[ad_1]

It has numbers and doesn’t lie like a dog’s tail. Pet insurance is becoming a booming industry. On May 17, the North American Pet Health Insurance Association (NAPHIA) published his highly anticipated 2022 industry report. The North American pet insurance sector will surpass $2.83 billion at the end of 2021. This means the industry has more than doubled since 2018.

Tracking the industry closely, this means an increase in gross premiums in force of nearly $700 million in 2021 (up more than 30.5% from 2020), with 4.41 million pets currently insured in the United States and Canada. means that there is—That’s a lot of protected pets! But considering he has more than 128 million pets in the United States alone, according to the American Humane Society,—Some of them have multiple pets (this doesn’t count Canada). This means that only a small percentage of the total North American pet population is currently insured. The fledgling pet insurance industry is just getting started.

Here are some key numbers to know from the NAPHIA report.

- About 20 companies participate and provide pet insurance data.

- Gross premiums written (GWP) in force has been steadily rising.

-2017: $1.03 billion -2018: $1.254 billion (up 21.7% from 2017) -2019: $1.558 billion (up 24.3% from 2018) -2020: $1.986 billion million (up 27.5% from 2019) -2021: $2.591 billion (up 30.4%) from 2020—almost 1/3)

- More people insure dogs than cats, and will account for 88.4% of all U.S. dogs with GWP in 2021, down from 2020, when 89.1% of GWP was dog insurance. slightly decreased.

- The total number of pets insured in the United States is increasing each year.

-2017: 1.8 million -2018: 2.15 million (18% increase from 2017) -2019: 2.51 million (16.7% increase from 2018) -2020: 3.10 million (23.2% from 2019) -2021: 3.98 million pets (up 28.3% from 2020)

- Where are these pets? Not surprisingly, the most populous states also have the most puppies.

– California has 19.3% of all pets with insurance. This means that about 21.6% of total pet insurance GWP comes from California. – New York is a good distance away, where he’s second, making up 8.4% of all insured pets, or about 9.3% of his total GWP. – Florida lags behind with 6.1% of all insured pets in the US, or about 6.2% of all GWP. -Texas and New Jersey each own about 5.5% of the nation’s pet insurance (although GWP is a little lower in Texas, where he has 4.8% compared to his 5.4% in New Jersey) ). – The list concludes with Massachusetts (4.7%; GWP 4.8%). Pennsylvania (4.6%; GWP 4.4%); Washington (4.1%; GWP 4.0%); Illinois (3.2%; GWP 3.3%); Virginia (3.1%; 3.2% GWP).

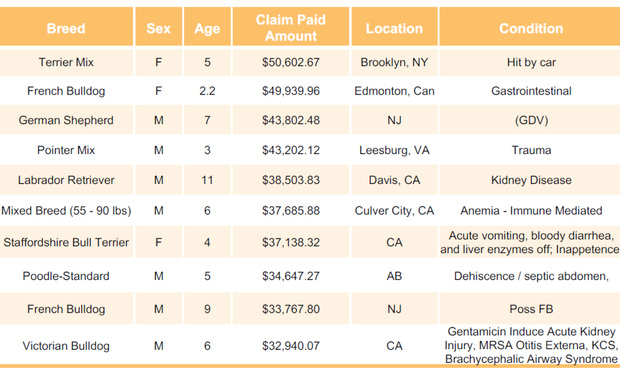

What does a pet insurance claim look like? Pet insurance is most similar to human health insurance, with most claims being for routine vet visits, emergency surgery, or accidents. According to NAPHIA, below is a compilation of the top 10 dog and cat surgeries in the United States in 2021. The numbers are staggering, with the “top dog” billing him just over $50,000 after being hit by a car. According to Consumer Reports, the average annual premium paid for dogs in 2020 was just under $600, and about half that for cats ($340). Based on the numbers below, some pet surgeries can cost tens of thousands of dollars. As a longtime pet owner who has paid thousands of dollars for unforeseen pet emergencies over the years, pet insurance can save lives. If you don’t have the funds for a pet, insurance can change the world to save pets who may not get the medical care they need to survive.

table.Photo provided

table.Photo providedWhat does significant growth in the pet insurance sector mean from a legal and regulatory perspective?

The National Association of Insurance Commissioners (NAIC) clearly takes pet insurance seriously. In April 2019, the NAIC published a white paper on pet insurance, “A Regulator’s Guide to Pet Insurance.” Specifically, at its Spring 2022 National Meeting (April 4), the Property and Casualty Commission voted to revive the Pet Insurance Working Group so it can complete the compilation of the Model Law. The working group will make necessary amendments to the model law before it is presented again to the parent committee for consideration. Regulations are now very different, and California is currently the only state with laws specifically governing pet insurance, according to the NAIC. California law requires policies to contain clear language regarding coverage limits, lifetime limits, waiting periods, and deductibles. It will be interesting to see how closely, if at all, this model law mirrors the laws California already has in place. A pet insurance bill was introduced in New York, but never enacted.

Do more pets insured mean more lawsuits against pet insurance companies? As with any insurance product, more claims and more lawsuits can go hand in hand. The more claims there are, the more claims are likely to be dismissed, leading to more consumer dissatisfaction and more lawsuits against insurance companies. And like any other insurance product, insurers are not exempt from malicious claims even if a seemingly small claim is denied. One such issue that seems to be hotly debated in the pet insurance industry surrounds what constitutes “the existing state.” This is because pre-existing conditions are often excluded from subsequent pet insurance coverage. In a recent Los Angeles Times article, a pet owner in California was denied an insurance claim for his dog when it developed cancer. The insurance company considered cancer a pre-existing condition, but the owner (she herself worked at a cancer facility) believed the insurance company was wrong. She was different in new areas of her body. While this issue does not appear to have escalated with litigation, it is almost certain that similar claim disputes will increase over time.As pet insurance grows in size and scale, so do additional legal considerations. likely to grow on a similar scale.

Sandra K. Jones He is an Insurance Partner at Faegre Drinker Biddle & Reath in its Philadelphia office, Co-Leader of the Long Term Care Insurance Team and Co-Leader of the Structured Settlement Annuities Team.contact her [email protected]

[ad_2]

Source link