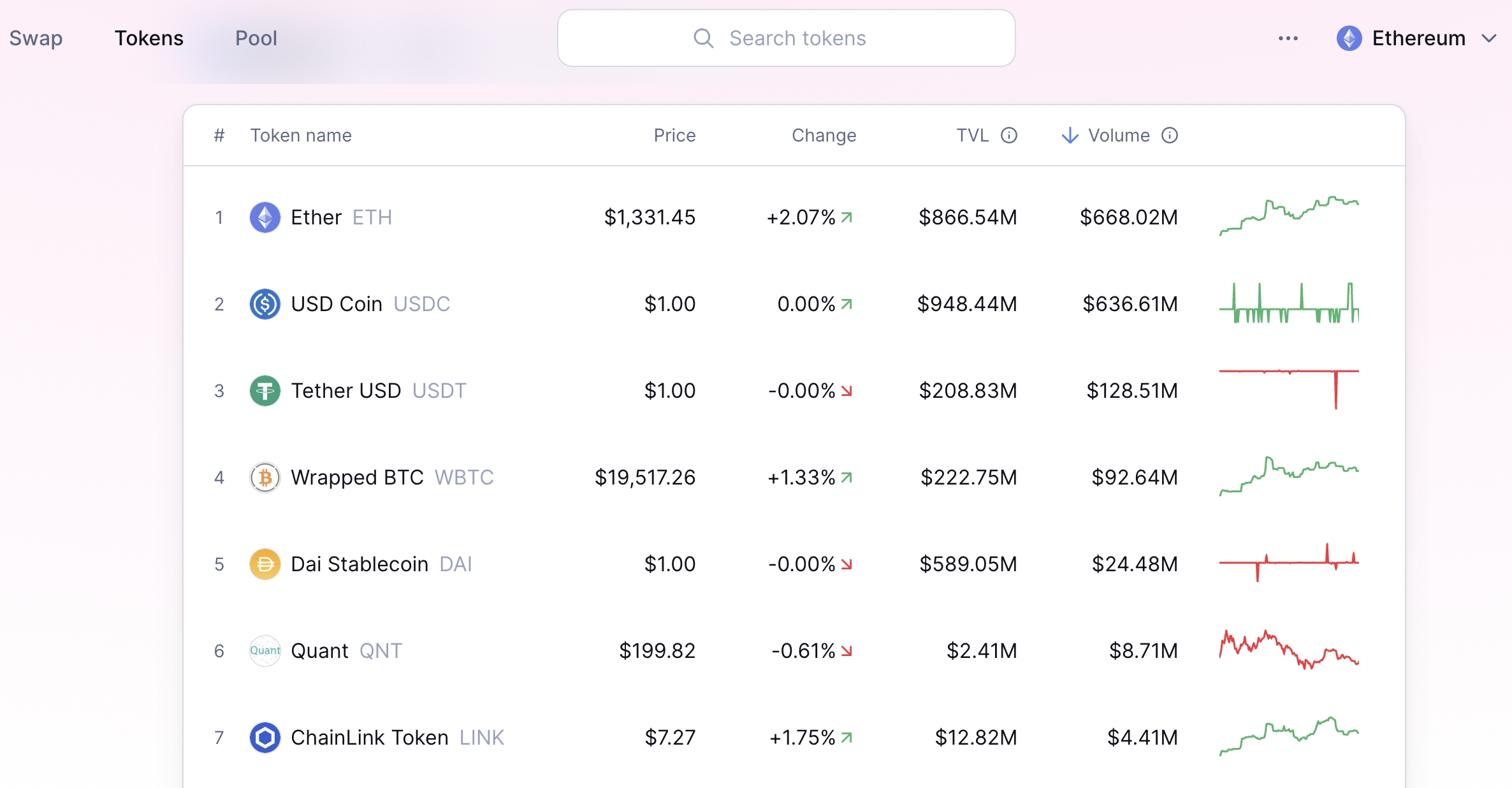

Instead, it’s just a case of connecting a crypto wallet to the platform and carrying out a token swap. Users can even add their own trading pairs and liquidity pools should they wish. In terms of supported markets, Uniswap is the best P2P crypto exchange for Ethereum-based cryptocurrencies. This means that the platform supports thousands of ERC-20 token pairs.

Uniswap utilizes the automated market maker (AMM) system, which means that token swaps are carried out autonomously via liquidity pools. As such, buyers can swap tokens without needing to have a seller at the other end of the trade. Standard trading fees on the Uniswap DEX amount to 0.35% of the transaction size. A portion of the fees collected are sent to liquidity providers.

This is because Uniswap enables investors to engage with yield farming crypto tools. In simple terms, by adding idle tokens to a Uniswap liquidity pool, investors can earn a share of any trading commissions that are generated. Uniswap is also the go-to place to find the fastest-growing cryptocurrencies, with newly launched ERC-20 tokens preferring the exchange.

| Supported Coins | Trading Fee |

| Most ERC-20 tokens | Exchange rates set by AMM. 0.35% trading fee charged by Uniswap. |

Visit Uniswap Now

4. PancakeSwap – Most Popular DEX for Trading BSc Tokens

While Uniswap is the go-to place for Ethereum-based coins, PancakeSwap dominates the BSc token swap scene. As such, PancakeSwap is ideal for finding the next crypto to explode, not least because many new projects now opt for the Binance Smart Chain as per its low fees and fast transaction speeds.

For instance, a recent example of this is the listing of Battle Infinity (IBAT), which is one of the best penny crypto assets of 2022. This P2E metaverse project had a hugely successful presale before generating sizable gains after listing on PancakeSwap. The PancakeSwap P2P platform – just like Uniswap, is actually a decentralized exchange rather than a peer-to-peer provider.

