[ad_1]

ablokhin

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC), two government-sponsored enterprises (GSEs), play a crucial role in the US housing market. They have a long history of providing liquidity and stability to the mortgage market by purchasing mortgages from banks and other lenders, and then packaging them into securities that are sold to investors. However, their future has been uncertain since they were taken under government conservatorship during the 2008 financial crisis. This article will examine the current state of Fannie Mae and Freddie Mac, their role in the housing market, and the potential implications of privatizing them.

Investment Thesis

It is important to note that there is no pending legal action that would require a liquidation preference writedown, such as the Takings lawsuit, which was not taken up by the Supreme Court. In other words, no lawsuit challenges the net worth sweep. Moving forward, the only restructuring path forward from the government’s perspective is thus to convert its stake as there is no pending litigation that gets resolved by writing it down and thus no legal reason for the government to do so. As such, common shares are a gamble on whether the government thinks capital markets will be more receptive of GSE equity offerings if it gives a little. This is a gamble I’m not willing to make.

The conversion of the liquidation preference of the Senior Preferred Stock Purchase Agreements (SPSPAs), along with the exercise of warrants and the raising of capital, has the potential to dilute common shares by over 99%. This outcome maximizes the government’s ownership stake and thus looks to ultimately be in the best interest of the government. The preferred stock, currently trading at 5-10% of their par value, have the potential to trade up to 100% of their par value in an equity restructuring that allows them to raise capital. This highlights the potential for significant gains for investors in the preferred stock, particularly in light of the current state of the Fannie Mae and Freddie Mac being that they have been prepared to exit conservatorship by FHFA but are priced as if it’s never going to happen.

The Case For Admin Reform

Reprivatizing Fannie Mae and Freddie Mac is beneficial for both housing and the government. Firstly, as the government-sponsored enterprises (GSEs), they play a crucial role in the U.S. housing market by providing financing to lenders for nearly half of current U.S. mortgages. This is done by buying mortgages from lenders and packaging and selling them to investors, which makes mortgages cheaper and more available across the country.

Secondly, conservatorship has created an opportunity for addressing the nation’s affordable housing crisis and advancing racial equity in housing. The government received stock interests in the GSEs valued at $48 to $98 billion by the Congressional Budget Office. These assets should be used to support the GSEs’ public mission, particularly by exchanging them for a commitment by the GSEs to additional affordable housing measures and a restorative justice housing program that provides targeted down payment and other assistance aimed at closing the racial homeownership gap.

Thirdly, a utility oversight structure is the best structure for the GSEs going forward. It enables them to provide critical relief to the housing market and the overall economy during a crisis, and to advance their public mission in regular times. This structure should be implemented permanently to secure the GSEs as an emergency backstop, and to enhance their operation and oversight.

It is important to note that many of the proposed changes to Fannie Mae and Freddie Mac can be implemented through administrative reform, rather than requiring action from Congress. This includes increasing affordable housing support, implementing racial equity programs, and solidifying utility oversight. The main area where congressional action would be necessary is if the decision was made to implement a security level guarantee, which would provide an explicit government guarantee on the GSEs’ securities. This would be a significant shift from the current implicit guarantee / corporate level guarantee and would require legislation to authorize and implement. However, by utilizing administrative reform for other reforms, progress can be made in improving the GSEs’ operations and fulfilling their public mission while discussions on a security level guarantee continue.

It is worth noting that I do believe that the path to utility model includes preserving the remaining limited explicit government backstop for Fannie and Freddie at the enterprise level, and that Fannie and Freddie will likely have to pay for this moving forward instead of it being free like it was pre-2008.

Why 2023 Feels Ripe For Admin Reform

The current administration has made it clear that they are committed to addressing the affordable housing crisis and advancing racial equity in the housing market. Reprivatizing Fannie Mae and Freddie Mac, and ensuring they are better equipped to serve their public mission, could be a key part of this effort. In recent years, administrative reform of the GSEs has been ongoing and the Federal Housing Finance Agency (FHFA) has hastened the process of releasing them from conservatorship.

Additionally, the political landscape also appears favorable for administrative reform this year. The current administration has a majority in the Senate but not in the House of Representatives, which can help to facilitate the passage of any necessary administrative actions because legislative options are less available with a split House and Senate. Furthermore, there is a growing consensus among policymakers, industry experts, and advocacy groups that the GSEs need to be reformed in order to address the affordable housing crisis and advance racial equity in the housing market.

