[ad_1]

Black_Kira

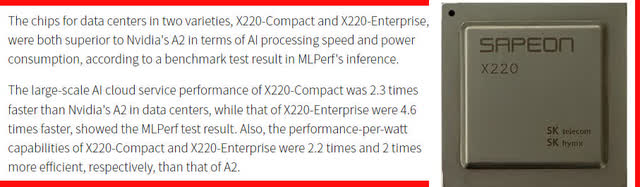

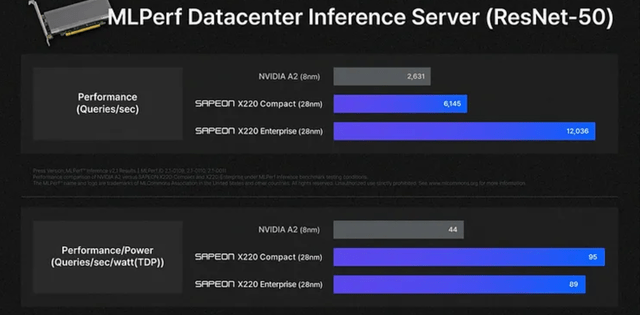

The fast-growing $93.5 billion Artificial Intelligence industry is why I have a buy rating for SK Telecom Co., Ltd (NYSE:SKM). Its subsidiary, Sapeon, markets an Artificial Intelligence chip that is reportedly much faster than Nvidia’s (NVDA) GPU A2 Tensor Core product. Going forward, the Sapeon X220 AI inference chip could boost SKM’s 9% net income margin.

Aside from data center purposes, the Sapeon X220 is being used inside U.S. digital TV broadcasting systems.

The Korea Herald

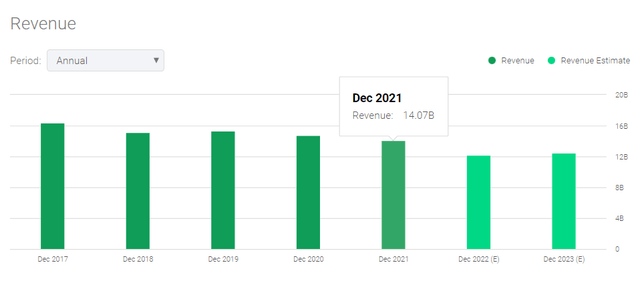

The AI processor market was worth around $10.25 billion last year. It is growing at 46.03% CAGR. This venture into AI processors/accelerator products could help reverse SKM’s declining annual revenue. It is the bane of all telecom firms to have low or negative revenue CAGR. Sapeon AI processors might help SKM reverse that projected -9.21% forward revenue growth.

Seeking Alpha Premium

Yes, it will take time before Sapeon becomes a threat to Nvidia. On the other hand, SK Telecom’s $50 billion spending plan for its U.S. subsidiaries include California-based Sapeon. SK Telecom’s sister company, SK Hynix owns factories that could manufacture Sapeon processors. Nvidia is still a fabless firm.

Sapeon AI processors also power SK Telecom’s Artificial Intelligence as a Service (AIaaS) platform. The AIaaS industry is estimated to have a CAGR of 56.25%. It could have a market size of $77 billion by 2025. SKM has a bright future ahead if it could develop more paid AI services like its X Caliber pet dog diagnostic system.

