[ad_1]

The goal of Credible Operations, Inc. (NMLS number 1681276, hereinafter “Credible”) is to give you the tools and confidence you need to improve your finances. We advertise products from partner lenders who insure our services, but all opinions are our own.

The latest private student loan rates from the Credible Marketplace, updated weekly. (iStock)

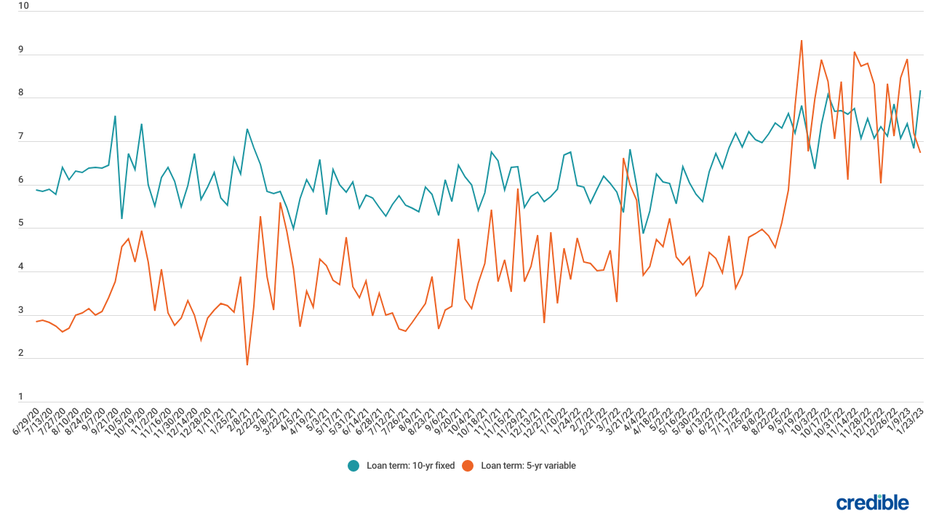

During the week of January 23, 2023, if borrowers with a credit score of 720 or higher used the Credible Marketplace to obtain a 10-year fixed-rate loan, the average private student loan interest rate would rise to 5-year Variable rate loans fell. .

- 10 year fixed rate: 8.18%, up from 6.83% the week before, +1.35

- 5-year floating rate: 6.73%, down from 7.19% the week before, -0.46

Through Credible, you can compare private student loan rates from multiple lenders without affecting your credit score.

Interest rates on private student loans dropped significantly this week on 5-year variable-rate loans, while rates on 10-year fixed-rate loans surged. Interest rates on 10-year loans increased by 1.35 points and those on 5-year loans decreased by 0.46 points. In addition to this week’s interest rate change, interest rates on both loan terms are higher than at the same time last year.

Still, keep in mind that borrowers with good credit may get lower interest rates on private student loans than on some federal loans. Federal student loan interest rates for 2022-23 will range from 4.99% to 7.54%. Interest rates for private student loans for borrowers with good or good credit can currently be low.

Federal loans have certain advantages, such as access to income-driven repayment plans, so you should first exhaust your federal student loan options before resorting to private student loans to cover your financial shortfall. Private lenders such as banks, credit unions, and online lenders offer private student loans. Private loans can be used to pay for education and living expenses that federal education loans may not cover.

Student loan interest rates and terms vary depending on your financial situation, credit history, and lender of choice.

Take a look at our Credible partner lenders’ rates for borrowers who have selected their lenders using the Credible Marketplace during the week of January 23rd.

Private Student Loan Interest Rates (Graduate and Undergraduate)

Weekly Student Loan Interest Rate Trends

Who sets federal and private interest rates?

Congress sets federal student loan interest rates each year. These fixed interest rates vary depending on the type of federal loan you borrow, your alimony status, and grade level.

Private student loan interest rates can be fixed or variable and depend on credit, repayment term, and other factors. As a general rule, the higher your credit score, the lower your interest rate may be.

you can Compare interest rates from multiple student loan lenders Use Credible.

How does student loan interest work?

Interest is a loan percentage that is added to your balance at regular intervals and is basically the cost of borrowing money. Interest is one of the ways a lender makes money from a loan. Interest is often paid first in monthly payments, and the remainder is the amount originally borrowed (principal).

Getting a lower interest rate will save you money over the life of the loan and help you pay off your debt faster.

What are Fixed Rate Loans and Variable Rate Loans?

The difference between fixed and variable interest rates is:

- with fixed interest rate, Your monthly payment will remain the same for the life of the loan.

- with floating interest rate, Your payments may increase or decrease based on changes in interest rates.

Credible makes it easy to compare individual student loan rates.

Calculate your savings

The Student Loan Interest Calculator allows you to estimate your monthly payments and the total amount owed over the life of a federal or private student loan.

After entering your information, you can see your estimated monthly payment, the total interest you will pay over the life of the loan, and the total amount you will repay.

About Credible

Credible is a multi-lender marketplace that enables consumers to discover the financial products that best suit their unique circumstances. Credible’s integrations with leading lenders and credit bureaus allow consumers to quickly compare accurate and personalized loan options without compromising their personal information or impacting their credit score. The Credible Marketplace offers an unparalleled customer experience. 4,300 positive Trustpilot reviews TrustScore is 4.7/5.

[ad_2]

Source link