[ad_1]

French startup Seyna is slowly building an all-in-one platform for insurance brokers to help them create, sell and manage insurance products from scratch. The company is launching a new product called Seyna Claims. As the name suggests, Seyna Claims empowers insurance brokers to handle claims themselves.

Seyna is an insurtech startup with an insurance license from the French regulator (ACPR). The company created a core insurance system. This means that insurance policies with different clauses can be quickly generated to help brokers find the right balance of coverage and price. The startup has raised 47 million euros since its inception.

Companies working with Seyna include pet insurance startup Dalma and unpaid rent insurance company Garantme. Seyna’s clients can build subscription funnels with real-time quotes and create contracts and invoices on the fly.

In addition to Seyna’s own balance sheet, the company also partners with major reinsurers such as Swiss Re, Scor and Munich Re. Some companies use only Seyna’s technology platform because they have existing relationships with insurers.

Brokers can do a lot now but often have to turn to third party claims management companies. Check and analyze the document. We also cut insurance premiums.

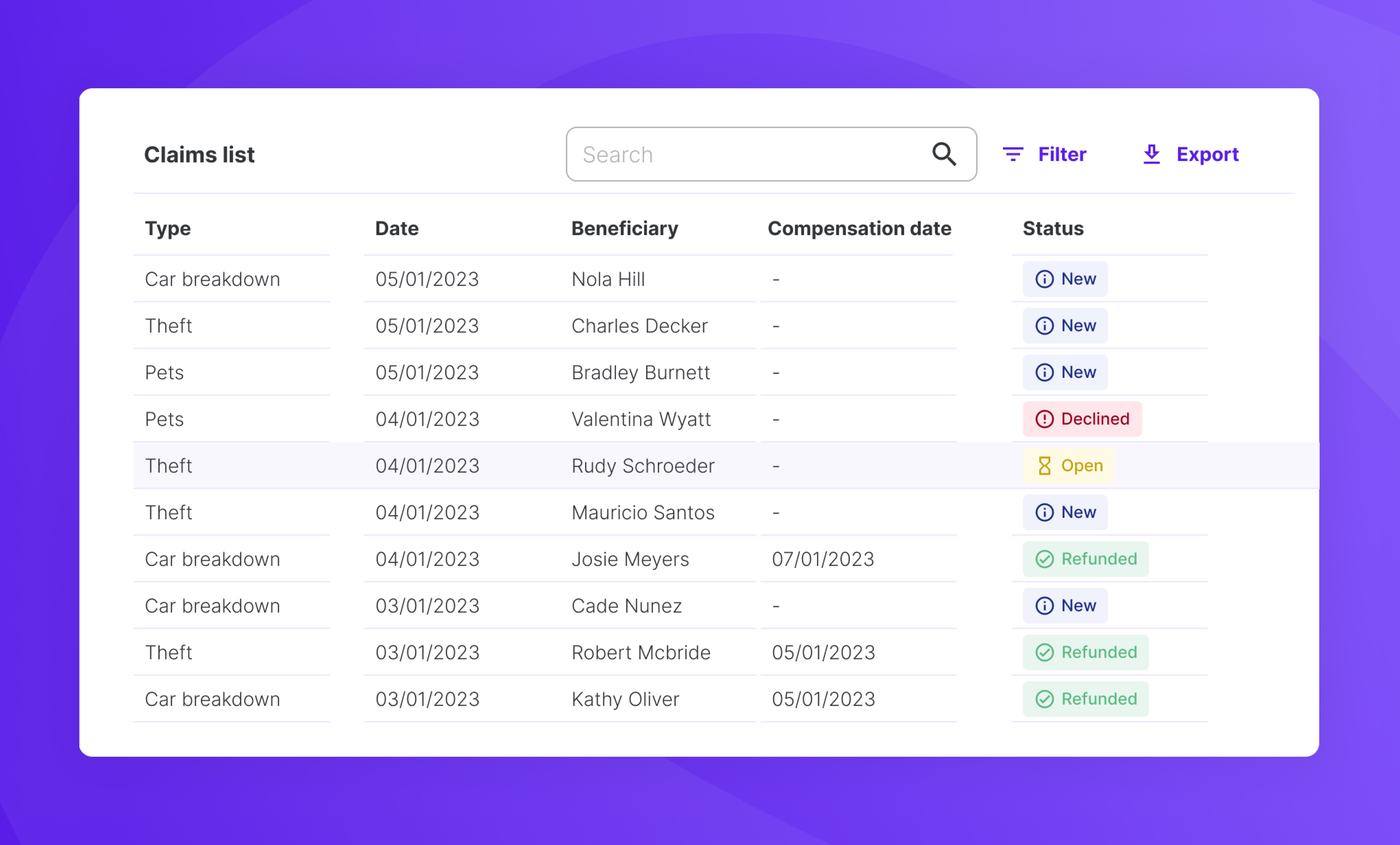

Seyna Claims enables many insurance brokers to handle these heavy lifting directly. It’s a software-as-a-service product with a white label interface that costs less than working with a claims management partner.

Unlike other broker platforms like Courtigo or Sydia, Seyna is more than just a management tool. It is integrated with the rest of the Seyna insurance platform. For example, claims data can directly enrich the accounting tab showing the performance of insurance products.

In the future, the startup hopes to enable third-party integrations on Seyna Claims to expand the possibilities of its product. For example, Seyna can offer integrations with Shift Technology for fraud detection, Stripe or MangoPay for payments with integrated KYC capabilities, and more.

Insurers can also choose to use Seyna Claims separately from the rest of the Seyna platform. The start-up hopes to build a modular platform to allow the insurance industry to choose Seina’s products when they see it relevant to improving operations. Essentially, Seyna is trying to modernize the insurance tech stack.

Image credit: Seina

[ad_2]

Source link