[ad_1]

Refinancing through a private lender offers better terms, including new interest rates. (iStock)

Student loan debt is an economic burden that weighs heavily on millions of American borrowers. For some, refinancing while interest rates are still near all-time lows may ease the burden.

Refinancing a student loan is taking out a new loan with better terms to pay off your current loan. Paying off your student loans sooner, reducing your monthly payments, and refinancing to a lower interest rate can potentially save you money over time.

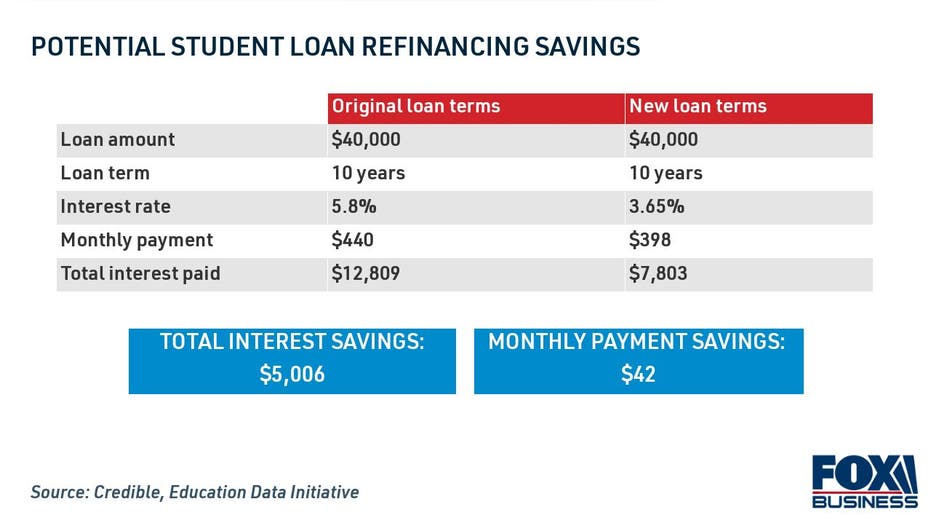

According to the Education Data Initiative, the average student loan interest rate for all existing borrowers is 5.8%. By comparison, according to reliable data, the average interest rate on her 10-year fixed-rate student loan for eligible borrowers who refinanced in the week of Jan. 24, 2022 was his 3.65%.

At current student loan rates, some borrowers could save $5,000 or more in total interest by refinancing. Keep reading to learn how to calculate your potential savings and visit Credible to compare student loan refinance rates for free.

Why refinancing variable rate student loans is a smart choice

Student Loan Refinancing Saves Some Borrowers $5,000

Currently, student loan refinancing rates are much more favorable than what most borrowers are currently paying. Private student loan lenders are prohibited from charging refinancing fees and prepayment penalties, so interest is the total borrowing cost you are expected to pay.

Assuming a student loan balance of $40,000, the borrower can save over $5,000 in total interest payments by refinancing to a private student loan at the above interest rate. You can also reduce your monthly student loan payments by $42.

That said, student loan refinancing isn’t for everyone. Refinancing a federal loan to a private loan provides some protections, including unemployment deferral, COVID-19 emergency moratorium, Income-Driven Repayment Plan (IDR), and federal student loan forgiveness programs such as Public Service Loan Forgiveness (PSLF) You will no longer be eligible.

If you have private student loan debt that doesn’t allow you to enjoy the benefits above, or if you don’t plan to take advantage of these federal protections, it may be worth consolidating your student loans while interest rates are near record lows. You can use Credible’s Student Loan Refinance Calculator to determine your savings potential and determine if this debt repayment option is right for your situation.

