[ad_1]

News highlights:

- Spending limits, warnings and card truncation are how New Zealanders double down on debt

- 19% have debt that will take up to 6 months to settle

- Balance transfer method

25 January 2023, New Zealand – Lingering debt is a heavy burden for New Zealanders, according to new research from global comparison site Finder.

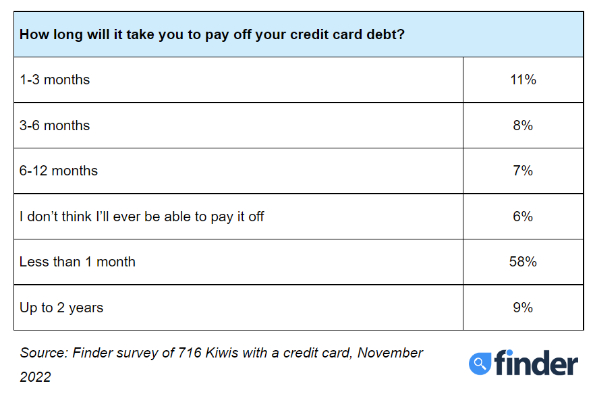

A national survey of 716 New Zealanders using credit cards revealed that one in five (19%) took up to six months to pay off their credit card debt. rice field.

A survey found that an additional 7% of people take 6-12 months to pay off their debt.

Nearly 1 in 10 (9%) said they would take up to two years to become debt free, and about 6% admitted they thought they would never be able to pay off their debt.

Finder New Zealand editor Angus Kidman said many Kiwis are turning to credit cards as they struggle to cope with the rising cost of living.

“The ease of access to credit cards in New Zealand, combined with the rising cost of living, has made credit cards an attractive option. .

“Many credit card companies offer low referral fees and reward programs to attract consumers, but they also make it easier for you to accumulate debt.

“Things are only going to get worse as spending continues to rise and interest rates rise.”

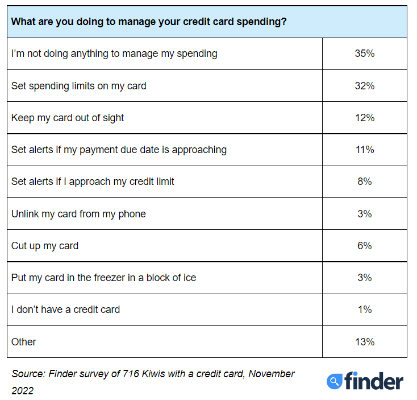

To control credit card spending, 64% of Kiwis have plans to maximize their budgets.

Some (32%) set spending limits on their cards, while others (12%) take a “blind, blind” approach to spending less.

Just over 1 in 10 (11%) set up alerts when payments are approaching due to avoid late fees, and 8% set alerts when credit limits are approaching to avoid overspending. Setting.

Some (6%) truncated their cards to avoid using them altogether.

Kidman says there are several ways to deal with credit card debt and regain financial stability.

“By understanding where your money is going each month, you can identify areas where you can cut spending and use that money to pay off your credit card debt.

“Creating a budget helps you prioritize your spending, so you can ensure essential expenses like rent and groceries are taken care of before paying for non-essential items. .”

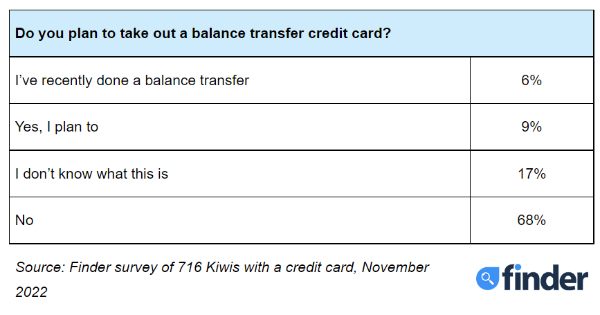

Nearly one in ten (9%) plan to use a balance transfer credit card to manage their debts, and 6% have already done so.

Kidman said consolidating debt saves interest and makes payments easier to track.

“There are balance transfer credit cards with 0% transfer balance or low interest rates, which means you can focus on paying off your debt.

“Credit card debt can be overwhelming, but it is not insurmountable. Take back control of your finances and break the cycle of debt by reducing your spending and taking the necessary steps to consolidate your debt. You can do it,” said Kidman.

How to transfer your balance:

Compare balance transfer offers.

Use the Finder table to compare offers and see how much you can save.

Please apply for a new card.

Read the requirements, gather your documents, and request a balance transfer during your application.

Activate your new card.

Once you receive your card, activate it (and initiate a repayment) by phone or Internet banking.

Close your old account.

You don’t have to close your old account, but it’s usually a good idea to avoid debt.

© Scoop Media

[ad_2]

Source link