[ad_1]

While the King Charles Cavalier Spaniel has a worried look on its face, pet owners find better insurance quotes.

gzorgz/iStock via Getty Images

Evaluate the torpanion (Nasdaq: TRUP) strong selling.

In addition to my background in leading pricing strategy advisory and CFA/M&A/buy-side experience, there is another source of insight to evaluate Torpanion. Insurance and have had our own pet insurance policies for years. Our current provider is Nationwide, a dominant player in this space and a competitor of Trupanion.

I only write about Seeking Alpha if the company makes a change in pricing strategy that could have a dramatic positive or negative impact on the company’s performance. This typically requires the company to be very concentrated, ideally one or two products subject to pricing decisions that drive the company’s financial position. Torpanion has recently increased its price/premium by 18% and fits the bill perfectly.

Will the Torpanion price hike help an already loss-making business or make the problem worse?

Torpanion’s basic business model

Think of Torpanion as an investment vehicle. Each quarter, we acquire an asset portfolio of tens of thousands of newly issued policies (last quarter we acquired approximately 70,000 new pets). Each cohort then generates a fixed monthly cash inflow (a set and known premium) and a cash outflow (payment of veterinary bills submitted). Some pets drop out due to policy cancellations (Last quarter, approximately 32,000 across existing cohorts, net addition of approximately 38,000).

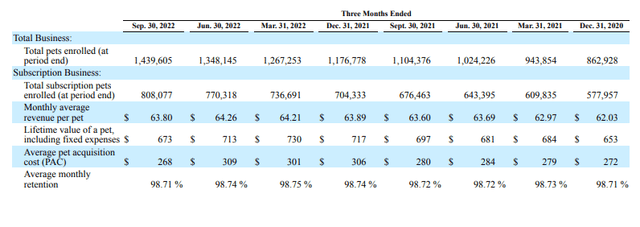

Trupanion’s latest 10Q outlines basic metrics for portfolio inflows (we focus on the subscription business that drives the company’s business).

Trupanion Quarterly Business Metrics (Torpanion 10Q)

Using the latest retention rates, we calculate the average life expectancy of each contract as 77 months. (According to 10Q, “Monthly implied average subscriber life is calculated as the quotient of 1 divided by 1 minus the average monthly retention rate”).

Based on this, the “unit economics” would be:

- Outflow: $268 PAC “Upfront Investment”

- Inflow: $4,912 (approximately 77 months x $63.80 average monthly revenue per pet). At the company’s claimed underwriting IRR of 37%, this monthly cash stream would be worth $1,870 in NPV.

- Spilled: $ paid on veterinary bills before 77 months of life (Torpanions are heavily post-processed as they don’t pay for pre-existing conditions and tend to register young, healthy pets ). At the recent 73.5% loss ratio, $4,912 * 73.5% = $3,610 (undiscounted for time value).

- Resulting NPV (“Pet Lifetime Value”) = $673.

I’m having trouble getting the math to work.

$673 (NPV of pet) = $1,870 (NPV of inflow) – $268 (PAC of pet) – $? ($3,610 NPV of outflow).

It means that the NPV of future veterinary bills is $3,610 = $1,870 – $673 – $268 = $921. This would require a lot of backend spills over a 77 month lifetime.

