[ad_1]

Rabbitry

sif gold

Money

trend of the moment

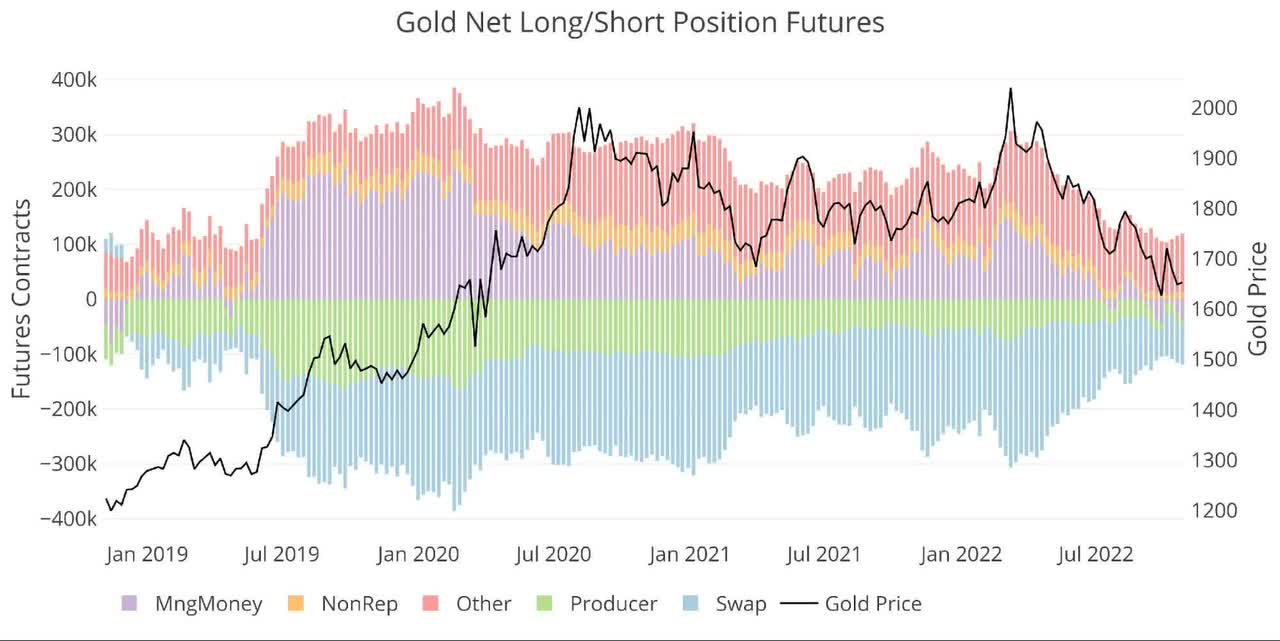

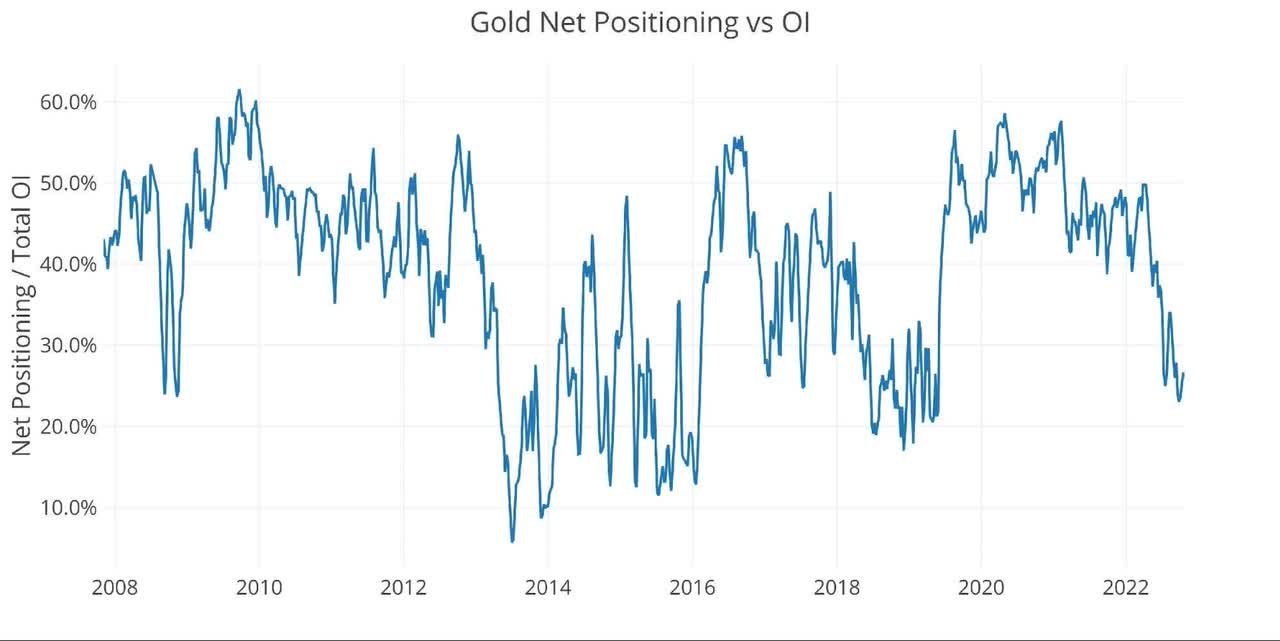

Managed money net short is now at 38.8k, 13k higher than last week, but down 5k from last month’s report.Swap also increased net short over the month and this helped Slightly increases total net positioning. Despite a modest rise, the overall market has contracted significantly over the past six months.

