[ad_1]

nevertheless i Rhythm Technologies Co., Ltd. (NASDAQ:IRTC) stock rose 5.2% last week. An insider who has sold shares worth US$6.9 million in the past year is probably in the advantage. Selling at an average price of US$122, higher than the current price, might have been the best bet for these insiders.

Insider trading is not the most important thing when it comes to long-term investing, but in theory you should pay attention to whether insiders are buying or selling stocks.

Check out the latest analysis from iRhythm Technologies.

iRhythm Technologies insider trading last year

Last year’s largest insider sale was by president Quentin Blackford, with shares worth US$1.6 million, or about US$123 per share. We usually don’t want to see insider sales, but the lower the sale price, the more interest we have. It is somewhat consoling that this sale came at a price well above his current stock price of $102. As such, it may not shed much light on insider trust at its current level.

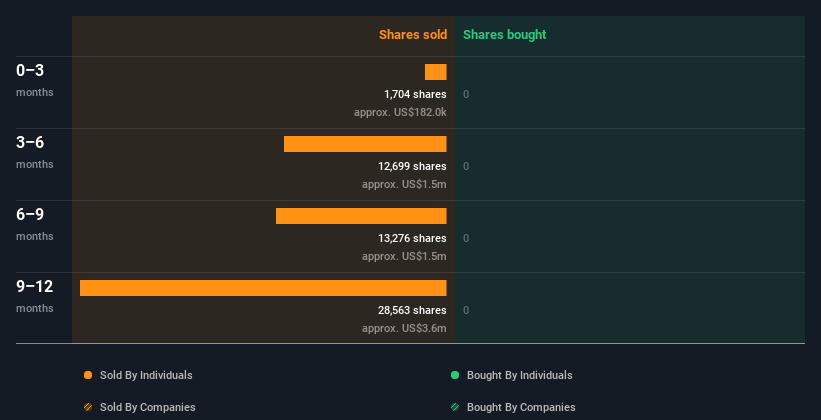

No iRhythm Technologies insider bought a single share last year. The chart below shows insider trading (by company and individual) over the past year. If you want to know exactly who sold, how much and when, click the chart below.

If you see big insider purchases, you’ll love iRhythm Technologies.Check here while you wait freedom A list of growing companies that have made significant recent insider acquisitions.

iRhythm Technologies Insider Selling Stock

The past three months have seen a significant amount of insider selling at iRhythm Technologies. Specifically, Chief Legal Officer Patrick Murphy sold $182,000 worth of stock at the time, but the purchase was never recorded. Given this, it’s hard to argue that all insiders consider the stock a bargain.

Does iRhythm Technologies boast high insider ownership?

I like to look at how many shares an insider owns in a company to inform my view of how well insiders and insiders match up. High insider ownership often leads company management to pay more attention to the interests of shareholders. An iRhythm Technologies insider appears to own his 1.6% of the company, worth about $49 million. While this is a strong level of insider ownership, it is not an outstanding level, but it is sufficient to indicate some alignment between management and minority shareholders.

So what does this data tell us about the iRhythm Technologies insider?

The insider has not bought iRhythm Technologies stock in the last three months, but there has been some selling. And if you look at last year, you didn’t see any purchases. Insiders own shares, but given the history of sales, we’re still pretty cautious. While we’d love to know what’s going on with insider ownership and trading, we should also consider the risks facing the stock before making an investment decision.During the analysis, iRhythm Technologies three warning signs Ignoring them is unwise.

of course iRhythm Technologies may not be the best stock to buySo you might want to watch this freedom A collection of quality companies.

For the purposes of this article, an insider is an individual who reports a transaction to the relevant regulatory body. Currently, we consider open market transactions and private disposals, but not derivative transactions.

What are the risks and opportunities iRhythm Technologies?

iRhythm Technologies, Inc., a digital healthcare company, provides ambulatory electrocardiogram (ECG) monitoring products for patients at risk of arrhythmia in the United States.

View full analysis

reward

-

Revenue is projected to grow 16.81% annually

risk

-

Shareholders have been diluted in the past year

-

Significant insider sales in the last 3 months

-

Currently in the red and not expected to turn profitable in the next three years

See all risks and rewards

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

[ad_2]

Source link