[ad_1]

Read in PDF

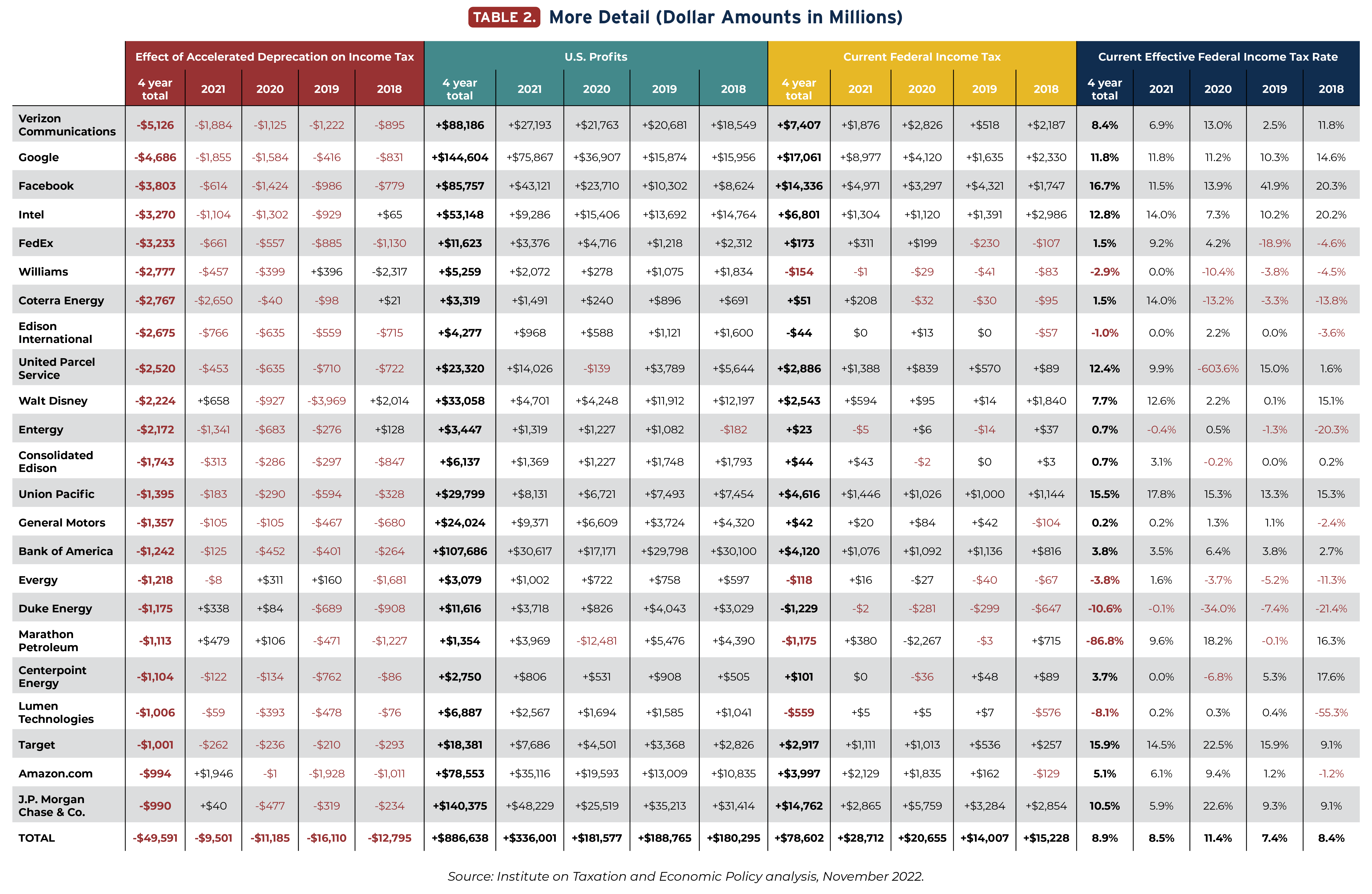

From 2018 to 2021, some 20 of America’s largest companies received tax cuts totaling about $50 billion from 2018 to 2021 under the terms of the Trump tax law that many lawmakers now want extended. Corporate lobbyists are even asking Congress to extend this “accelerated depreciation” tax cut as part of the year-end tax bill.[1]

Many of these companies are well-known names such as Google, Facebook, Intel, Target and JP Morgan. Many companies have also taken advantage of accelerated depreciation to bring their effective tax rate down to his single digits. These include Verizon, FedEx, Walt Disney, General Motors, Bank of America and Amazon.

Federal tax law has long allowed accelerated depreciation. This allows companies to deduct equipment costs faster than they wear off. However, the Tax Cuts and Jobs Act enacted under former President Trump in 2017 provides the most extreme version of this tax cut, often referred to as “bonus depreciation,” where companies pay for all of their equipment in the year it was purchased. It made it possible to write off the costs.