Figure: Net position with one holder

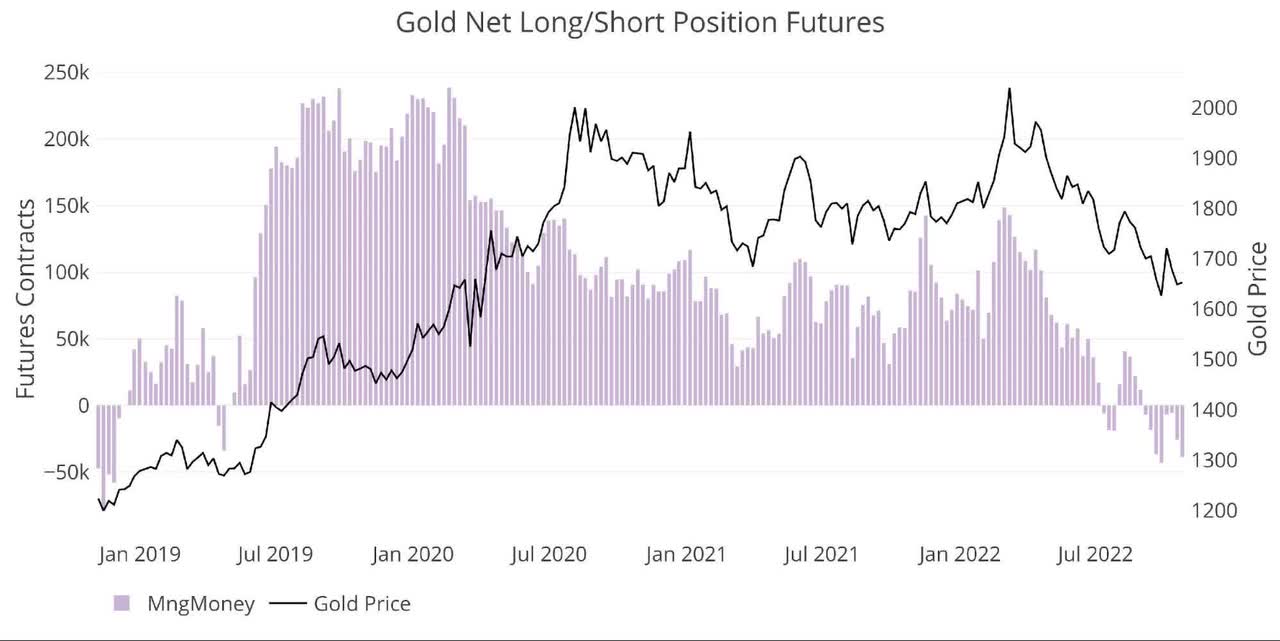

Managed Money Group has full control over this market (for now). The chart below shows the close relationship between Managed Money’s net position and price. The correlation coefficient for 2022 is a staggering 0.95. Correlation is not causation, but the relationships shown below are unlikely to be non-causal.

That said, the last time managed money had such a large net short position was in 2019, when the price of gold fell $400, so the correlation doesn’t hold up for long.

Figure: 2 Net position of managed money

weak hands at work

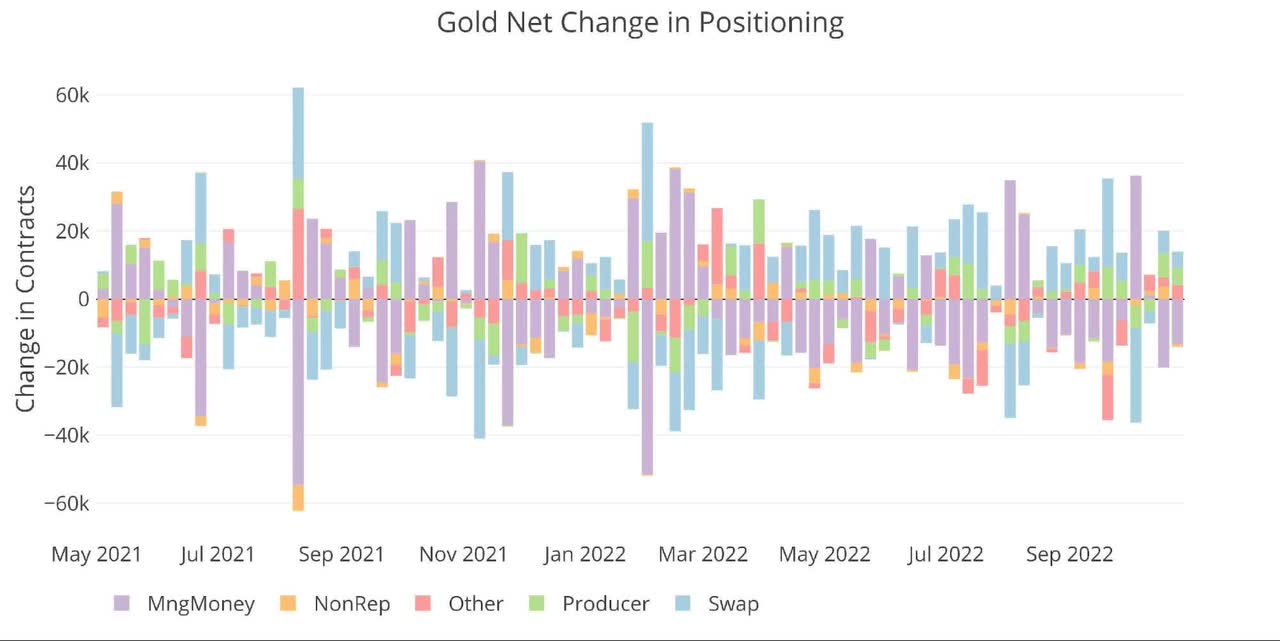

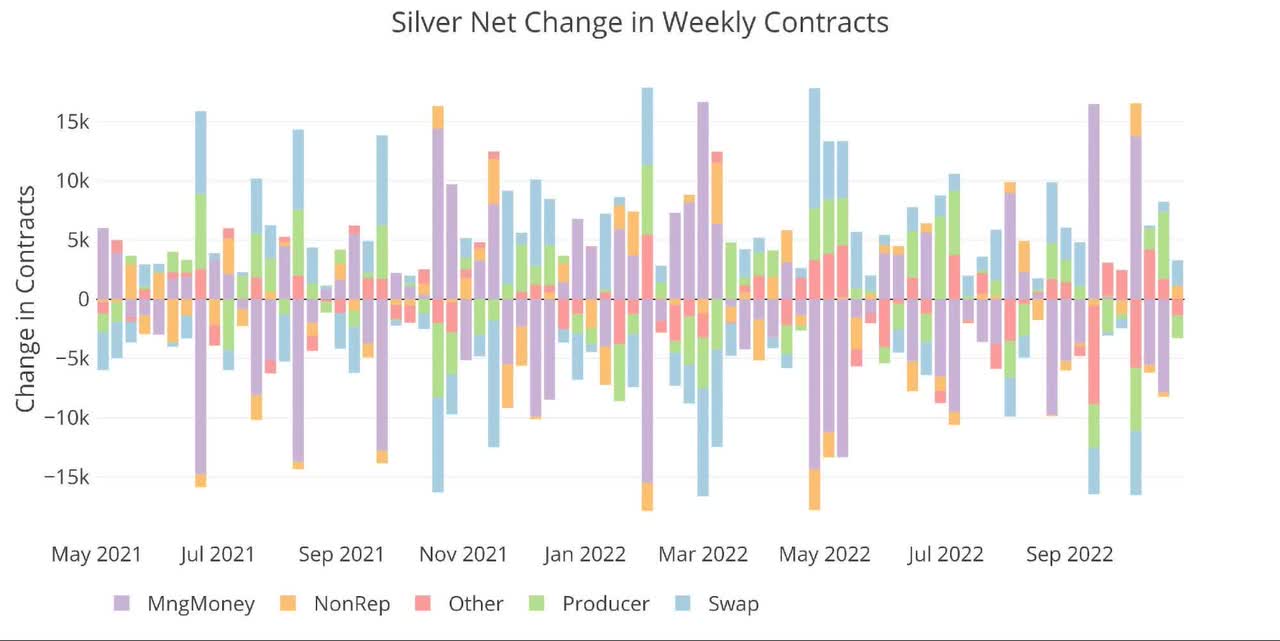

The chart below shows weekly data. Managed money typically fluctuates between long and short. Over the past 34 weeks, it’s been a different story. Managed money increased its net positioning in just 8 weeks against a 26-week decline in net positioning.

