[ad_1]

Big data analytics combines large amounts of data to uncover information such as data correlations, hidden patterns, market trends, and consumer preferences that help organizations make informed business decisions. It’s a multifaceted process to explore. It is a type of advanced analytics that includes composite applications that include key elements such as predictive models, statistical algorithms, and what-if analysis using analytical systems. Primary sources of information include online platforms (social media, media publishers, blogs, etc.), data collected by user devices (computers and mobile gadgets), corporate assets (archives, databases, etc.), and search inputs.

The history of big data analytics and its role in banking

The term big data was first used in the mid-1990s to describe large amounts of data. In 2001, analyst Doug Laney, who works for consultancy Meta Group Inc., expanded the definition of big data as the amount, variety, and velocity of data generated and used by organizations increased. In 2006, Hadoop, a distributed processing framework, was launched. This established a clustered platform built on commodity hardware and a platform capable of running big data applications.

By 2011, big data analytics could be found in almost every large internet and e-commerce company such as Yahoo, Google, Facebook, etc., with all their analytics capabilities.

and marketing service providers. Recently, however, a wide range of users, including retailers, financial services companies, insurance companies, and healthcare providers, have begun using big data analytics as a key technology to drive their digital transformation.

As digital technology advances, data becomes more important and banks are working hard to adapt to these sudden changes. The scale of competition in the industry is so great that a successful business must adopt new ways to survive and thrive in a highly competitive market environment.

Big data analytics have enabled banks to improve the standards and quality of services they provide to their customers. So it’s no big deal that the banking sector is making huge investments in big data and its technology. Another important role of big data can be understood from the increasing amount of data generated and processed by banks and financial institutions. data analysis It helps banks and financial services store data efficiently, analyze it, and improve scalability.

Big data analysis process

The four steps in the big data analytics process are:

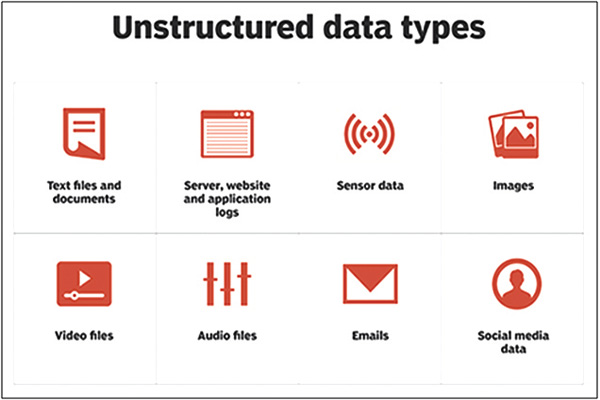

1. Data collection: Data professionals use different data streams such as internet clickstream data, web server logs, cloud data, mobile applications, social media content, survey responses, cell phone records, etc. to extract semi-structured data from different sources. Collect a combination of data and unstructured data.

2. Data processing: After data is collected and stored in a data warehouse or data lake, data professionals properly organize, structure, and partition the data for analytical queries. Analytical queries require detailed data preparation and processing for better performance.

3. Cleansing data: Data experts use scripting tools or data quality software to clean the data. Check data for errors and inconsistencies, such as redundancy and incorrect formatting, and finally classify and organize the data.

4. Analysis of data: Clean data is analyzed with analysis software. This includes data mining (finding patterns and relationships in data sets), predictive analytics (models that predict customer behavior), machine learning (algorithms that analyze large data sets), text mining, statistical analysis software , and data visualization tools.

Uses and examples of big data analytics

Big data analytics can be used to help businesses in many ways. Some of them are:

● Targeted advertising: Personalization and analysis of data from sources such as previous purchases, interaction patterns, and historical product page view data can help generate compelling, targeted advertising campaigns for your customers.

● Customer Acquisition and Retention: Customer data analytics assist companies in their marketing efforts by determining trends that increase customer satisfaction. For example, companies such as Amazon and Netflix offer personalized pages to improve the customer experience.

● Final product development: Big data analytics can be used to determine product feasibility, development decisions, measure progress, and

We will improve our products to meet the needs of our customers.

● Price optimization: Retailers can choose pricing models that use and model data from a variety of data sources to maximize revenue.

● Supply chain and channel analysis: Predictive analytics models help with proactive replenishment, B2B supplier networks, inventory management, route optimization, and notification of potential delivery delays.

● Risk management: Big data analytics can help identify new risks from data patterns for effective risk management strategies.

● Improved decision-making: Insights extracted from the right data help businesses make faster and better decisions.

Growth, Trends and Forecasts of Big Data Analytics in the Banking Market

The advent of COVID-19 has cost financial markets up to US$744 billion by March 20201.was

Banks have all but dried up due to the closure of multiple businesses in various regions, proving that banks are discouraged from investing in big data analytics. Still, big data analysis of the banking market is estimated to register a CAGR of 22.97% by 2027.

