(London, January 2023) Advisors believe we are currently in the worst investment environment since 2008, but bets are betting that US equities will outperform this year as technology recovers. , shown in a new study.

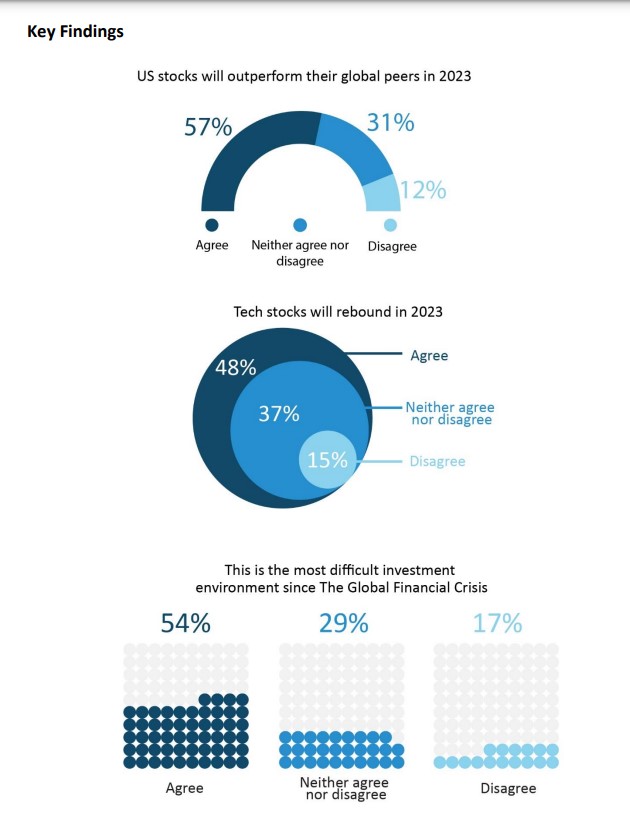

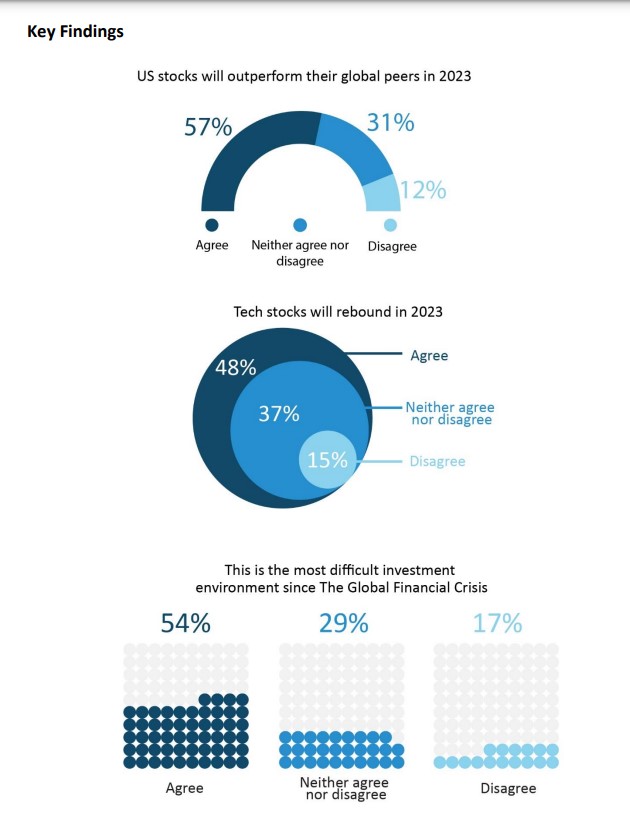

A CoreData Research survey of nearly 500 U.S. financial advisors found that nearly 6 in 10 (57%) believe U.S. stocks will outperform global peers in 2023 . About half (48%) say tech stocks will recover in his 2023, compared to just 15% who disagree.

US advisers favor the domestic market, but believe it’s the worst time to invest since 2008. More than half (54%) say the investment environment is the most difficult since the global financial crisis. In addition, advisors expect market turmoil to intensify. Four in 10 (40%) agree that volatility will increase in the next 12 months. This is almost double the percentage of those who disagree (23%).

In addition to the pessimistic outlook, further rate hikes are expected to combat inflation, raising fears of a recession. Half of advisers (50%) believe the Fed will raise interest rates above his 5% in 2023.

The survey, conducted in December, also shows that these macro and market headwinds are top priorities when it comes to the biggest risks facing advice firms. Respondents said volatile markets (57%), inflation (56%) and economic recession (49%) will be the top challenges for their businesses over the next 12 months.

Against this bleak macroeconomic backdrop, geopolitical challenges also loom large on advisors’ risk radars. In fact, three in 10 (30%) believe US-China tensions pose a greater risk than a recession.

More than 4 in 10 (42%) of advisors say they are positioning their clients’ portfolios defensively amid expectations of increased volatility. However, they face challenges in implementing these strategies, with nearly half (45%) struggling to find safe assets. This raises questions about the suitability of the 60/40 portfolio, with almost 3 in 10 (27%) saying the model no longer works.

“The 60/40 portfolio model had a year to forget in 2022,” said Andrew Inwood, Founder and Principal at CoreData. “As this year is likely to be another challenging year, we expect our advisors to re-evaluate their strategies based on this traditional model as they seek more innovative solutions to diversify their portfolios. I have.”

On the other hand, the difficult situation is pushing US advisors to active managers.

Nearly 4 in 10 (38%) say they will increase their allocation of clients to active funds over the next 12 months. Just over a quarter (27%) plan to increase allocations to passive funds.

Elsewhere, about a third (31%) of advisors plan to increase their client allocations to ESG funds over the next year. However, one-fifth (21%) do not invest client funds in her ESG. Renewable energy enthusiasm is also muted, with more advisors set to increase their client quotas in oil and gas stocks (30%) than in clean energy stocks (27%).