[ad_1]

fuzz martin

Rolls-Royce Holdings (OTCPK:RYCEY) is an internationally operating industrial technology company primarily providing aircraft and marine engines. The company’s brand name is associated with luxury cars that are famous all over the world.But Rolls-Royce Holdings sold the licenses related to its automotive division to BMW A while ago. To date, the company appears to be in a great deal of pain, and its market cap has halved since the beginning of the year, indicating that the market is concerned about its future performance. We’ll look at the issues and why I don’t believe in this company in the long run.

Deteriorating profitability

Reflection on the past 10 years

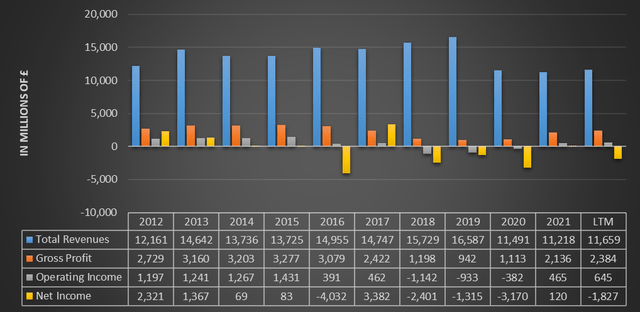

First, assess long-term profitability. A competitive and solid company should grow over the long term, but that is not the case with Rolls-Royce.

TIKR terminal

Current revenues and profits are down compared to 10 years ago, which is very concerning. Even assuming the current troubles are caused by a difficult macroeconomic environment, it should be noted that Rolls-Royce was struggling to turn a profit even before the pandemic hit. It is very common to suffer losses considered “abnormal” in the billions of pounds range. This used to be a less than optimal situation. To date, things have only gotten worse. From a long-term perspective, Rolls-Royce has proven in the past not to be a good investment. Yes, it’s a highly volatile stock, so there have been opportunities for short-term gains, but I don’t think investors offering a buy-and-hold strategy will be happy with the results so far. not.

First half of 2022

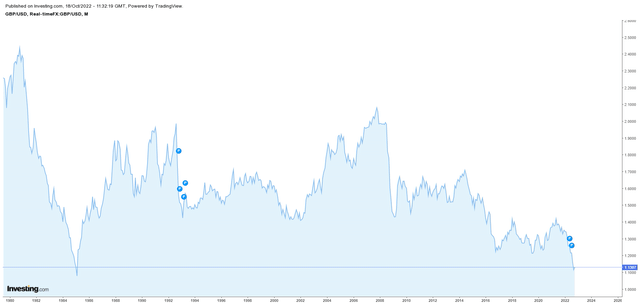

Looking at the first half of the year, things look more complicated than before. In addition to the usual problems with his chain of supply, inflation and rising interest rates, Rolls-Royce has also been hit by the significant drop the pound has had against the dollar.

investment.com

Such depreciation has not been seen since 1985 and has impacted the company’s balance sheet. Exports are good, but imports are bad. In addition, such significant exchange rate fluctuations can create significant risks related to the depreciation of derivatives on balance sheet assets.

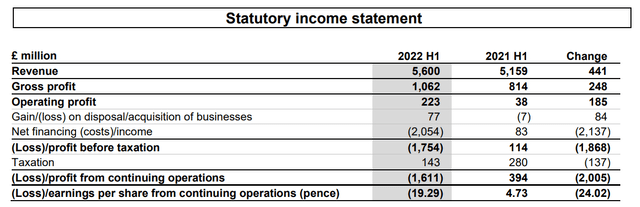

Rolls-Royce Holdings plc – 2022 Half Year Results

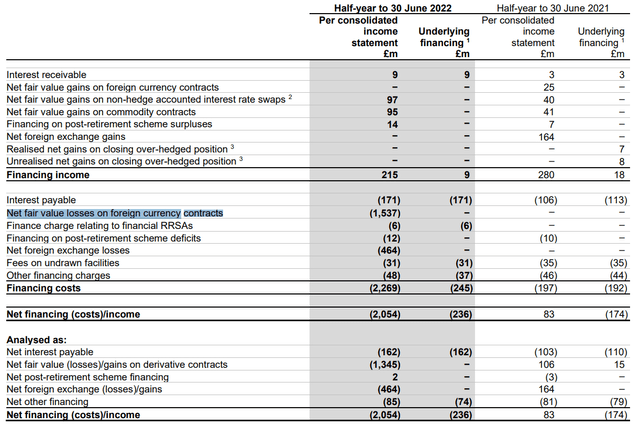

Based on H1 2022 results, we see a £441m increase in income compared to H1 2021, benefiting from a weaker sterling. As a result, both gross profit and operating profit increased. So far, the devaluation of the pound has had an overall positive effect, but the next item, ‘Net funding costs/income’, found a loss of just over £2bn. What is this?

