[ad_1]

Andres

investment paper

My main paper on Digital Turbine (NASDAQ: APPS) (1) acts as a key intermediary between OEMs/operators and publishers and (2) owns the end-to-end digital supply chain from demand-side platforms (“DSPs”) to ad exchanges . Supply Side Platform (“SSP”) Large acquisitions of Appreciate, AdColony and Fyber. When integrated, they can remove massive inefficiencies in the supply chain, create multiple cross-sell opportunities, and increase revenue and profit margins.

In this post, I’d like to take a look back at Digital Turbine’s 2Q23 earnings call and give you my thoughts on the quarter. In summary, with Mobile Posse set to resume growth in his FY23, fundamentals are intact and Single-Tap’s Q1 2023 and beyond progress is on track, The device distribution footprint continues to grow strongly. They are also building new features on AdColony and Fyber to earn more advertising dollars. More importantly, it demonstrated improved gross margins and strong operating margins. I believe this trend could pick up further once things are put into action and growth accelerates again in his 23rd year. Valuations look uncertain today, but I believe uncertainty is built into valuations for good reason.

On-device solution

App 10-Q

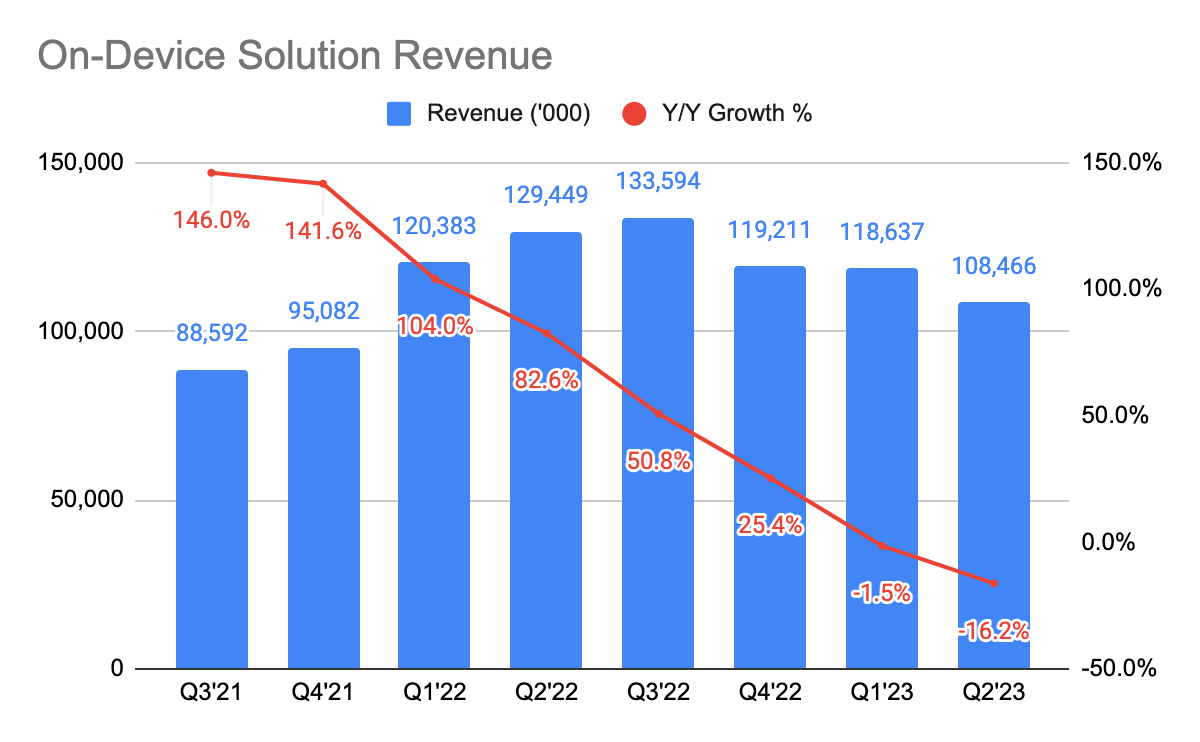

2Q23 earnings slightly exceeded expected earnings guidance, with Y/Y growth down 16.2%. This was due to (1) management’s focus on improving gross margins, which led to lower revenues, (2) macro-driven declines in advertising spending, and (3) shifts in customer acquisition to content media and This is the result of Mobile Posse’s weak revenues. strategy.

