[ad_1]

The fintech regulatory environment in the European Union can change constantly, and Europeans may struggle to buy cryptocurrencies in their respective countries.

Today, we take a look at the top 6 best exchanges currently available in Europe and whether they are right for you.

1. Coinbase: Top Global Exchange Available in Europe

coin base is a leading cryptocurrency exchange co-founded by Brain Armstrong in 2012. It is the most popular exchange in the US and also allows users in the UK, Italy, Ireland and several other European countries to buy, sell and trade cryptocurrencies. Various DeFi tokens and stablecoins.

Coinbase currently supports over 100 tradable cryptocurrencies and its interface is user-friendly. For more professional traders and institutional investors, the exchange offers his Coinbase Pro with a more advanced charting interface and all the tools and resources needed for high-level trading.

If you prefer to use Coinbase on the go, the exchange also has mobile versions for iOS and Android devices to easily manage your portfolio and buy and sell digital assets.

Additionally, Coinbase offers a hot storage wallet: Coinbase Wallet not only allows you to store your crypto assets, but also allows you to store NFT (Non-Fungible Token) assets and explore a wide range of decentralized applications (dApps). increase.

Pro tip: Use low-cost Coinbase Pro. The functionality is the same, but the interface is different with a wider range of assets.

Coinbase Pros and Cons:

Strong Points:

- user friendly

- Secure platform with 2FA verification

- Advanced charting and trading tools for professional traders

- high liquidity

- Has mobile app

Cons:

- Fees are typically higher than competitors

- Poor customer support

CoinCentral readers can earn sign-up rewards by creating new Coinbase accounts.

2 – Gemini: New York-based secure crypto exchange for Europeans

Gemini Security is always a popular mention. The exchange was founded in 2014 by Cameron and Tyler Winklevoss. The twin twins shared a class with Mark Zuckerberg at Harvard University. Gemini currently supports a wide range of over 100 cryptocurrencies, including DeFi, NFTs and gaming tokens.

Newbies may find Gemini’s interface to be user-friendly, with easy buying and selling options. There is also a support page with answers to common questions, and customer support is relatively decent. Professional traders may want to switch to Gemini’s ActiveTrader platform, which features a more advanced charting platform, multiple order options and margin and derivatives trading.

One of Gemini’s main focuses is user security, allowing users to enable 2FA, PIN code, and Face ID for iOS and Android users. In addition, Gemini offers her two wallets. One is a hot storage wallet for personal accounts and a cold storage wallet for institutional accounts.

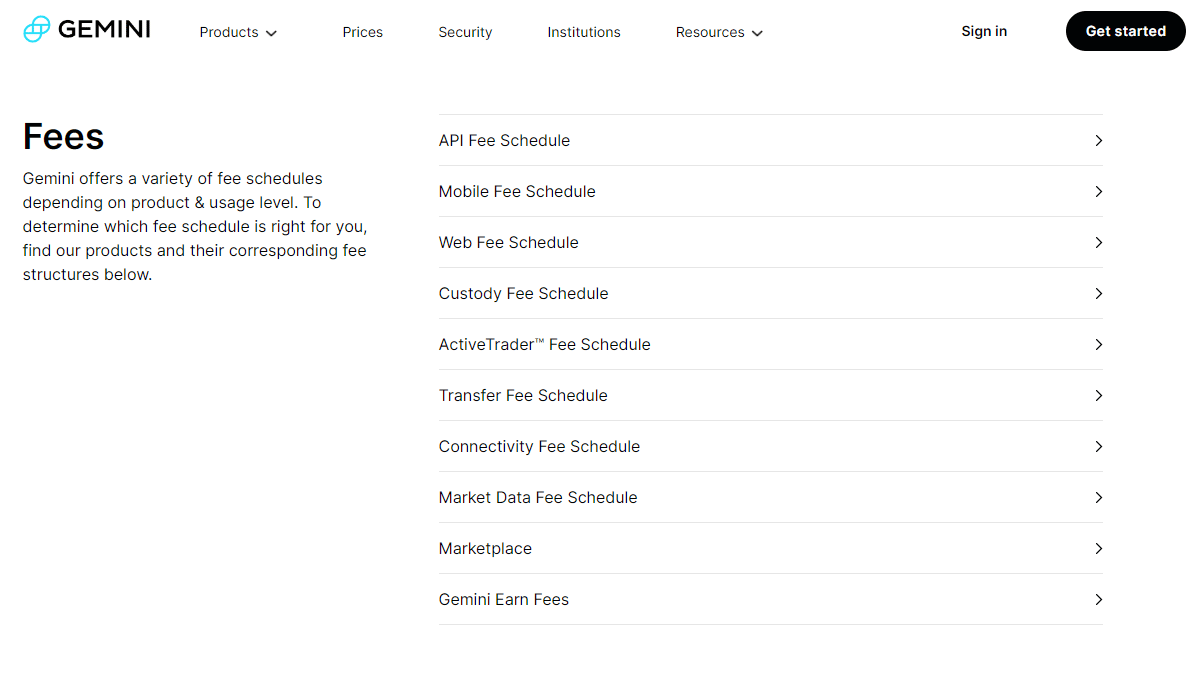

However, it should also be noted that Gemini’s fees are high and Gemini’s fee structure is considerably more complicated than its competitors. If you check the Gemini pricing, pageAt , you will find 10 sections that describe the various fees for each product or service on the exchange. It looks like this:

Gemini strengths and weaknesses

Strong Points:

- Provides trading education and help section for beginners

- Allows staking and lending

- user friendly

- high safety

- Supports multiple crypto-related products

Cons:

- Complex fee structure

- high fees

CoinCentral readers can earn sign-up rewards by creating new Gemini accounts.