Rolls-Royce Holdings plc – 2022 Half Year Results

£1,530m was attributable to net fair value losses on foreign exchange contracts and therefore to write-downs of derivative contracts on the balance sheet and £464m to net foreign exchange losses. As the net fair value loss is a non-cash expense, the loss of £1.53bn had no adverse impact on the cash flow statement. In fact, in the first half of 2022 Rolls-Royce generated £597m of operating cash flow despite a significant loss on the income statement. As this balance sheet only represents the first half of the year and the pound has continued to depreciate significantly in the second half, we expect a similar situation to occur again in the second half of 2022.

Performance of individual segments in the first half of 2022

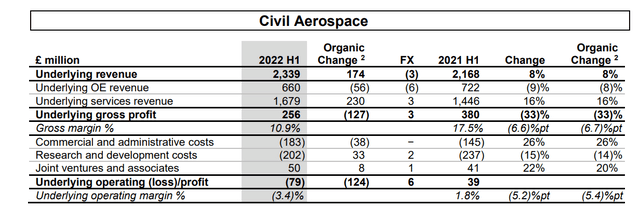

Rolls-Royce Holdings plc – 2022 Half Year Results

Commercial aerospace is the company’s most important segment in terms of revenue, showing organic growth of 8% in the first half of 2021, but still losing money as it has yet to fully recover from the impact of the pandemic. is covered The company’s guidance for this segment is as follows:

- Engine flight hours will maintain their current trajectory and return to pre-pandemic levels in 2024 as global travel restrictions are lifted.

- In 2022, we expect a total of 350-400 OE deliveries and 1,100-1,200 total shop visits. Underlying revenue growth at his CAGR percentage in the low double digits.

- Efforts will be made to keep costs low and profitability in 2022 will improve compared to 2021. Underlying operating margin expands to his high single-digit percentage.

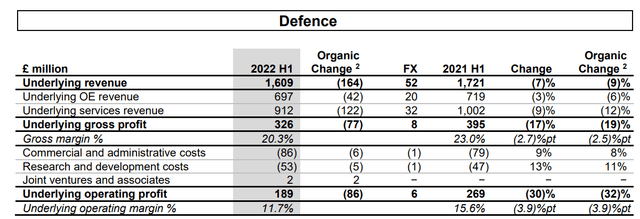

Rolls-Royce Holdings plc – 2022 Half Year Results

The Defense segment is the second largest in terms of revenue and the only segment to experience negative organic growth since the first half of 2021. Operating margins are declining, but at least positive operating margins exist, unlike the commercial aerospace segment. The segment isn’t immediately exposed to short-term changes in defense demand, according to the company, but this 2022 increase in military spending has strengthened its long-term outlook. Royce is investing heavily in decarbonizing and modernizing its facilities. A low double-digit operating margin is expected for him in 2022.

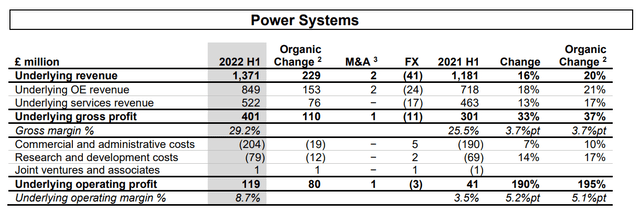

Rolls-Royce Holdings plc – 2022 Half Year Results

The Power Systems segment is the least important in terms of revenue, but it is also the fastest growing. With 20% organic growth in the first half of 2021 and operating margin up 5.2 points from his, it is the best performing segment. Demand for products in this segment remains strong, but the problem is that supply chain-related slowdowns are preventing Rolls-Royce from producing as much as it would like. I’m here.

Overall, from a growth perspective, the Power Systems segment outperformed the other segments in this first half of 2022. Although no gains were recorded due to the decline in the fair value of derivative contracts, cash from operating activities remains positive. Compared to pre-Covid years, profitability remains limited and the discontinuity remains higher than in the past. We look at how debt sustainability has changed compared to years ago.

too much debt

This company’s high debt is the main reason I won’t invest. I prefer companies with low debt, but I don’t think it’s wrong to invest in a company with debt if the income supports the debt. The problem with Rolls-Royce is that his two-year crushing drop due to the pandemic has left him in very high debt and without a solid income to cope with it. This doesn’t mean the company will go bankrupt tomorrow, but Rolls-Royce is going to struggle as it is not supported by steady and growing earnings and profits to lower its current debt levels. Historically, we’ve seen how profits can go up and down, but the current macroeconomic environment certainly doesn’t help. Here are some charts to support my thesis.

