[ad_1]

Mizina/iStock via Getty Images

Grove Collaborative Holdings Inc.NYSE: Grove) is a consumer goods company and online retailer focused on environmentally sustainable home and personal care (HPC) brands.If you’re looking for vegan and plastic-free hand soaps, cleaning supplies, and even skin care items; Grove offers over 400 of his Target Corp (target).

On the other hand, the segment faces significant challenges given macro headwinds such as record inflation and rising interest rates that weigh on consumer spending. GROV’s share price has fallen more than 60% in the past month, highlighting extreme volatility and weak sentiment based on recurring losses and negative cash flows as it tries to scale. increase.

Still, there are cases where stocks may represent attractive conversion opportunities in light of excessively prolonged selling. Ongoing retail expansion that puts Grove products in front of more consumers could propel the growth runway. GROV remains speculative, but has long-term upside potential.

Source: Company IR

Main indicators of GROV

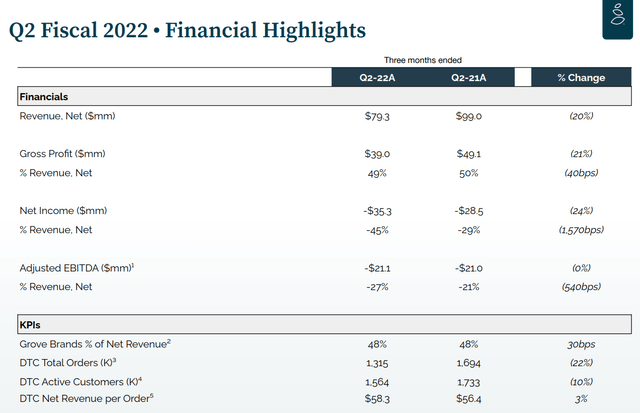

The company last reported second-quarter earnings in August, and the headline numbers weren’t pretty. Revenue was $79.3 million, down -20% year-on-year, but gross profit was also down, with a net loss of -$35.3 million, widening from Q2 2021. His operational metrics of total orders and total active customers are also down by double digits.

In this context, we believe consumer spending has been particularly strong over the past year, making for a tough comparison given the broad shift in trends in the e-commerce industry. Management explains that the company has cut advertising spending to attract new customers. This at least helped contain his adjusted EBITDA loss, which was flat at -$21 million from last year.

Source: Company IR

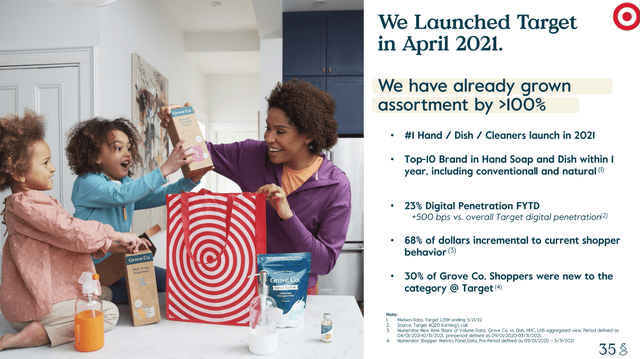

While we recognize that the silver lining is few, one encouraging point is the consumer acceptance of the Grove brand at other retailers. Grove mentioned his Q2 2021 launch of Target. This effort helped drive awareness of the brand and product lines that are the blueprint for the company going forward.

Source: Company IR

Developments in recent months include new announcements of expansion to retailers such as CVS Health Corp (CVS) and Kohl’s Corp (KSS), as well as non-branded retailers such as Giant Eagle, Meijer and Harris Teeter. Includes public local pharmacies and grocery chains. , and “HEB Store”. According to the latest information, Grove Brand products are now sold in over 4,000 retail outlets.

The important point here is that Grove’s website now lists products from other manufacturers that account for about 52% of net revenue. Grove Brands’ composition is expected to rise within its total net revenue over time, which should support higher margins in line with its strategic priority of improving profitability.