This has pushed the gold price down from over $2,000 to under $1,700.

Figure: 3 Silver 50/200 DMA

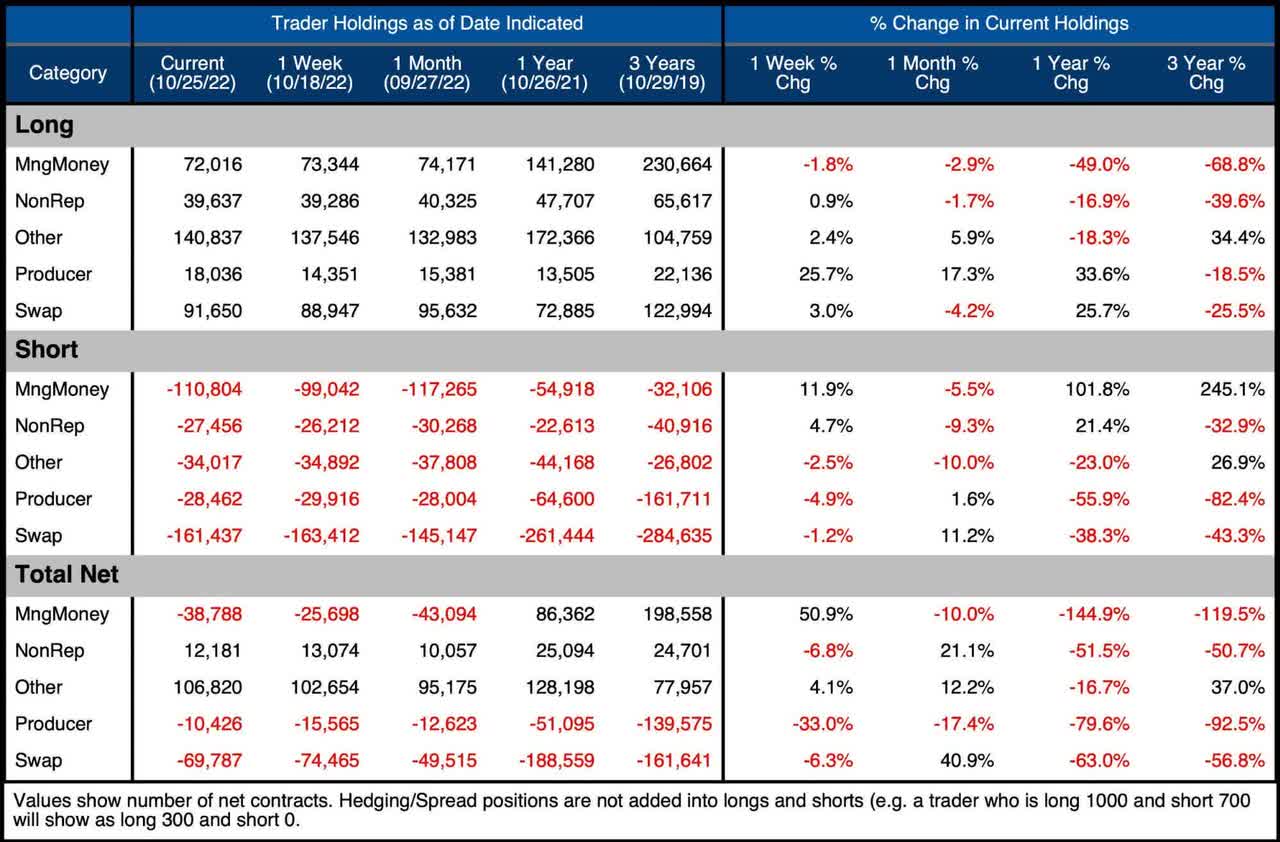

The table below provides detailed location information. A few things to highlight:

-

- The month-to-month change in managed money is primarily due to a 12% increase in gross shorts from 99,000 to 110,000.

- Last year, managed money gross longs fell by 50% and gross shorts increased by 102%.

-

- This changed the overall net positioning by -150%

-

- However, the rest of the players cannot be ignored. Over the past year:

-

- Non-reps net long decreased by over 50% (12k)

- Other net longs down almost 17% (22k)

- Producer net shorts down 80% (41k)

- Swap net shorts down 63% (119k)

-

All participants reduced their overall gross positions, but managed money was the only group to reverse (and significantly) from net long to net short.

One thing to note is that managed money gross short last year increased by 55,000 contracts (102%). At the same time, his four other participants Decrease Combined 142,000 contracts or 64% total short.

Figure: 4 Gold Summary Table

So what is going on? I think a trap has been set!

While this is pure speculation, the physical market is sending a huge signal that supply is disappearing. I think Swaps, Producers, Other, and Non-rep paid attention and reduced short positioning out of the way.

Managed money is only played on the paper market and traded technically. They don’t want or care about physical things. Despite high inflation, gold failed to sustain momentum. So when the Fed started raising rates, managed money could only see why gold was plummeting. They smelled blood and attacked.

Four other participants (mainly swaps and producers) were able to close their shorts as managed money reduced their longs and increased their shorts. without it push the price up. They effectively put the short into managed money.

The overall market has returned to neutral as shown in the net positioning chart below. The producer now has the lowest net short his position since 2014, at the bottom of gold’s bear market. So while everyone is reducing their net exposure last year, his money managed went from 86,000 net long (3 years ago he was 198,000 net long) to 40,000. net short.

Eventually managed money goes back long, but swaps and producers step in to provide liquidity (by shorting). This liquidity helps keep prices down during big moves in the futures market. This is why gold did not crash to $1300 in the face of an incredible managed money sell-off. Swaps and producers were liquidating short sales.

The point is swap and producer (who Physical supply constraints) are unwilling to step up on the short side, price may fall many It gets higher when managed money comes back. Another scenario is that management money remains shorted and is on hooks to deliver metal to contract holders who are receiving deliveries. But they don’t have the physical ones, so they will rely on Comex’s rapidly depleting stocks.

