[ad_1]

Average interest rates for private student loan refinancing remain low, but you may be eligible for even higher interest rates by doing your research. (iStock)

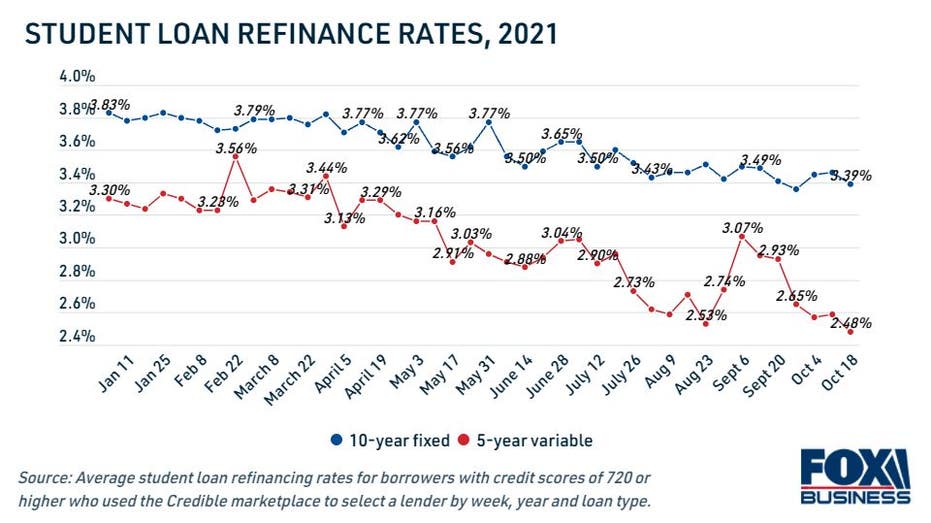

Interest rates on private student loans have fallen to their lowest levels for the entirety of 2021 in the past few weeks, according to Credible data, giving borrowers a chance to cut rates to pay off college debt.

During the week of October 18, the average refinancing rate for 10-year fixed-rate loans for eligible borrowers through Credible’s marketplace was 3.39%. same period.

4 tips on private student loans for college students

These average interest rates are already very low, but refinancing your student loans can give you even better interest rates. Some lenders offer five-year floating rates as low as about 2% or less.

But just because you can lower student loan rates doesn’t mean it’s always smart. For example, if you refinance a federal loan to a private loan, you receive government benefits such as the Income Driven Repayment Plan (IDR), COVID-19 administrative moratorium, and certain federal student loan forgiveness programs such as the Public Service Loan Forgiveness (PSLF) You will no longer be eligible.

However, private student loan borrowers do not have access to these programs, so they have nothing to lose by refinancing to a lower interest rate. Keep reading to learn how to keep your student loan refinancing rates as low as possible for your unique situation.

When you’re ready to refinance your student loans, visit Credible and compare interest rates from multiple lenders at once.

12 Lenders Considering Student Loan Consolidation

How to lower student loan refinancing rates

By refinancing your current loan with a new one with a better interest rate, you can reduce your monthly payments, pay off your debt faster, and save interest over the life of your loan. The lower the interest rate, the more repayment options you have. Here are some tips to keep your student loan refinancing rates low.

Consider each strategy in the sections below.

What is a Contingent Repayment Plan for Student Loan Income?

Shop with multiple student loan lenders

Federal student loan interest rates vary depending on the year you borrow, while private student loan interest rates vary depending on a variety of factors. Lenders look at the length and amount of the loan, as well as the borrower’s credit history, to determine eligibility and set interest rates.

That’s why it’s so important to shop with multiple lenders to ensure you get the lowest possible interest rate for your situation. Do your due diligence and see estimated interest rates without impacting your credit score. This way, you can choose the moneylender that offers the best terms.

You can contact individual student loan lenders individually or prequalify with multiple lenders at once through Credible’s online marketplace. Please refer to the actual private financial institution interest rates in the rate table below.

Impact of Student Loans on Debt-to-Income Ratio

Consider different repayment terms

Shorter repayment terms tend to result in lower interest rates and vice versa. This allows you to pay off the loan faster, thus saving interest over time. However, the shorter the repayment period, the higher the monthly payment, so it is not recommended if you want to keep your monthly expenses down.

You may also be able to get a lower interest rate by choosing a variable rate loan. A fixed rate loan has the same interest rate for the life of the loan, while a variable rate loan can change the interest rate over time.

Now that interest rates are low, variable interest rates are also low. However, your lender may raise (or lower) your interest rate over time due to larger economic factors beyond your control. That’s why you choose. However, private lenders cannot charge fees such as origination fees or prepayment penalties, so you have nothing to lose by refinancing again if interest rates rise.

Use our student loan refinance calculator to see how choosing a short-term or variable rate loan affects the total interest paid over time.

FSA Prepares for ‘Unprecedented Task’ to Resume Federal Student Loan Payments

Get help from a trusted co-guarantor

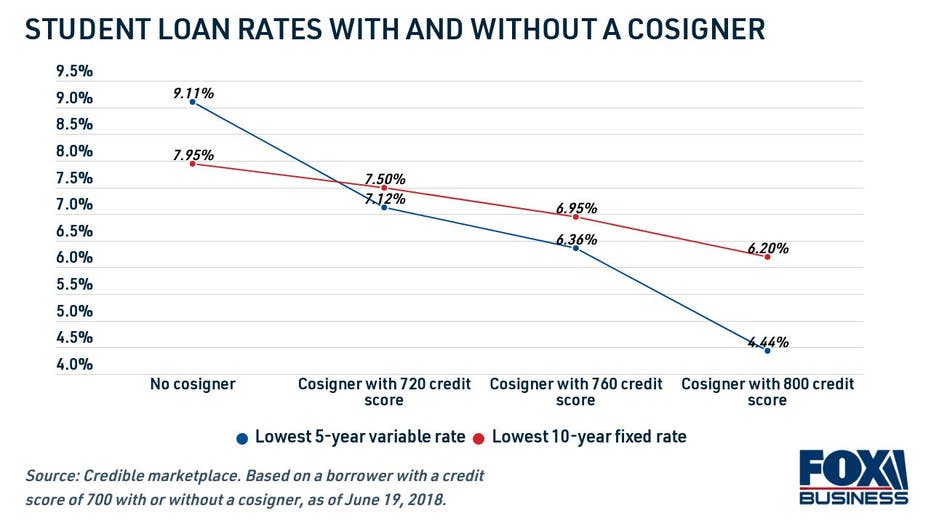

A good credit score helps you meet lender eligibility requirements and secure the lowest possible interest rates on many financial products, including student loans. On the other hand, poor credit quality can lead to low refinancing rates for student loans.

If your credit score is low or fair, consider taking the help of a high-credit co-guarantor. However, the co-guarantor shares the responsibility to repay the loan, so only seek help from the co-signer if you are sure you can make the monthly payments.

Learn more about student loan refinancing for free on Credible.

Despite Ongoing Forgiveness Talks, Student Loan Borrowers Should Prepare for the End of Deferrals

Have a financial question and don’t know who to ask? Email a Credible Money Expert moneyexpert@credible.com Your question may be answered in Credible’s Money Expert column.

[ad_2]

Source link