[ad_1]

Data center colocation market

DUBLIN, Feb. 02, 2023 (GLOBE NEWSWIRE) — Data Center Colocation Market – Global Outlook and Forecast 2022-2027 Report Added of ResearchAndMarkets.com Recruitment.

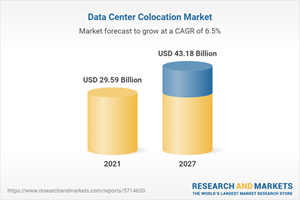

The global data center colocation market is projected to grow at a CAGR of 6.5% from 2021 to 2027.

The growth of the data center colocation market was fueled by previously announced projects and facility expansions at several locations. Cloud-based service providers contribute the most demand for data center services. Growth continues to spur the entire infrastructure category, leading to a sustainable facility environment.

The APAC region dominates the data center colocation market in terms of investment, followed by North America and Western Europe. Other regions such as Middle East, Africa, and Latin America are among the emerging colocation markets expected to grow during the forecast period.

The United States, China, Canada, Japan, United Kingdom, France, Germany, and the Netherlands are market leaders in terms of colocation revenue generation. Other countries in Latin America, Middle East and Africa will grow with more investment by global and local operators.

Leading data center colocation market operators, including Equinix, Digital Realty, CyrusOne, STACK Infrastructure, QTS Realty Trust, and ST Telemedia Global Data Centers, have taken big steps towards sustainability by embracing renewable energy. is a company.

These companies are working on signed power purchase agreements (PPAs) with several energy companies to procure renewable energy, such as wind and solar energy, to power their facilities. . Renewable energy procurement is expected to continue during the forecast period.

The global data center colocation market for investment in 2021 was led by Digital Realty, which holds the largest market share in the industry. Digital Realty has invested in over 79 projects in several locations around the world, including investments with subsidiaries such as Interxion, icolo.io, MC Digital Realty and Ascenty. Vendors focus on continuous development to sustain the colocation industry.

Market trends and drivers

Increased penetration of cloud, big data and IoT demand

-

Over the past few years, growing internet penetration, government data protection laws, and growing demand for services have led cloud providers to operate centers around the world.

-

The data center colocation market has also seen increased cloud adoption following the outbreak of COVID-19. Due to the COVID-19 outbreak, about 90% of employees across all sectors are now working remotely.

-

Demand for colocated, managed, and cloud-connected services will gain momentum as companies look to adopt cloud services such as PaaS and IaaS.

-

Increasing adoption of big data and IoT technologies across sectors such as BFSI, healthcare, government, entertainment and media, and education will drive demand for facilities.

Innovations that create sustainable power technology

-

Lithium-ion batteries, nickel-zinc and Prussian blue sodium-ion batteries are the major new innovative batteries. Adoption of lithium-ion batteries is expected to increase significantly during the forecast period.

-

The evolution of microgrids as a power backup for the grid will benefit regions with high power costs and unstable power supply.

-

Due to their high carbon emissions, natural gas generators may replace diesel generators.

-

During the forecast period, the emergence of fuel cells such as natural gas and hydrogen fuel cells as main or backup power sources will be adopted.

-

The advent of 100% biodegradable, sustainable and non-toxic HVOs (hydrotreated vegetable oils) offers the same conveniences as traditional fossil fuels. Kao Data was the first operator to replace diesel generators with HVO-fueled generators.

5G Deployment to Boost Edge Data Center Development

-

Most countries and regions around the world have seen commercial deployment of 5G services, with local data generation and edge center facilities being developed.

-

Several edge facility companies such as Edge Centres, AtlasEdge Data Centres, American Tower, HostDime, EdgeConneX, VueNow and Open Access Data Centers (OADC) are actively participating in the industry. They have expanded their presence in several countries and regions.

-

Edge center development will increase demand for sensors, routers, cables, and PDUs. As more data is generated, rack densities increase, requiring power systems to support the IT infrastructure.

Increased data center activity such as M&A and JVs

-

In the data center colocation market, services such as M&A and joint ventures are on the rise, helping companies to dominate the market, reduce competition, and gain a foothold in the market.

-

Companies are acquiring data center companies or facilities, or taking stakes in companies to gain prominence in the data center colocation market. For example, NorthC acquired Netrics to enter the Swiss data center market in April 2022.

-

March 2022 marks one of the largest M&A deals between KKR, Global Infrastructure Partners (GIP) and CyrusOne. His two previous companies acquired a data center company for about US$15 billion.