Nonetheless, this means that there is no requirement to open an account with PancakeSwap, nor is there a need to have a seller at the other end of the trade. Instead, PancakeSwap also utilizes the AMM model. PancakeSwap is slightly more cost-effective when compared to Uniswap, with the DEX charging 0.25% per trade.

PancakeSwap is also a good option for those that wish to generate income on their idle crypto tokens. The exchange supports high-yield farming pools across thousands of pairs. PancakeSwap also hosts regular lottery draws, with the top prize of writing at over $110,000. Where PancakeSwap falls short is that it lacks any advanced charting tools or data.

| Supported Coins | Trading Fee |

| Most BSc tokens | Exchange rates set by AMM. 0.25% trading fee charged by PancakeSwap. |

Visit PancakeSwap Now

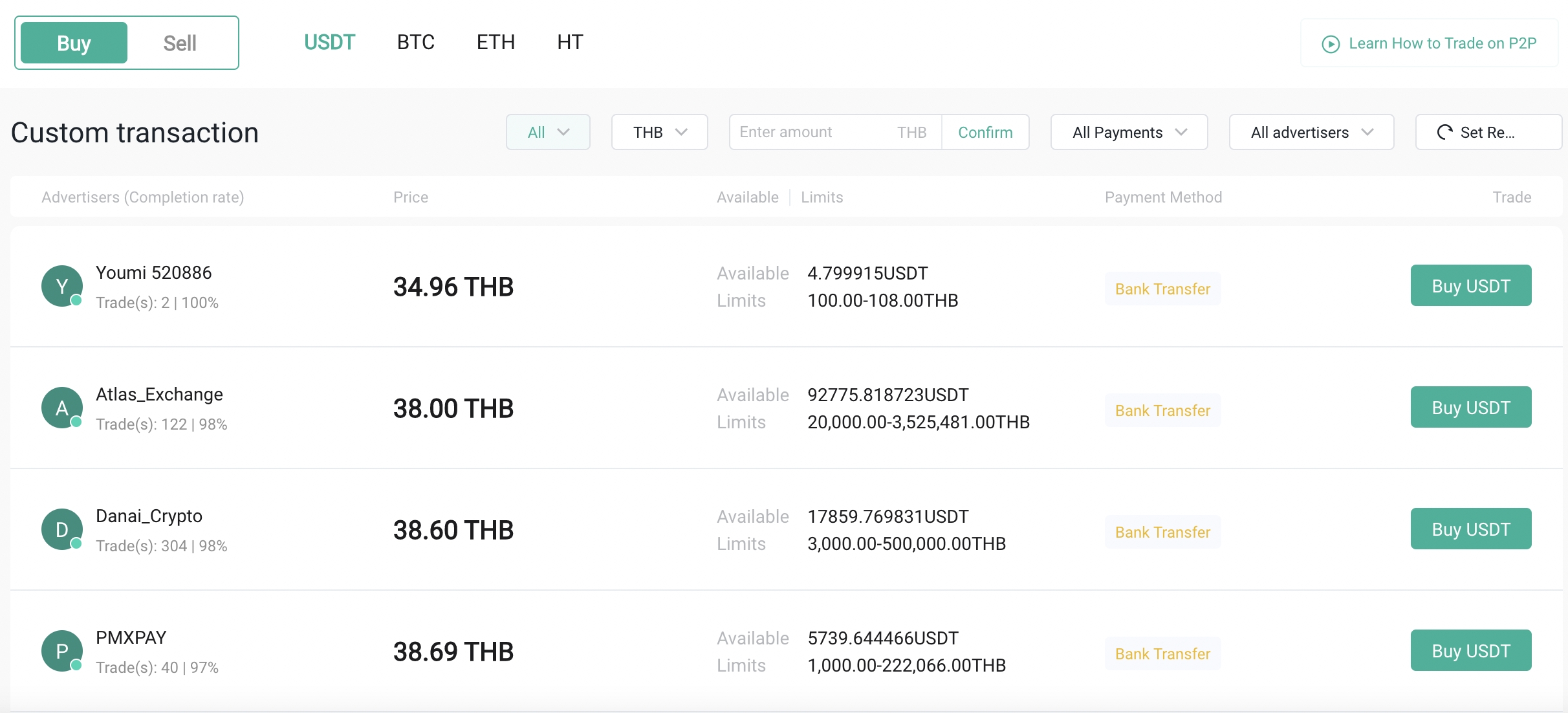

5. Huobi – Top Peer-to-Peer Exchange to Trade USDT, BTC, and ETH

In a similar nature to Binance, Huobi is best known for its low-cost centralized exchange. In fact, Huobi charges spot trading fees of just 0.20% across hundreds of crypto pairs. With that said, Huobi has also launched its very own peer-to-peer trading platform. In addition to its Huobi Token, the platform supports just three coins – USDT, Bitcoin, and Ethereum.

Nonetheless, dozens of fiat currencies are supported across a wide range of payment methods. This includes everything from TransferWise and domestic wire payments to Paypal and SEPA. Huobi hosts a filter system, so buyers can choose the coin they want to buy and their preferred country and payment type.

Buyers can then choose the best deal on the table at the time of the purchase. Prices are set by sellers, some of which charge significantly more than the global spot price of the respective cryptocurrency. Moreover, unlike PancakeSwap and Uniswap, all P2P traders on Huobi are required to go through a KYC verification process.

