[ad_1]

ArLawKa Aung Tung

established theory

Upstart Holdings (Nasdaq: UPST) has a rough year in 2022, and investors are wondering if it can perform better in 2023. The answer depends on how Upstart’s business model works in the next few years.we are going to… Let’s take a look at the good, bad, and ugly factors that make Upstart an either-or opportunity that can result in big rewards or huge losses for stock buyers.

good stuff

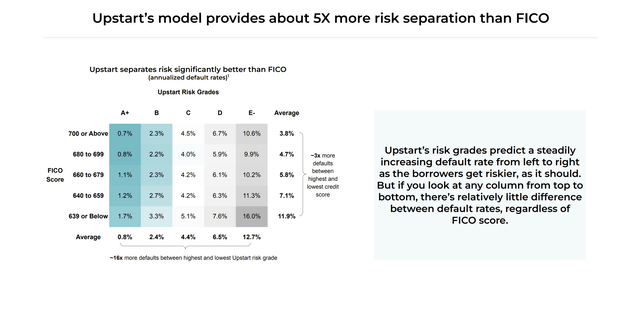

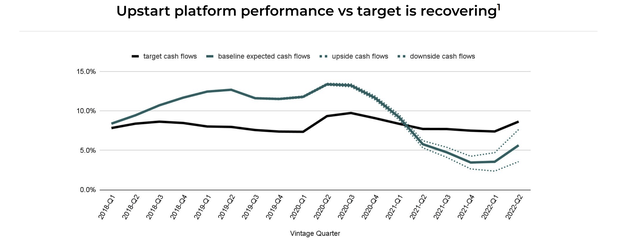

Startups claim their model for assessing borrower risk is superior to FICO. Their claim has some merit, and academic research by Harvard University and his LSU appears to support the company. Upstart shows the earnings presentation slides. This could single-handedly sum up the entire bullish case.

Upstart Third Quarter Financial Results Briefing

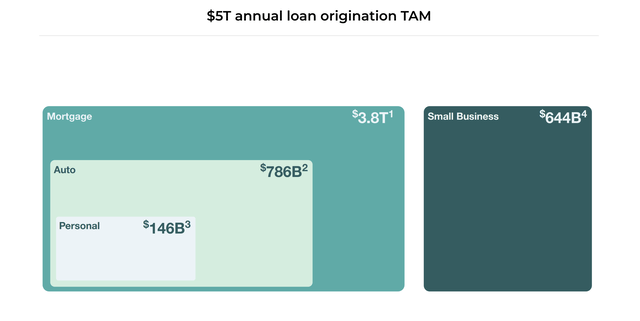

This risk isolation is a key benefit that Upstart offers, compared to traditional FICO score. This is where most of the stock’s potential upside comes from. The bullish case is that this advantage is permanent and can be extended to other very large markets such as autos, housing and small business lending.

Upstart Third Quarter Financial Results Briefing

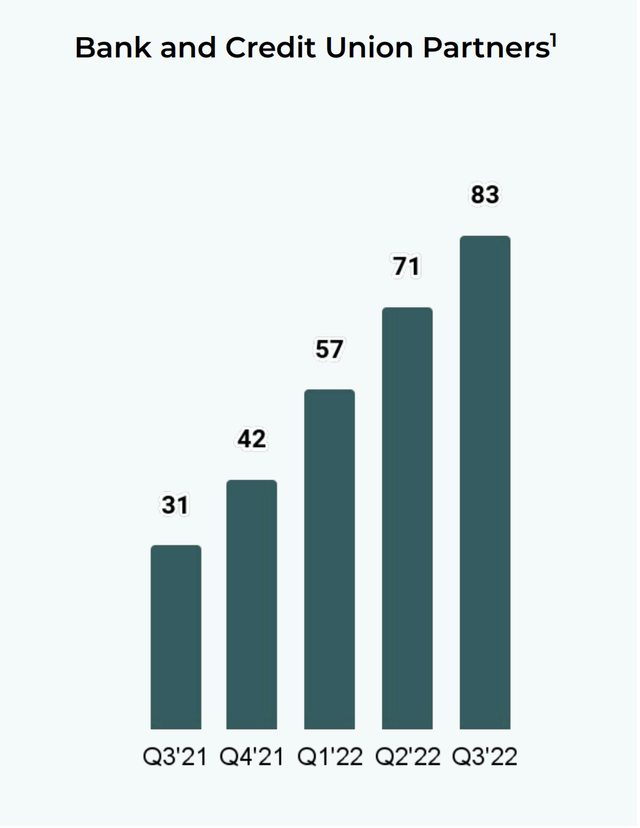

Upstart has successfully added more bank and credit union partners, but revenue concentration is still very high and improving, as we’ll see later. Investors should continue to monitor the addition of partners over the next few years to see if risk assessment solutions continue to gain momentum. In all fairness to the company, banks have traditionally been very conservative when it comes to changing internal processes. Even if Upstart’s risk assessment proves to be the best, it will take time for financial institutions to adopt it.