This chart shows a reduction in net positioning

Figure: 5 Net Positioning

historical perspective

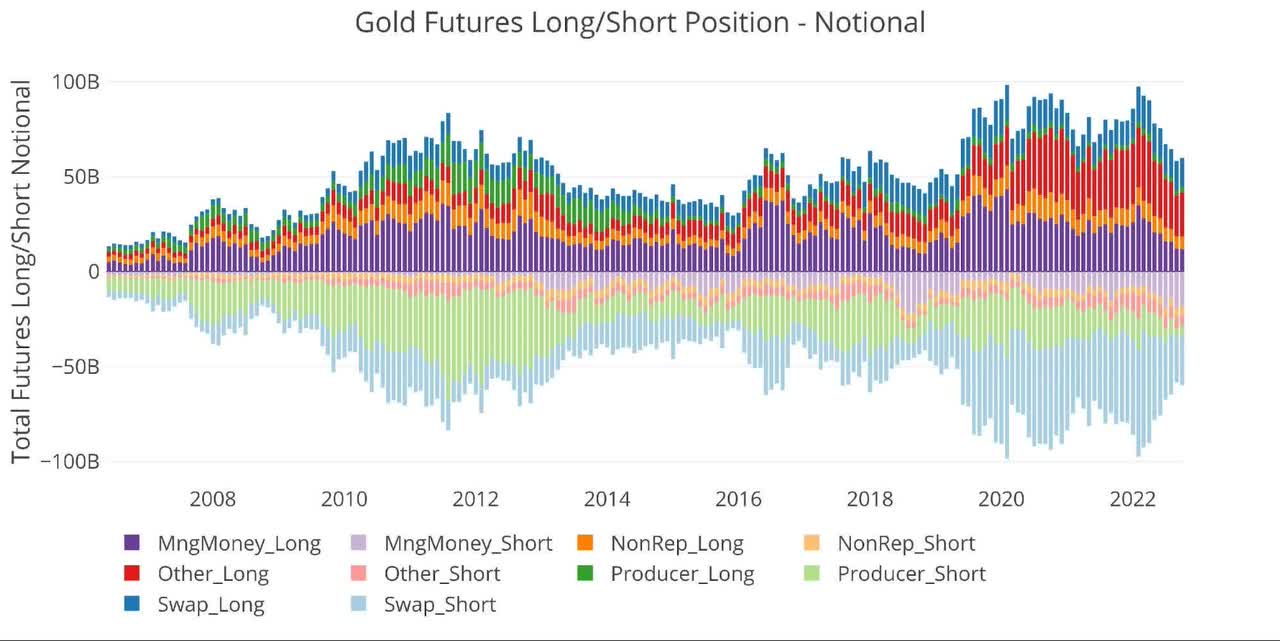

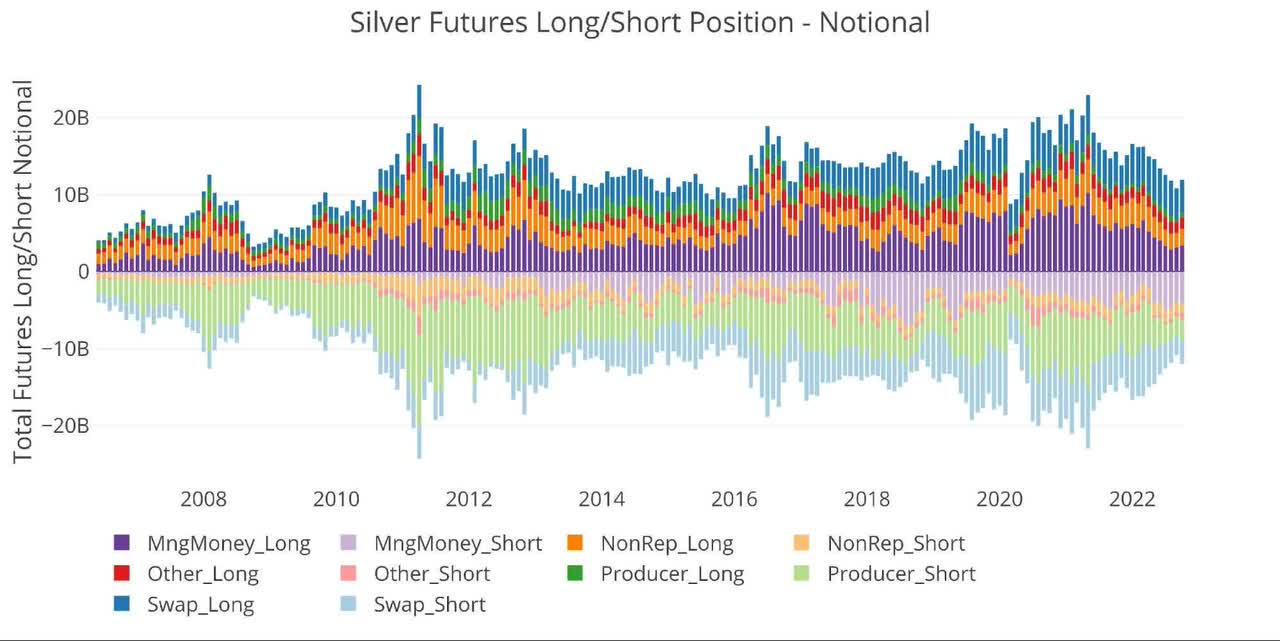

Examining the full history of CoTs data by month produces the chart below (values are in dollars/notional, not contracts). There was no downward movement like there was recently. And this downward movement has come in the face of historically strong physical demand from Comex vaults!