On the flip side, we like that the Huobi P2P exchange does not charge any commissions. Huobi offers 24/7 customer service around the clock via its live chat feature. The platform also encourages users to set up two-factor authentication for enhanced account security. Albeit, this isn’t mandatory.

| Supported Coins | Trading Fee |

| HT, USDT, BTC, ETH | Exchange rates are set by sellers. 0% commission fee offered by Huobi. |

Visit Huobi Now

6. Bybit – Derivatives Exchange Offering P2P Trades via Fiat Money

Bybit is a popular crypto exchange that offers high levels of leverage via derivative markets. With that said, not only has Bybit since begun offering spot trading services, but it also hosts a fully-fledged P2P facility. Traders from most countries are welcome, albeit, Bybit does not serve US clients.

Its P2P trading suite covers four digital currencies – USDT, USDC, BTC, and ETH. Multiple fiat currencies and payment methods are supported. Although Bybit does not charge any commissions for utilizing its P2P exchange, sellers set their own prices. This means that buyers will need to ensure that they are getting a good deal.

There is an in-built escrow system that ensures buyers and sellers can trade safely. As is the case with the best P2P crypto exchanges in this space, buyers can view the seller’s rating, which is left from previous trades. This enables buyers to ensure they are dealing with legitimate P2P sellers with a strong trading track record.

| Supported Coins | Trading Fee |

| USDC, USDT, BTC, ETH | Exchange rates are set by sellers. 0% commission fee offered by Bybit. |

Visit Bybit Now

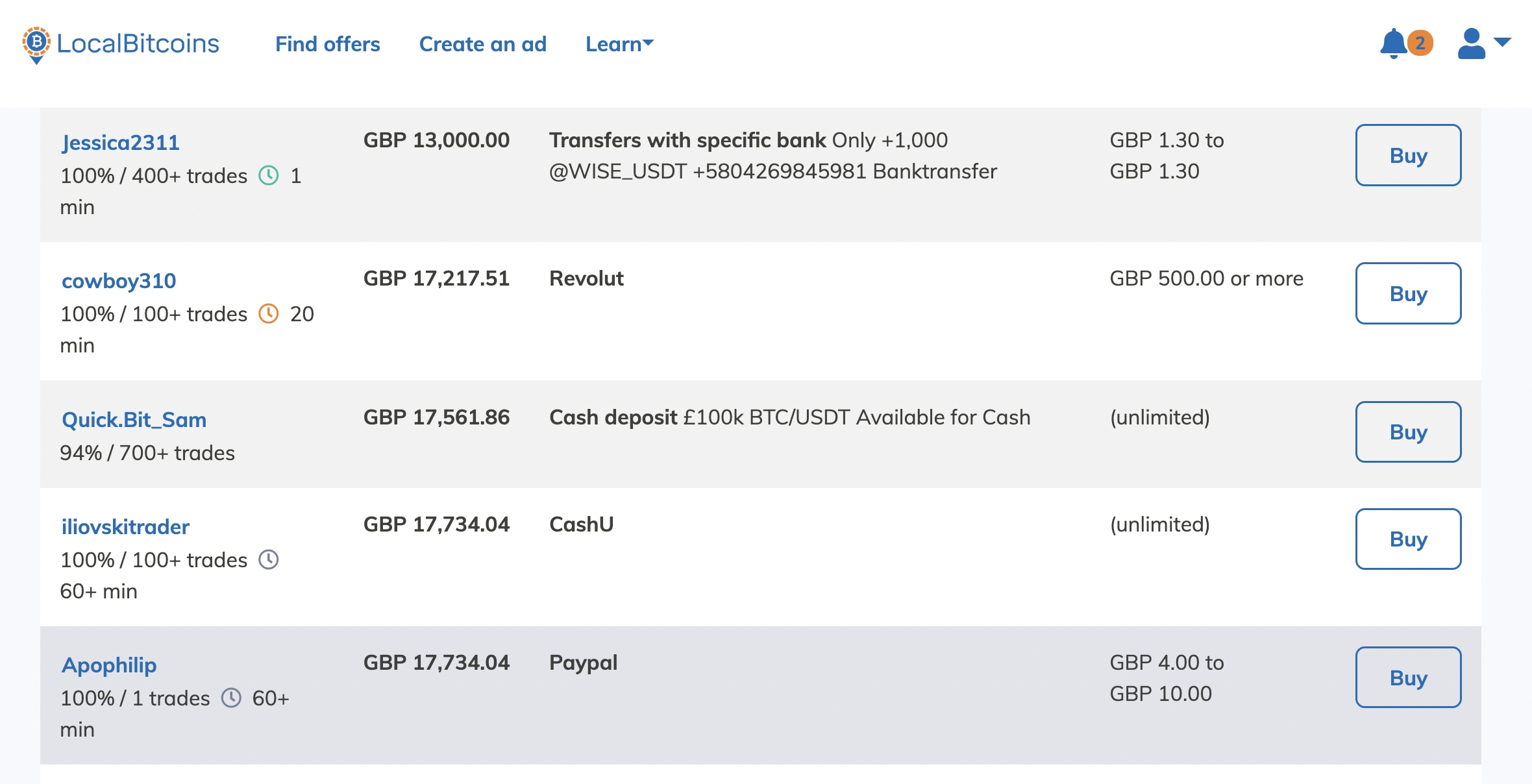

7. LocalBitcoins – Enjoy 30 Days of 0% Trading Fees After Registering

Founded in 2012, LocalBitcoins is considered the original P2P crypto exchange. Even to this day, and as the name suggests, LocalBitcoins specializes exclusively in Bitcoin trades. The platform is simple to use and it often takes less than 10 minutes to open a verified account. As per growing KYC regulations, LocalBitcoins now requires traders to upload ID.

