[ad_1]

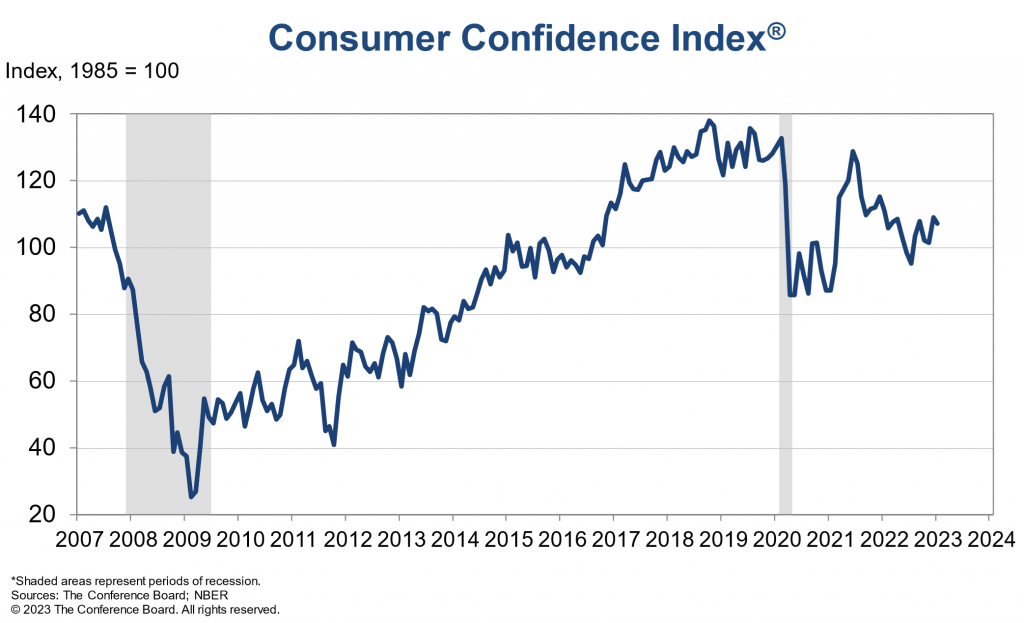

conference committee consumer confidence index The index declined in January after being revised upwards in December 2022. The index is now at 107.1 (1985 = 100), down from December’s 109.0 (revised upwards).of Current situation index— increased to 150.9 (1985=100) from 147.4 the previous month — based on consumer ratings of current business and labor market conditions.

of expectation index– based on consumers’ short-term outlook for income, business and labor market conditions – fell from 83.4 to 77.8 (1985 = 100), partially reversing December’s rise. The Expectations Index is below 80, which often points to a recession within the next year. Both the Current Status Index and the Expectation Index were revised upward slightly in December.

Ataman Ozyildirim, senior director of economics at The Conference Board, said: “Consumer confidence fell the most in households where he earns less than $15,000 and in households where he’s under 35.”

“Consumers’ assessment of current economic and labor market conditions improved in early 2023. However, the Expectations Index retreated in January, reflecting concerns about the economy over the next six months. Consumers were less optimistic about the near-term prospects for employment, and they also expected the business environment to deteriorate in the near-term. We expect monthly income to be relatively stable, while plans to buy cars and appliances remain strong, but consumers planning to buy a home, whether new or existing, Consumer expectations of inflation have risen slightly over the next 12 months, from 6.6% to 6.8%, but inflation expectations are still below the peak of 7.9% seen in June. I have.”

current situation

Current consumer ratings Business conditions Improved in January.

- 20.2% of consumers said the business environment is “good”, up from 19.2%.

- 19.7% to 19.2% answered “bad.”

consumer evaluation labor market was also advantageous.

- 48.2% of consumers say jobs are ‘abundant’, up from 46.4%.

- 11.3% of consumers said jobs were ‘difficult to get’, down from 11.9%.

Expectations after half a year

Consumers became more pessimistic short-term economic outlook in January.

- 18.6% of consumers expect the business environment to improve, down from 20.9%.

- 21.6% expect the business environment to deteriorate, up from 19.9%.

Consumers Short-term labor market outlook.

- 17.9% of consumers expect more jobs to become available, down from 20.0%.

- 20.1% expect fewer jobs, up from 18.7%.

consumer’s Short term Expected income Stable.

- 17.2% of consumers expect their income to increase, compared to 17.3% last month.

- 13.4% expect their income to decline, similar to 13.3% the previous month.

The monthly Consumer Confidence Survey, based on online samples, is powered by Toluna, a technology company that provides real-time consumer insights and market research through innovative technology, expertise and a panel of over 36 million consumers. Conducted for The Conference Board by The deadline for provisional results was January 24th.

[ad_2]

Source link