[ad_1]

Inman Connect New York is the perfect blend of out-of-the-box thinkers, cutting-edge leaders, and hard-working, successful agents. Join us January 24-26 to get the content, education, and networking opportunities you need to succeed in today’s changing marketplace. Register here.

A new report from the Consumer Federation of America, a nonprofit consumer watchdog, found significant differences in real estate commission rates and agent compensation across New York City, depending on the rules of the multiple listing services in which the property is listed. I have.

In the report, “Real Estate Fees Diverse: An Anomaly in New York City’s Home Brokerage,” the Real Estate Commission of Brooklyn MLS, OneKey MLS, and New York’s Residential Listing Service (RLS).

There is no single dominant MLS in the New York City real estate market, but that is usually the case in other markets, and MLSs are almost always affiliated with realtors.

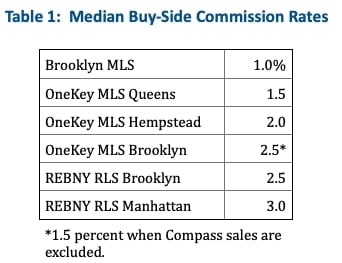

CFA found that the median commissions offered by listing agents to buyer agents ranged from 1% in parts of Brooklyn to 3% in Manhattan, with a median total commission rate of 3% in Brooklyn and 6% in Manhattan. I discovered that

Source: CFA

CFA Senior Fellow and author of the report Stephen Brobeck said in a statement:

Steve Brobeck

“A $1.2 million condo in Manhattan has $72,000 in total agent fees, which could be triple the $24,000 total agent fees for an $800,000 condo sold in part of Brooklyn.”

The CFA investigated the report because previous research found buyer agent commission rates to be very uniform across nearly 20 US cities, excluding Brooklyn.

According to the CFA, according to its latest report, realtors and brokers can make a profit even with lower commission rates than common in most markets.

“[T]Brooklyn MLS and, to a lesser extent, nearby community OneKey MLS, allow agents and brokers to sell homes at much lower commission rates than the 5-6% commission rates common in most local U.S. housing markets. It shows that you can sell your real estate profitably. ‘ said the report.

“In the New York City area, where house prices are relatively high, it is the lowest in many communities with the lowest commission rates. In addition, commission rates are also high in many other parts of the country where house prices are high. I have.”

The CFA’s latest report concludes that the most important reason for commission rate differences in the New York City area is the MLS where the sale took place, specifically the rules of the MLS.

According to the CFA, REBNY’s RLS requires listing brokers to offer and provide equal compensation to buyer brokers. This means that we split the total commission evenly and establish a standard of 5-6% of the total commission.

In the Brooklyn MLS, on the other hand, listing brokers were not required to offer compensation to buyer brokers, and 10% of the listings in the study’s sample chose not to do so. There, most total commission rates were 3 or 4%, with a 2% increase in commission rates, especially when listing agents worked with both buyers and sellers to double-end transactions.

Also, OneKeyMLS, which is affiliated with the National Association of Realtors, does not require that buyer agent compensation be equivalent to listing agent compensation, but that listing brokers offer comprehensive and one-sided compensation to buyer brokers. There are NAR rules that require you to provide An order to submit a list. Multiple federal antitrust lawsuits are now attacking the rule, and the CFA has condemned it in multiple reports.

Source: CFA

“The NYC market has shown that rates go down when listing agents don’t have to offer non-negotiable commissions to buyer agents,” said Brobeck. “But we need these commissions.” , and the fees remain high when listing agents have to offer comparable compensation to buyer agents.”

In its report, the CFA reiterated its call for a complete ban on sellers offering buyer-broker commissions.

“The New York City residential real estate market shows that some price competition is possible between brokers and agents,” the report said.

“Fare unbundling not only increases price competition, but may require experimentation with different prices and service models.”

Watchdog urged NYC consumers, especially those served by REBNY, to insist on lower commission rates.