Some of the latest trends and drivers of big data analytics adoption include:

● The massive increase in the amount of data that banks generate and this rapid growth requires better capture, organization, integration, and analysis.

● The number of devices that clients use to initiate transactions is also increasing, further increasing the number of transactions. Big data analytics provides a single place for data analysts to view and easily find all data points.

Teams share insights and improve the banking sector.

● Big data solutions enable enterprises to store data in a cost-effective and flexible environment that provides the processing, persistence, and analytical capabilities needed to discover new business insights.

●Big data analysis Store and curate structured and unstructured data.

● The BFSI industry is embracing cloud deployment of data due to increasing digital disruption and technological advancements such as edge computing, Internet of Things (IoT), and artificial intelligence. Additionally, COVID-19 has increased the demand for increased computing power among the banking and fintech sectors, resulting in a surge in data cloud deployments in the BFSI market.

● It is estimated that more than three-quarters of the world’s adult population will have a bank account by 2022, up from 51% in 2011.

● The adoption of big data analytics in the banking market is driven by the growing number of digital users. For example, Bank of America said that in 2021 he added over 2 million active digital clients1.

● The pandemic has also brought the importance of personalization and customer experience. With the shift to smartphones, digital-only institutions are outperforming traditional banks as more than 89% of his global customers prefer mobile his banking channels. Fintech companies were the most profitable.

Advantages of Big Data in Banking

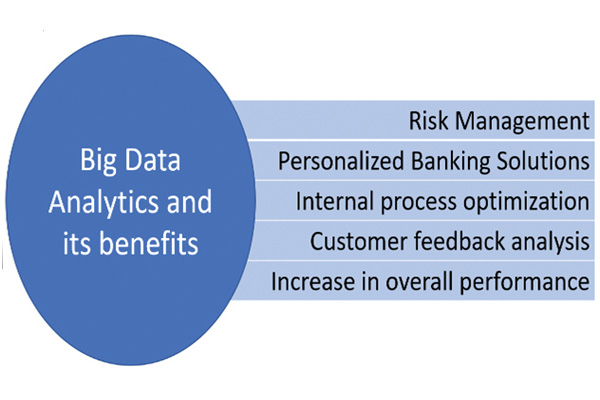

Big data offers several benefits for banks. Some of them are listed below.

●Risk management–

Banks use big data analytics to analyze market trends and customer data records to make decisions such as:

A. Determine the interest rate

B. Identify customers with poor credit scores to avoid giving loans

C. Detect fraud and prevent potentially malicious activity.

1 – According to a study conducted by research firm Mordor Intelligence

● Personalized Banking Solutions – Banks use big data analytics to detect customer behavior based on information received from investments, shopping trends, or financial context. Banks can find ways to retain and attract more customers with personalized solutions.

● Optimization and streamlining of internal processes – Banks can achieve this using big data analytics to improve performance and reduce operational costs.

● Customer feedback analysis – Bank customer centers are usually overloaded with queries. By helping create a master database, big data tools can help you scan large amounts of data and respond quickly and appropriately to your customers. Customers value this speed.

● Improved overall performance – Big data analytics can also help assess employee performance against goals and suggest ways to scale better.

Challenges of big data analytics

Some challenges with banking usage. Some of them are listed below.

● Legacy System Struggle – Banking sector reform is somewhat lagging. Many banking systems are finding it difficult to keep up with increasing workloads. There is a risk of system instability during the process of collecting, storing, and analyzing data on older infrastructures.

● Security Concerns – Banks deal with huge amounts of data. Banking service providers must ensure the amount of user data they collect and the security of the processes carried out.

● Maintaining data quality – With large amounts of data coming in structured and unstructured formats from various sources, managing data quality requires significant time, effort, and resources.

● Choosing the right tools – With a large number of big data analytics tools and platforms on the market, it can be difficult for banks to choose the best tools for their users’ needs and infrastructure.

Conclusion

Big data analytics are currently being implemented in various areas of the banking sector, helping banks to better serve their internal and external customers, while also improving their active and passive security systems.

Views of Thomas Matthew, Research Officer, State Bank of India

Elets The Banking and Finance Post Magazine has carved out a unique niche in a crowded marketplace with exclusive and unique content. Get in-depth insights on the innovations and transformations that are setting the trends in the BFSI sector. Best offers for print and digital editions! Subscribe here➔ www.eletsonline.com/subscription/

This is your chance to meet NBFC and insurance industry luminaries. Join us at our upcoming events to explore business opportunities. Like us on Facebook, connect and follow us on LinkedIn twitterInstagram, Pinterest.

[ad_2]

Source link