[ad_1]

Ossia Hyper Retail (NSE:OSIAHYPER) shares are down 22% after nearly three months. But if you look closely, you might find that the key financial metrics look pretty decent. This could mean that stocks could rise in the long term, given the way markets typically reward more resilient long-term fundamentals. In this article, we decided to focus on: ROE of Ossia Hyper Retail.

Return on equity, or ROE, tests how effectively a company enhances its value and manages investors’ money. In other words, ROE shows the return each dollar makes on a shareholder’s investment.

View the latest analysis from Osia Hyper Retail

How do you calculate return on equity?

ROE can be calculated using the following formula:

Return on Equity = Net Income (from Continuing Operations) ÷ Shareholders’ Equity

Therefore, based on the above formula, Osia Hyper Retail’s ROE would be:

9.6% = ₹105m ÷ ₹1.1b (based on last 12 months to Sept 2022).

“Revenue” is the income a business earned in the last year. In other words, for every INR 1 shareholder’s equity, the company has generated a profit of INR 0.10.

What does ROE have to do with revenue growth?

It has already been established that ROE serves as an efficient profit-making metric to gauge a company’s future earnings. Next, the company should assess how much of its earnings will be reinvested or “retained” for future growth. This will give you an idea about the company’s growth potential. Assuming all else remains the same, higher ROE and profit margins will necessarily lead to higher growth for a company compared to a company that does not have these characteristics.

Osia Hyper Retail revenue growth and 9.6% ROE

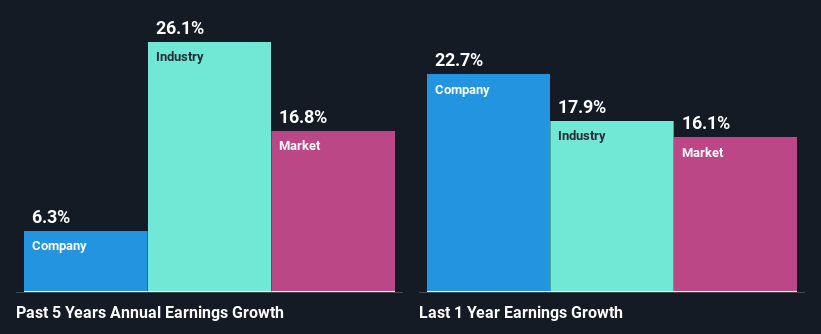

At first glance, Osia Hyper Retail’s ROE doesn’t look very attractive. However, more in-depth research shows that his ROE for the company is closer to his industry average of 9.6%. That being said, Osia Hyper Retail has shown he has modest net profit growth of 6.3% over the last five years. Considering the moderately low ROE, it’s entirely possible that there are some other aspects that are positively impacting the company’s revenue growth. It’s possible that you did, or the company’s payout percentage is low.

We then compared Osia Hyper Retail’s net profit growth with the industry and found that the company’s growth rate was lower than the industry’s average growth rate of 26% over the same period. This is a bit of a concern.

The foundation for adding value to a company is largely tied to revenue growth. The next thing investors need to determine is whether expected earnings growth, or lack thereof, is already baked into the stock price. That way, you’ll know if your stock is headed for clear blue waters, or if wet waters await. One good indicator of expected earnings growth is the P/E ratio. This determines the price the market is willing to pay for a stock based on its earnings prospects.so you might want to Find out if Osia Hyper Retail is trading at a higher or lower P/E compared to the industry.

Is Osia Hyper Retail reinvesting profits efficiently?

Osia Hyper Retail does not pay dividends, so all profits are reinvested in the business.

Conclusion

Overall, Osia Hyper Retail’s business appears to have some positive aspects. So, respectable earnings growth, achieved by retaining most of the earnings. But given the low ROE, investors may not be reaping the benefits of reinvestment after all. I wouldn’t dismiss the company outright, but I would try to see how risky it is to make a more informed decision about it. The risk dashboard has five risks that we have identified for Osia Hyper Retail.

Valuation is complicated, but we’re here to help make it simple.

find out if OCEA HYPER RETAIL You may be overestimated or underestimated by checking out our comprehensive analysis including: Fair value estimates, risks and warnings, dividends, insider trading and financial health.

View Free Analysis

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

[ad_2]

Source link