“For the most part, people selling homes in Manhattan are being deceived by high commission rates,” said Brobeck. “If an agent sells a $1 million condo, he rarely deserves a $60,000 reward — the price of two new cars or one expensive car.”

manchill williams

Asked for comment on the CFA report, NAR spokesperson Mantil Williams told Inman:

Compass, the city’s second-largest residential real estate company, charges the “REBNY rate” when selling through Brooklyn’s OneKey, according to a CFA report. Given that Compass co-brokered nearly all of its sales with non-OneKey members through OneKey in Brooklyn, the CFA states that Compass will split his 2.5% and his 3% commissions for other his REBNY members. I speculated that it may have been secured to

Without the Compass sale, Brooklyn’s OneKey’s median buy-side commission rate fell from 2.5% to 1.5%.

“Brooklyn’s MLS fees appear to be putting downward pressure on all fee rates in New York City, except those charged on REBNY sales,” said Brobeck.

From this, the CFA concluded that even one MLS with low fees in one market can drive down the fee rates of other MLSs operating in the same or nearby markets.

“This pressure on fees may reflect consumer perceptions of lower fee rates in some regions,” the report said.

“This may also reflect the practice of some agents, accustomed to offering low buy-side rates in one MLS, to offer low rates in another MLS.

“And it may reflect the perception of other listed agencies that price competition is a viable alternative to rigid industry rate standards in a business that relies heavily on agency cooperation. I have.”

However, low commission rates can have unintended negative consequences. Double-ended deals were rare in REBNY’s RLS and highest in the Brooklyn MLS, with 46% of the latter’s sales being double-ended by individual agents (the same agent who worked with the buyer and seller), according to the CFA’s report. and 58% of sales doubled. -Finished by the office (the same broker was working with the buyer and the seller).

In contrast, a previous CFA study found double dips by individual agents in 12 cities ranged from 3% to 15%, with an average of 9.4%.

“Most agents that sell real estate through the Brooklyn MLS not only offer low buy-side rates, but they work hard to find buyers themselves.

“They often withhold or delay MLS listings and make it difficult for buyer agents to sell properties, for example by limiting communication.”

According to the CFA, listing agents typically do business with buyers as customers, not customers, in New York State.

“Unless the buyer hires an attorney, most buyers will not be represented in a double-ended sale,” says Brobeck.

However, the CFA concluded that the more frequent double endings were likely a result of lower commission rates, not the cause.

“[L]Due to lower commission rates, agencies appear to be doubling their sales,” the report said.

“In New York State, buyers are typically treated by listing agents as customers rather than clients, so this double ending is costly to fiduciary representation of buyers.

“In other parts of the country where double agency is widespread, the costs are borne primarily by sellers who lose trustee representation. You may not legally provide the Seller with advice or assistance to give

The CFA report contains methodological caveats.

“Most of this report attempts to illustrate typical rate differences within New York City’s six MLS groups and the variance of these rates,” the report said.

“Because of the limited data and analytical methods, the investigation of causation remains suggestive rather than conclusive, despite strong evidence for the influence of some factors.”

This report is based on data provided to Watchdog by discount broker and consultant Derek Eisenberg. This data primarily includes sales made through his late spring/early summer 2022 Brooklyn MLS and OneKey MLS, as well as listings (not sales) collected through his REBNY collected in the fall of 2021. is included. From REBNY.

The CFA also interviewed 20 New York City real estate professionals, brokers, and agents and reviewed published articles and academic research to produce the report.

MLS generally does not include data on sell-side fees. Asked how the CFA got its total commission data, Brobeck said, “Last year, when I was trying to figure out the data for Brooklyn, I spoke with several New York City real estate agents. is typically 3-4%.

“Recently, I spoke with dozens of real estate agents, most of whom were from Brooklyn. 3% in total), but when the buy-side rate is higher, the total rate tends to be 4%.

“This is true even outside of the Brooklyn MLS, where the typical buy-side rate for OneKey Brooklyn (excluding Compass) or OneKeyQueens is 1.5%, the typical rate is 4%.

“But in Manhattan there was agreement that the typical rate is 6%. standards).”

Editor’s Note: This article has been updated with additional comments from CFA’s Stephen Brobeck.

Email Andrea V. Brambilla.

Like us on Facebook Follow us on Twitter

[ad_2]

Source link