Figure: 6 Total Open Interest

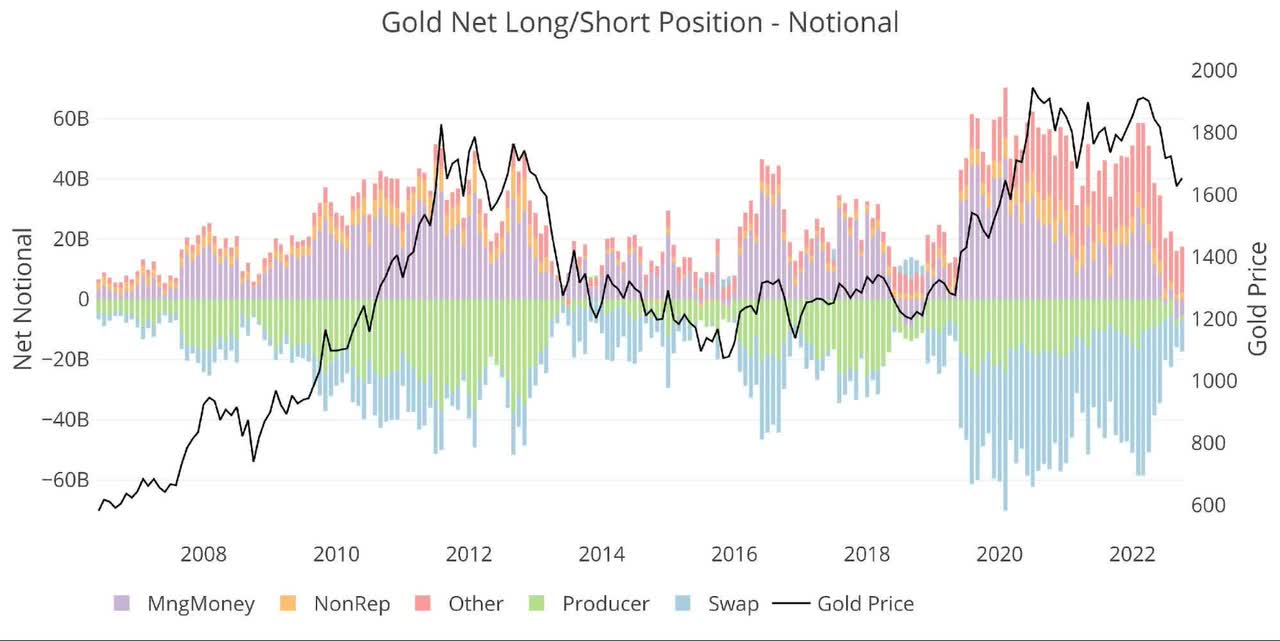

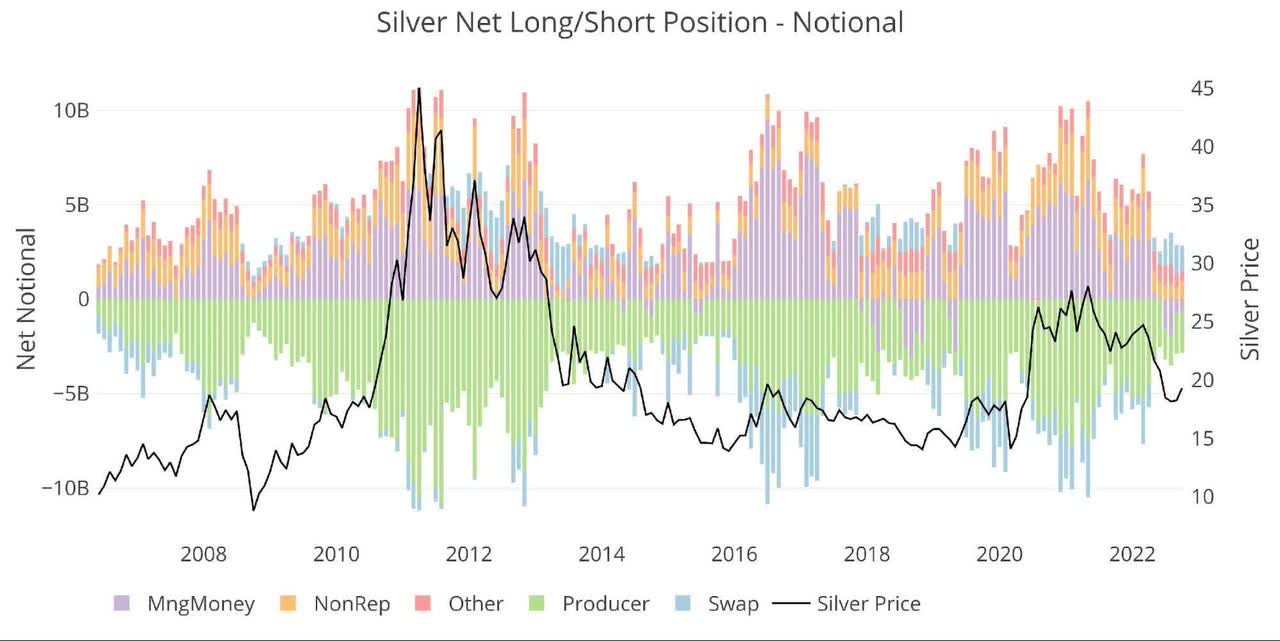

The chart below shows the net notional positioning for price on the longer timeframes. Again, the market (colored bars) has been worse recently than it was in 2012. At the same time, the price (line) has not reacted much the same as it did in 2012.