On its Q2 2023 earnings call, management revealed it rolled out a postpaid content revenue product with Verizon (VZ) and soon AT&T (T).

“We launched a postpaid Verizon content native relationship and are now on 50 different device models. We expect to resume growth next year.”

App 10-Q

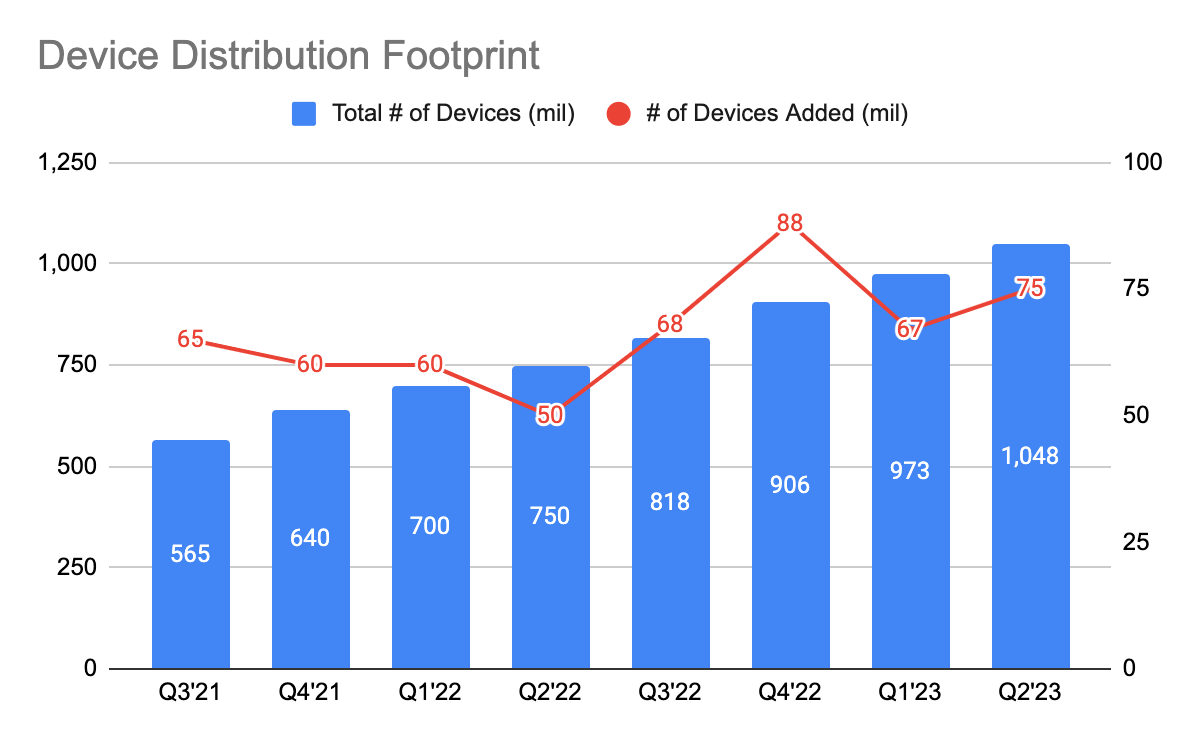

Digital Turbine added 75 new devices, bringing the total to 1,048 devices as of 2Q23. The company has positioned itself as a key partner for partners to monetize their devices.