After registering an account for the first time, users will have access to 0% commission trading for 30 days. With that said, Bitcoin exchange rates are set by the seller. While local bank transfers seem to offer the best price possible, the likes of e-wallets and TransferWise payments can attract a highly unfavorable exchange rate.

| Supported Coins | Trading Fee |

| Bitcoin only | Exchange rates are set by sellers. 0% commission fee is offered by LocalBitcoins for the first 30 days after registering. |

Visit LocalBitcoins Now

8. DeFi Swap – Up-and-Coming DEX About to Launch

DeFi Swap is in the final stages of launching its decentralized exchange to the public. The much-anticipated launch has been over a year in the making, albeit, we have had a sneak peek at DeFi Swap in its current form. We found that the exchange is user-friendly with a super clean interface and there is no requirement to open an account or upload any KYC documents.

After connecting a wallet to DeFi Swap, users will be able to buy and sell cryptocurrencies anonymously. The exchange utilizes the AMM model, so buyers can purchase their required token without needing a seller. At this moment in time, DeFi Swap supports BSc tokens. However, in early 2023, the exchange will offer cross-chain compatibility.

DeFi Swap also offers yield farming and staking services, with an NFT marketplace also in the pipeline for 2023. This up-and-coming DEX also has its own native digital currency – DeFi Coin. With a market capitalization of under $1 million, this could be one of the best low-cost crypto assets to consider buying for maximum upside.

| Supported Coins | Trading Fee |

| Most BSc tokens. Cross-chain compatibility will launch in 2023. | Exchange rates set by AMM. |

Visit DeFi Swap Today

What is a Peer-to-Peer Crypto Exchange?

In a nutshell, peer-to-peer crypto exchanges enable buyers and sellers to trade the best cryptos directly. This means that there is no requirement to go through a centralized exchange that utilizes traditional order books. Instead, the buyer will determine their preferred currency and payment type, and then transfer the funds to the seller.

Before the transfer is made, the seller will deposit the respective cryptocurrencies into the escrow wallet hosted by the peer-to-peer exchange. This means that if the buyer does not complete the repayment, the tokens will simply be released back to the seller. On the other hand, if the buyer proceeds with the payment, then the tokens will be transferred to their wallet.

Depending on the provider, P2P exchanges will accept a wide range of payment types. This includes everything from local bank transfers, SWIFT, SEPA, PayPal, Skrill, Western Union, and more. In the vast majority of cases, trades carried out on a P2P exchange are conducted quickly and safely. However, P2P exchanges are not immune from fraud.

This is especially the case when a face-to-face cash transaction is selected. After all, the trade is essentially being completed outside of the P2P platform, so anything could happen. Another drawback of using a P2P platform is that oftentimes, exchange rates and fees are a lot less competitive when compared to traditional crypto exchanges.

How do P2P Exchanges Work?

To determine whether or not P2P Bitcoin exchanges are worth considering, it is wise to first have a solid understanding of how the trading process works.

In this section, we’ll explain the fundamentals of P2P Bitcoin exchanges from the perspective of a beginner.

Trade Parameters

After opening an account with the chosen P2P exchange, the buyer will initially need to set up their trading preferences.

This includes the following metrics:

- The coin that the buyer wishes to buy in exchange for fiat money – e.g. Bitcoin

- The country that the buyer wishes to buy from – e.g. United Kingdom

- The preferred payment method to pay for the crypto purchase – e.g. local bank transfer

- The size of the purchase – e.g. £2,000

After the above has been specified, the respective P2P exchange will list each and every seller that has the capacity to facilitate the requirements. In other words, sellers that have £2,000 worth of Bitcoin to sell in exchange for GBP, via a local bank transfer.