Upstart Third Quarter Financial Results Briefing

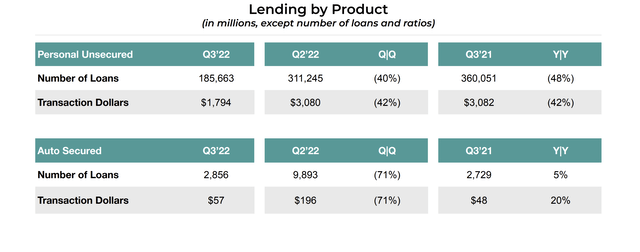

Upstart is well on its way to expanding its automotive offerings. This is a key growth area for investors to watch. The bullish case rests on the ability to enter new loan markets with higher volumes and lower risk profiles than personal loans.

Upstart Third Quarter Financial Results Briefing

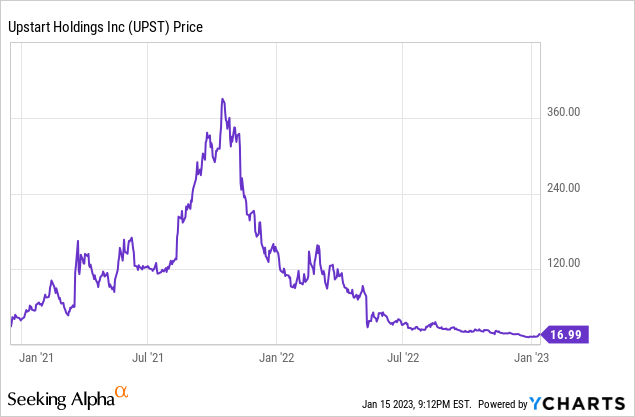

Unfortunately for investors, the good news ends here. The company’s stock price has fallen dramatically and we are beginning to understand why he still maintains a short-term interest rate of 38.38%.

bad person

Banks are reluctant to start lending in an environment of rising interest rates, causing funding for Upstart’s platform to dry up. Due to lack of funds, Upstart has many loans on its balance sheet.

Upstart Third Quarter Financial Results Briefing

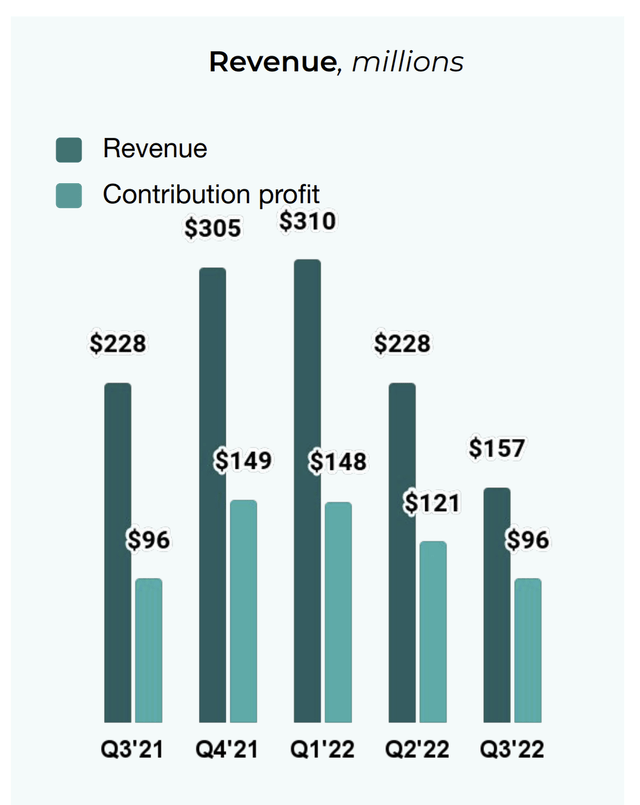

Declining originations have led to a sharp decline in revenue over the past two quarters.

