[ad_1]

The goal of Credible Operations, Inc. (NMLS number 1681276, hereinafter “Credible”) is to give you the tools and confidence you need to improve your finances. We advertise products from partner lenders who insure our services, but all opinions are our own.

The latest trends in student loan refinance interest rates from the Credible Marketplace are updated weekly. (iStock)

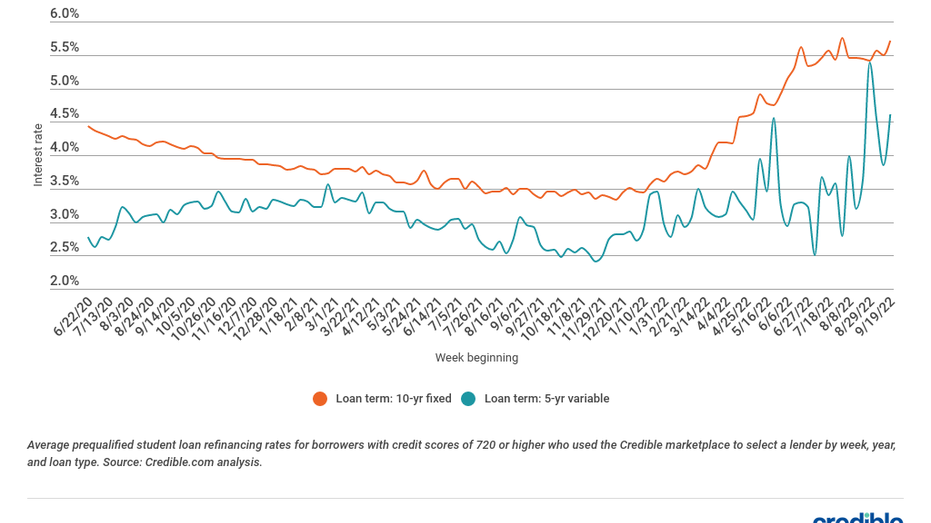

Rates for eligible borrowers using the Credible Marketplace student loan refinancing rose this week for both 10-year fixed-rate loans and 5-year variable-rate loans.

For borrowers with a credit score of 720 or higher who selected lenders using the Credible Marketplace during the week of September 26, 2022:

- Rates on 10-year fixed-rate refinancing loans averaged 5.56%, down from 5.71% last week and up from 3.36% a year ago. Interest rates for the quarter hit their lowest point so far in 2022 at 3.44% in the week of Jan. 10.

- Rates on five-year floating-rate refinancing loans averaged 3.38%, down significantly from 4.61% last week and up from 2.65% a year ago. Interest rates for the quarter reached their lowest point so far in 2022 at 2.51% in the week of July 4th.

Student Loan Refinancing Weekly Rate Trends

If you want to know about student loan refinancing rates, You can use online tools like Credible Compare options from various private lenders. Checking your rate does not affect your credit score.

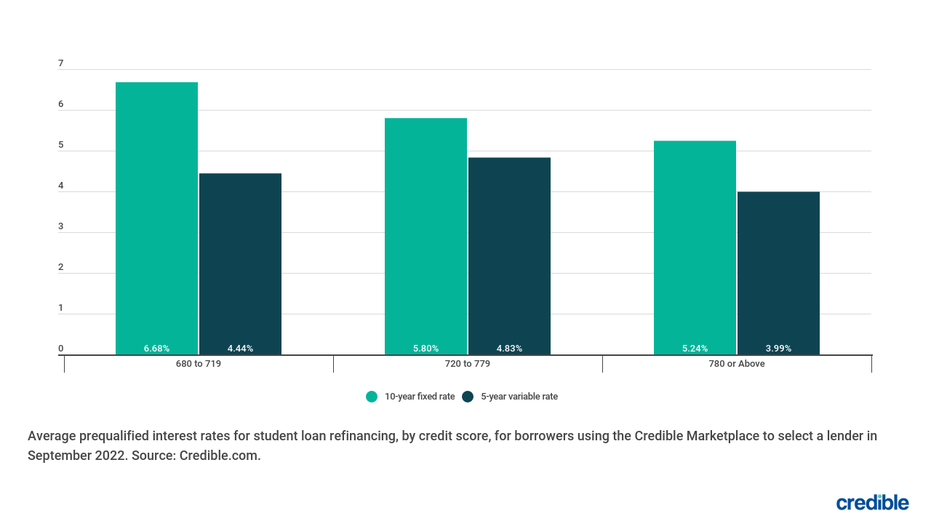

Current Student Loan Refinancing Rates by FICO Score

To mitigate the economic impact of the COVID-19 pandemic, federal student loan interest and payments are suspended until at least December 31, 2022. federal student loan refinancingHowever, many borrowers with private student loans are taking advantage of the low interest rate environment to refinance their education loans at lower interest rates.

If you are eligible to refinance a student loan, the interest rate you may be offered depends on factors such as your FICO score, the type of loan you want (fixed or floating rate), and the loan repayment term.

The chart above shows that higher credit ratings tend to result in lower interest rates, while loans with fixed interest rates and longer repayment terms tend to have higher interest rates. Each lender has its own way of evaluating borrowers, so it’s a good idea to request interest rates from multiple lenders so you can compare your options.a student loan refinance calculator It helps you estimate how much money you can save.

if you want to low credit refinancing, you may need to apply with the signer. Alternatively, you can work on improving your credit before applying. Many lenders allow children to refinance their parent’s PLUS loan in their own name after graduation.

You can do it Compare rates using Credible From multiple private lenders at once without impacting your credit score.

How Student Loan Refinancing Rates Are Determined

The interest rates that private lenders charge to refinance student loans depend, in part, on the economy and interest rate environment, but also on the length of the loan, the type of loan (fixed or floating rate), the creditworthiness of the borrower, the operating costs of the lender, and the operating costs of the lender. It also depends on the profit margin. .

About Credible

Credible is a multi-lender marketplace that enables consumers to discover the financial products that best suit their unique circumstances. Credible’s integrations with leading lenders and credit bureaus enable consumers to quickly compare accurate and personalized loan options without compromising their personal information or affecting their credit score. The Credible Marketplace offers an unparalleled customer experience as reflected in over 5,000 positive Trustpilot reviews and a TrustScore of 4.7/5.

[ad_2]

Source link