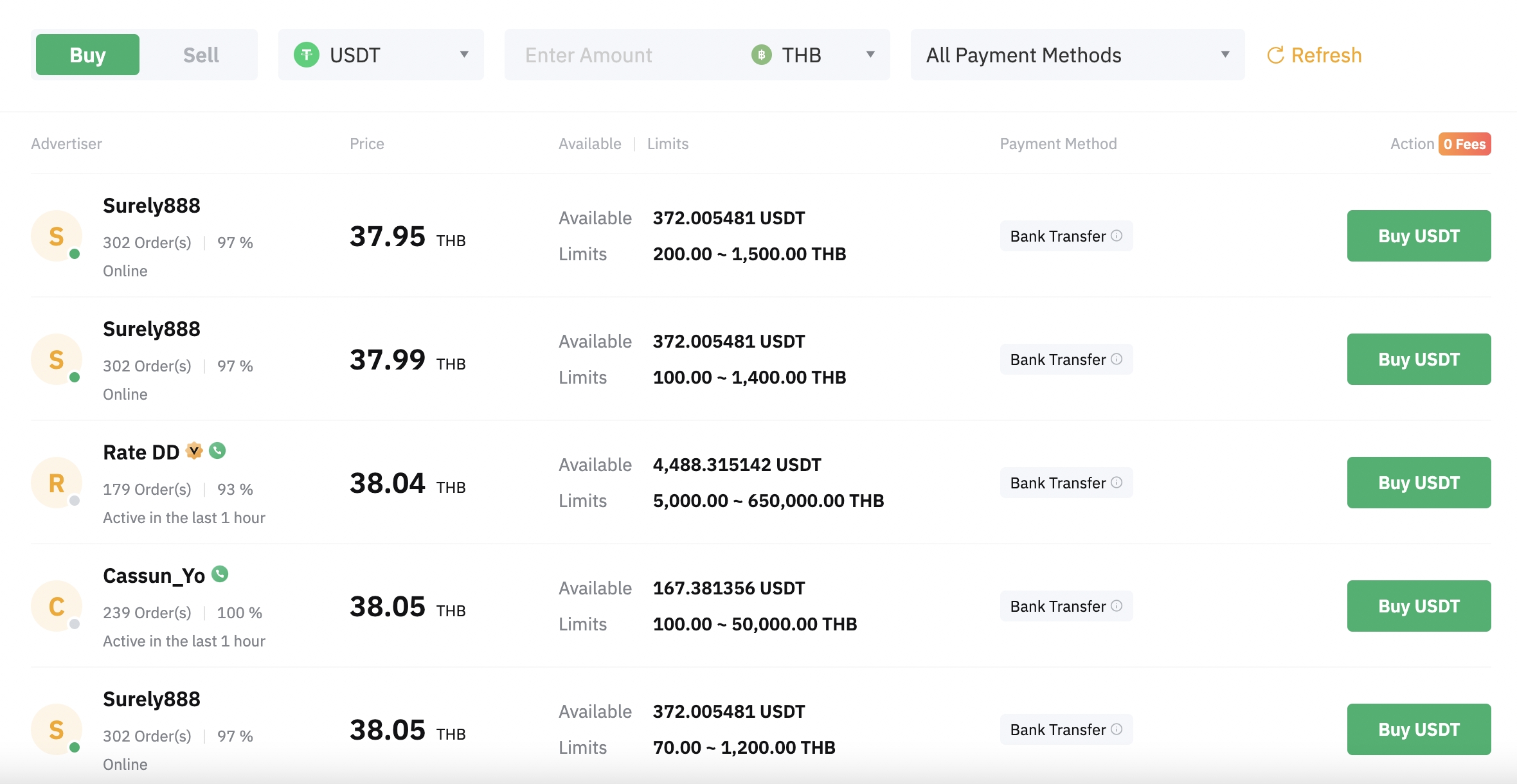

Exchange Rates

The buyer will now be able to view a list of sellers that can facilitate the respective trade. The best P2P Bitcoin exchanges will display the search results from the best price possible, downwards.

This is with respect to the exchange rate offered by the seller.