Upstart Third Quarter Financial Results Briefing

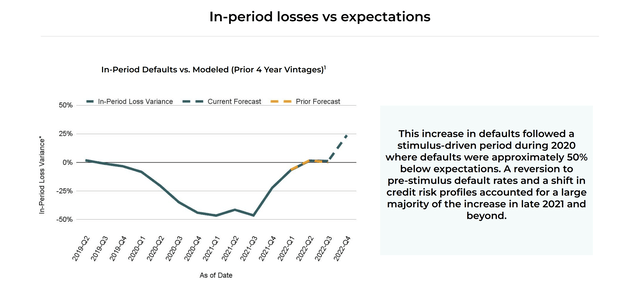

Startups have seen loan performance start to deteriorate as government support expires and rising inflation weighs on consumer finances. These trends should be monitored. Because if Upstart’s loan turns out to default at the same rate as his FICO when measured over a long period of time, the bullishness will be completely busted.

Upstart Third Quarter Financial Results Briefing Upstart Third Quarter Financial Results Briefing

Ugly

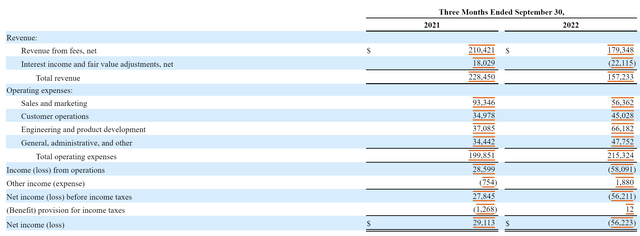

Upstart’s operating losses are starting to accelerate, which is disappointing considering the company was once quite profitable. This is mainly due to the difficult macro environment for originating personal loans. Unlike many recent IPOs, management has already shown it can run a profitable business. These losses are not large, but management will be able to get the ship right if the macro improves.

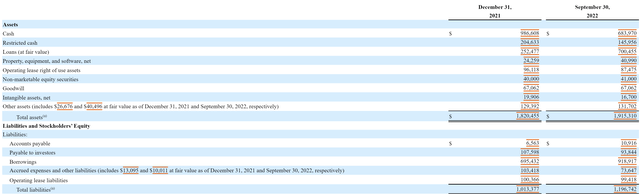

Startup Third Quarter Earnings Report

With the platform’s funds depleted, the company was forced to hold more loans on its balance sheet. Not only does it increase financial exposure to potential bad debt, it erodes the bullish case with platform-like valuations. The more loans they hold on their balance sheet, the more they are valued like a bank without access to a low-cost deposit base.

The company is looking to secure a long-term funding arrangement to mitigate this in the future, but it remains to be seen how successful it will be.

Startup Third Quarter Earnings Report

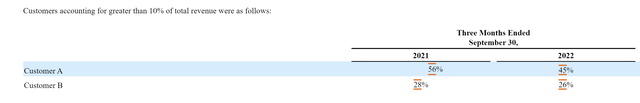

Revenue concentration remains high, with two customers accounting for 71% of revenue. While this represents an improvement from the year-ago quarter, such high levels of earnings concentration are alarming and remain a significant risk to the company.

Startup Third Quarter Earnings Report

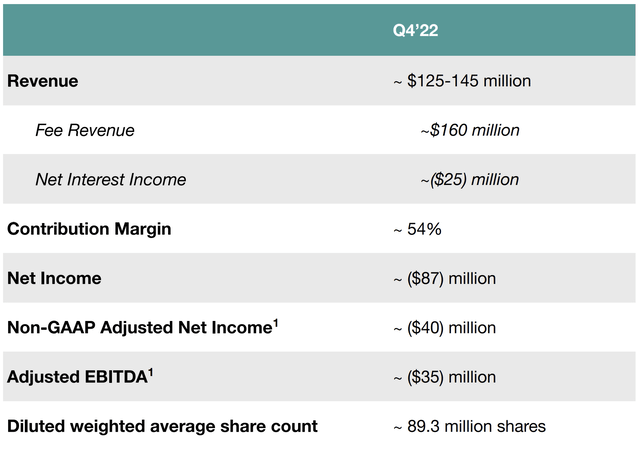

Finally, Upstart’s guidance for Q4 was terrifying. Most, if not all, of these numbers are below market expectations. Q4 should be his Upstart bottom quarter of the cycle. If not, investors should prepare for further potential downside and consider whether the bullishness is about to break.