Why You Should Care

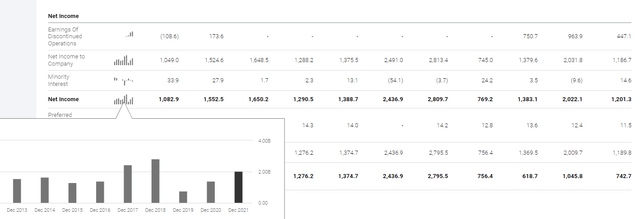

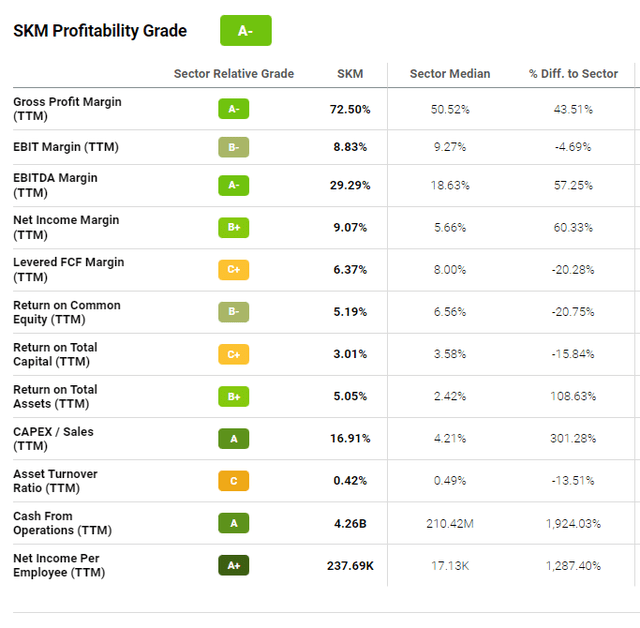

AI processors and AIaaS expansions could fortify the consistent profitability of SK Telecom. Take note, the decreasing annual revenue did not prevent SKM from achieving increased profitability during 2019 to 2021. This feat should be another good reason to go long on this AI-enhanced company.

Seeking Alpha Premium

Amazon.com (AMZN) Web Services recently signed a partnership with SK Telecom. They will jointly develop computer vision services. SK Telecom will provide the AI models and AWS will contribute its edge computing, IoT, data and storage capabilities. Amazon’s acceptance of SK Telecom as an AI partner is a long-term tailwind. The global AI computer vision market size was $9.04 billion in 2021. Its CAGR is 46.9%. It will be worth $98.05 billion by 2027.

SK Telecom’s technology collaboration with Canada can also fast-track deep learning optimization for Sapeon X220 and X330 processors.

Sapeon Is Competitive

The principle of presumption of regularity compels me to believe the stated performance numbers below. The mega-cap founding members of MLCommons (responsible for MLPerf Benchmarks) are not going to allow Sapeon Inc. to publish this graphic showing the X220 outperforming the Nvidia A2. Nvidia also uses MLPerf benchmark scores to promote its products. Nvidia is a founding member of ML Commons.

Sapeon, Inc.

The 28nm 8GB Sapeon X220’s spec sheet said its INT8 performance could reach 100 Tera OPS using Boost Mode. The 8nm 16B Nvidia A2’s INT8 performance is 36 Tera OPS.

Sapeon will launch the X330, X340, and X350 AI processors next year. The X430 will come in 2025. The upcoming Sapeon X350 might be able to match the 660 Tera OPS INT8 capability of the Nvidia A100.

A big-budget marketing campaign for Sapeon X220 could make it harder for Nvidia to sell its A2 product. SK Telecom should imitate the $1 billion U.S. marketing campaign of Flutter Entertainment (OTCPK:PDYPF, OTCPK:PDYPY). This aggressive advertising helped the Flutter-owned FanDuel become the no. 1 sports betting platform in the U.S. It takes money to make money.

Spending $1 billion to promote Sapeon X220 could make data center operators rely less on Nvidia. Nvidia’s data center segment’s quarterly revenue is $2.94 billion. There’s big money in supplying AI processors to the data center market.

