[ad_1]

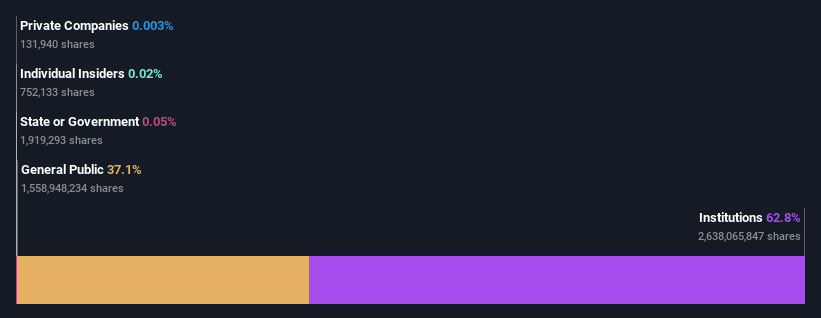

All investors in Verizon Communications Inc. (NYSE:VZ) should watch out for the most powerful group of shareholders. The institution with a 63% stake owns the largest stake in the company. In other words, the group stands to gain the most if the share price rises (or suffer the most loss if it falls).

Because institutional investors have huge pools of resources and liquidity, their investment decisions tend to be heavily influenced, especially for individual investors. As a result, the significant amount of institutional money invested in companies is generally viewed as a positive attribute.

Let’s take a closer look at each type of Verizon Communications owner, starting with the table below.

Check out the latest analysis from Verizon Communications.

What can agency ownership tell you about Verizon Communications?

Many financial institutions measure their performance against indices that approximate local markets. As such, they typically pay more attention to companies included in major indices.

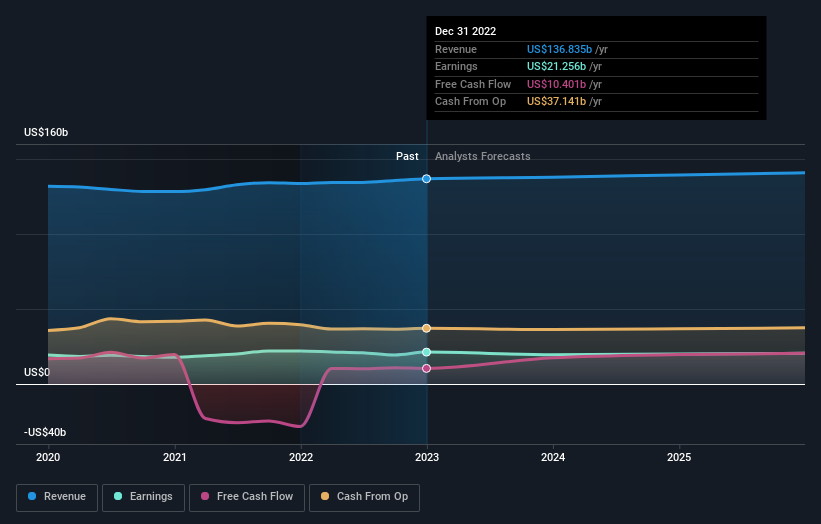

Verizon Communications already has an institution on the stock register. In fact, they own a sizeable stake in the company. This means that analysts working for these institutions have seen the stock and liked it. But, like everyone else, they can be wrong.If multiple institutions change their views on a stock at the same time, the stock can fall rapidly. So, it’s worth taking a look at Verizon Communications’ earnings history below. Of course, the future really matters.

Institutional investors own more than 50% of a company and can have a significant influence on board decisions. Hedge funds note that he has made no meaningful investments in Verizon Communications. According to our data, The Vanguard Group, Inc. is the largest shareholder, holding his 8.3% of outstanding shares. For context, the second largest shareholder holds approximately 7.6% of the outstanding shares, and the third largest shareholder holds his 3.9%.

A closer look at the ownership data reveals that the top 25 shareholders collectively own less than half of the register. This suggests a large group of small owners where one shareholder does not have a majority.

Researching institutional ownership is a good way to measure and filter a stock’s expected performance. The same can be achieved by studying analyst sentiment. There are many analysts covering stocks, so it might be worth taking a look at their forecasts as well.

Insider Ownership of Verizon Communications

While the precise definition of an insider can be subjective, we believe that most directors are insiders. Management finally answers to the board. However, it is not uncommon for managers to be members of the board of directors, especially for founders and CEOs.

I usually think insider ownership is a good thing. However, in some cases, it becomes more difficult for other shareholders to hold the board accountable for decision making.

According to our information, Verizon Communications Inc. insiders own less than 1% of the company. Being a large company, the percentage owned by insiders is negligible. But it’s worth noting that they own shares worth US$31 million. Arguably, it’s also important to take into account recent sales. Click here to see if insiders are buying or selling.

general public

The general public, usually private investors, own 37% of Verizon Communications. Ownership of this magnitude is substantial, but may not be sufficient to change company policy if decisions are out of sync with other major shareholders.

Next steps:

I think it will be very interesting to see who exactly owns the company. But for true insight, other information must also be considered. Consider, for example, the ever-present specter of investment risk. Identified two warning signs Understanding them should be part of the investment process.

Don’t miss this if you want to know what analysts are predicting when it comes to future growth freedom Reports on analyst forecasts.

Note: The numbers in this article are calculated using the last 12 months of data. This refers to his 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the annual report figures for the full year.

Do you have feedback on this article? What interests you? contact directly with us. Or send an email to our editorial team (at) Simplywallst.com.

This article by Simply Wall St is general in nature. We provide comments based on historical data and analyst projections using only unbiased methodologies and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. We aim to deliver long-term focused analysis based on fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Is not …

Participate in Paid User Research Sessions

you $30 USD Amazon Gift Card An hour of your time while helping build better investment tools for individual investors like you.SIGN UP HERE

[ad_2]

Source link