[ad_1]

WanderDrone/iStock via Getty Images

Over a year ago I wrote about the St. Joe Company (NYSE: Joe).Since that time, rising interest rates have hit most real estate stocks hard, and JOE’s share price has fallen to last few months.wanted to cross Third quarter results Determine if the bullish thesis is still valid.

trading view

Business overview

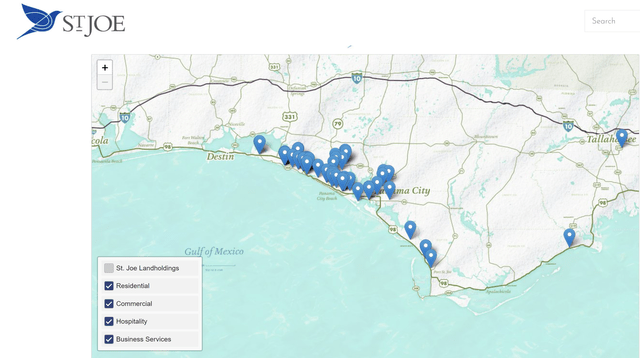

The St. Joe Company owns over 170,000 acres in Northwest Florida. Over 90% of his properties are scattered along the coast and slightly inland near Panama City.

St. Joe Investor Annual Report 2021

JOE has a different business model than most real estate companies and real estate investment trusts (“REITs”). This makes the company a little more difficult to understand and evaluate.

St. Joe’s operations are reported in three segments: (1) Residential, (2) Hospitality and (3) Commercial.

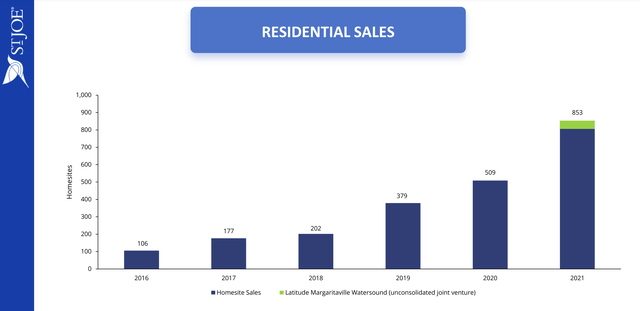

First, in the residential segment, JOE develops residential lots and land and sells them to home builders and consumers.

JOE Investor Presentation May 2022

Since 2019, homesite sales have started to grow tremendously after years of stagnation.

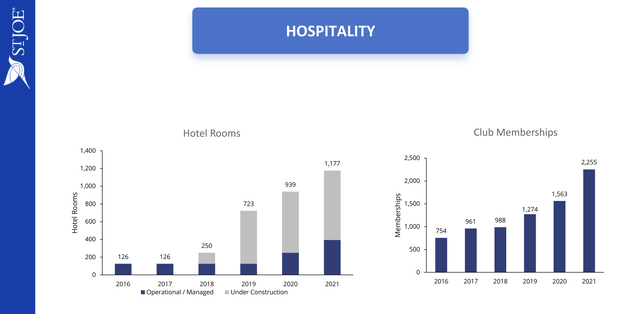

The Hospitality segment develops and owns hotels, golf clubs and operates private membership clubs. Home page sales are over 60%, which is a high profit margin, but sales are lumpy. As such, the company offset the lumpy nature of homesite sales with a more consistent revenue stream.

JOE Presentation May 2022

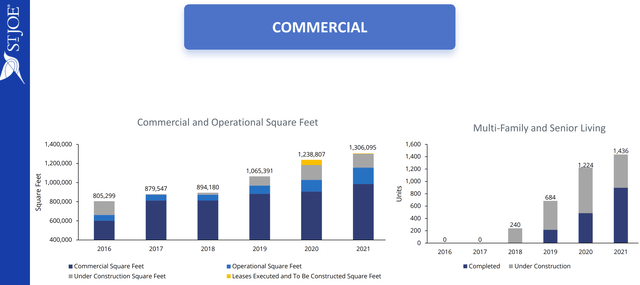

The Commercial segment is mainly engaged in commercial property leasing.

JOE Presentation May 2022

Robust demand for residential land

We had expected to see signs of weakening demand for home sites due to the nationwide real estate downturn. I was surprised to see that demand for home sites remained strong with no cancellations.

“As of September 30, 2022, we have a backlog of 2,376 homesites under contract and 641 Latitude Margaritaville Watersound homes under contract, totaling a record $502.8 million. We are also continuing to feel the effects of supply chain disruptions, which have delayed deliveries to homesites and homes by months and increased construction costs. , is a matter of a change in the timing of the sale and does not result in the cancellation of the contract.The home builder will have our home site ready for us as soon as we complete the development, without an extension request. I will continue to buy.”

Source: St. Joe 10-Q, 26 October 2022

Given that mortgage rates have recently hovered above 7%, it was quite surprising to see homebuilders seem confident in the prospects for development in the area. By the way, a year ago the interest rate on his 30-year mortgage was 1.8%.