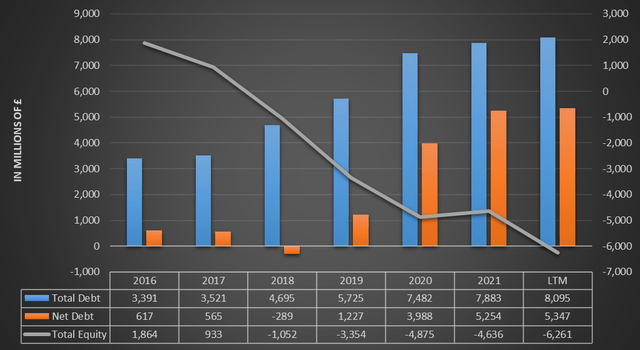

TIKR terminal

Gross debt is increasing year by year, but the real worry is that net debt is growing even faster. Before the pandemic he was £1.22 billion, now he’s $5.34 billion, an increase of 335%. This means that corporate liquidity is increasingly declining, while total debt is following the opposite trend. Additionally, we can see the company’s shares are now below 0 due to ongoing losses on the income statement that began well before the pandemic. This is certainly not the best situation for shareholders. Even considering that such negative capital does not come from a strong share buyback program.

TIKR terminal

Debt sustainability is at great risk.

- It will take nearly a decade for FFO to cover its total debt, and just over two years in 2018.

- A worrisome figure given that net debt is 4.13 times EBITDA, which was almost halved in 2018.

Overall, this is a rather worrisome balance sheet situation, as Rolls-Royce is significantly undercapitalised. Covid has completely distorted balance sheets.

TIKR terminal

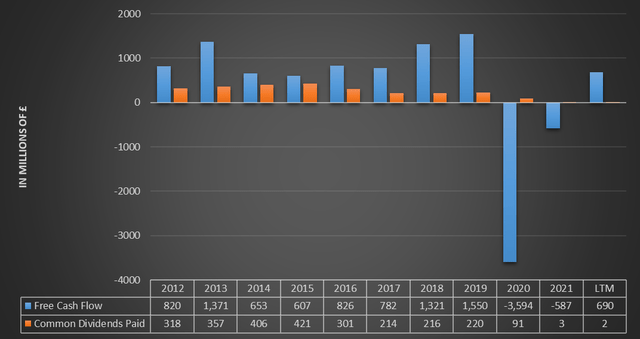

In the past, the company could also issue a sustainable dividend, which is utopian today. further reducing equity.

At this point, one might wonder how long the company will remain liquid if it continues to lose money with huge amounts of debt. Rolls-Royce has answered this question in its latest report.

Rolls-Royce Holdings plc – 2022 Half Year Results

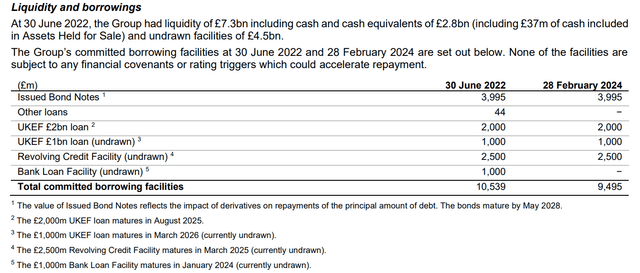

As of June 2022, the company has a total liquidity of £7.3bn, which includes:

- £2.8 billion cash and cash equivalents.

- £4.5bn of unused facilities. The company considers this amount liquid. This is because the lender is obligated to lend money to the borrower when requested because it is “committed.” So if Rolls-Royce needed it, it would have to borrow £4.5bn. But watch out for the maturity of these contracts (included in the image) and the increased liability.

Given its total liquidity of £7.3bn, combined with its future cash flow estimates, the company said it has sufficient liquidity for at least the next 18 months. So while Rolls-Royce is highly unlikely to run out of liquidity in the short term, the long term remains questionable.

In conclusion, my valuation is a strong sell in the light of all the considerations made.

- Low operating margins, years of stagnant earnings, too discontinuous profits.

- Negative equity, high net debt, no dividends, unfavorable macroeconomic environment.

Additionally, the recent S&P 500 crash has created an interesting buying opportunity for solid companies that were previously overvalued. This is another reason to invest your money elsewhere. Basically, there’s no reason to speculate about Rolls-Royce when companies like Alphabet and T. Rowe Price are available at discounted prices. Either way, nothing is certain about the future and I could be wrong.

[ad_2]

Source link