[ad_1]

Margier

prologue

I have often said and written in the last few months that I am working on a larger real estate portfolio. So far, I own two of his REITs that are each other’s biggest competitors. Extra Space Storage (EXR) and Public Storage (PSA).). In this article, I will introduce a company that I have covered several times. However, despite their ability to generate enormous wealth in the long run, they still keep a low profile.the company is Equity Lifestyle Property (NYSE: ELS)a REIT gem that doesn’t have very high yields, but all the other qualities I’m looking for in a dividend growth stock.

Unless you’re a retired investor who relies on high cash flow, I think the ELS ticker should be on your watchlist.

Let’s consider why.

Great Dividend Growth REIT

I am a very picky investor.Own less than 25 shares Holds 90% of my net worth.

When picking stocks, look for a mix of low-yielding dividend growth stocks and high-yielding stocks to keep the average yield close to 3%. This is mainly for tax reasons. I will talk about the long story another time.

I am fully aware that investors buy REITs primarily for high yields, but I am a little different. I like REITs that can grow rapidly, including dividends. However, I also want a REIT with a certain level of yield. So we don’t buy a lot of REIT exposure.

What is ELS?

Equity LifeStyle is one of America’s largest residential real estate companies.

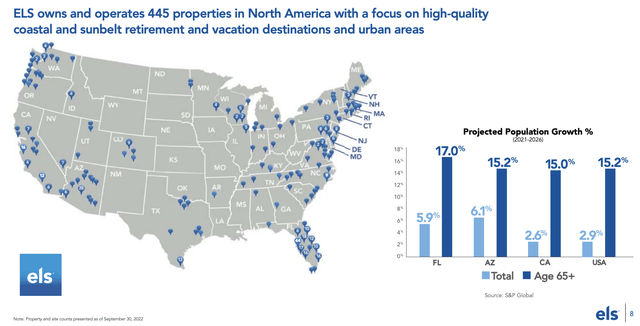

With a market capitalization of $13.5 billion, ELS is the second largest company specializing in manufactured homes and recreational vehicles. Founded in 1969, the company owns 445 facilities in 35 provinces and his one province of Canada. These sites cover over 170,000 sites and are maintained by 4,100 employees.

Equity Lifestyle Property

There are two main factors that make ELS an attractive business.

Attraction of ELS

- This is an efficient and easily scalable business model.

ELS has a unique business model of owning land and leasing premises to customers who own manufactured homes, cottages, RVs or boats.

To use company-specific language:

Our customers may lease individual development areas (“Sites”) or enter into a use rights agreement, also known as a membership subscription. This allows access to specific properties for limited stays. Compared to other real estate companies, The business model is characterized by low maintenance costs and low customer turnover..

Unlike companies that own malls and other large buildings, ELS has low maintenance costs. On an annual basis, the company spends nearly $80 million on asset maintenance (infrastructure) and amenities improvements and renovations. This includes pools, leisure areas, and anything you can think of to keep things clean for your company’s residents. is spent.

The company’s occupancy rate is 95%. His 54% uptime in the MH community exceeds his 98%. Approximately 95% of residents are homeowners, typically long-term customers. In 2013, approximately 92% of our clients were homeowners. This upward trend is good news for the company.

In terms of inflation, the company is in a great place to raise prices, which I also think is great, despite the opportunity for senior residents to lock in good prices for the long term.

[…] All leases in our MH community allow for monthly or annual rent increases, which allows us to increase rents when the market justifies it. Such types of leases usually minimize the risk of inflation. Additionally, annual RV and marina site rental rates are set on an annual basis. Our membership subscriptions typically offer an increased annual fee, but if a customer is over the age of 61, the membership fee may be frozen under certain terms and conditions. Currently, 20.0% of membership fees are frozen.

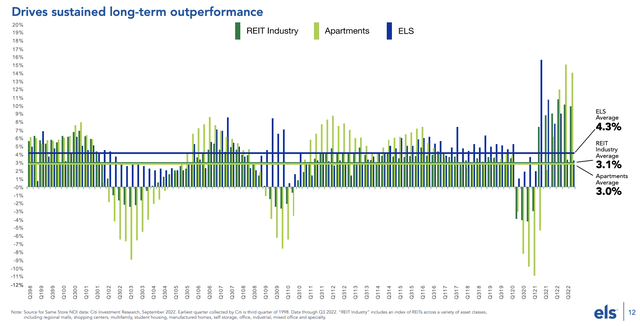

Thanks to pricing and cost control, ELS has grown net operating income at an annual rate of 4.3% since 1998.