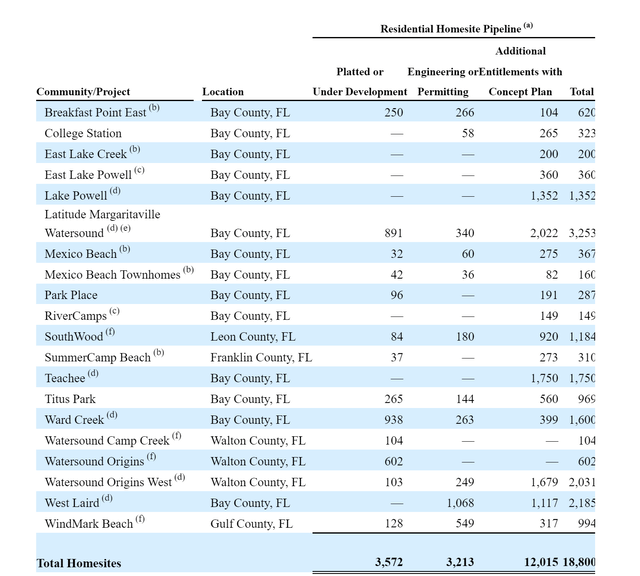

development pipeline

The company continues to prepare lots for sale at a pace similar to the previous quarter. Clearly they don’t expect a significant slowdown in the coming months.

26 October 2022, St. Joe 10-Q

The company is developing 3572 home sites. As of September 30, 2022, St. Joe had his 2,376 residential properties under contract. This will generate approximately $186.3 million in revenue over the next few years. Our pipeline of contracted home sites grew to 716 last year.

impressive management

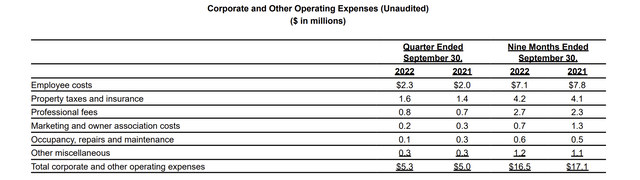

I continue to be impressed with JOE’s management team. Operating expenses are barely growing, but revenues are up 14% over last year. Moreover, since 2018, revenues have nearly tripled, while operating expenses have only increased by up to 30%.

10Q

JOE’s business model is lean and has a lot of operational leverage. We don’t expect future revenue growth of 15-20% to come with significant increases in marketing expenses or staff. Management seems to be conscious of keeping costs down.

Buybacks and Insider Purchases

During the first nine months ended September 30, 2022, the Company repurchased 576,963 shares of its common stock for $20 million. Normally, I would want the company to allocate more of its $160 million cash pile to buybacks at such depressed levels. However, the company can generate higher profits from land development.

More importantly, the company’s CEO bought about $150,000 of stock on the open market in May or June. He paid around $41-$51 per share for him. That’s a significant premium to the current around $36. This was the first large cluster of insider buying in the last two years.

evaluation

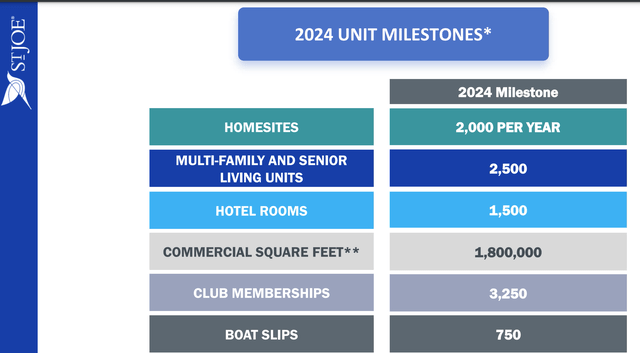

As I said before, JOE is heavily masked by the analyst community and there are many different ways to rate the company. I’d be pleasantly surprised if JOE manages to hit his 2024 milestone despite the widespread real estate slowdown. It’s worth noting that home site sales dropped significantly in the third quarter. Homesite sales decreased 34% to 78 homesites compared to 119 homesites in Q3 2021. Therefore, the estimates of 1000 homesite sales this year and 2000 homesite sales next year may be overly optimistic given the macro environment.

JOE Presentation, May 2022

JOE is valued at approximately $2.5 billion. My profit estimate from homesite sales for 2023 is ~$80 million. An 18x multiple for this business, which is expected to grow 12-15%, is very conservative and is valued at ~$1.45 billion.

On recurring revenues from hospitality and commercials, we expect net cash of $75 million next year. The 18x multiple is very conservative with recurring revenue growing at 30% annually. Nonetheless, that puts it at a valuation of $1.35 billion. The total valuation in the bear scenario is $2.7 billion, but the enterprise value is $2.5 billion.

final thoughts

We do not expect St. Joe’s stock price to rise over the next 6-12 months. The slowdown in real estimates across the country only started a year ago, and real estate typically bottoms out after his 48 months. Home builders, land developers, and building products companies have all been caught in a turmoil despite the industry’s decent financial results.

However, in the long run, I am confident that my investment in JOE will pay off. Even with the bearish valuation, I don’t think JOE will be worth less than $2.5 billion. Land values continue to rise as JOE continues to develop more and more amenities in the area. The demographic tailwinds that are moving people to the Florida Panhandle are long-term trends that show no signs of slowing down.

[ad_2]

Source link