The government supports investment through incentives:

-

Several national and regional governments offer tax incentives to support investors looking to invest in the data center colocation market. Such measures will encourage more operators to invest in the industry.

-

In North America, especially in the United States, several state governments offer different types of incentives to data center operators. For example, Virginia offers tax incentives for facility installations that meet capital investment and employment requirements.

-

Over the past decade, Amazon Web Services has received over US$4.7 billion in grants from federal and state governments to build offices, data centers, call centers, and other facilities.

-

India’s state government, Tamil Nadu, has launched a data center policy. Provides land, power, and connectivity incentives to support investment in new facilities statewide.

Main indicators

|

report attribute |

detail |

|

page number |

1001 |

|

Forecast period |

2021-2027 |

|

Estimated market value in 2021 (USD) |

$29.59 billion |

|

Projected market value to 2027 (USD) |

$43.18 billion |

|

compound annual growth rate |

6.5% |

|

Target area |

global |

Market opportunities and trends

Sustainability Initiatives by Colocation Operators

-

5G Adoption Drives Edge Data Center Investments

-

Rapidly increasing rack power density

-

Sustainable innovation in data center power technology

-

eco diesel generator

-

natural gas generator

-

Fuel cell

-

Hydrotreated vegetable oil (Hvo) fuel

-

nuclear power

Other innovations

-

Adoption of advanced IT infrastructure

-

Converged & Hyperconverged Infrastructure

-

Arm-based server

-

Server virtualization

-

Innovative data center power technology

-

Adoption of advanced ups battery

-

Software-Defined Data Centers & AI in Power Monitoring

-

micro grid

-

Automation and intelligent monitoring solutions

Factors enabling market growth

-

Growing Submarines and Inland Connectivity

-

Increase in M&A and Jvs across the industry

-

Impact of Covid-19

-

Big Data and IoT Drive Data Center Investments

-

Government support for data center investments

-

Increased demand for cloud-based services

market constraints

-

Increased carbon footprint from data centers

-

Location Constraints in Data Center Development

-

Shortage of skilled data center professionals

-

Security challenges in data centers

-

High maintenance costs and inefficiencies

-

Supply chain disruption

Prominent colocation investor

Other Prominent Vendors

-

3 data

-

365 data centers

-

african data center

-

air trunk

-

Alignment

-

american tower

-

AQ Computing

-

Aruba

-

art man

-

at north

-

at Tokyo

-

BDx (Big Data Exchange)

-

bulk infrastructure

-

bridge data center

-

CDC data center

-

chayora

-

china mobile

-

Chindata

-

CloudHQ

-

Cologix

-

COPT Data Center Solution

-

CtrlS Data Center

-

Sixtera Technologies

-

data 4

-

data bank

-

DC Blocks

-

element critical

-

ePLDT

-

eStruxture Data Center

-

fifteenfortyseven Critical Systems Realty (1547)

-

Flexible

-

green mountain

-

H5 data center

-

host dime

-

KDDI

-

Keppel Data Center

-

LG Uplus

-

main cube one

-

MainOne (Equinix)

-

Millicom

-

Next DC

-

ODATA

-

orange business service

-

prime data center

-

Princeton Digital Group (PDG)

-

Proximity data center

-

Laxio Group

-

Rostelecom data center

-

Sabey Data Center

-

Scala data center

-

Sify Technology

-

Skybox data center

-

stream data center

-

SuneVision

-

switch

-

T5 data center

-

Tenron Holdings Group

-

Teraco (Digital Realty)

-

Tier Points

-

Turksel

-

Urbacon Data Center Solution

-

wing

-

Youngdol

-

Yotta Infrastructure (Heinan Valley Group)

Newcomer

segment analysis

Segmentation with colocation services

-

retail collocation

-

wholesale collocation

Segmentation by infrastructure

Segmentation by electrical infrastructure

Segmentation by machine infrastructure

Segmentation by cooling system

-

CRAC & CRAH unit

-

chiller unit

-

Cooling towers, condensers, dry coolers

-

economizer and evaporative cooler

-

Other cooling units

Segmentation by cooling technology

Segmentation by general construction

-

Core & shell development

-

Installation and commissioning service

-

Engineering and architectural design

-

Fire detection and suppression

-

physical security

-

DCIM/BMS

Segmentation by tier criteria

-

Tier I & Tier II

-

Tier III

-

Tier IV

For more information on this report, please visit https://www.researchandmarkets.com/r/fo8efc-center?w=12.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. It provides up-to-date data on international and regional markets, key industries, top companies, new products and latest trends.

accessories

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[ad_2]

Source link