Equity Lifestyle Property

Since 2013, the average annual NOI growth rate is 5.1%. This is the result of a 4.8% increase in average annual income and a 4.5% increase in annual spending.

- MH community is a great alternative

The MH community has evolved a lot since it was primarily known as a trailer park. The quality of MH housing alternatives has improved significantly, providing an alternative for those looking for affordable alternative housing.

ELS’ core customer base is people between the ages of 55 and 80. The population over 55 is expected to grow by 17% between 2022 and 2037.

These people are critical when it comes to finding affordable housing that isn’t necessarily near an office building.

But even younger people are increasingly interested in alternatives to MH.In Europe, for example, a new crowd is starting the Tiny House trend, where people want to minimize costs and benefit from utility providers. They live minimalist lives, often independent of their parents and landlords.

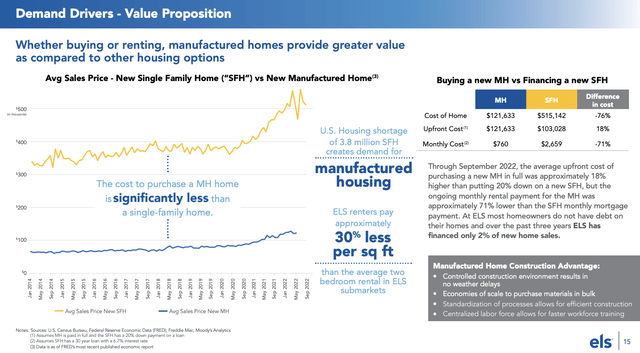

In the United States, the average manufactured home price is $121,600. This is 76% below the average cost of single-family homes. Monthly costs are 71% lower. The only difference is the higher initial cost.

Equity Lifestyle Property

This is good news for ELS as well. That’s because the company finances only 2% of new home sales. We have a solid customer base. This makes interest rates even less likely to rise than the average homebuyer with a fixed-rate mortgage.

As for the construction of manufactured homes, there are also advantages such as a controlled construction environment, economies of scale that provide cost advantages, and a centralized labor force that contributes to efficient construction.

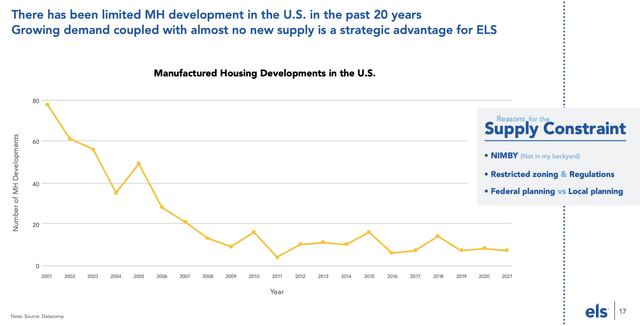

Despite these advantages, the MH community has not seen an explosive supply. This has to do with zoning and regulatory headwinds, area planning, and his NIMBY (not my backyard!). MH supplies declined rapidly in the early 2000s. not recovered.

Equity Lifestyle Property

With that said, let’s dive into the ELS dividend.

ELS Dividend

ELS’ current quarterly dividend is $0.41 per share. This translates into a yield of 2.4%.

According to Seeking Alpha data, the average yield for the sector is 4.3%. This makes sense, as investors buy his REITs primarily for yield.

But ELS’ business model offers some things that other REITs simply cannot compete with. That’s why ELS is a great alternative for everyone who doesn’t rely on high-yield investments.

- ELS 10-year dividend CAGR is 11.9%

- 5-year dividend CAGR of 11.0%

- The sector medians are 3.2% (10 years) and 1.7% (5 years).

- Dividend safety is high. The company has an AFFO payout percentage of 71% for him, just below the sector median of 73%.

On March 8, 2022, management announced an increase of 13.1%.

As a simple example, let’s assume that the ELS dividend increases by 8.5% annually over the next 10 years. It will probably be higher, but let’s assume a margin of safety in our calculations. We also assume that the sector will grow at a CAGR of 3%.

- Ten years from now, ELS will have a cost yield of 5.4%.

- The sector’s yield on cost is 5.8%.

The gap is closing rapidly. After that, the difference in ELS approval increases. Even assuming a further slowdown in dividend growth.