Battered-Down to Bargain Status

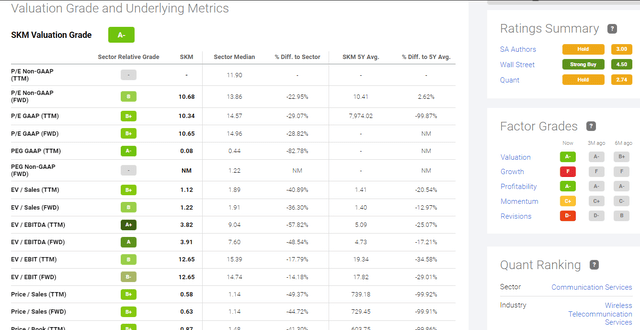

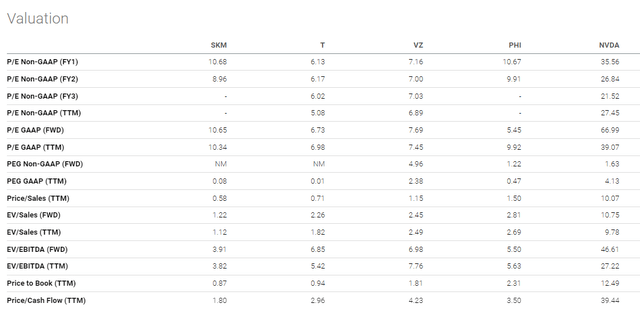

SKM’s 6-month price return is -30%. This stock trades at 10.34x TTM P/E. Investing in an AI-enhanced company that trades at 10x P/E seems is judicious.

SKM is relatively undervalued against its sector peers. Seeking Alpha’s Quant System only gives SKM a hold rating, but it gives it a valuation rating of A+. This is due to SKM’s TTM P/E of 10.34x being 29% lower than the Communication Services sector’s average of 14.57x. The TTM Price/Sales valuation of SKM is also only 0.58x. This is 40% lower than the sector average of 1.14x.

Seeking Alpha Premium

The bargain status of SKM is even greater when you consider its good profitability grade. The 9% net income margin is 60% higher than the sector median of 5.66%. Being more profitable than its peers is why SKM deserves a higher valuation than 10.65x forward P/E.

Seeking Alpha Premium

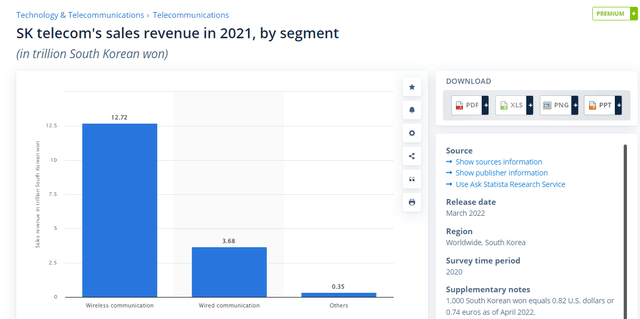

SKM’s handicap is its dependence on wireless and wired communications segments. It is very unappealing that SKM’s Others segment contributes almost nothing. Selling AI processors and the subscription fees from AI-as-a-Service could boost the Others segment’s revenue.

Statista Premium

Final Thoughts

The high CAGR AI chips industry (46.03%) and AI-as-a-Service (56.25%) are emerging catalysts for SK Telecom. These two expansion ventures should help SKM avoid prolonged decline in annual sales.

Promoting SKM as an AI-enhanced company might help its stock rebound near its $48.47 52-week high. Seeking Alpha is still the best platform to disseminate the good qualities of under-followed stocks.

Sapeon AI hardware and SK Telecom software solutions are probably why SKM has higher valuation ratios than its Wireless Telecommunication Services peers. AT&T (T) and Verizon (VZ) are not yet selling AI processors. On the other hand, SKM’s valuation stats are still way lower than NVDA’s.

Seeking Alpha Premium

Three years from now, SKM could probably generate 10% of its annual revenue from AI hardware and AIaaS. This is feasible thanks to its AI partnership with Amazon Web Services. That AI partnership started in computer vision. However, AI has other applications in the cloud.

Excel Global Solutions

Given enough time, AI processors and AIaaS could contribute $1 to $2 billion to SKM’s annual sales.

[ad_2]

Source link