The Trump tax law allows bonus depreciation through 2022, but corporate lobbyists are asking Congress to extend it and make other changes in the law that expand other corporate tax deductions.[2]

Figures in the table are based on public disclosures provided to the Securities and Exchange Commission by publicly traded companies.

Combined, these 23 companies saved $49.6 billion in tax dollars because depreciation accelerated during the first four years of the Trump tax law (2018-2021). Without bonus depreciation, this figure would be much smaller. During this period, these companies are reported to have paid a total of $78.6 billion in federal income taxes, representing only 8.9% of total reported profits of $886.6 billion.

The federal statutory corporate tax rate is 21%. This means that if companies enjoy no special graces or loopholes, they will pay 21% of their profits in taxes. As a group, these companies have taken advantage of various types of tax relief to reduce the effective federal income tax rate from 21% to 8.9%. Across corporate groups, accelerated depreciation accounts for about half (46%) of tax cuts.

Some companies have been able to use depreciation to significantly reduce their effective federal income tax rate.

Walt Disney Of its $33.1 billion in profits from 2018 to 2021, only 7.7% paid federal income taxes. It was $4.4 billion. Accelerated depreciation provided half the federal income tax credit (51%).

verizon It paid only 8.4% of its $88.2 billion in federal income taxes over the last four years. He said Verizon’s total federal income tax cuts during this time were $11.1 billion, with nearly half (46%) of the cuts coming from accelerated depreciation.

fedex Only 1.5% of its $11.6 billion profit from 2018 to 2021 paid federal income tax. Total federal income tax credits during this period will reach $2.3 billion, all due to accelerated depreciation. (Technically, FedEx’s accelerated depreciation deduction would have been even greater, because without the tax cuts, the company would have cut his effective tax rate of more than 21% as the previously deferred taxes were due. I should have paid for it.)

Some lawmakers believe that accelerating depreciation will encourage investment, but the more likely effect is to encourage companies to accelerate investments they would have at some point made had it not been for the tax cut.[3] Some studies have found that corporate executives pay little attention to accelerated depreciation when making investment decisions.[4]

Learn more

The impact of accelerated depreciation on corporate income tax is taken from the 10-K Forms filed by publicly traded companies with the Securities and Exchange Commission and made available to the public. Financial accounting regulations governing what is reported on forms cannot write off equipment costs as quickly as tax laws. The 10-K shows the tax savings from these tax incentives.

Depreciation expense reported under financial accounting rules more accurately reflects economic reality. This is because these rules require the cost of capital investment to be amortized over several years until the equipment is expected to wear out.

Technically, accelerated depreciation affects the timing of tax payments. This allows businesses to claim expense deductions sooner than they otherwise would. This may mean you pay more later than you otherwise would because the deduction has already been claimed. This is why Table 2 shows that some firms pay more in a given year as a result of accelerated depreciation (it shows a positive rather than a negative number for the tax impact of accelerated depreciation). ). A depreciation suspension allows businesses to defer tax payments to future years.

However, as if the same amount of tax revenue would ultimately be collected regardless of what depreciation rules were in force, it would be unreasonable to assume that accelerated depreciation only affects the timing of tax payments. You are wrong. First, some businesses can use depreciation year after year, year after year, thus avoiding federal income taxes for decades.

Second, a deferred tax is a tax that is partially avoided by the effects of inflation. For example, if a company has to pay his $10,000 in income tax in 2022 and can delay payment until 2030, it will effectively pay less tax in 2030. The federal government will effectively receive less money. This is especially true in an environment of high inflation.

Inflation, of course, is a real problem that affects American life. Every family is trying to raise their prices. Either way, it does nothing for them to offer corporate tax credits to reward companies that make investments they would have made.

Click the table below for more details, including figures for each of the four years.

[1] Steve Wammhoff, “Congress Shouldn’t Exclude Children from Potential Year-End Tax Transactions,” 3 Oct. 2022, Institute for Taxation and Economic Policy. https://itep.org/congress-should-not-leave-children-out-of-possible-year-end-tax-deal/

[2] Letter from the National Association of Manufacturers to the Chairs and Senior Members of the Senate Finance Committee and House Ways and Means Committee, September 27, 2022.

[3] Steve Wammhoff and Richard Phillips, “Expense and Other Depreciation Mistakes,” November 19, 2018, Institute for Taxation and Economic Policy. https://itep.org/the-failure-of-expensing-and-other-depreciation-tax-breaks/

[4] Lily L. Batchelder, “Accounting for Behavioral Considerations in Business Tax Reform: The Spending Case,” Draft, January 24, 2017, page 20.

[ad_2]

Source link