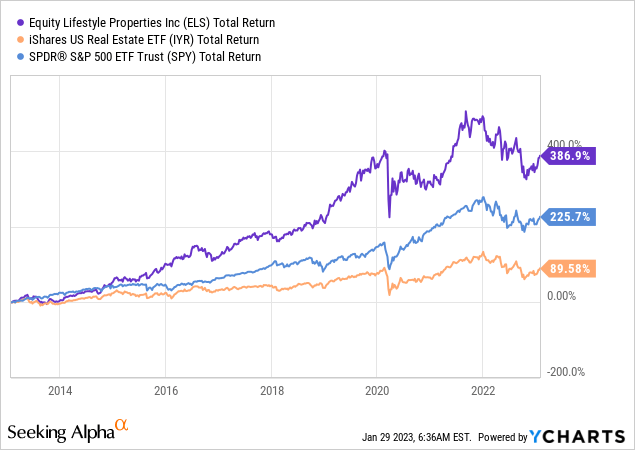

One of the things that comes with high dividend growth is outperformance. Over the past 10 years, ELS stock has earned his 387% return. That’s a mile above the S&P 500. Average real estate stocks performed very poorly, especially given the fact that dividends are incorporated into the chart below. This is one of the disadvantages of buying higher yields. Not always so great in the long run. Again, unless you want high yields because you’re retired. There is nothing wrong with that.

Using the data below, we can see that ELS stock has consistently outperformed the market. Since 2001, ELS stock has returned 14.4% annually. This outperformed both the iShares US Real Estate ETF (IYR) and the market. ELS has not outperformed sector benchmarks in the past three years. Prior to that, however, it had consistently outperformed. Plus, the company has similar standard deviations to their benchmarks! That’s because you’re comparing one stock to an entire basket of stocks.

Portfolio Visualizer (Jan 2001 – Dec 2022)

But wait. One more thing you should know.

ELS balance sheet

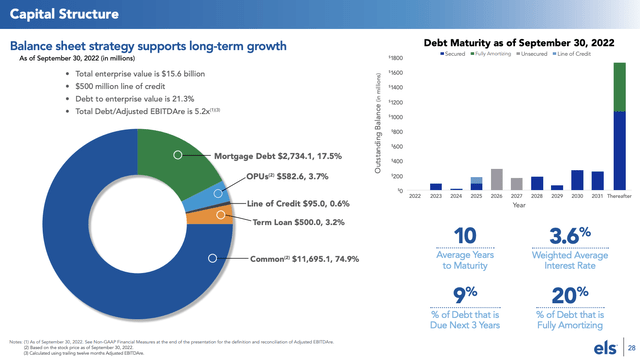

One of the reasons for ELS’ low volatility is its balance sheet (low risk). This is also why the company is less prone to the current high rate environment.

The average term to maturity of ELS debt is 10 years. This means the company is buying a lot of time on refinancing in a high interest rate environment. Only 9% of debt is due within the next three years. Its weighted average interest rate is just 3.6%.

Equity Lifestyle Property

Only 10% of the company’s debt is floating rate debt, which means it is even less susceptible to rising interest rates.

evaluation

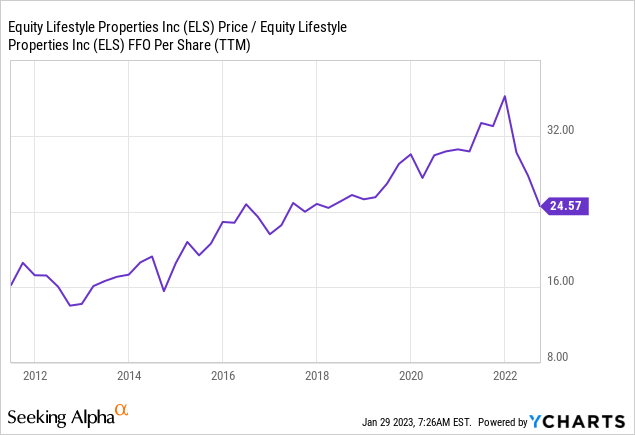

ELS aims to generate at least $2.60 of cash under management per share on an annual basis. Normalized, that number is $2.64. This means a 26x NFFO rating. The sector median is 17x.

Its rating is not high. But it’s not too glamorous.

When I covered ELS in October, the stock was at $60. This was a much better rating. But full-year estimates were also good at the time.

It depends a little on the market, but I will buy when the ELS hits $60.

Given the macroeconomic conditions, markets seem too dovish when it comes to Fed expectations, and we believe there will be new opportunities.

remove

In this article, we’ve covered stocks that deserve far more attention than they do today. Equity lifestyle properties don’t yield as much, but they’re great dividend growth stocks. The company has a history of decent yields, high and consistent dividend growth, a low risk and low cost business model, a very healthy balance sheet and low volatility outperformance, and I expect that to continue. increase.

I would like to add ELS stock to my portfolio to get as close to $60 as possible. This is because I like risk and reward.

(against) Do you agree? Let us know in the comments!

[ad_2]

Source link