[ad_1]

Simoncle

established theory

desktop metal (New York Stock Exchange: DM) is challenging the high-volume approach to additive manufacturing by acquiring various related manufacturing companies. Of these companies, ExOne will be acquired by him in 2021 for $575 million. $580 million market cap. Investors now have the opportunity to buy DM and other acquisitions at ExOne’s single, innovative and popular company at the price they paid. In addition, DM has a higher growth rate compared to other additive manufacturing companies with flat growth rates, but a similar valuation. For this reason, I think now is the perfect time for those who are bullish in the additive manufacturing industry to take advantage of this opportunity.

What is metal casting?

Before explaining why ExOne is most important to the future of manufacturing, let’s take a look back at the 5,000-year-old metal foundry industry.good definition It comes from the American Foundry Society.

metal casting process (American Foundry society)

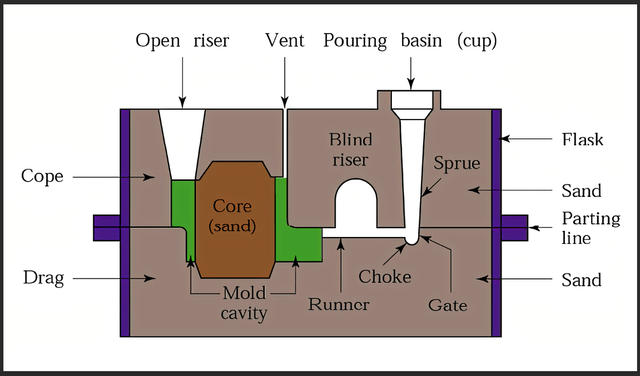

Of this definition, we will focus on “sand”, more specifically sand cores. For reference, the sand core forms the internal shape of the casting.

casting diagram (Blogspot machine invention)

water jacket core (Flow 3D)

Creating these cores requires another tool called a core box. These are typically made of aluminum or cured polyurethane resin. Sand and binder are typically hammered or blasted inside these boxes to harden and create the finished core. Depending on the complexity of the part, this tool can be very expensive to manufacture. This manufacturing process also has design constraints. First, to properly draw the casting, the core must have a draft or bevel feature to prevent sticking. Second, any negative features should be addressed by adding core to the loose piece or mix. Simply put, the more complex the casting, the more time and energy it takes to cast it properly. will become necessary. This severely limits the design possibilities and the overall progress of manufacturing.

urethane core box (Le Sur)

Other problems can arise if the design needs to be changed during production. This would require manufacturing a new core box or rebuilding another core box to accommodate the design. Again, this limits your design capabilities. However, ExOne offers a solution that is used successfully in the industry today.

ExOne Solution

ExOne’s solution to this problem is the binder jet system, specifically the S-max series. The system uses binder jetting to 3D print sand cores and is currently being used by US pattern shops such as Hoosier Pattern and Humtown with great success. The Foundry has come to the conclusion that the current state of 3D printing sand casting serves his two scenarios.

- Experimenting with a new design.

- Mass production of complex parts.

However, 3D printed cores are not cost effective for mass production of simple parts. The word “yet” is used here intentionally.

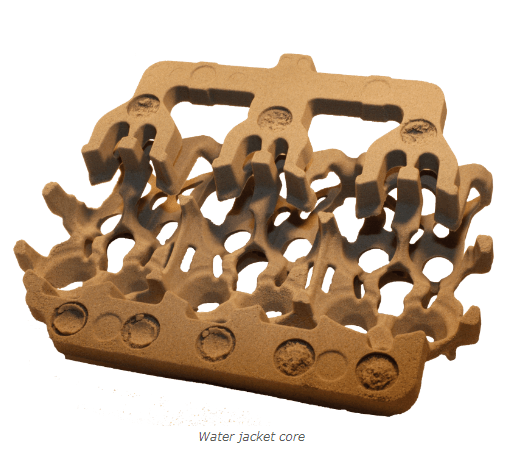

This is also called break-even analysis and is explained in the DM IR presentation. Fundamentally, 3D printed parts come to a point where they are no longer efficient using traditional manufacturing methods alone.

DM break-even point analysis (DM IR Presentation)

However, this is based on a standard FDM machine. ExOne’s binder jet system selectively deposits resin into a layer of sand and cures it to form the desired shape. This process produces 3D printed sand cores 100x faster than traditional FDM. Best of all, it’s just more efficient.

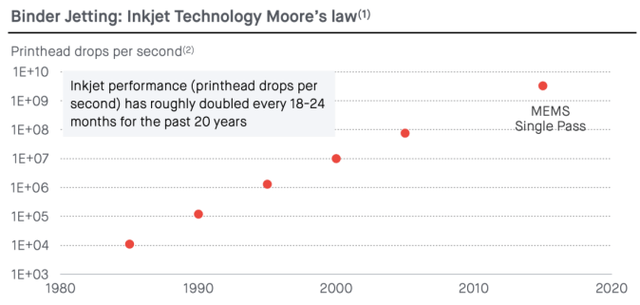

Moore’s law

In 1965 Gordon Moore observed that the number of transistors on a microchip doubles approximately every two years. Even if you’re even slightly familiar with the semiconductor industry, this observation is the lifeblood of progress. This same progress can be observed in Binder jetting his printhead his drops per second, described in the same slide of the DM investor presentation.