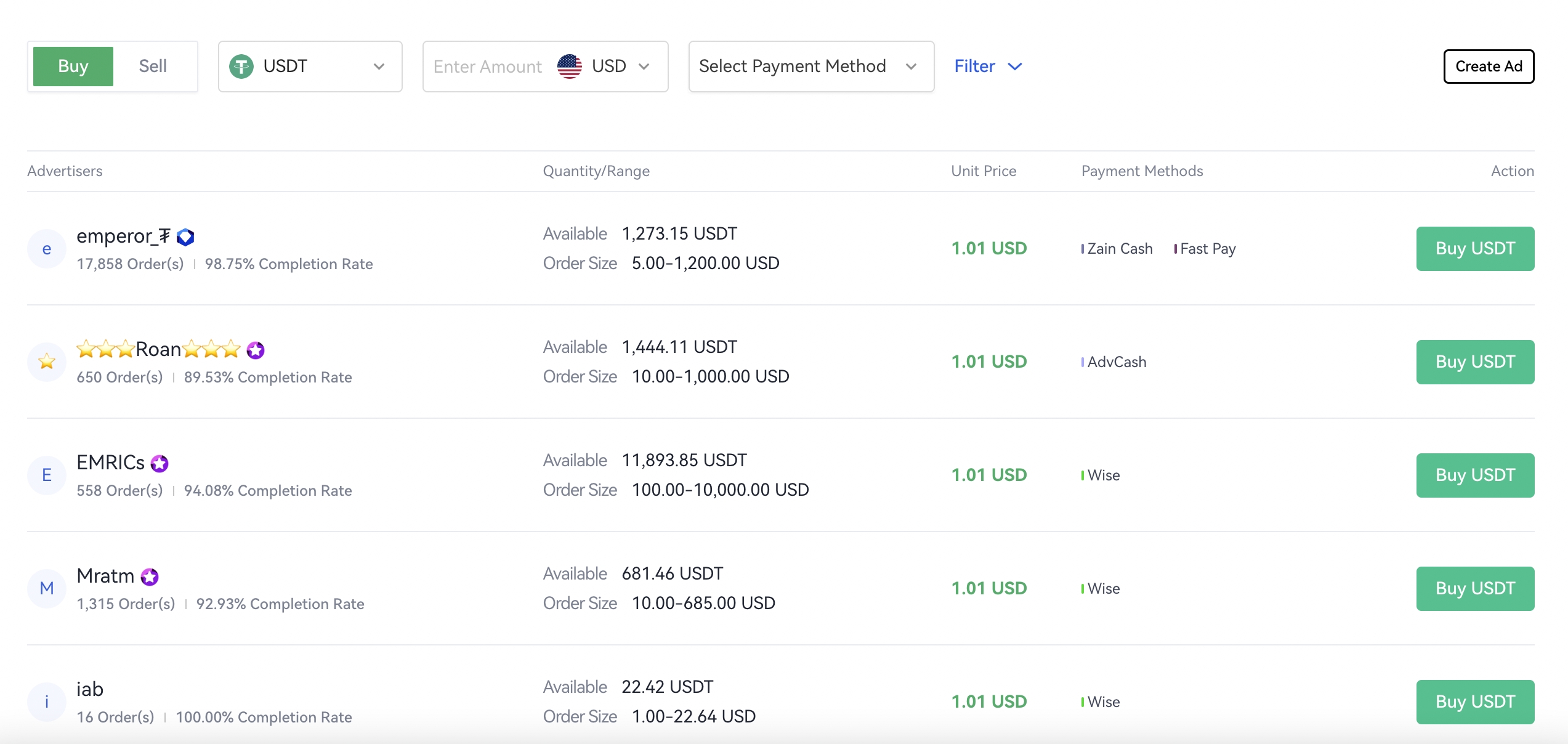

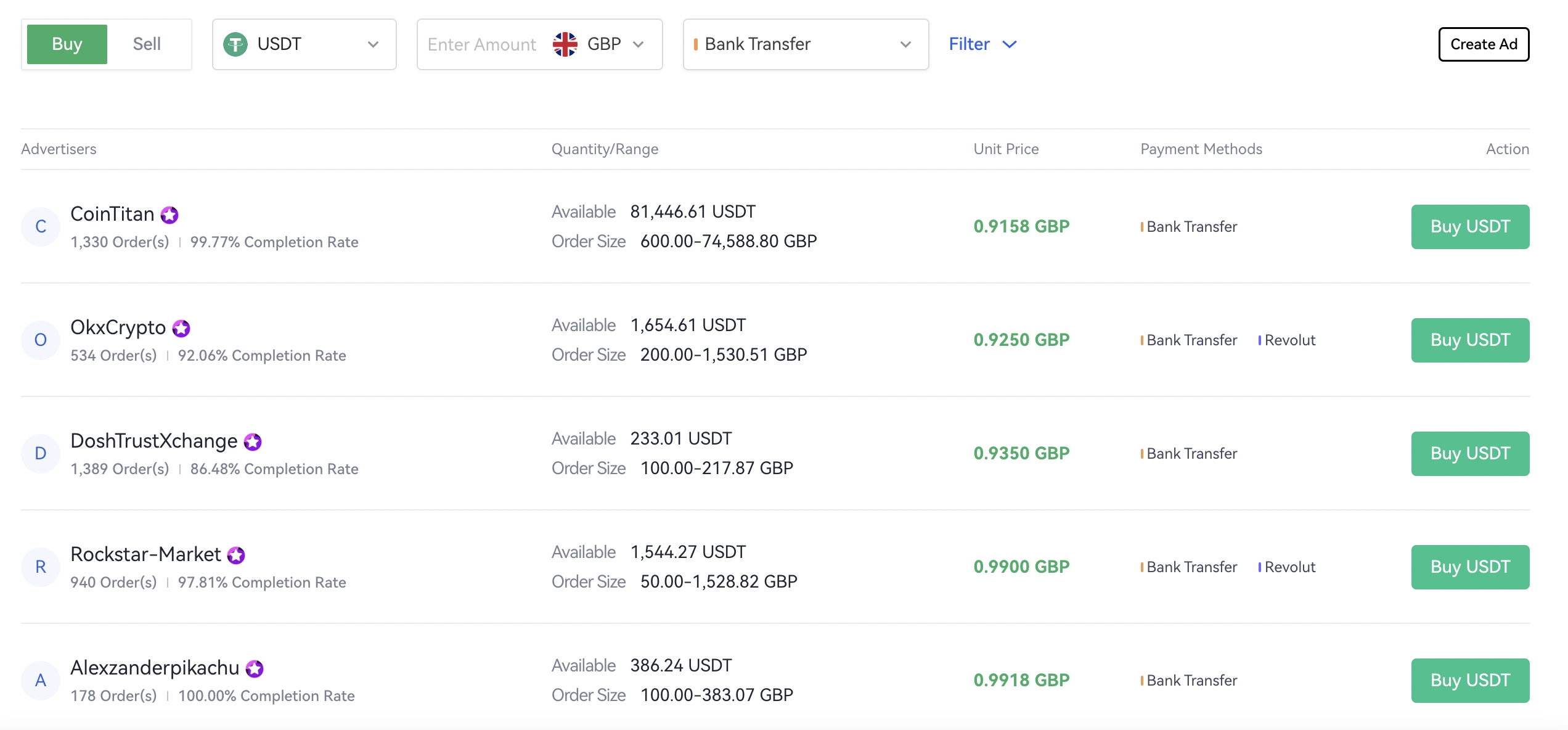

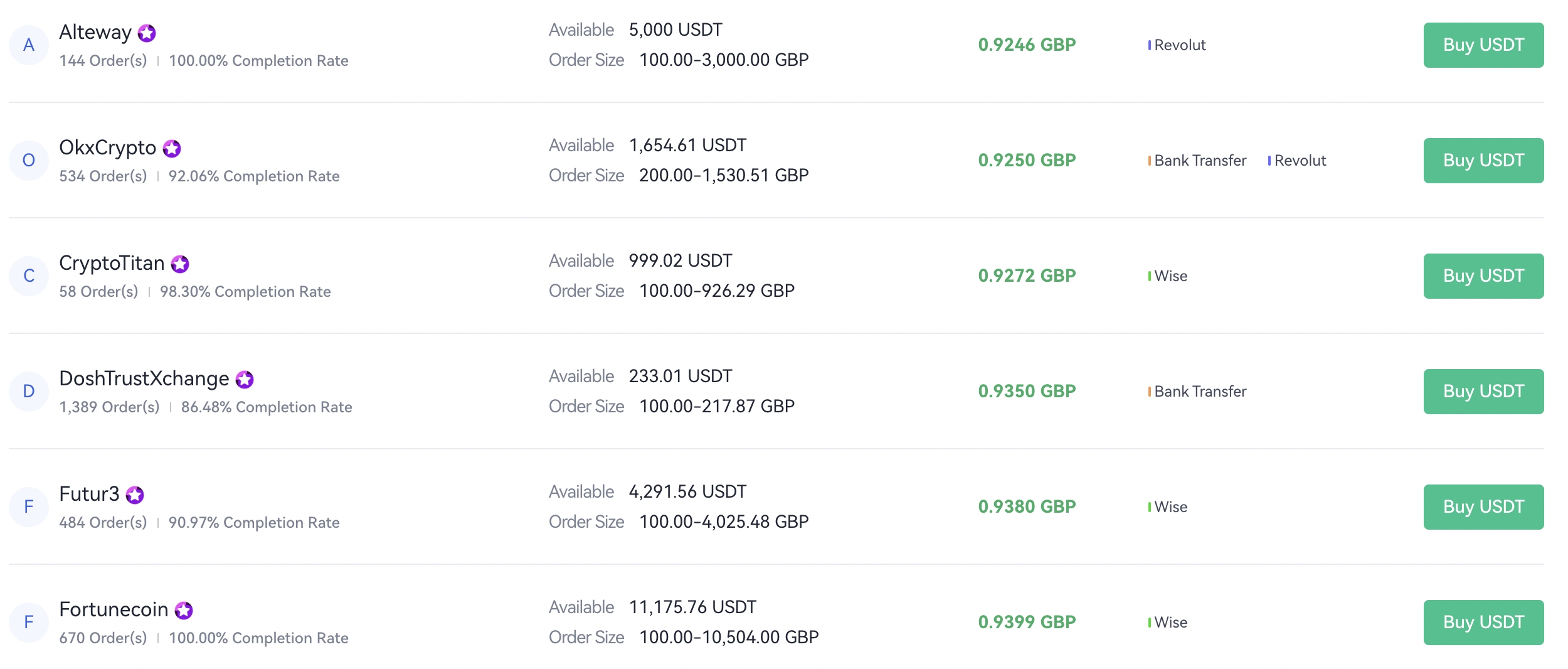

For example, in the image above, we have set our parameters to buy USDT with GBP via a bank transfer.

At the very top, a seller called ‘CoinTitan’ is offering the best price possible at 0.9158 GBP for every 1 USDT purchased. We can also see that ‘CoinTitan’ has nearly £75,000 worth of USDT that they are able to sell at the stated exchange rate.

As we begin to make our way down the list of options, we can see that the exchange rate starts to become super unfavorable. For instance, a seller called ‘Alexzanderpikachu’ is looking to charge 0.9918 GBP for every 1 USDT purchased.

In comparison to ‘CoinTitan’, this represents an exchange rate that is over 8% higher.

Accepting an Offer

Once the buyer has had a chance to browse through the offers presented, the next step is to accept the best option.

This will then provide details of the seller’s payment method. For example, if the buyer has opted for a local bank transfer, it will display information such as the account number and the name of the financial institution.

After confirming the deal, the seller will then be required to do two things. First, they will need to accept the buyer’s request and second – deposit the cryptocurrencies into the P2P exchange’s escrow wallet.

Escrow

The overarching safeguard offered by the best P2P crypto exchanges is an escrow service. This means that the buyer will only be asked to transfer the funds once the cryptocurrencies have been deposited into the exchange by the seller.

The P2P Bitcoin exchange will keep hold of the cryptocurrencies until the buyer makes the payment. Once they do, the buyer will mark the payment as complete.

The seller will then check that the payment has been received. If it has, the seller will then confirm receipt of the funds and subsequently mark the payment as complete.

In turn, the P2P Bitcoin exchange will then release the cryptocurrencies from its escrow wallet and into the account of the buyer. The buyer can then proceed to withdraw the cryptocurrencies from the P2P Bitcoin exchange and into their chosen wallet address.

Benefits of Using P2P Bitcoin Exchanges