Remember, in our last earnings call, CEO Bill Stone said Single Tap would be rolling out to five partners by 2Q23. In addition, it has partnered with Google (GOOG) (GOOGL) to sell single-tap licensed products on the Google Cloud Marketplace, which will be highlighted in the coming quarters. I was.

app growth platform

App 10-Q

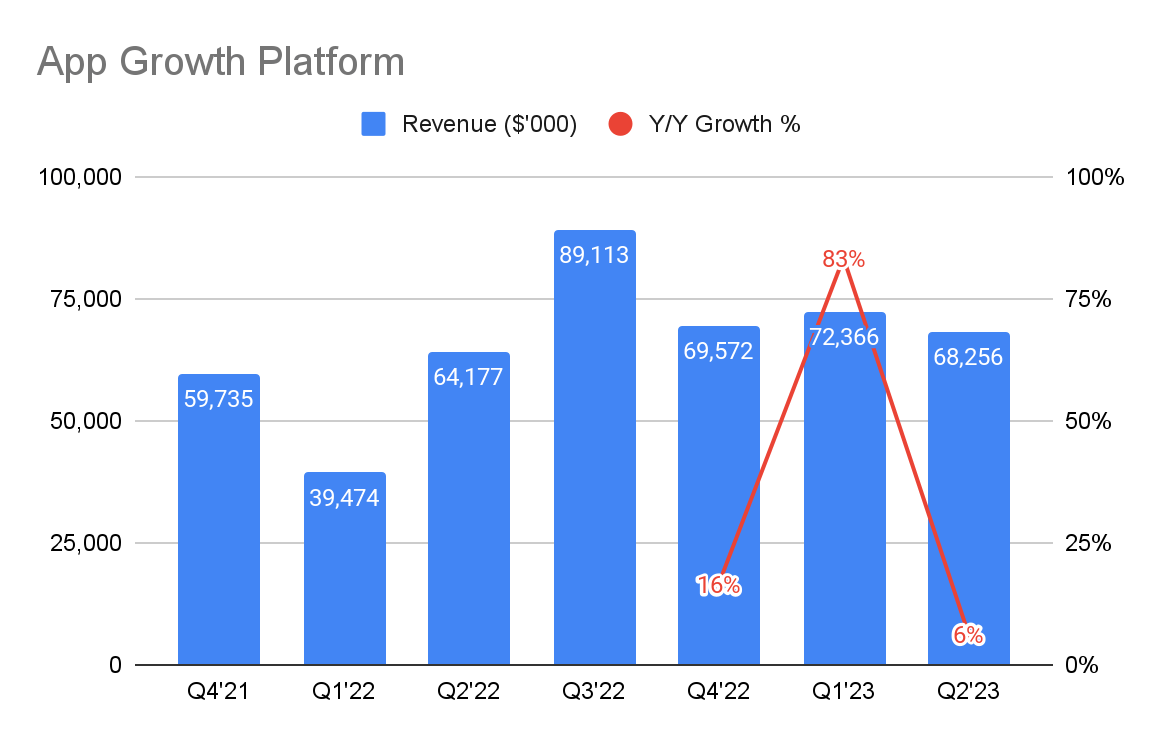

The app growth platform isn’t particularly noteworthy, other than slightly weaker revenue growth. The company is building new features with his AdColony and Fyber to generate more ad spend.

“We want to build on that success and are just starting to hit the market and are busy building a lot of new features that should act as great growth catalysts and how The market where we can cast a wider net for the advertising dollars that are out there.”