The GSEs have played a crucial role in providing relief to the housing market during the COVID crisis. Hence, it is likely that the administration will want to solidify and formalize the GSEs’ role in addressing the affordable housing crisis and advancing racial equity and this can be accomplished as part of exiting conservatorship via consent decree.

In summary, the current administration’s commitment to address the affordable housing crisis, the favorable political landscape, and the urgency of the current economic condition, all point towards the possibility of near term administrative reform of the GSEs.

Capital Restoration Plans Due This Year

The formalization of the capital planning rule was an important step towards the reprivatization of Fannie Mae and Freddie Mac.

Under the final rule, each Enterprise will submit its first capital plan by May 20, 2023.

The rule, which has been developed by the Federal Housing Finance Agency (FHFA), set clear guidelines and will help Fannie and Freddie access capital markets. This will enable Fannie Mae and Freddie Mac to raise the capital they need to operate and support the housing market, which is crucial for their ability to fulfill their public mission of advancing affordable housing. This will enable them to secure the GSEs as an emergency backstop during a crisis, enhance operation of the GSEs in regular times, and advance the GSEs’ public mission. It will also help to ensure that the GSEs have the resources they need to continue providing financing to lenders for nearly half of current U.S. mortgages by buying the mortgages from lenders and packaging and selling them to investors, making mortgages cheaper and more available across the country. A capital restoration plan would only have significance if the GSEs equity was restructured in order to attract a capital raise so it is interesting that Sandra Thompson finalized the capital planning rule under Biden.

FHFA’s 2022 Performance And Accountability Report

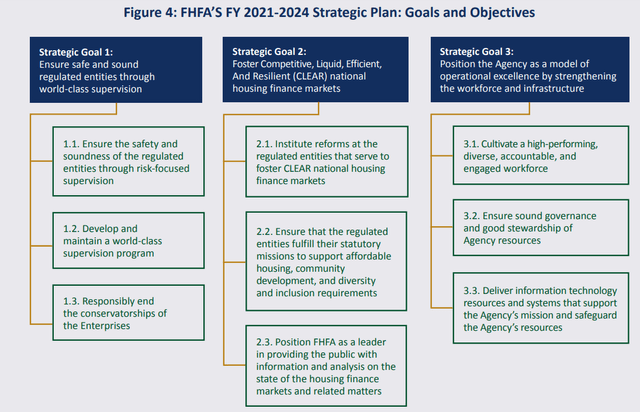

In November 2022, FHFA released a report outlining that FHFA had accomplished their strategic objectives associated with their responsibility to end the conservatorships of the Enterprises:

FHFA Strategic Plan: Goals and Objectives (FHFA)

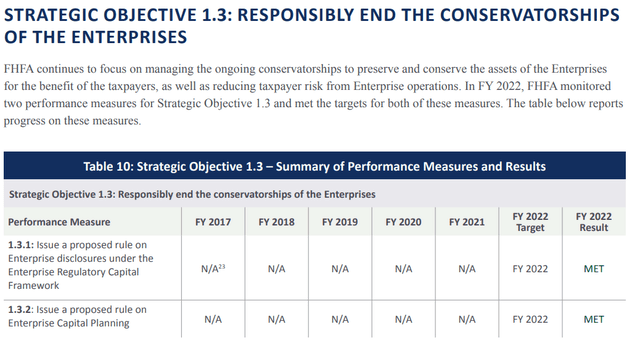

FHFA reported that it met all its strategic objectives with respect to this strategic goal in 2022:

Strategic Objective 1.3 Responsibly End the conservatorships (FHFA)

FHFA finalized all the rules that needed to be complete in order to responsibly end the conservatorships of Fannie and Freddie. The proposed rule on Enterprise Capital Planning was subsequently elevated and put into action in the sequential strategic plan.

FHFA’s 2022-2026 Strategic Plan

FHFA updated their strategic plan under Sandra Thompson. Instead of creating the rule for enterprise capital planning, now FHFA has moved forward to include Strategic Objective 1.3.3:

Oversee the Enterprises’ implementation of capital plans to achieve regulatory capital requirements

Sandra Thompson’s director’s message reads:

FHFA is continuing to take incremental steps to strengthen the capital positions of Fannie Mae and Freddie Mac (together, “the Enterprises”) so that they can fulfill their responsibilities throughout the economic cycle. FHFA recently finalized important enhancements to the Enterprise Regulatory Capital Framework that provide the Enterprises with the necessary incentives to transfer credit risk to private investors, which will help protect taxpayers from the risks posed by the Enterprises and support the Enterprises in facilitating equitable and sustainable access to mortgage credit. Furthermore, FHFA proposed additional capital planning and disclosure requirements to help ensure the Enterprises have robust systems and processes in place to achieve and maintain proper levels of capital.