Still wondering whether or not P2P exchanges offer the best way to buy crypto online?

If so, we will now explain the main benefits to consider to help clear the mist.

Avoid Centralized Platforms

One of the main reasons why some buyers prefer peer-to-peer exchanges is that there is no requirement to go through a centralized platform.

Instead, buyers can deal directly with sellers. In many ways, this follows the ethos of Bitcoin and other cryptocurrencies, insofar as it keeps the transaction decentralized.

With that being said, there is an argument to be had that P2P platforms are not truly decentralized. After all, buyers and sellers are typically required to open an account and go through a KYC process before being able to trade.

Moreover, the P2P exchange essentially acts as a centralized third party, not least because its escrow service holds onto the cryptocurrencies while the payment is being carried out.

With this in mind, for a truly decentralized experience free from centralized actors, it might be best to use a DEX. In doing so, there is no requirement to register an account, provide any personal information, or upload KYC documents.

On the flip side, DEXs do not accept fiat money. Instead, only crypto assets can be used when depositing and withdrawing funds.

Wide Range of Payment Methods

Another benefit offered by the best P2P crypto exchanges is that the number of payment methods accepted is typically far and beyond what centralized platforms offer.

For example, when using the OKX P2P exchange, buyers can often pay for their crypto purchase via a local bank transfer, in addition to SWIFT, SEPA, and other regional payment networks.

Moreover, OKX also supports PayPal, Skrill, and other e-wallets. Ultimately, there is no limit to the number or type of payment methods that can be used when opting for a P2P exchange.

After all, the buyer is transferring funds to the seller’s preferred payment method. To complete the trade and for the P2P exchange to release the cryptocurrencies, the seller simply needs to confirm that they have received the funds.

Escrow Service Protects Both Parties

We briefly mentioned the escrow service offered by the best peer-to-peer crypto exchanges earlier. Nonetheless, to recap, this offers a safeguard for both buyers and sellers.