Figure: 7 net assumed positions

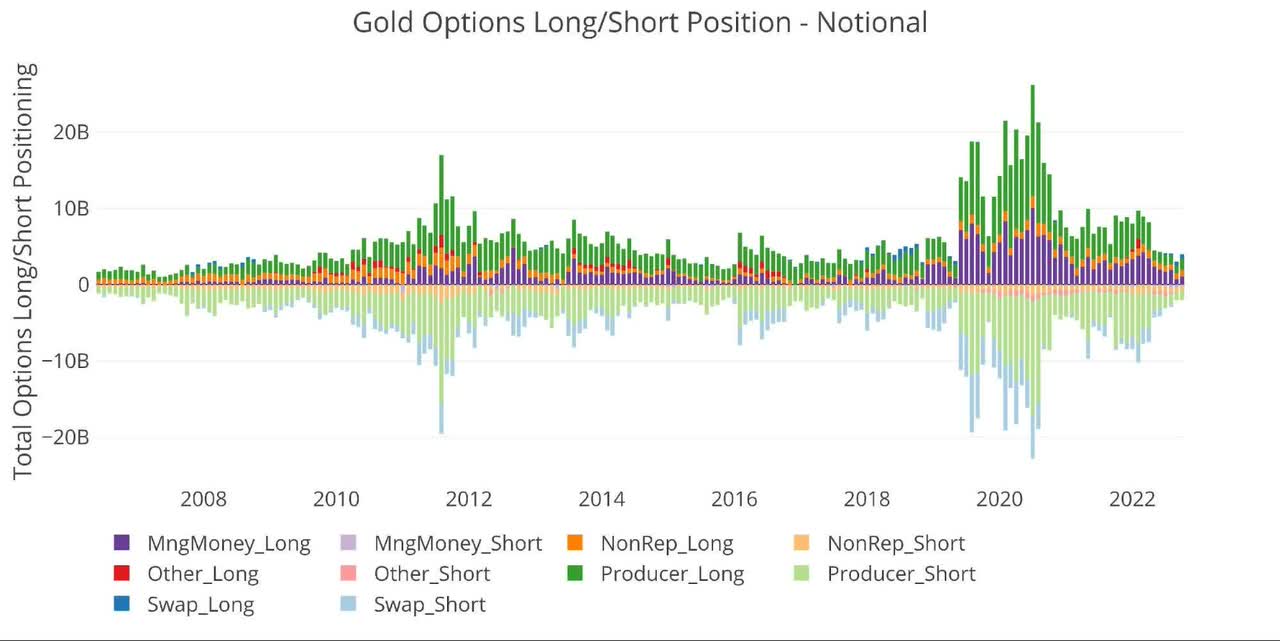

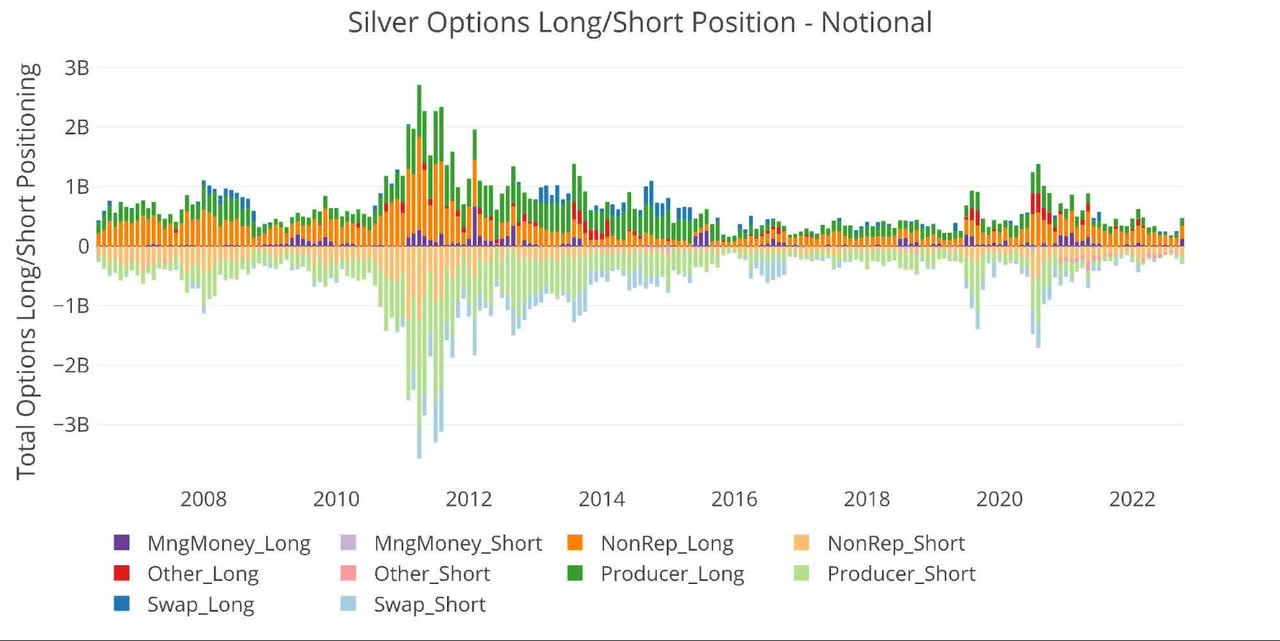

The options market still looks very quiet.

debtFigure: 8 optional positions

Silver

trend of the moment

I think the same trap that was set for gold is set for silver, and perhaps even further.

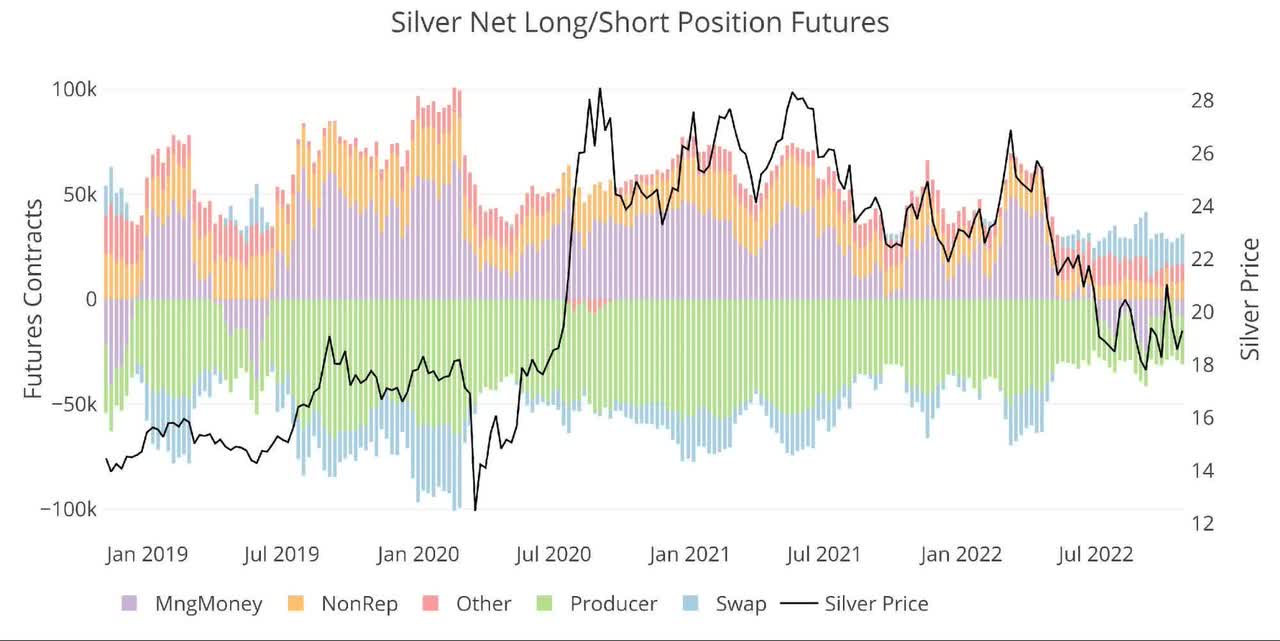

Like gold, managed money is a constant seller of silver. However, unlike gold, the swap completely reversed his position short and has continued his long net in silver since May. Producers have been largely static in recent months and are still in short supply.