Profitability

App 10-Q

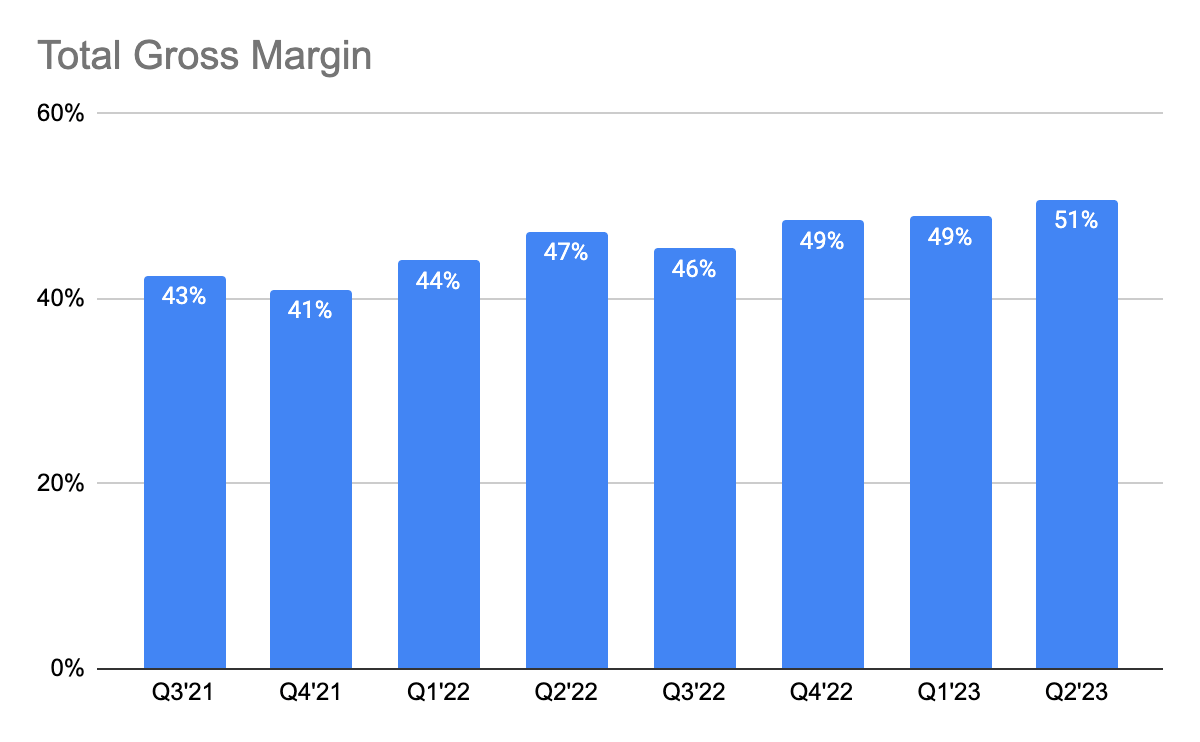

One of the highlights is the improved gross margin. Previously, management decided to focus on improving gross margins at the expense of revenue trade-offs. Accounting terms require the company to report “Revenue Share and License Revenue” as cost of revenue, resulting in a reported gross margin of 66%. Given the asset-light business model of the app growth platform, the cost synergies, and the reacceleration of growth in FY23, I think the gross margin is trending upwards.

App 10-Q

App 10-Q

(Source: APPS 10-Q)