Upstart Third Quarter Financial Results Briefing

price action

Upstart’s stock has plummeted since its IPO. After becoming a momentum stock, the company has seen its stock crash for over a year.

evaluation

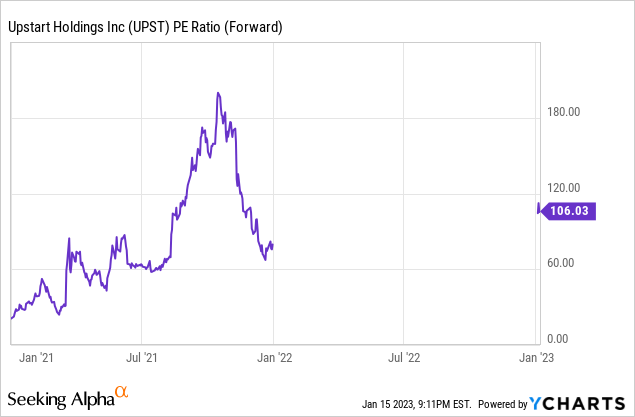

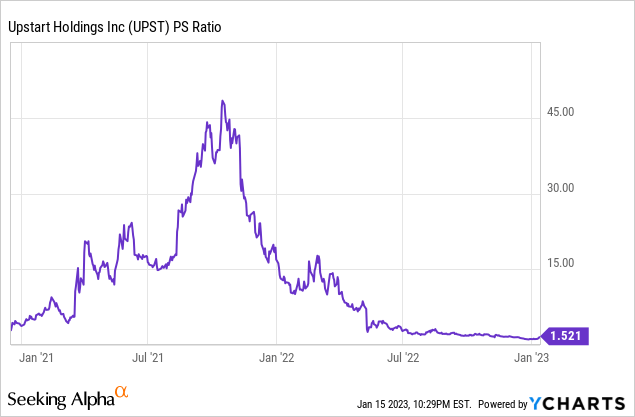

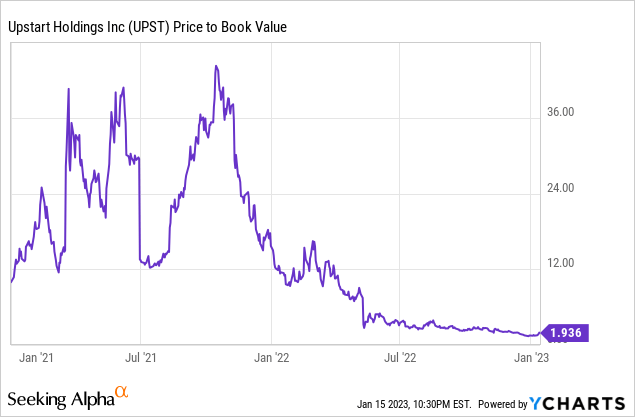

Startups have always traded at premium valuations, but recently they have started trading at very low P/S and P/B ratios. If your business is stable and returns are above expectations, you can actually create an investment deal based solely on valuation.

Investors may want to sit on the sidelines until business stops deteriorating rapidly. We believe Upstart is the result of binaries with high potential rewards and losses. If Upstart’s model proves to be superior, expanding into new loan markets and restoring profitability, the stock could hit $300 or more. If their model is broken and their loans actually perform worse than he FICO in the long run, the stocks are potentially at zero or liquidation value because there is no reason for financial institutions to acquire them. may become. Few publicly traded companies today have such a wide range of potential outcomes.

risk

Our thesis is neutral in nature, so there are upside and downside risks.

Upside risks include the company’s ability to improve its risk assessment model and successfully expand into other loan markets. The auto market, with a lower risk profile than current personal loans, could be a big win for them.

Downside risks include the company’s inability to assess risk better than FICO and its inability to expand into new loan markets or attract new partners. Falling stock prices can make it difficult for companies to attract and retain talent.

important point

If Upstart can get out of this period and show that their AI risk assessment model outperforms FICO, they will be able to thrive, expand into new loan markets, and attract new partners. If the risk rating model proves to be inferior to FICO when measured over time, the company may not survive. Despite the potentially huge rewards, there are risks, and we believe investors should sit on the sidelines until there is more clarity.

[ad_2]

Source link