For instance:

- The buyer will not transfer the funds until the seller deposits the cryptocurrencies into the P2P escrow wallet

- The seller will not release the cryptocurrency from the escrow wallet until the funds are received

Furthermore, if a conflict arises between the buyer and seller, the P2P can investigate the transaction and make an informed decision. For instance, let’s suppose that the seller claims that they did not receive the funds.

In this scenario, the buyer would be required to send proof of the transaction – such as a bank account statement.

Transactions are Often Fast

In the vast majority of cases, once the buyer and seller have accepted the deal, the transaction can be completed in a matter of minutes.

This is on the proviso that an instant payment method is being used, such as an e-wallet or local bank transfer.

P2P Exchanges vs OTC Exchanges

There is often a misconception that P2P and OTC exchanges offer the same service. However, this isn’t the case at all.

As we have explained throughout this guide, P2P exchanges enable buyers and sellers to deal with one another directly. This means that the buyer will transfer the funds directly to the seller. In turn, the seller will transfer the cryptocurrencies to the buyer, via the P2P exchange.

- In contrast, OTC – or over-the-counter exchanges are aimed at large-cap buyers that wish to buy a significant amount of cryptocurrencies.

- This is often at least $50,000, albeit, some OTC dealers require much more.

- Nonetheless, OTC exchanges are specialist brokers that have the capacity to procure large volumes of cryptocurrencies from the open market.

When using an OTC exchange, buyers typically have access to industry-leading rates, due to the size of the purchase.

How to Trade on a P2P Crypto Exchange

First-time investors that wish to buy cryptocurrency via a P2P exchange can follow the step-by-step guide outlined below.

In doing so, investors will learn how to complete the P2P process with OKX.

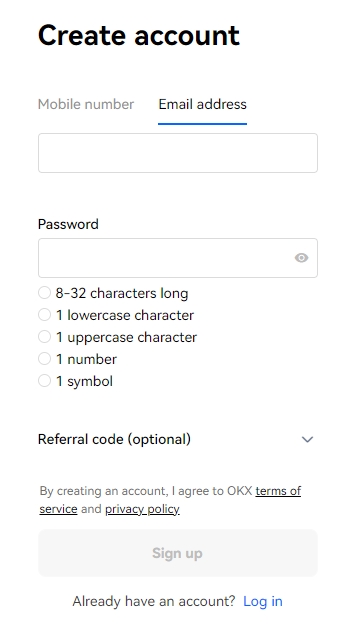

Step 1: Open OKX Account

OKX requires all new customers to open an account before having access to its peer-to-peer trading service. This is to ensure that both buyers and sellers remain safe.

This will initially require an email address and a chosen password. Next, as the P2P exchange is aimed at buyers that wish to use fiat money, a KYC process is required.

This is a standard procure that will require the buyer to provide some personal information, contact details, and a copy of their government-issued ID.

Step 2: Set P2P Parameters

Once the account is verified, the buyer can then head over to the OKX P2P exchange.

First, select the cryptocurrency that will be purchased – from USDT, USDC, BTC, ETH, TUSD, and DAI. Then, select the preferred fiat currency, purchase amount, and the required payment method.

Step 3: Select the Best P2P Offer

OKX will then provide a list of sellers that meet the stipulated requirements. As noted earlier, OKX will display the search results from the best price possible.

Step 4: Accept Offer and Transfer Funds

Next, the buyer will need to confirm that they accept the seller’s offer.

In doing so, the payment details will be displayed. For instance, this could be the email address associated with the seller’s PayPal or their bank account details.

Then, the buyer will need to transfer the funds to complete the payment. At this stage, the cryptocurrencies will be held in the P2P exchange’s escrow wallet.

Step 5: Confirm Payment and Receive Crypto

Once the buyer has made the payment, they will need to mark the transaction as complete. The seller will then be notified and they can subsequently check that the payment has been received.

If it has, the seller will mark the trade as complete and the P2P exchange will transfer the cryptocurrencies to the buyer’s account.

The buyer can then withdraw the tokens to their private wallet.

Conclusion

This guide has compared the best P2P crypto exchanges for supported coins, fees, security, liquidity, and more.

We concluded that OKX is the overall best provider in this space. The exchange is super user-friendly and it takes just minutes to get set up.

Plus, the OKX P2P exchange supports a variety of new crypto projects and payment methods – with the latter including local bank transfers, e-wallets, and more.

Visit OKX P2P Now

FAQs

Is P2P the best way to buy crypto?

The best P2P crypto exchanges offer buyers the opportunity to purchase digital assets directly from sellers. However, the buyer will still need to open an account with the P2P exchange and assuming that fiat money is being used, go through a KYC process. Moreover, we found that conventional spot trading exchanges offer much more competitive rates and fees when compared to P2P platforms.

Is there P2P on Crypto.com?

Crypto.com does not offer a P2P exchange. It does, however, offer a decentralized exchange that enables buyers to swap cryptocurrencies without going through a third party. Moreover, Crypto.com also offers the best P2P crypto lending facility for those looking to raise capital.

What is the best P2P exchange?

Our research findings pointed to OKX as the overall best P2P Bitcoin exchange. Buyers and sellers can transact through a variety of currencies and payment methods, and verified accounts take just minutes to open. Plus, OKX provides an escrow service that ensures both buyers and sellers remain safe at all times.

Does Coinbase have P2P?

No, Coinbase does not offer a P2P Bitcoin exchange. On the contrary, Coinbase is as centralized as it comes. All users – whether buying or selling, will need to go through a KYC process to gain access to its exchange. Those in the market for the best P2P cryptocurrency exchange might consider OKX.

[ad_2]

Source link