[ad_1]

Despite macroeconomic headwinds, Microsoft (Nasdaq: MSFT) showed strong cloud segment strength in its most recent quarterly results and should be a strong earnings catalyst for the company going forward.

I believe this will rebound the company’s earnings growth significantly in the short to medium term and create an attractive investment opportunity. Therefore, I am bullish on Microsoft stock.

Second quarter results were actually strong

Investors and analysts had low hopes for Microsoft to announce its second quarter fiscal 2023 results. A continued slowdown in economic growth has constrained business spending, which in turn dampened the performance of some divisions of tech giants. It certainly was. For example, revenue from devices plunged 39% or 34% in constant currency (CC) as sales peaked during the work-from-home economy sustained during the pandemic.

The same is true for Microsoft’s Xbox content and services revenue, which declined 12% (8% in CC) year-over-year. Gaming spending also peaked last year, so it makes sense to see an adjustment now that outdoor entertainment has rebounded. For context, Xbox Content and Services revenue increased 10% over the same period in fiscal 2022. So all we really see is the growth trajectory of the segment returning to single-digit (currency equivalent) growth averages.

We would expect some cyclicality in games and device revenue in a tougher economy, so in that respect, the decline in revenue from these two segments is relatively natural and shouldn’t alarm investors. .

However, when it comes to Microsoft’s core growth segments, which determine Microsoft’s long-term evolution trajectory and prospects for world domination, Microsoft once again delivered impressive results. Specifically, the company’s intelligent cloud segment revenue was $21.5 billion, up 18% (versus 24% for CC). This was driven by a 20% increase in cloud services revenue (26% in CC), which was driven by a 31% increase in Azure revenue (38% in CC).

These growth rates are out of this world, especially when it comes to Azure. Remember, we are currently in a recession filled with uncertainty and corporate cost cutting. On the other hand, macro conditions could lead to a prolonged recession.

Still, it seems that nothing can stop Azure from growing. Without the stronger dollar, his earnings would have been up nearly 40% last quarter.

It’s interesting to imagine what that growth would be, assuming normalized business conditions. The growth rate was probably over 40%-45%. Still, Microsoft sees multiple add-on opportunities that are likely to keep Azure’s momentum going, such as his upcoming integration with ChatGPT.

Steady recovery in profitability

Microsoft’s profitability should rebound strongly once the current headwinds in its more cyclical segment ease, supported by exceptional growth in its high-margin business, the cloud segment.

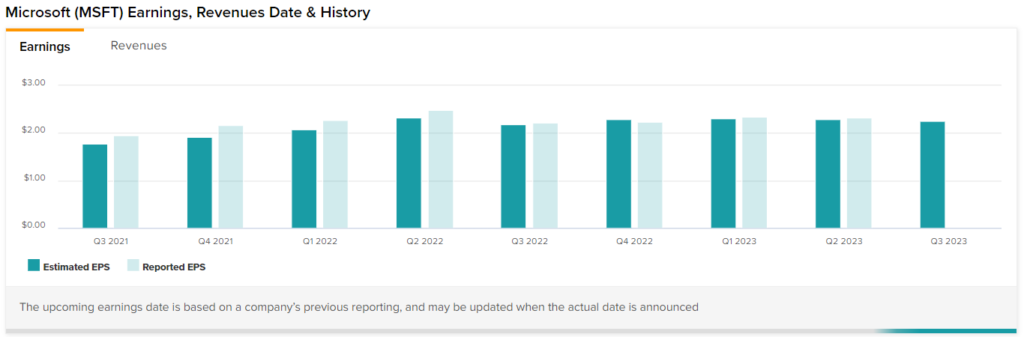

For context, Microsoft’s earnings per share reached $4.56 in the first half of fiscal 2023, suggesting a decline of about 12.8% year-over-year. ), this makes sense because profitability may collapse if the revenue of .

But again, these segments are cyclical. If performance normalizes in these areas, the cloud will essentially take over the revenue growth prospects. In the second quarter of the fiscal year, the Microsoft Cloud gross margin increased nearly 2% year-over-year to 72%. If you have a high-growth business with profit margins of 20% or more, your profitability is set to grow significantly even if other segments don’t recover.

Wall Street analysts seem to agree, with the company expected to generate earnings per share of about $9.32 in fiscal 2023, despite a 12.8% decline in earnings per share in the first half. , which means one year. -Increased by 1.2% year-on-year. In other words, the market expects strong net profit growth in the second half of the year, and this is none other than Microsoft’s profitable Cloud division.

Is MSFT Stock a Buy, According to Analysts?

Turning to Wall Street, Microsoft has a strong Buy Consensus Rating based on 25 Buy, 4 Hold and 1 Sell ratings assigned in the last three months. . At $274.69, Microsft’s average share price forecast suggests an 8% upside potential.

Bottom Line: Attractive Valuation Given Growth Potential

As previously mentioned, Microsoft’s profitability is expected to recover rapidly in the second half of this year. Additionally, with Microsoft’s Intelligent Cloud showing no signs of slowing down and the segment experiencing margin expansion, net income growth is a strong catalyst moving forward. Add in Microsoft’s hefty share repurchase, and you can see why Wall Street analysts forecast his earnings per share growth of about 16% annually in his 2024 fiscal year and his 2025 fiscal year.

Such growth means that Microsoft’s stock is now trading at about 22 times next year’s earnings and about 20 times next year’s earnings. Given the company’s global dominance, overall quality, and strong growth catalyst in the cloud, Microsoft’s forward-looking valuation multiple is very attractive, especially if you intend to hold the stock for the long term. I think.

Disclosure

[ad_2]

Source link