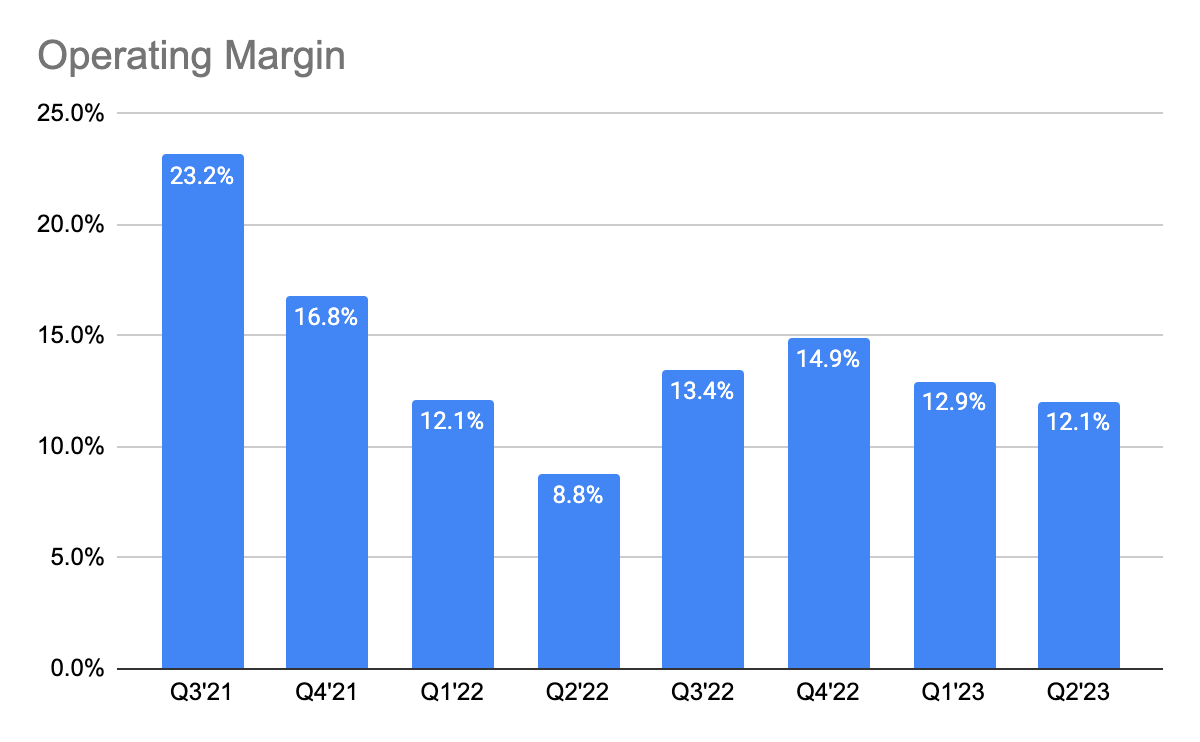

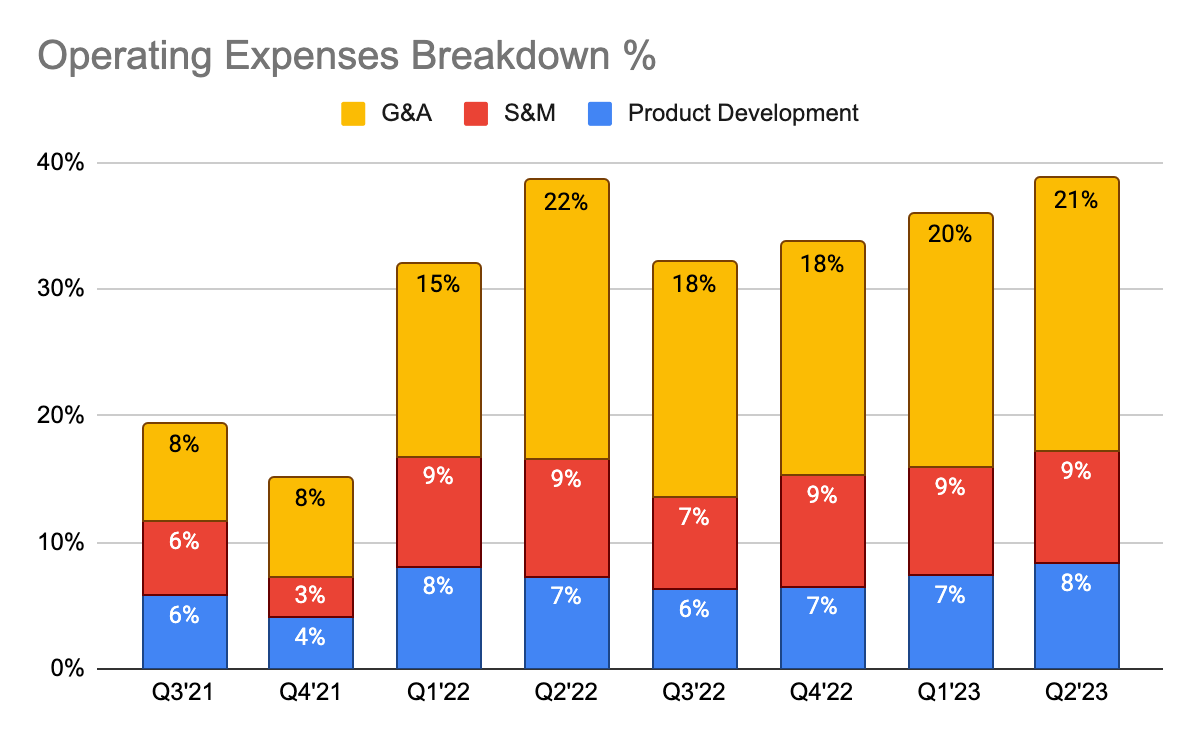

Instead of looking at Adjusted EBITDA, we would like to use it as an operating profit margin that (1) does not include stock-based compensation (“SBC”) or other one-off costs such as transaction costs, and (2) is only visible. think. In profitability from the company’s operations. From my point of view, this is much simpler than looking at Adjusted EBITDA.