Figure: Net position by 9 holders

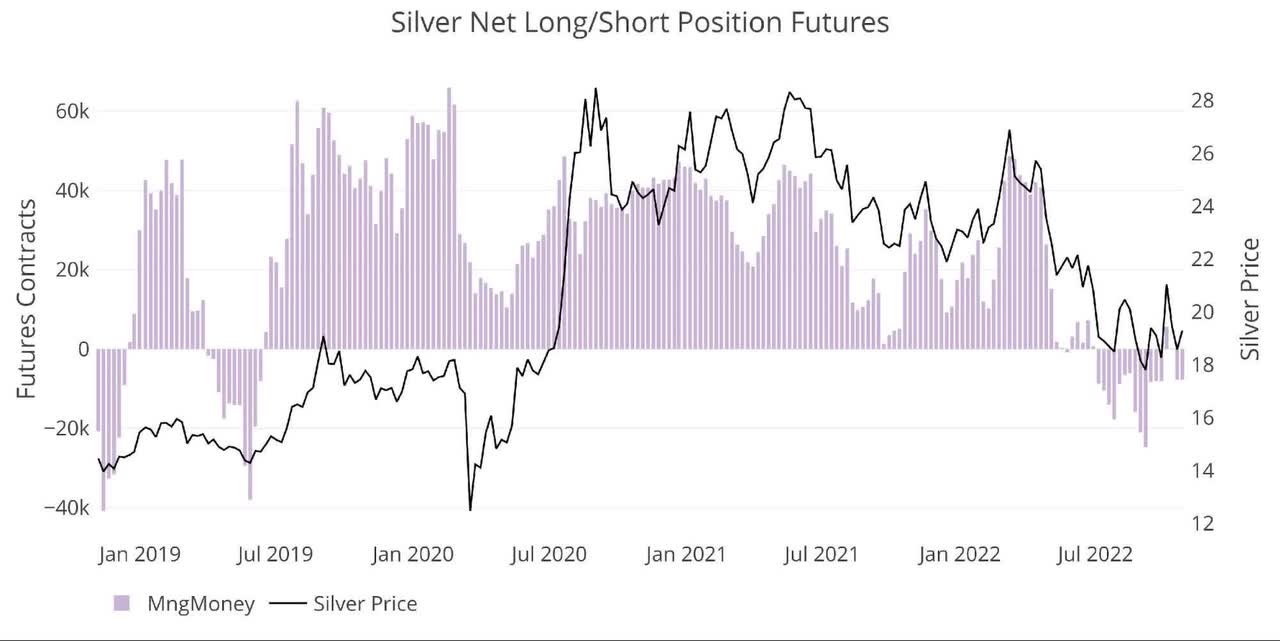

Managed money net short has been largely stable in silver for several months, except for a brief reversal to net plus in early October when the price quickly climbed above $21. This shows how much Managed Money controls prices and how fast things can move.

Figure: 10 Managed Money Net Position

Trading with managed money is a bit more volatile with gold, as you can see below.

Figure: 11 Net change in positioning

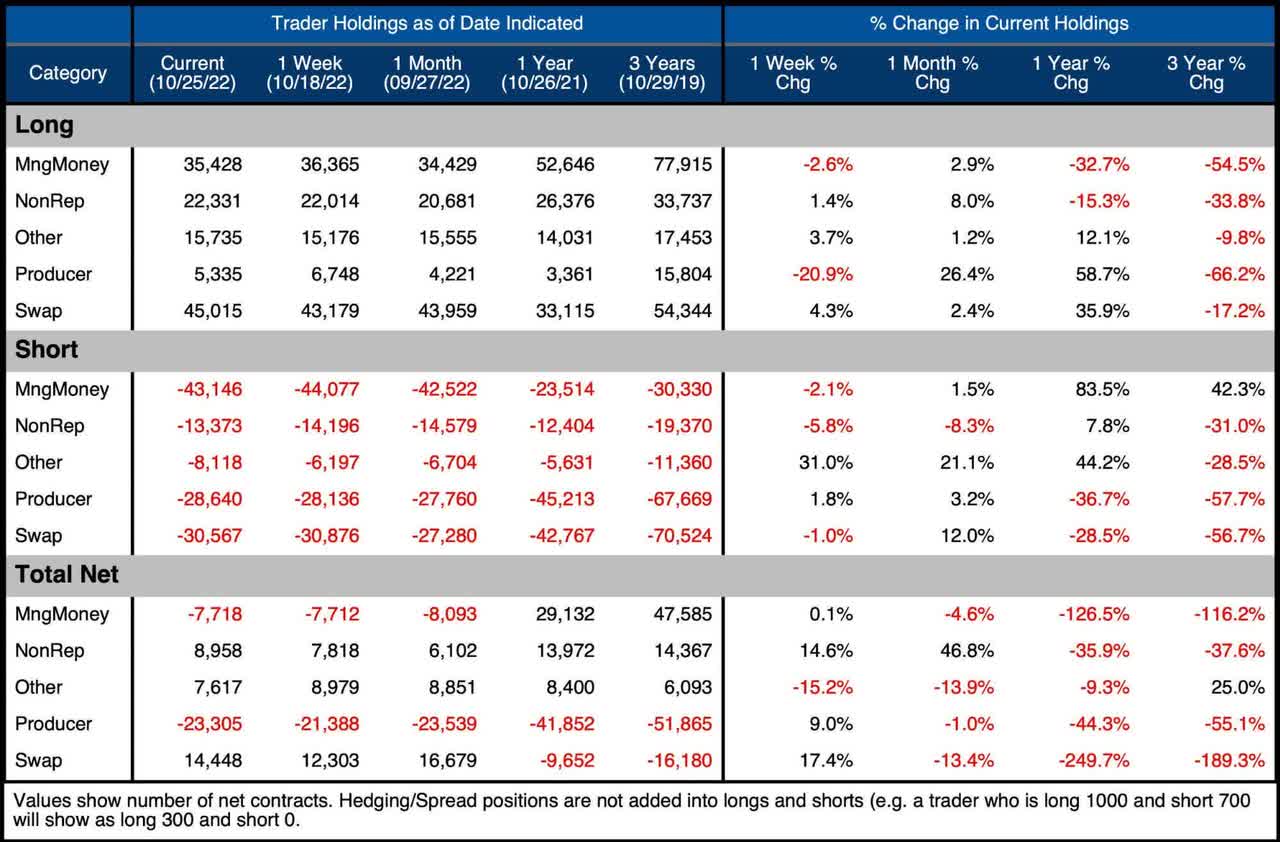

The following table shows a series of snapshots in chronological order. This data does not include options or hedging positions. Important data points to note:

-

- Managed money net positioning changed from long to short last year -126%

-

- This is due to a 32.7% decrease in longs and an 83.5% increase in shorts.

-

- Managed money net positioning changed from long to short last year -126%

Like gold, managed money has gain Their gross shorts were significant (83% or 20,000 contracts), while the other four combined cut their gross shorts by 24% or 25,000 contracts. Again, this is driven by swap and producers.