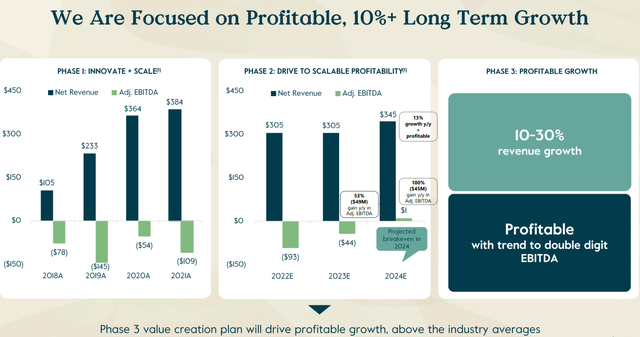

In terms of guidance, full-year 2022 net revenues are in the range of $302.5 million to $312.5 million, up significantly from the previous interim target of $305 million. This compares to his $233 million in 2019 as a pre-pandemic benchmark, but is still down from his record $384 million in 2021.

Finally, the company ended the quarter with $133 million in cash against $44 million in long-term debt. Remember, GROV went public in June after the SPAC merger was completed. Liquidity looks stable in the short term, but given current cash outflows and negative earnings, additional equity issuance may be required in the coming years.

What’s next for GROV?

We feel that we have fallen victim to a poor macro environment in which the company does not cooperate. The “premium” positioning of eco-friendly, plastic-free products becomes a difficult sell when we see consumers squeeze their budgets in nearly every other spending category.

looking for alpha

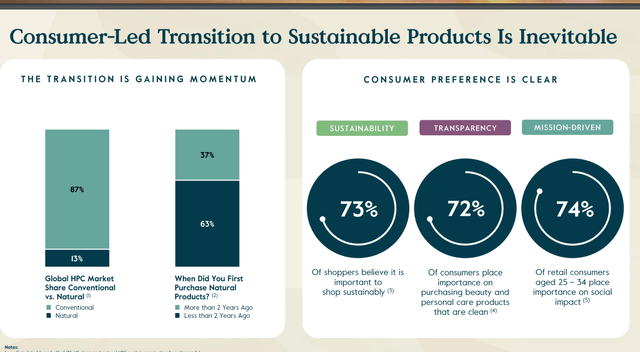

At the same time, the bullish case is simply that Grove Brand products have long-term potential and can gain market share against their competitors. Most consumer goods giants offer lines of “natural” home and personal care products, but the idea here is that Grove represents pure play in this category. suggests that this natural HPC is gaining market share over conventional products as more consumers seek potentially healthier options.

Source: Company IR

As products become available through more channels, such as through retail expansion, more consumers can become customers for life. This goes back to the old business adage, “If you build it, they will come.” In this case, Grove puts the product out there and sales follow.

Management expects revenue trends to stabilize by next year and return to 10% growth by 2024. The goal for this period is for his EBITDA, Adjusted, to turn positive and accelerate further. This trend may be due to the declining ratio of selling, general and administrative expenses to revenue, but also the need for advertising. The shift of the company’s business to company-owned brands on online direct-to-consumer portals adds to the margin. Ultimately, we believe the plan will work.

Source: Company IR

final thoughts

Grove Collaborative Holdings’ ‘show me’ story takes the first step by providing evidence that the company is on a stable track record of operations and finances. Going into 2023, more lucrative sales comps could turn the narrative into a recovery that’s gaining momentum.

Assuming revenue hits full-year 2024 forecast of $345 million, EBITDA could be positive with double-digit growth in that year, resulting in a current market cap of approximately $240 million Given that it’s in dollars, the stock would look cheap under 1x sales.

We rate the stock as a hold, suggesting a neutral near-term view, but we believe risks are tipped to the upside, at least due to the technical rebound. is probably too late to sell. Our request is to add any signs of strength to the position in order to bring down the cost base.

For now, stocks are expected to remain volatile in the upcoming third quarter earnings report as the next catalyst to watch. Although the date is yet to be confirmed, the report will likely reveal him in November, with sales trends and margin levels as key monitoring points. As for risks, weaker-than-expected results or below forwarding guidance could lead to further declines in stock prices.

[ad_2]

Source link