3. Kraken: User-Friendly and Powerful Cryptocurrency Exchange

Kraken is a widely trusted cryptocurrency exchange that is suitable for both beginners and advanced users. While boasting a user-friendly interface, it offers a powerful charting platform and trading tools to take your trading to the next level. Big, over 120 including DeFi tokens and stablecoins.

Like its peers, Kraken has mobile versions available for iOS and Android devices and Kraken, a more advanced platform for trading a variety of products, including margin trading and derivatives such as futures and perpetual contracts. There is also Pro. It also has lower fees compared to regular platforms.

Kraken also offers a built-in digital wallet so users can store their funds. Fun fact, the exchange encourages customers to keep their funds off the exchange and store them in cold storage for added security.

Kraken Pros and Cons

Strong Points:

- Supports a wide selection of cryptocurrencies

- Highly secure platform

- Has mobile app

- relatively low fees

- user friendly

Cons:

- No credit/debit card deposits

- Customer support is pretty slow

- slow verification process

4. Bitpanda: Good for buying multiple cryptocurrencies

Austria-based broker BitPanda was one of the first Bitcoin exchanges established in Europe in 2014. The exchange currently boasts a huge list of over 1000 cryptocurrencies. Bitpanda is a good option if you are looking for a diverse library of digital assets.

As of February 2022, BitPanda hosts over 3 million active users on its platform, and its easy-to-use trading interface is suitable for beginners. Of course, for professional traders there is, as you might expect, Bitpanda Pro with a more advanced charting platform that allows you to place multiple order options and trade traditional and crypto derivatives.

The exchange also offers BitPanda Go, a service that allows users to buy cryptocurrencies directly with cash. If you are an Austrian customer, you can use cash at your local post office to purchase the coupon code and redeem it for virtual currency, which is ideal. However, please note that the BitPanda Go fee is currently 3%.

Like its competitors, BitPanda has mobile versions for iOS and Android users that can be downloaded from the exchange’s website. There, you can buy, sell, hold and trade cryptocurrencies easily and seamlessly.

BitPanda Pros and Cons

Strong Points:

- A secure and trusted platform

- Wide range of tradable cryptocurrencies

- mobile version available

Cons:

- Higher fees than other exchanges

- Additional cost of deposit

- Does not support staking or lending

5. FTX: Great for Portfolio Diversification

Founded by Sam Bankman-Fried, CEO and Founder of Alameda Research. FTX It is one of the largest centralized exchanges by trading volume. FTX offers a wide range of financial products for all customers, from simple trading of stocks and digital assets to trading derivatives, foreign exchange, commodities and more.

There are over 300 cryptocurrencies available on FTX, including high-market capitalization assets such as Bitcoin, Ethereum, DeFi, games, NFT tokens, and stablecoins. The exchange also has its own NFT Marketplace and NFT Wallet.

FTX has relatively low transaction fees, but deposit and withdrawal fees are necessary as well. One of the exchange’s drawbacks is that it has very limited customer support. No phone support or live chat is available, support can only be reached via tickets.

Pros and Cons of FTX

Strong Points:

- Wide selection of financial products

- Wide range of cryptocurrencies supported

- A secure and trusted platform

- Supports staking, NFTs and leveraged trading

- relatively low fees

Cons:

- Limited customer support

- not user friendly

6. eToro: Cryptocurrency, Forex and Social Trading

Founded in 2007, eToro A solid option for European users. While supporting only traditional assets until 2013, it became one of the first traditional exchanges to support Bitcoin trading, adding even more crypto assets in the following years. Buy, sell, and trade over 30 cryptocurrencies, including DeFi tokens and stablecoins.

eToro is suitable for both beginners and professional traders. New users will appreciate the easy-to-navigate trading interface, but more advanced users may want to switch to his eToroX, a platform designed for high-level professional trading. You can also create an institutional account, but you will have to submit more documents to verify your business identity.

eToro stands out from its competitors thanks to its copy trading feature that allows new users to copy successful strategies from top-tier investors.

Pros and Cons of eToro

Strong Points:

- Secure platform

- Suitable for both beginners and advanced traders

Cons:

- Supports a limited amount of cryptocurrencies

- Poor customer support.

Other European Crypto Exchanges to Consider

You may be thinking, what about Binance?

binance is one of the leading cryptocurrency exchanges by trading volume in 2022. However, due to the regulatory situation, they have struggled to serve in Europe and it is now quite a disaster. The good news is that Binance is stepping up its plans to enter the European scene. We recently received approval from the Organismo degli Agenti e dei Mediatori (OAM) to open an office in Italy and expand our services nationwide.

Another country that recently gave Binance the go-ahead was France, giving the exchange full permission to offer its services in the country. The crypto community sees these last two pieces of news of him as a step towards bringing digital assets into the EU.

Final Thoughts: Which Crypto Exchange Is Best For You?

There are several cryptocurrency exchanges that offer a wide range of products for European users. Meanwhile, the European Union has yet to define a suitable regulatory framework for the cryptocurrency industry.

Whether you want to earn passive income through staking, lend crypto assets, or simply buy and sell cryptocurrencies, it’s best to compare the available exchanges to determine which one is best for you.

A final note: invest capital you can afford to loseCryptocurrencies are volatile and prices can fluctuate wildly, so there’s no need to put all your eggs in one basket, as the old saying goes.

[ad_2]

Source link