[ad_1]

Lifestyle China Group Limited (HKG:2136) Shareholders will no doubt appreciate the 97% increase in the stock last quarter. But the stock has performed poorly over the past five years. In fact, the stock is down 48% for him, well below the return you’d get from buying an index fund.

After a rough five years for Lifestyle China Group shareholders, the past week has shown encouraging signs. So let’s look at the long-term fundamentals and see if they’re driving the negative returns.

Discover the latest analysis from Lifestyle China Group

To quote Buffett, “Ships sail the world, but the Flat Earth Society thrives. There will continue to be a great discrepancy between price and value in the market…” One flawed but reasonable way to assess how stock prices have changed is to compare earnings per share (EPS) to stock prices.

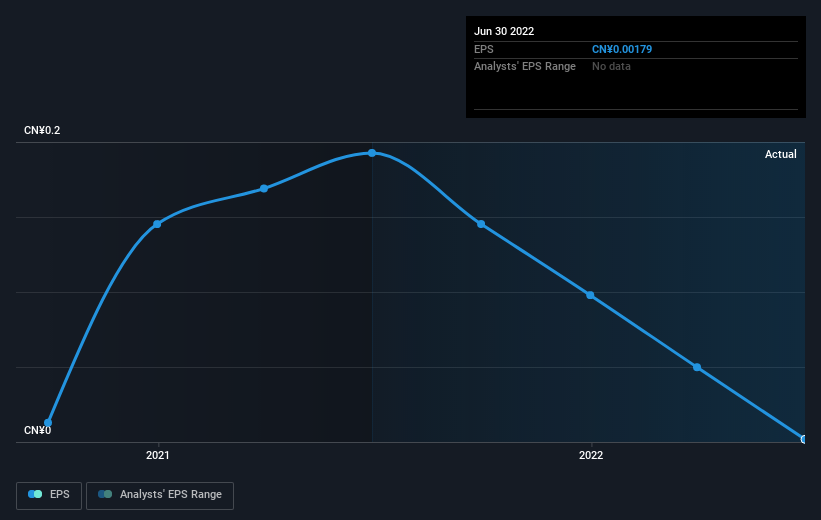

Looking back over the five years, Lifestyle China Group’s stock price and EPS have both fallen. The latter is at a rate of 61% annually. This is due in part to unusual items impacting earnings. A 12% year-on-year decline in stock prices is less severe than the fall in EPS. As such, the market may have previously expected a decline, or otherwise expected the situation to improve. With a P/E ratio of 548.30, it’s no exaggeration to say that the market sees a brighter future for the business.

The image below shows how the EPS changed over time (click the image to see the exact values).

Thorough research is always recommended before buying or selling stocks Historical growth trends are available here.

another point of view

The 1.7% drop in Lifestyle China Group’s share price for the year was admittedly disappointing, but not as bad as the market’s 5.7% decline. Far more worrisome is the 8% annualized loss it has brought to shareholders over the past five years. Losses are slowing, but I doubt many shareholders are happy with the stock. I find it very interesting to look at stock prices over the long term as an indicator of performance. But for true insight, other information must also be considered. for example, Two Warning Signs of Lifestyle China Group (about 1) What you should know.

of course, You can find great investments by looking elsewhere. Let’s take a look at this freedom A list of companies whose revenue is expected to increase.

Please note that the market returns quoted in this article reflect the market-weighted average returns of stocks currently traded on the Hong Kong exchange.

Valuation is complicated, but we’re here to help make it simple.

find out if lifestyle china group You may be overestimated or underestimated by checking out our comprehensive analysis including: Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View Free Analysis

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

[ad_2]

Source link