[ad_1]

Interest rates on personal loans from banks, credit unions and online financial institutions have risen after the Federal Reserve hiked rates repeatedly this year.

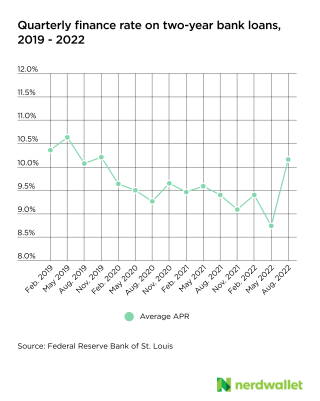

Interest rates on 24-month personal loans from banks jumped to 10.16% in August from 8.73% in May, according to the latest data from the St. Louis Federal Reserve Bank. The average annual rate on 36-month credit union loans rose from 8.84% in June to 9.15% in September, according to the National Credit Union Administration.

Most personal loans have fixed interest rates, so if you already have a personal loan, your monthly payment will remain the same. However, future borrowers may see higher monthly payments and lower loan amounts compared to earlier this year.

Why Personal Loan Interest Rates Are Rising

Until recently, lenders have kept interest rates relatively low for several reasons.

Interest rates on personal loans are somewhat tied to supply and demand, which is why they don’t follow federal funds rates as closely as other financial products, such as mortgages, said executive vice of consumer direct lending at US Bank. President Werner Loots said.

According to Loots, demand for personal loans is high this year. One reason, he says, is that personal loans are an attractive fixed-rate financing option, available for just about anything at a time when prices for just about everything are skyrocketing.

High demand has fueled competition among lenders, keeping personal loan rates low even as the Fed rate rose, said Salman Chand, vice president of consumer finance at TransUnion.

But the Fed and economic conditions may be putting pressure on lenders. Fed interest rate hikes and recession fears, combined, could push lenders to tighten borrowing standards and reduce lending overall, pushing up personal lending rates.

“If you’re not taking out a lot of loans and borrowing costs are rising, there’s no incentive to lower interest rates and try to get as many consumers as possible,” Chand said.

Is it difficult to get a personal loan?

Chand said lenders could tighten underwriting standards if they deem a recession likely.

Unsecured personal loans do not require collateral, so lenders rely on the applicant’s credit profile and financial situation to determine if the borrower is likely to repay the loan.

According to TransUnion’s credit industry report, personal loan delinquency rates — the percentage of all loans that are delinquent — have risen steadily this year, surpassing pre-pandemic levels in the third quarter.

Rising delinquency rates are one of the signals lenders use when deciding whether to tighten their approval criteria, according to Chand. If so, consumers with fair or bad credit scores (usually below 689) may struggle to qualify.

Katherine Fox, certified financial planner and founder of Sunnybranch Wealth, based in Portland, Oregon, said the rising unemployment rate is making it harder for lenders to lend to consumers who may be laid off. It is concerned, he said, which could lead to stricter borrowing standards.

The unemployment rate has remained consistently low so far this year.

Even if lenders don’t tighten their approval criteria, higher interest rates mean they are eligible to receive lower loan amounts than earlier this year, says Fox.

When deciding whether to approve your application, the lender will check how much of your monthly income is being used to pay off your debt. That calculation includes potential personal loan payments.

For example, if a lender only accepts borrowers with a DTI of less than 40%, it means that current debt payments plus new personal loan payments will not cost more than 40% of your monthly income.

Higher interest rates on personal loans mean higher monthly payments, so lenders may approve smaller loans to avoid overborrowing, she says.

Is now the time to take out a personal loan?

Rates today may not be as low as they were a few months ago, but they could be higher, says Fox.

If you plan to apply for a personal loan in the next few months, she says it’s wise to do your research and lock in rates before rates rise again.

For non-urgent expenses like home repairs or vacations, you’ll have to wait to get the most ideal APR. Even if interest rates go down, it probably won’t last for at least a few months, Fox said.

“You can either act fast or be completely flexible, because lower interest rates could come sooner or take longer than we think,” she says.

Interest rates on other financial products, such as home equity loans and credit cards, are rising, but it’s still wise to compare other options to see where you can get the lowest rates, said CFP. said Ian Bloom, owner of Open World Financial Life Planning in Raleigh, North Carolina. .

Those with sufficient equity in their homes may get higher interest rates on equity financing than on personal loans, and consumers with good credit may be able to take advantage of 0% annualized credit cards. he says. If you use an interest-free credit card, you can avoid high interest rates by paying the balance during the promotional period.

Tips for lowering personal loan interest rates

A rising APR means you have to take more steps to get a lower rate. Here are some tips to increase your chances of qualifying for an affordable loan.

pre-qualification. Prequalification allows you to verify the amount, interest rate, and repayment term of a personal loan without compromising your credit. Online lenders, banks and credit unions offer prequalification. Even if your bank doesn’t offer it, you can still receive a prequalification offer and ask if it’s better than the offer.

Consider co-applicant or collateral. Consider a co-signed, co-signed, or secured loan if credit or DTI may be preventing low interest rates. With a co-signed or co-loan, you add someone with good credit and high income to your application, and they promise to repay the loan if you fail to pay it back. Or provide collateral in exchange for a larger loan, but if you fail to pay, the lender can take your property away.

Build credit and reduce debt. The best way to get a good rate is to have good credit (score of 690 or above) and low DTI. If prequalification doesn’t get you the offer you want, it’s time to consider other borrowing options and work on paying off your debt. This helps build trust and lower DTI.

The article, “What Rising Personal Loan Rates Mean for Borrowers,” originally appeared on NerdWallet.

[ad_2]

Source link