Implementing capital plans that achieve regulatory capital requirements ends the conservatorship by recapitalization and release. Fannie and Freddie have been retaining earnings since 2019 and with every continued step to strengthen their capital positions continues to affirm that receivership is not a viable restructuring option moving forward.

The Government’s Valuing of Junior Preferreds

In the government’s recapitalization report, it outlines the effects of ending the conservatorships in 2023 and 2025. In fact, the only way to wipe the junior preferred is through receivership:

If, however, the Treasury wanted to raise capital through the sale of new common shares without resorting to receivership for the GSEs, the claims of junior preferred shareholders would have to be addressed.

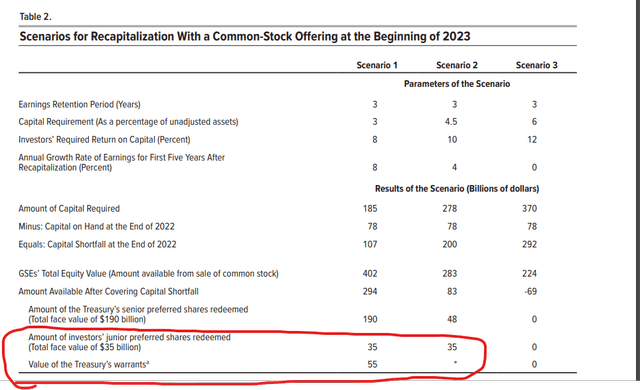

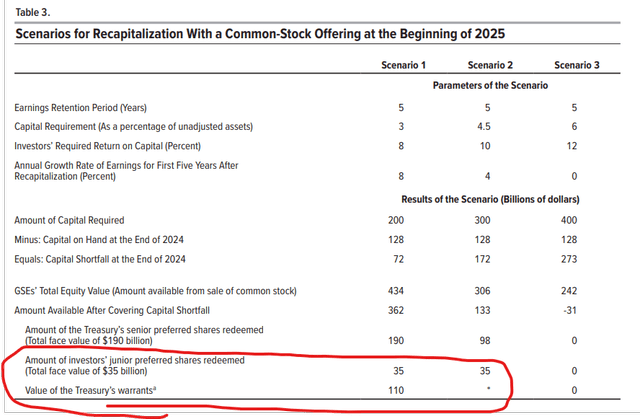

In the two infographics below, the government shows that the junior preferred are made whole in scenarios where the SPSPA is worth less than face value and where the government’s warrants are worthless (denoted with an asterisk *).

2023

2023 Recapitalization Plan (CBO GOV)

2025

2025 Recapitalization Plan (CBO GOV)

Junior preferred take priority to the government’s stake in a recapitalization according to the government reports. The CBO report continues to outline converting its preferred to common as a restructuring option:

One way in which the Treasury could modify the agreements would be to convert its preferred shares into common shares, into warrants for common shares, or into some form of debt in the GSEs

With the Supreme Court’s recent ruling, there is no pending litigation that would prevent SPSPA conversion. Further, the government outlines that it has taken this path before in footnote 24:

Converting preferred shares into common shares would be similar to the approach that the Treasury took during the financial crisis when it intervened to help other firms, such as the American International Group, known as AIG.

As such, I expect this to result in substantial dilution to existing common, making them uninvestable as there is no security in the face of the pending restructuring that is a necessary step to raising new third party capital.

Summary and Conclusion

In conclusion, Fannie Mae and Freddie Mac’s preferred stock presents a potential opportunity for investors, due to the potential for significant value appreciation through an equity restructuring that allows them to raise capital. This restructuring, which may involve the conversion of the liquidation preference of the SPSPAs and the exercise of warrants held by the Treasury, would dilute the value of existing common shares but would be done to maximize the size and value of the government’s ownership stake. As such, this outcome is likely to be in the best interest of the government and ultimately, the stability of the U.S housing market. In this fashion of security analysis and buying those that have security and value that can be deduced, common have no security and are akin to a gamble on the government’s perspective, informed by investment bankers, as to whether or not converting the SPSPA or the mechanics therein, maximizes the value of its equity stake. The preferred on the other hand are money good in a recapitalization by the governments own admission in its own documents. Plan accordingly.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link