Here you can see that the operating margin decreased from 12.9% in the first quarter to 12.1%. This is a result of higher reinvestment in operating expenses as a percentage of revenue increased during the quarter. Moreover, the company’s profitability certainly puts it in a better position to invest for growth given the macro environment. And operating margins are likely to increase over time as growth accelerates again from his 23rd year.

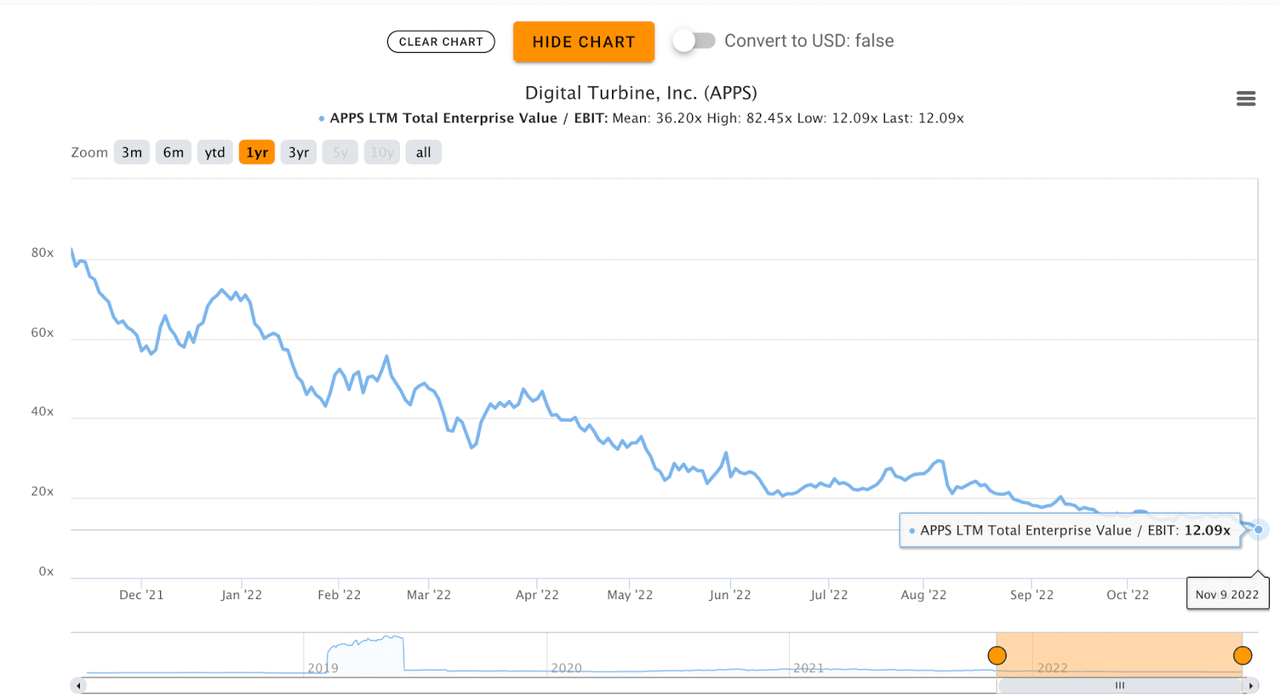

evaluation

TIKR

Given that the current 12-month EV/EBIT is 12.09x and growth is likely to accelerate again in FY23, I think today’s valuation is certainly reasonable. On the one hand, (1) the macro impact on ad spend in 2023, (2) single-tap progress (i.e. number of partners, revenue contribution), and (3) mobile his posse rollout. Perhaps investors who want more clarity can consider waiting on the sidelines.

Conclusion

Overall, it’s been a pretty good quarter for Digital Turbine given the steady progress of Single-Tap, the growing number of devices, and the rollout of postpaid Mobile Posse products from Verizon and AT&T. Revenue growth for app growth platforms (such as Fyber and AdColony) has been somewhat weaker, but management is building new capabilities to boost ad spend. In terms of profitability, the company continues to be very strong, a strong advantage in the current macro environment. I think there is uncertainty priced into valuations today as investors are watching execution on the sidelines.

What do you think of this quarter? Let us know in the comments below!

[ad_2]

Source link