12 Lenders Considering Student Loan Consolidation

Borrowers with good credit can save even more

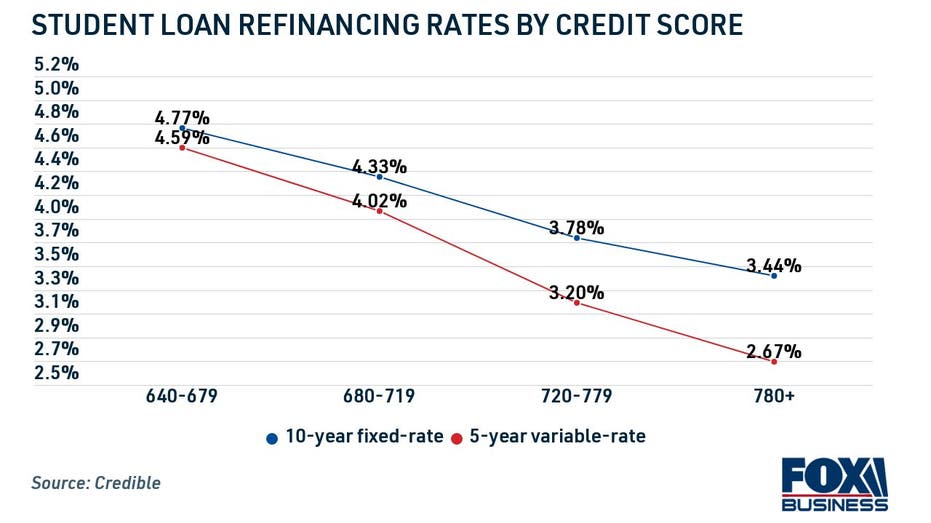

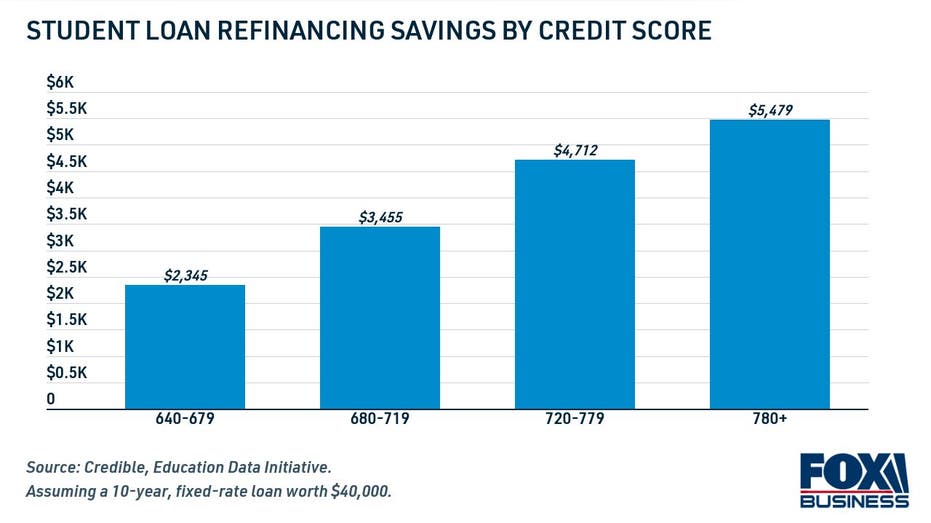

Student loan refinancing rates vary depending on the borrower’s credit score, so students with good credit can save the most money by refinancing. Borrowers with fair credit, on the other hand, will have higher interest rates and less opportunity for savings over time.

Eligible borrowers with a credit score of 780 or higher qualify for an average interest rate of 3.44%. This represents a total savings of nearly $5,500 over the life of the loan. Even a borrower with a decent credit score between 640 and 679 with an average fixed rate of 4.77% could save about $2,500 in total interest.

To take advantage of the lowest possible interest rates and maximize your potential savings, it’s a good idea to consider refinancing your student loans with a good credit co-guarantor. A trusted co-guarantor is a trusted friend or relative who agrees to take equal responsibility for repayment. Helps meet lender eligibility requirements.

However, refinancing student loans with a co-guarantor comes with risks. Failing to pay back student loans also takes a toll on a co-signer’s credit score. Additionally, the lender can sue both parties to recover its costs. A loan in case of default.

Learn more about refinancing student loans by contacting a knowledgeable loan officer at Credible. That way, you can decide if refinancing is the right student loan repayment plan for your financial situation.

Who Qualified for Student Loan Forgiveness Under Biden?

Have a financial question and don’t know who to ask? Email a Credible Money Expert moneyexpert@credible.com Your question may be answered by Credible in the Money Experts column.

[ad_2]

Source link