Figure: 12 Silver Summary Table

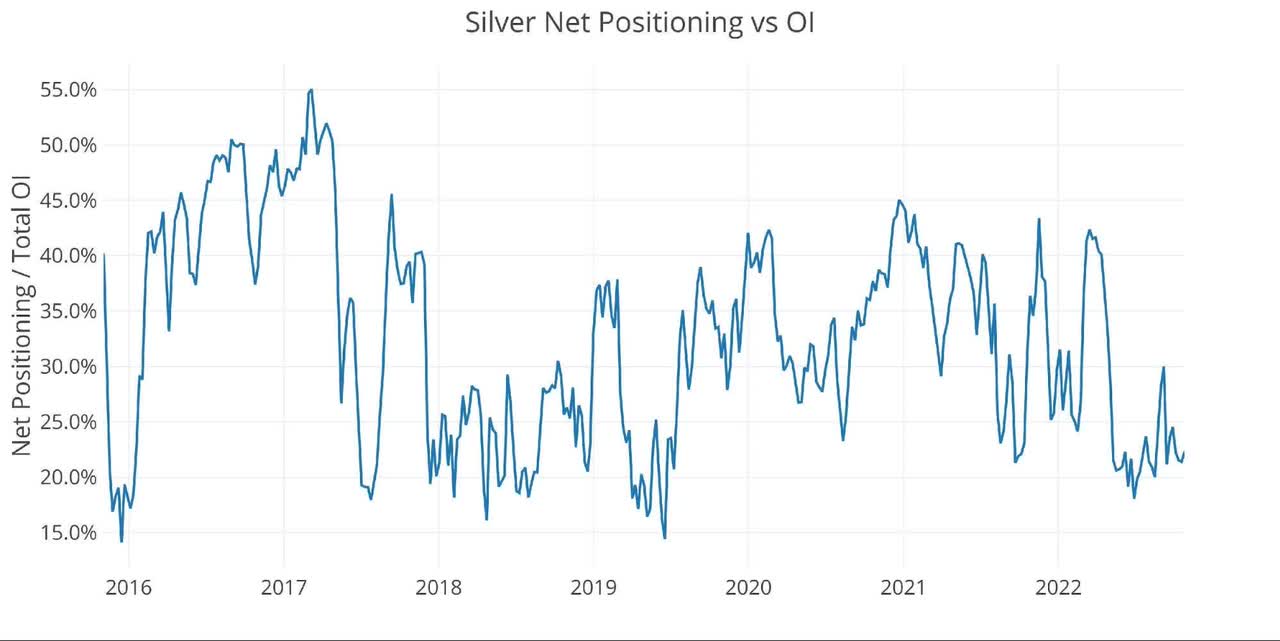

Net positioning as a percentage of total open interest remains low compared to previous years.

Figure: 13 Net Positioning

historical perspective

Examining the full history of the CoTs data by month produces the following chart. The market as a whole has contracted to multi-year lows in recent months.

Figure: 14 Total Open Interest

Looking at historical net positioning, managed money has never held a net short position beyond the end-May period. This he did in 2018. positive area. Managed money could show an upturn in more than short bursts as the Federal Reserve shows signs of pivoting. Given how quickly the price reversed in early October, this could lead to a significant increase in price on short orders if managed money decides Long needs to be put back into his position. .

Figure: 15 net notional positions

Perhaps this is why managed money has the largest net long position in the options market since May 2021.

Figure: 16 Option Positions

Conclusion

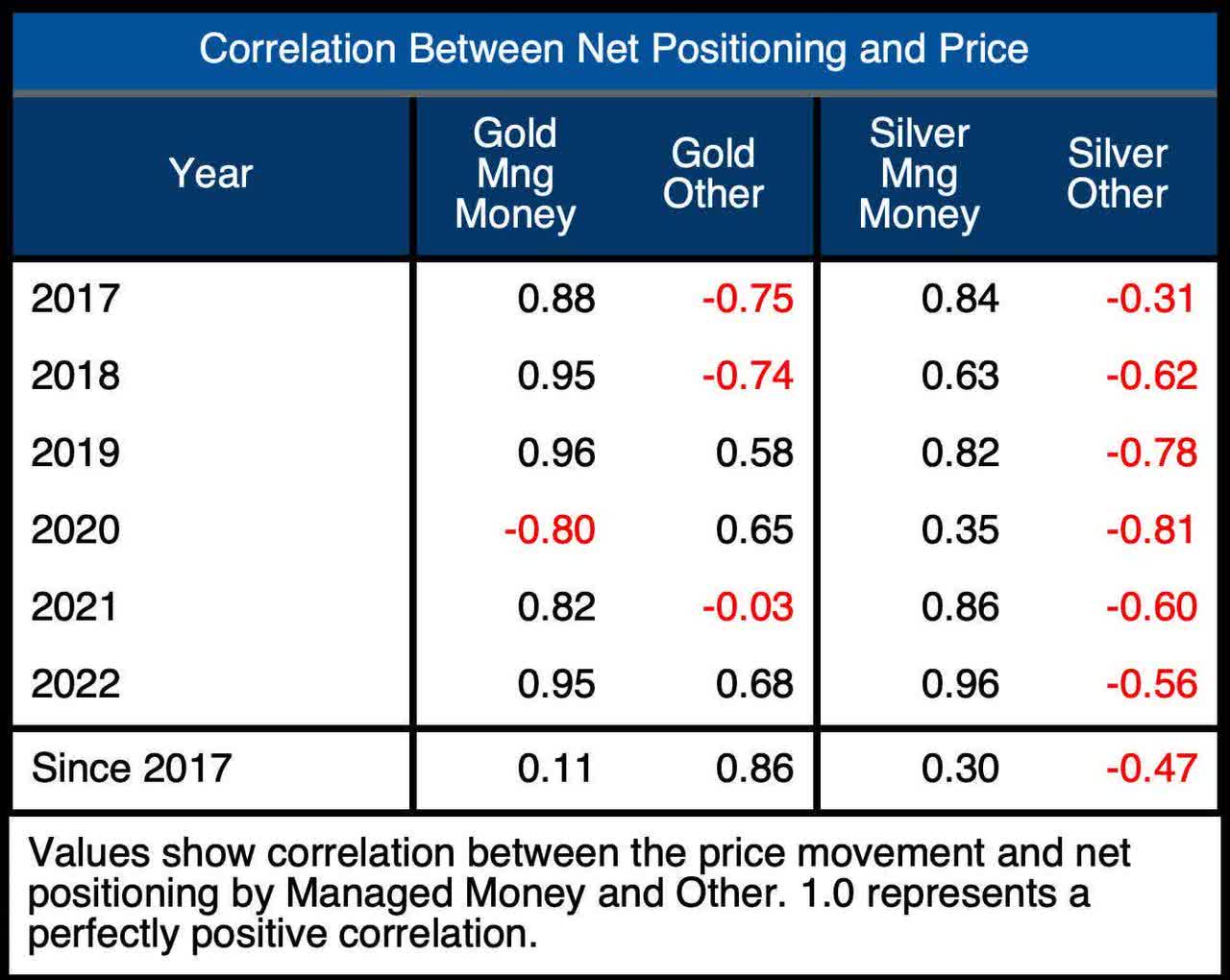

Managed money continues to dominate the market. Looking at the correlation table below, .95 for gold and a staggering .96 for silverThis is full control of the market.

Figure: 17 correlation table

But what if this gives a false sense of confidence? Physical supplies are in short supply given the recent massive metal spills from Comex vaults. This could lead to short-term pressure on the physical market, which could spill over into the paper market, creating a sea of blood in paper shortages.

The Fed is likely to scale back hawk talk this week, which could be a soft pivot signaling a bottom in the gold and silver markets. Managed money is prepared for a significant drop in metals and may need to cover quickly if prices start to rebound. If swaps and producers don’t want to re-enter the ring on the short side due to supply constraints, the price of the metal could rise dramatically.

It may take some more time for the market to gain a foothold, but when it does, the situation is perfectly prepared for a significant increase in prices.

Data Source: Trader’s Commitment

Data update: Every Friday at 3:30 PM (as of Tuesday)

Last updated: October 25, 2022

Gold and Silver interactive charts and graphs can be found on the Exploring Finance Dashboard: Gold and Silver Analysis

original post

Editor’s note: The summary bullet points for this article were chosen by the editors of Seeking Alpha.

[ad_2]

Source link