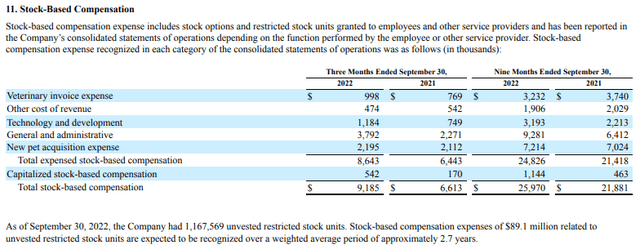

That NPV Killer: Stock Compensation

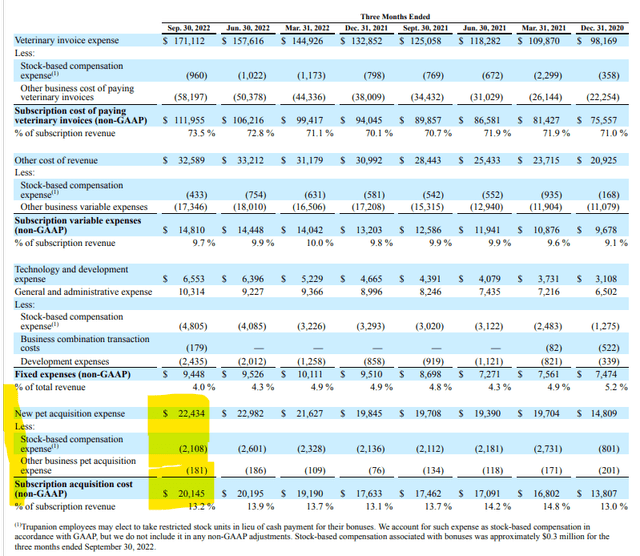

Torpanion does not include SBC in calculating a pet’s lifetime value. But it should because the true extent of her SBC proficiency is revealed by comparing it to her PAC and unit economics. After making all the “non-GAAP” adjustments, that brings us to about $20 million in PAC each recent quarter (divide by about 70,000 new pets and that’s approaching.

From Torpanion’s 10Q (Torpanion’s 10Q)

Compared to the $20 million spent on pet acquisitions, the company spent $9.2 million on SBC last quarter, increasing its effective “upfront investment” to its portfolio of acquired assets by approximately 46%.

From Trupanion’s latest 10Q (Torpanion 10Q)

Put another way, this adds ~$131 per pet to an effective PAC. Using the above unit economics, that leaves just $790 in current dollars ($921 above minus the SBC impact of $131) to fund $3,610 in future veterinary bills (Torpanion does not disclose his growth rate assumption, which is assumed in his inflation forecast). But the final-quarter loss rate was 73.5% higher than the target of 71%, clearly better than expected.)

Now you can see why the company was already boasting a short ratio of over 20% before last week’s recent reserves. Mathematics used to be a bad bet, but the surge in stock prices has made math bets even more attractive.

Saved by a price hike?

Torpanion raises the price not because it can, but because it has to. That in a row he said the 11% and he said 7% increases continue to flow into the portfolio of insurance contracts.

With a loss rate of over 70% much higher than its peers, it is in the red, and given that veterinary bills are on the rise, something has to be given. Torpanion can reduce coverage or increase premiums, deductibles, and more. Even if this worked without a significant rise in churn (which we’ve already seen a small drop in retention rate this quarter), we’re going to face a loss in competitiveness. Provided over time and weighed down by that excess SBC.

But our educated guess is that without at least churn and PAC/pet ups, growth rate downs, or all of the above, it’s not going to work.

We arrive at this through some substantive research that demonstrates:

- Many veterinary operations have reported some slowdown in demand in recent months (some seasonal, some returning to average post-COVID upswing, and the veterinary industry response to overall price increases).

- Torpanion’s new premium compares unfavorably to its biggest competitor, Nationwide, in the multiple hypothetical pet scenarios we examined (Note: Torpanion will charge once for each (lifetime) condition It’s very difficult to make a true apples-to-apples comparison, as it uses a “revolutionary” concept of charging deductibles for each). , instead of every year.

- Whether pet parents are willing to pay premiums has already been a tenuous experiment in the United States (as evidenced by very low penetration compared to other countries). Never before have we seen double-digit price gains in response to trends such as a softening economy, a possible recession, and a return to post-coronavirus averages.

Sharp price increases to cover sharp cost increases are, of course, nothing new in the economy. But at the end of the day, they’re a cost-plus idea, unless you can argue that the value of the product you’re offering has increased and the willingness to pay (WTP) of consumers (pet parents) has increased. Torpanion makes a valid argument that higher veterinary costs increase insurance value. But that policy doesn’t cover things like regular checkups and prevention…it only takes care when health conditions get worse.It ensures that most new pets tend to be young. Given , pet parents may not see real payouts until a very delayed year of life expectancy of 77 months. inflation pinch is here now.

To use behavioral economics terms, for pet parents, the pain of paying (insurance premiums) is now, and the benefits of avoiding those high bills are far in the future (per condition further delayed by the amount of the deduction). This does not bode well for sharp price increases.

Conclusion

I rate Torpanion as a strong sell. You can also rate your policy as Switch or Skip (self-insured) based on how it compares to other competitive products available.

As quirky SBC levels reward increasingly consistent failures on a massive scale, pet parents and investors alike are being asked to cash directly into the buried rewards of Torpanion’s inner circle. I feel like

[ad_2]

Source link