Moore’s Law DM Investor Presentation (DM investor presentation)

This is why we use the word “yet” when describing previous progress. Binder jetting is already incredibly useful in the industry and is still in its early stages, so there is a lot of room for growth.

evaluation

I rate DMs in three ways:

- A comparison of industry-wide growth rates and price/sales multiples.

- Earnings multiple analysis based on expectations.

- Discussion of DM acquisition.

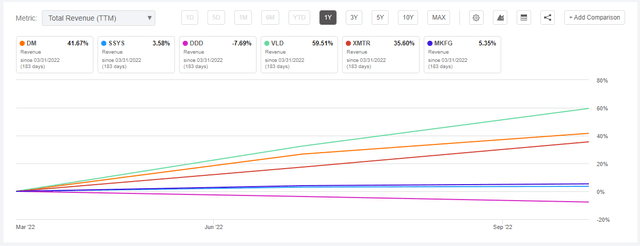

A comparison industry approach allows you to see revenue growth relative to your competitors. Of the major additive manufacturing tickers, only Xometry (XMTR) and Desktop Metal DM and (VLD) showed significant growth last year. XMTR is also primarily an outsourcing services/software company, while DM is more closely associated with other manufacturing companies. VLD shows 20% higher growth than DM, but more than double the current price-to-sales ratio.

Desktop metal revenue growth (Seeking alpha)

DM is currently reasonably priced/sales compared to the industry. In other words, investors now have the opportunity to pay the same price for growth compared to other additive manufacturing companies.

Additive Manufacturing Pricing/Sales (Seeking alpha)

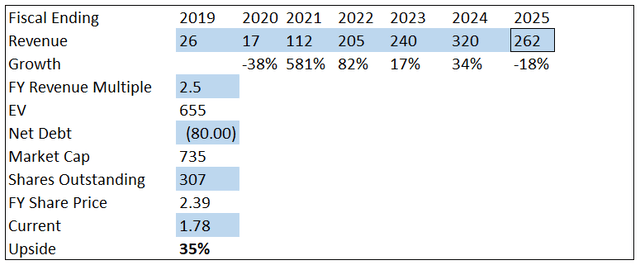

A second way to evaluate DM is to use revenue projections from Seeking Alpha. With a current earnings multiple of 2.5x, that could be up 35% based on the analyst’s lowest forecast for 2025.

Desktop Metal Revenue Multiple (Author, Seeking Alpha)

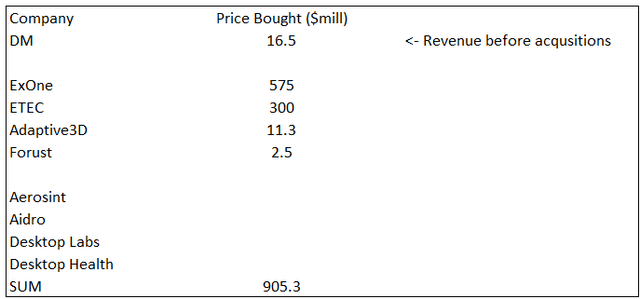

A third way DMs can be evaluated is by discussing acquisitions. DM is currently trading at the price paid by ExOne. We are bullish on ExOne so DM can be valued as if it were the sole source of revenue for this small conglomerate of binder jetting solutions. Although this is highly unlikely, it does build a safety factor. In that case DM is about 8x price to sales and he bought ExOne so you can value DM as a whole at 8x price to sales. That’s big, but not entirely far from VLD’s current valuation.

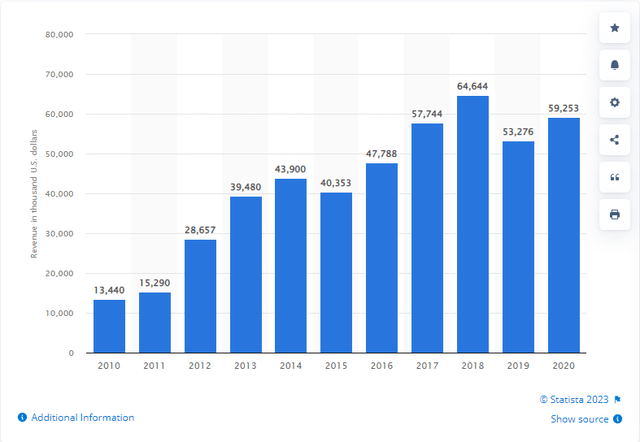

Desktop Metal Acquisitions (author research) ExOne Revenue Growth Rate (Statista)

Conclusion

Overall, I rate DM as if it were the only useful company recently acquired by ExOne, which is highly unlikely. Even in this case the DM looks very close to fair value. ExOne is currently used in industry as a 3D printing solution and is expected to continue to grow. I’m excited about the industry as a whole, and since it’s currently at a relatively close valuation, I’m devoting a small portion of my portfolio to DM.

[ad_2]

Source link